The Germany Structured Product Label (SPL) Management Market is projected to reach a market value of USD 7,927.6 million in 2025 and is expected to grow at a CAGR of 12.8%, reaching USD 26,321.2 million by 2035. The market's expansion is driven by the increasing demand for compliance solutions, digitization of labelling processes, and the adoption of advanced SPL technologies by pharmaceutical, biotechnology, and medical device companies.

| Attributes | Values |

|---|---|

| Estimated Germany Industry Size 2025 | USD 7,927.6 million |

| Projected Germany Industry Size 2035 | USD 26,321.2 million |

| Value-based CAGR from 2025 to 2035 | 12.8% |

The German single point of delivery (SPL) market is undergoing rapid evolution, encouraged by European Medicines Agency (EMA) regulation and greater automation across regulatory workflows. There is an increasing demand for cloud-based SPL solutions because companies need efficient, real-time compliance tracking and electronic labelling submissions.

Additionally, the adoption of AI-powered validation tools enhances data quality and minimizes compliance vulnerabilities. As a result, the pharma, biopharma, and life sciences companies are accelerating their labelling processes, reducing errors, and achieving compliance to the stricter EMA standards with more efficiency than before.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

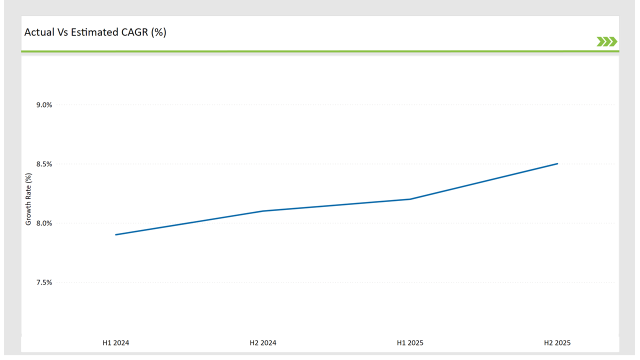

The following table illustrates the compound annual growth rate (CAGR) trends for the Germany SPL market over six-month intervals, providing a structured analysis of market progression.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 12.3% |

| H2, 2024 | 12.5% |

| H1, 2025 | 12.7% |

| H2, 2025 | 13.0% |

H1 signifies January to June, while July to December analysis is signified through H2.

This growth is attributed to increasing investments in SPL automation, regulatory standardization, and digital transformation of labeling management across multiple sectors. The CAGR has improved steadily from 12.3% in H1 2024 to 13.0% in H2 2025, reflecting a positive market trajectory.

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-2025 | SAP introduced AI-driven SPL automation software for European regulatory compliance. |

| Oct-2024 | Veeva Systems expanded its cloud-based SPL offerings in Germany, integrating real-time regulatory updates. |

| Mar-2024 | EMA enforced stricter labeling guidelines for digital submissions, accelerating SPL adoption. |

| Sep-2024 | IBM partnered with leading CROs to develop blockchain-enabled SPL compliance tools. |

| Dec-2023 | Oracle acquired a Germany-based SPL solutions firm to enhance its market presence. |

The regulatory landscape and technological advancements are shaping the SPL market, with vendors focusing on automation, cloud-based compliance tools, and AI-driven regulatory tracking solutions.

AI-Powered SPL Automation Enhances Efficiency

It utilises AI and automates SPL processes drastically improving compliance accuracy by removing human errors from regulatory submissions. Pharmaceuticals and biotechnology companies use automated tools to streamline approval processes, reduce compliance risks, and increase operational efficiency.

Artificial intelligence algorithms analyse previous regulatory trends, anticipate compliance failures, and optimize structured labelling workflows, minimized approval periods. The rejection of integration facilitates the amalgamation of technology with SPL solutions which avails resulting advancement and efficiency irritation during the filings.

Cloud-Based SPL Platforms Witness Rapid Adoption

The cloud-based SPL platforms are being rapidly adopted in Germany for their scalable, accessible and real-time SPL compliance updates. These solutions empower enterprises by allowing them to guarantee secure regulatory submissions, automate workflows, and keep updated labelling documentation without massive infrastructure outlays.

The introduction of cloud-based SPL platforms enables companies to adopt regulatory collaboration across geographies while adhering to changing EMA regulations. The transition towards cloud solutions is projected to fuel continuous growth in the market during the next decade.

EMA Regulations Drive Digital Labelling Compliance

With evolving EMA regulations, the need for digital labelling solutions has grown significantly. Structured product label compliance ensures the transparency, traceability, and accuracy of medical product information. Complying with EMA’s regulatory frameworks necessitates life sciences companies to stay abreast of and update their SPL systems regularly.

