Germany market, in generic injectable are significantly expanding. With rate of 7.2%, the market will reach to USD 18.3 million in 2035 from USD 9.1 million in 2025.

| Attributes | Values |

|---|---|

| Estimated Germany Industry Size (2025) | USD 9.1 million |

| Projected Germany Value (2035) | USD 18.3 million |

| Growth Rate from (2025 to 2035) | 7.2% |

Being the largest pharmaceutical market in Europe, the infrastructure for healthcare is pretty well equipped, hence ensuring a high adoption of generic injectables in Germany. Cost containment emphasis by government in healthcare, besides favorable reimbursement policies, would further drive the adoption of biosimilars and complex injectables.

Moreover, the drug formulation development of long-acting injectables and nanoparticle-based injectables that provide more effective treatments thus, easy access to patients.

The regulatory bodies involved in Germany include the EMA and BfArM, which are quite instrumental in ironing out safe and effective generics approval. Because of that fact, the market is highly regulated to ensure high-quality biosimilars and generic injectables enter the market.

Explore FMI!

Book a free demo

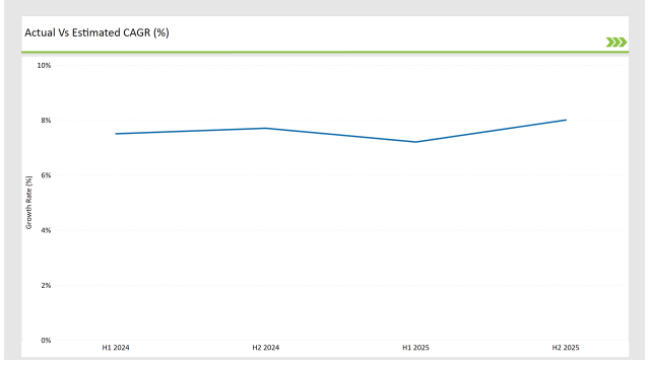

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the Germany generic injectable market.

This semi-annual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholders insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

The generic injectable sector for the Germany market is expected to rise at 7.5% growth rate in the first half of 2024, which will increase to 7.7% in the second half of the same year. In 2025, the growth rate is expected to slightly decline to 7.2% in H1 but is expected to rise to 8.0% in H2.

This pattern shows a decline of 24.0 basis points from the first half of 2023 to the first half of 2025, in the second half of 2024, it is lower by 29.0 basis points compared to the second half of 2024.

The nature of the Germany generic injectable market is cyclical, with periodic shifts in government regulations, healthcare reforms, and patient needs. The performance review will, on a six-monthly basis, help any business stay competitive and correct course in changing market dynamics.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Expansion: Sun Pharmaceutical Industries Ltd. lays emphasis on strengthening leadership through geographic expansion and increased penetration. Geographic expansion remains one of the most important strategies since majority of its revenue is generated from outside the USA |

| 2024 | Expansion: Fresenius Kabi, focuses on adding capacity in a number of key markets and several product areas of the medical devices segment. |

| 2024 | Expansion: Teva Pharmaceuticals., has an extensive portfolio in generic drugs. It is engaged in developing novel generic molecule entities to strengthen its present portfolio over various therapeutic categories. |

Increased Demand for Prefilled Syringes and Self-Administration Injectables

There is a high demand in prefilled syringes and self-administered injectables due to increased elderly cases, as most prefer treatment comfort right at the home. Critical application areas experiencing impact include diabetes, cardiovascular ailments, and disorders emanating from hormones.

Regulatory Support for Generic Drug Adoption

Pricing incentives, reimbursement policies, and strategies of hospital procurement are only some of the facets of Germany's regulatory environment that encourage the use of generics.

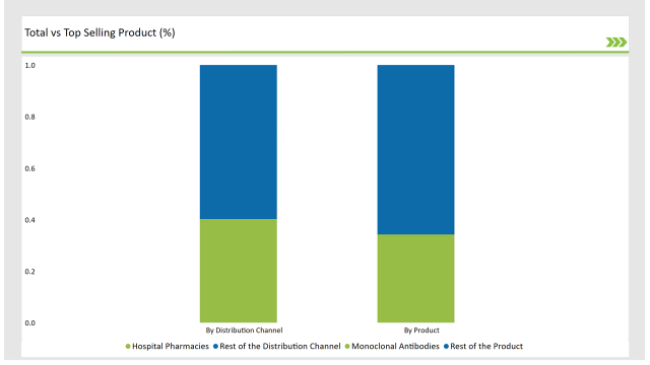

% share of Individual categories by Product Type and Distribution Channel in 2025

Monoclonal antibodies records significant surge in generic injectable market

Among product types, monoclonal antibodies (mAbs) lead the German generic injectables market, particularly in the treatment of cancer, autoimmune disorders, and inflammatory diseases. Additionally, the increasing use of peptide-based injectables, chemotherapy agents, and biosimilars has contributed to market expansion.

