The Germany software distribution market is poised for significant growth over the next decade, driven by increasing digital transformation initiatives, the growing adoption of cloud-based solutions, and the rising need for secure and scalable software distribution channels. The market is projected to reach USD 29,482.6 million in 2025 and will continue expanding at a CAGR of 13.8%, reaching USD 107,391.7 million by 2035.

Market Attributes and Growth Projections

| Attributes | Values |

|---|---|

| Estimated Germany Market Size in 2025 | USD 29,482.6 million |

| Projected Germany Market Size in 2035 | USD 107,391.7 million |

| Value-based CAGR from 2025 to 2035 | 13.8% |

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

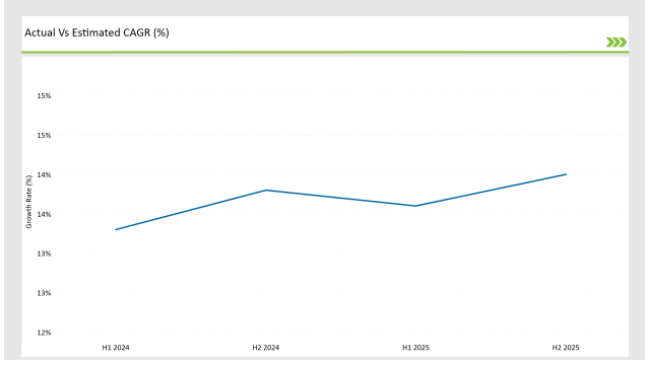

The table below outlines the semi-annual growth rate of the market, providing insights into industry trends.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 13.3% (2024 to 2034) |

| H2 2024 | 13.8% (2024 to 2034) |

| H1 2025 | 13.6% (2025 to 2035) |

| H2 2025 | 14.0% (2025 to 2035) |

The Germany software distribution industry exhibits steady growth, with semi-annual fluctuations driven by enterprise demand, regulatory changes, and increasing cloud adoption. The CAGR increased from 6.5% in H1 2024 to 7.0% in H2 2024, indicating strengthening market confidence. A minor correction to 6.8% in H1 2025 was followed by a rise to 7.4% in H2 2025, reflecting sustained investment in digital solutions.

| Date | Development / M&A Activity & Details |

|---|---|

| Jan-25 | SAP announces a new cloud-based software distribution platform for SMEs. |

| Oct-24 | TeamViewer expands enterprise licensing to support German IT distributors. |

| Mar-24 | SoftwareOne acquires a local software reseller to strengthen its presence in Germany. |

| Sep-24 | Deutsche Telekom partners with software vendors to enhance cloud distribution services. |

| Dec-23 | German government launches new regulations to enhance software licensing compliance. |

Strong Focus on Data Privacy and Compliance-Driven Software Distribution

Germany's software distribution market is heavily influenced by strict data privacy regulations (e.g. GDPR and BSI IT-Grundschutz). Enterprises prefer secure software delivery models which increases on-premises and private cloud distribution software adoption. Because of regulatory barriers, companies like SAP and Deutsche Telekom do compliance-centric software deployment.

Business endeavors also highlight the importance of software escrow agreements to guarantee availability of source code - reflecting Germany's, and also Europe's, careful attitude toward intellectual property protection. This has led local and regional software distributors to provide customized, regulation-compliant solutions to meet the increased demand for data sovereignty-ready software delivery.

Growing Adoption of Open-Source and Self-Hosted Software Models

Open-source software adoption is a key feature of German enterprises and government, minimizing reliance on proprietary for-profit software developed abroad. Free software regularly used in the public and private sectors includes Linux-based distributions, Nextcloud, and Open-Xchange. Self-hosted software deployment models are in demand from companies wanting to retain control over their own data and infrastructure, which is leading to strong demand for on-premises and hybrid cloud-based software distribution.

Efforts like Gaia-X drive local software ecosystems in sovereign cloud initiatives. This left the German software vendors supporting the typical proprietary fare in most cases, while Germany's core industries - financial services and banking, healthcare, and government services - used to rely on the enterprise-ready open-source solutions, which could be tailored to their specific requirements.

Enterprise Demand for Secure and Decentralized Software Delivery

In Germany, the corporate sector values safe and decentralized software distribution models without reliance on central global app stores. This trend is driven by fears of foreign surveillance risks, software integrity, and compliance violations.

