The rising demand and deployment of cloud-native networks and 5G infrastructure, the Germany NFV market is expected to witness strong growth over the future years owing to a growing need for scalable and cost-effective solutions across sectors.

NFV is witnessing accelerated adoption across domain due to the burgeoning adoption of cloud native architecture across enterprises & service providers which in turn helps service providers to adapt to new business models and provides compelling service agility, flexibility, automation and resource optimization benefits. The market will be worth USD 3,911.0 million by 2025, registering a CAGR of 24.6% and USD 35,275.0 million in 2035.

Germany Network Function Virtualization Industry Outlook from 2025 to 2035

| Attributes | Values (USD Million) |

|---|---|

| Estimated Germany Market Size in 2025 | USD 3,911.0 million |

| Projected Germany Market Size in 2035 | USD 35,275.0 million |

| Value-based CAGR from 2025 to 2035 | 24.6% |

Explore FMI!

Book a free demo

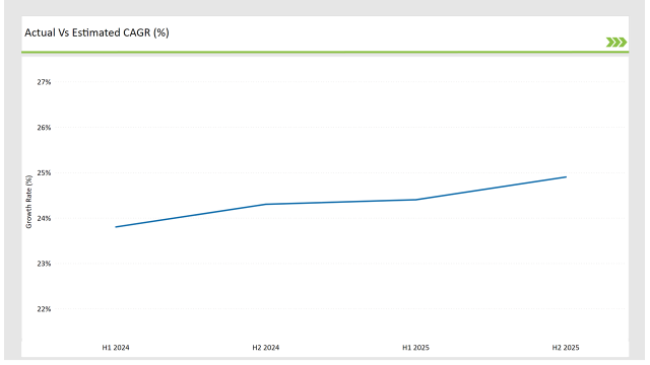

The table below outlines the semi-annual growth rate of the market, providing insights into evolving industry trends.

| Particular | Value of CAGR |

|---|---|

| H1 2024 | 23.8% (2024 to 2034) |

| H2 2024 | 24.3% (2024 to 2034) |

| H1 2025 | 24.4% (2025 to 2035) |

| H2 2025 | 24.9% (2025 to 2035) |

The country has been witnessing steady growth in the NFV market, with an increase in the investment associated with cloud and virtualization technologies. Driven by an acceleration in the 5G rollout, software-defined networking (SDN), etc., the market was up from 23.8% for H1 2024 to 24.3% for H2 2024, a gain of +50 basis points (BPS). Growth continued into 2025, with 24.4% CAGR H1 2025 | 24.9% H2 2025.

| Date | Development / M&A Activity & Details |

|---|---|

| Jan-25 | Deutsche Telekom launches a new AI-powered NFV orchestration platform. |

| Oct-24 | Vodafone Germany partners with Ericsson to integrate NFV in 5G infrastructure. |

| Sep-24 | IBM announces collaboration with German Data Centers for NFV-based cloud solutions. |

| Aug-24 | 1&1 collaborates with Huawei to deploy advanced NFV solutions for 5G deployment. |

| Mar-24 | Siemens invests in NFV-driven SD-WAN solutions to optimize enterprise networks. |

| Feb-24 | SAP launches a new suite of NFV analytics tools for real-time network monitoring. |

| Dec-23 | The German Federal Ministry of the Interior issues new NFV standards and guidelines. |

| Nov-23 | Bosch unveils AI-driven NFV solutions for industrial automation networks. |

Integration of NFV in 5G Networks

5G rollout in Germany is a major catalyst of NFV in the country as the telecom operators working on the planning stage for their core network transformations are striving to virtualized core network functions in a more flexible and scalable manner.

NFV supports network virtualization by decoupling network functions and hardware, allowing for more flexible and efficient use of resources, such as dynamic scaling, improved usage, service performance, and cost-effectiveness; helping to manage the increased traffic that 5G technology will bring in the coming years.

Leading telecommunications companies including Deutsche Telekom and Vodafone have already started to implement NFV as part of their own transformation – improving efficiency of operations, reducing costs, and supporting factors such as emerging IoT technology and increased use of AI-driven automation. The 5G expansion will lead to a broader adoption of NFV, ensuring resilience, high availability, and efficient functioning of cloud-native network resources to meet diverse user requirements and ever-evolving user experiences.

NFV's Role in Cloud-Native Infrastructure

NFV in this transition in Germany to cloud-native infrastructures is moving with sharp speed. NFV allows organizations to virtualize the functions of a network, decreasing dependence on expensive physical hardware, while providing for better agility and scalability.

This synergy can potentially revolutionize the telecom domain by enabling telecom operators and enterprises to achieve operational efficiency, automated service delivery, and better resource utilization when they combine NFV with cloud platforms.

Businesses Movers in finance, retail, and IT services sectors are taking particular advantage of this shift, as they require more dynamic and flexible networking solutions. NFV adoption leads to cost savings and a more resilient network in Germany’s digital economy, thanks to increasing demand of cloud-based services.

