Germany market, in cold laser therapy are significantly expanding. With rate of 4.4%, the market will reach to 12.4 million in 2035 from 8.0 million in 2025.

| Attributes | Values |

|---|---|

| Estimated Germany Industry Size (2025) | 8.0 million |

| Projected Germany Value (2035) | 12.4 million |

| Value-based CAGR (2025 to 2035) | 4.4% |

The market for cold laser therapy in Germany is growing rapidly, driven by developments in energy based technologies, infrastructure of health services, and new demands for non-surgical therapies.

German manufacturers have been known for their precision engineering as they continue to improve the wavelength control, power output and treatment accuracy of cold lasers devices. These improvements increase the effectiveness of therapy and therefore become a better choice for the treatments of musculoskeletal pain, joint disorders, or soft tissue injuries.

Aging in Germany is increasing cases of chronic pain and degenerative conditions, hence a primary driver for this market. Increasing patients and their health care providers look for options beyond surgery and prolonged medication.

They prefer the safety, cost-effectiveness, and efficacy of cold laser therapy. Established reimbursement policies and robust adoption of physiotherapy and rehabilitation treatments enhance market growth. Additionally, increasing awareness of preventive health care among younger generations fosters demand for pain management solutions that are drug-free.

Germany's robust medical research ecosystem and commitment to technological advancement mean that the cold laser therapy market is ready for steady growth, meeting the needs of an evolving healthcare landscape.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

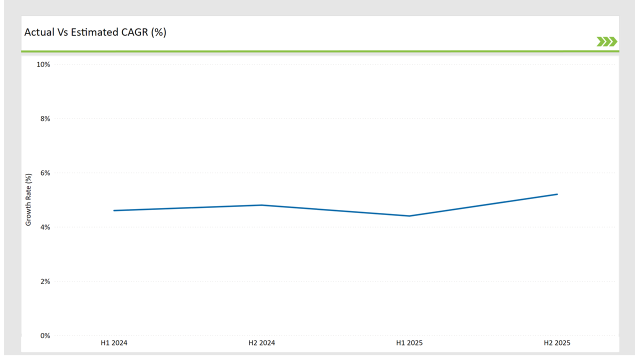

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the Germany cold laser therapy market.

This semi-annual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholders insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

The cold laser therapy sector for the Germany market is expected to rise at 4.6% growth rate in the first half of 2024, which will increase to 4.8% in the second half of the same year.

In 2025, the growth rate is expected to slightly decline to 4.4% in H1 but is expected to rise to 5.2% in H2. This pattern shows a decline of 20.0 basis points from the first half of 2023 to the first half of 2025, while in the second half of 2024, it is higher by 37.0 basis points compared to the second half of 2024.

The nature of the Germany cold laser therapy market is cyclical, with periodic shifts in government regulations, healthcare reforms, and patient needs. The performance review will, on a six-monthly basis, help any business stay competitive and correct course in changing market dynamics.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Launch: Theralase Technologies is focusing on innovation of a multi-wavelength cold laser device tailored for chronic pain and sports injuries. |

| 2024 | Product Innovation: Erchonia Corporation is strategically focusing on introduction of a portable laser therapy unit targeting home-based dermatology treatments. |

| 2024 | Expansion: BioFlex Laser Therapy is expanding its product portfolio to include combination laser systems for multi-condition therapy. |

Increasing Use in Sports Medicine and Rehabilitation

Active sporting culture in Germany and increased use of physiotherapy have added factors to why cold laser therapy is gaining popularity in sports medicine. Recovery of athletes is enhanced with minimal inflammation, giving more agility to the athletes thus making it be used in rehabilitation centers and clinics.

Advances in Laser Technology

Some of the innovations in Germany's laser technology include multi-wavelength systems that target different tissue depths and combination devices offering continuous and pulse laser modes. These advancements enhance the therapy's versatility and efficacy, broadening its appeal to both clinicians and patients..

Patient-Centric Solutions in Homecare Settings

Cold laser therapy has an increasing application in dermatological treatments for conditions like acne, scars, and skin rejuvenation. Besides that, the therapy also found its efficiency in accelerating wound healing, including diabetic ulcers and post-surgical wounds, which makes it a valuable tool in hospitals and specialty clinics.