General software based is a thing with regular users of in-house repositories all hardware based comes along with, but regional signs of software have served for tons of businesses around the world. Increasing adoption of blockchain-based software distribution networks adds an extra layer of tamper-proof software verification. Automotive, manufacturing, and banking companies adopt automated security patch management solutions which minimize the exposure to cyber threats and compliance with the German IT security law.

Rise of Vertical-Specific Software Distribution Strategies

The German software distribution market is getting more and more industry-driven with the automotive, industrial automation, and fintech sectors leading the way. Automakers and industrial companies require tailored solutions to manage software deployment scenarios, such as secure Over-the-Air (OTA) updates for connected cars and IIoT systems.

Fintech must be within the scope of the regulated software distribution model with respect to BaFin compliance for secured financial software. This is where software distributors in Germany can provide these industries sector-specific software delivery frameworks that are optimized for high security, real-time updates and regulatory compliance. This software distribution strategy led by the industry positions Germany as a tech-driven economy.

Strong Ecosystem of Local Software Distribution Platforms

Germany has a mature local ecosystem of software distributors, which provide local enterprise customers with tailored, compliance-driven solutions. German companies are more inclined towards localized software marketplaces like Softline, Prianto, and ALSO Deutschland, as opposed to markets led by global distributors. Such distributors offer regionally optimized software bundling models, local distribution platforms in the cloud and more secure software deployment frameworks.

Apart from that, if they have strong channel and VAR partnerships (and channel groups), this guarantees that German enterprises will be provided with software solutions that comply with local data protection laws, enterprise-grade security standards and IT compliance requirements. This localization trend sets Germany’s software distribution landscape apart from its counterparts globally.

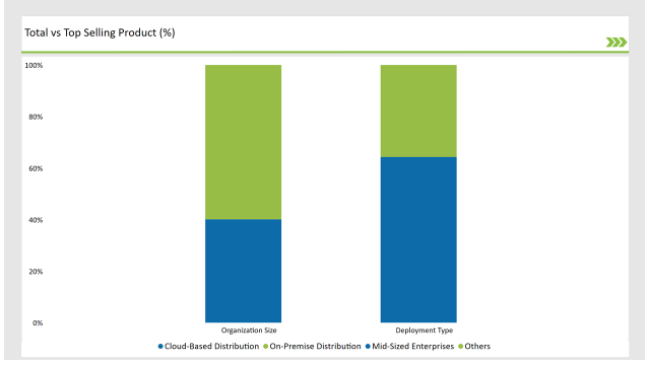

| Deployment Type | Market Share (2025) |

|---|---|

| Cloud-Based Distribution | 64.3% |

| On-Premise Distribution | 35.7% |

| Organization Size | Market Share (2025) |

|---|---|

| Mid-Sized Enterprises | 40.1% |

| Others | 59.9% |

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

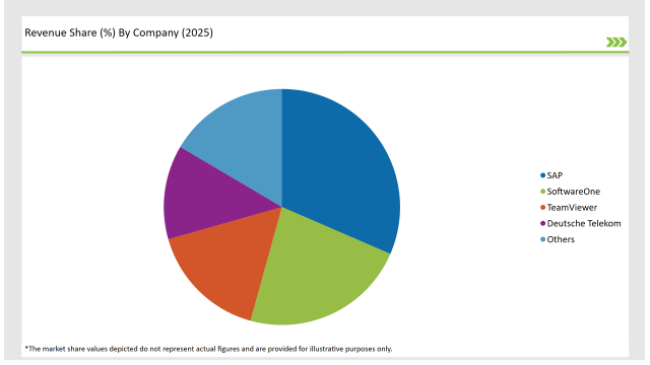

The Germany software distribution market is highly competitive, with several key players driving growth and innovation.

| Vendors | Market Share (2025) |

|---|---|

| SAP | 31.5% |

| SoftwareOne | 22.8% |

| TeamViewer | 16.3% |

| Deutsche Telekom | 12.9% |

| Others | 16.5% |

The market will grow at a CAGR of 13.8 from 2025 to 2035.

The industry will reach USD 107,391.7 million by 2035.

Key drivers include cloud-based software adoption, cybersecurity compliance, and AI-driven software license management.

The Bavaria, North Rhine-Westphalia, and Berlin regions lead in software distribution due to strong IT infrastructure and high enterprise adoption.

The major players include SAP, SoftwareOne, TeamViewer, and Deutsche Telekom.

Explore Vertical Solution Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.