Focus on Network Security with NFV

As German enterprises accelerate with the adoption of NFV, secure networking is of the utmost concern. With the increase of cyber threats, there has been an increasing demand in NFV-based security solutions, including but not limited to virtualized firewalls, intrusion detection systems and AI-based threat mitigation tools.

Telecom operators like Deutsche Telekom collaborate closely with Cybersecurity firms to set up quality security frameworks for the deployments of safe and reliable NFV. The above mentioned solutions assist in safeguarding sensitive data,thwart cyberattacks, and preserving the integrity of network traffic. With enterprises adopting virtualized environments, it is anticipated that innovation in NFV security will be key to securing Germany’s digital infrastructure and enterprise networks.

NFV Adoption in Enterprises for Cost Efficiency

NFV is increasingly being adopted by German enterprises as a means of reducing network costs and improving efficiency. Networking hardware, management, and upgrades are expensive in traditional solutions, but NFV helps use software-based alternatives instead. Overall, NFV is being embraced across various sectors, including automotive, healthcare, and finance, to improve network performance, optimize bandwidth utilization, and provide uninterrupted connectivity.

Which helps businesses scale networks based on demand dynamically and without the dependency on physical infrastructure. The transition to software-defined networking solutions fuels innovation, enhances operational flexibility, and enables enterprises to meet dynamic digital being in a connected world.

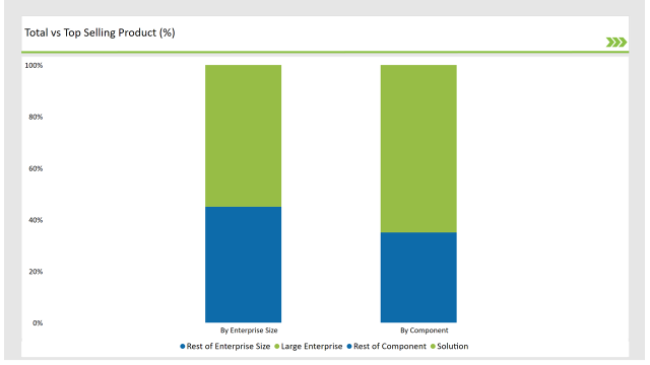

| Component | Market Share (2025) |

|---|---|

| Solution | 65.0% |

| Services | 35.0% |

By solution, 65.0% of the share in the German NFV market belonged to the solutions in 2025, due to strong demand for network-based software (NFV) platforms. Services (consulting, integration and managed services) will contribute 35.0% of the share in market. These services help to ensure that enterprises and service providers can deploy & integrate NFV seamlessly so that they enjoy the benefits of network virtualization.

| Enterprise Size | Market Share (2025) |

|---|---|

| Large Enterprise | 55.0% |

| Others | 45.0% |

NFV market share of large enterprises in Germany is expected to be around 55.0% by 2025, due to their high investment on network virtualization to achieve scalability, flexibility, and efficiency. On the other hand, 45.0% of the market will be accounted for by others (small and medium enterprises): the growing adoption of cloud technologies and the demand for cost-effective NFV solutions that can offer more flexibility and performance without heavy initial investments.

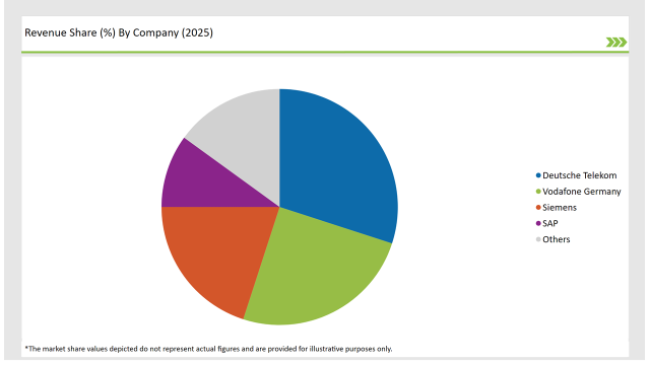

The Germany NFV market is moderately competitive, with several large players dominating the space. Companies are focusing on technological innovations, strategic collaborations, and expanding their service portfolios.

| Vendors | Market Share (2025) |

|---|---|

| Deutsche Telekom | 30.0% |

| Vodafone Germany | 25.0% |

| Siemens | 20.0% |

| SAP | 10.0% |

| Others | 15.0% |

Deutsche Telekom and Vodafone Germany will continue to dominate the German NFV market with 2025 shares of 55.0% combined thanks to their vast 5G networks and their investments in NFV technologies. In the enterprise space particularly Siemens and SAP are key players offering AI integrated NFV solutions and also play a fundamental role in the digital transformation of the industrial and business networks. Companies like Bosch, IBM are also impacting the market with their own solution for unique sectors.

The market is expected to grow at a CAGR of 24.6% from 2025 to 2035.

The market is projected to reach USD 35,275.0 million by 2035.

Key players include Deutsche Telekom, Vodafone Germany, Siemens, SAP, and Bosch.

Services will hold a 35.0% share in the market in 2025.

Service providers will lead the market with a 60.0% share in 2025.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.