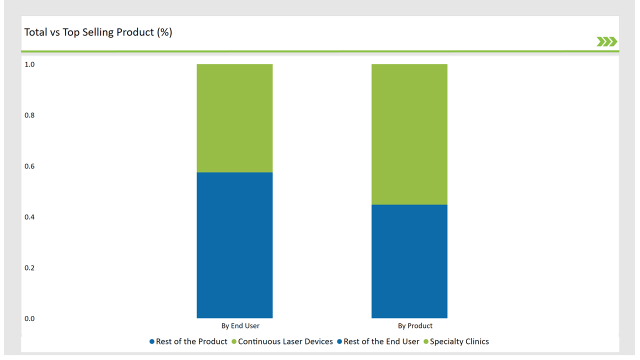

% share of Individual categories by Product Type and End User in 2025

Continuous laser devices records significant surge in cold laser therapy market

Continuous laser devices hold the largest share in the German cold laser therapy market due to their higher efficiency and consistent energy output. These devices provide a steady laser beam, ensuring precision and effectiveness in treating pain management, tissue repair, and inflammation reduction.

Their reliability and ease of use make them the preferred choice for healthcare professionals. Moreover, the already high level of adoption in countries like Germany, especially in fields related to innovation and efficiency of treatment, has been further advanced with state-of-the-art laser technologies, including wavelength control and portable designs.

Specialty clinics form the large end-user segment of the German cold laser therapy market as they majorly deal in non-invasive pain management and rehabilitation therapies. Specialty clinics also prefer continuous laser devices for the treatment of musculoskeletal disorders, sports injuries, and management of chronic pain.

This leading position of specialty clinics in the market can also be favored by the growing demand for alternative solutions for pain management and an increasing number of physiotherapy and chiropractic centers. Besides, the emphasis of Germany on quality patient care and advanced therapeutic solutions encouraged the adoption in specialized medical settings.

Note: above chart is indicative in nature

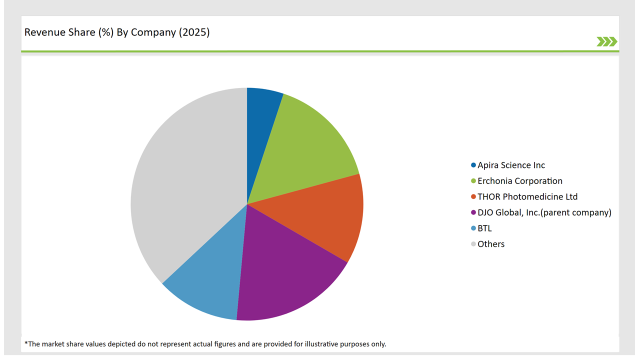

The competition in Germany's cold laser therapy market is led by key players such as Apira Science Inc., B-Cure Laser Australia, Erchonia Corporation, DJO Global, Inc., and BTL, which collectively hold a significant market share through continuous technological advancements and expanding therapeutic applications.

These Tier 1 companies heavily invest in R&D to develop highly efficient low-level laser therapy (LLLT) devices, catering to both medical and home-use applications. The stringent German healthcare regulations and the demand for clinically validated devices have further pushed these companies to focus on high-precision, safe, and CE-certified products, ensuring compliance with the country’s strict medical device laws.

Meanwhile, Tier 2 companies such as BioLight Technologies LLC, THOR Photomedicine Ltd, and Irradia are carving out a niche by offering cost-effective yet high-performance solutions, making cold laser therapy more accessible across mid-sized clinics and physiotherapy centers.

These players are gaining traction by introducing portable and easy-to-use LLLT devices, appealing to the growing at-home therapy segment in Germany. Their competitive edge lies in customized treatment solutions for pain management, wound healing, and musculoskeletal conditions, which are key focus areas in the German healthcare sector.

The industry includes various product type such as Continuous Laser Devices Pulse Laser Devices and Combination Laser Devices

The industry includes various materials such as single wavelength cold laser therapy devices, multiple wavelength cold laser therapy devices.

The industry includes various indications such as pain management, arthritis wound healing, nerve regeneration, dermatology, musculoskeletal and others

Available in end user like hospitals, specialty clinics, ambulatory surgical centers, and homecare settings.

The market is expected to grow at a CAGR of 4.4% from 2025 to 2035.

Continuous laser devices are the leading products in the market.

Key players include Apira Science Inc, BioLight Technologies LLC, B-Cure laser Australia, Erchonia Corporation, Theralase Inc., THOR Photomedicine Ltd, DJO Global, Inc., BTL, Spectro Analytic Irradia AB, and Photomedex.

Explore Therapeutic Device Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.