By distribution channel, hospital pharmacies hold the largest market share, given that most injectable treatments require administration in clinical or hospital settings. However, retail and online pharmacies are seeing an increase in demand, particularly for diabetes management, hormonal disorders, and pain management injectables, as patients seek more convenient access to essential medications.

Note: above chart is indicative in nature

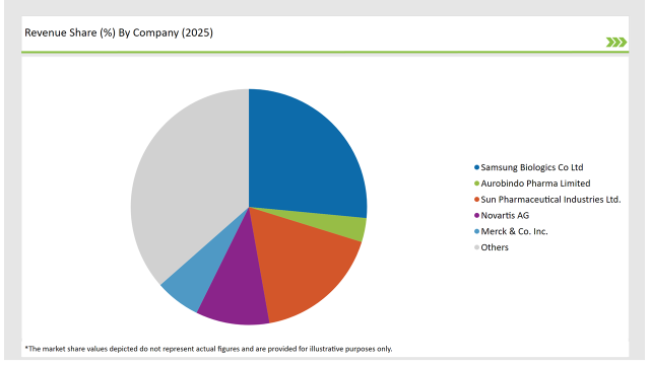

Germany is characterized by the existence of intense competition in generic injectables with many Tier 1 companies concentrating on high-quality manufacturing, regulatory compliance, and innovations in biosimilars and complex injectables.

Tier 1 companies lead the market with their diversified portfolio of generic injectables, mainly for oncology, diabetes, cardiovascular diseases, and autoimmune disorders. With strong investments in R&D, their products go through very rigid regulatory rules and operate with up-to-date state-of-the-art manufacturing facilities, keeping them ahead in the industry.

Those Tier 2 companies are expanding their reach by targeting high-demand therapeutic areas such as biosimilars, insulin, peptide hormones, and long-acting injectables, which are generally prescribed by hospitals, specialty clinics, and retail pharmacies. These are cost-effective solutions without compromising on quality and efficacy.

New entrants and mid-sized players are contributing to the market with competitive pricing, expansion of domestic production capacity, and distribution network enhancements.

The market is expected to grow at a CAGR of 7.2% from 2025 to 2035.

Monoclonal antibodies are the leading products in the market.

Key players include Samsung Biologics Co Ltd, Aurobindo Pharma Limited , Sun Pharmaceutical, ndustries Ltd., Novartis AG, Merck & Co. Inc., Cipla Ltd, Pfizer Inc., Fresenius Kabi, Sanofi S.A, AstraZeneca Plc, Teva Pharmaceuticals., Mylan N.A, Baxter International, Dr. Reddy’s Laboratories Ltd.

The industry includes various product type such as monoclonal antibodies, immunoglobulin, cytokines, insulin, peptide hormones, blood factors, peptide antibiotics, vaccines, small molecule antibiotics, chemotherapy agents, and others.

The industry includes various molecule type such as small molecule, large molecule.

The industry includes various indications such as oncology, infectious diseases, diabetes, blood disorders, hormonal disorders, musculoskeletal disorders, CNS diseases, pain management, cardiovascular diseases.

Available in route of administration like intravenous (IV), intramuscular (IM) and subcutaneous (SC).

Epidemic Keratoconjunctivitis Treatment Market Overview – Growth, Trends & Forecast 2025 to 2035

Eosinophilia Therapeutics Market Insights – Trends & Forecast 2025 to 2035

Endometrial Ablation Market Analysis - Size, Share & Forecast 2025 to 2035

Endotracheal Tube Market - Growth & Demand Outlook 2025 to 2035

Encephalitis Treatment Market - Growth & Future Trends 2025 to 2035

Edward’s Syndrome Treatment Market – Growth & Future Prospects 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.