As a result, there has been a rise in adoption of digital labelling solutions, allowing firms to simplify regulatory submissions and reduce risk of non-compliance. They also create greater efficiency through real time monitoring and verification of product labels.

Blockchain-Based SPL Tracking Enhances Security

Blockchain technology is transforming SPL management by ensuring data security, transparency, and traceability. Leading SPL providers are integrating blockchain-based solutions to authenticate structured labelling data and prevent regulatory fraud.

The decentralized nature of blockchain enhances compliance tracking, allowing regulatory authorities and life sciences companies to maintain a tamper-proof record of label modifications. As Germany strengthens its regulatory landscape, blockchain-based SPL tracking is poised to become a game-changing innovation in structured product label management.

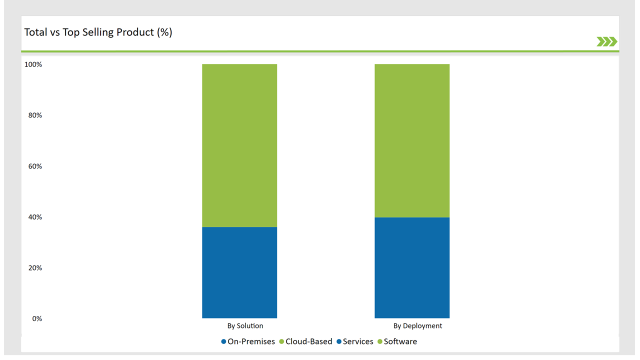

| Solution | Market Share (2025) |

|---|---|

| Software | 64.1% |

| Services | 35.9% |

Software dominates the SPL market, accounting for 64.1% of total revenue in 2025. The demand for software solutions is increasing as pharmaceutical, biotechnology, and medical device companies seek automation-driven compliance tools.

AI-powered SPL software streamlines regulatory workflows, enhances accuracy, and enables companies to handle large-scale digital labelling processes efficiently. Services, including regulatory consulting, integration support, and managed SPL solutions, continue to grow steadily as companies require expert guidance to navigate complex regulatory landscapes.

| Deployment Type | Market Share (2025) |

|---|---|

| Cloud-Based | 60.3% |

| On-Premises | 39.7% |

Cloud-based SPL solutions hold the largest market share at 60.3%, primarily due to their cost-effectiveness and ease of scalability. Enterprises prefer cloud-based deployment as it offers seamless real-time compliance tracking, automated updates, and integration with existing enterprise IT ecosystems.

The on-premises deployment remains relevant for companies requiring high security, data control and customized regulatory workflows. However, as cloud technology matures, the on-premises market share is expected to gradually decline.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

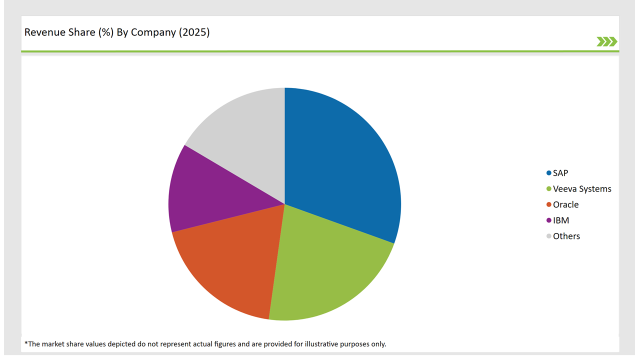

Key players in the Germany SPL market are investing in cloud solutions, AI-driven compliance tools, and blockchain security. Dominant companies include SAP, Veeva Systems, Oracle, IBM, and emerging SPL solution providers.

| Vendors | Market Share (2025) |

|---|---|

| SAP | 30.5% |

| Veeva Systems | 21.7% |

| Oracle | 18.9% |

| IBM | 12.4% |

| Others | 16.5% |

Software and Services. Software holds a higher share due to compliance automation and integration.

Cloud-Based and On-Premises. Cloud solutions are growing rapidly due to ease of scalability.

Pharmaceutical Companies, Biotechnology Companies, Medical Device Companies, Regulatory Authorities, and CROs. Pharmaceuticals and biotech firms are key adopters

The market will expand at a CAGR of 12.8% from 2025 to 2035.

By 2035, the market will reach USD 26,321.2 million.

AI-powered SPL Automation, Cloud based SPL Platforms and Blockchain based Tracking.

Munich is the leading regions due to their strong pharmaceutical and biotech presence.

SAP, Veeva Systems, Oracle Corporation and IBM.

| Estimated Size, 2025 | USD 64,983.6 million |

| Projected Size, 2035 | USD 210,576.2 million |

| Value-based CAGR (2025 to 2035) | 12.5% CAGR |

Explore Vertical Solution Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.