Increasing industrialization and urbanization, as well as the increase of infrastructure development projects across the world are the primary drivers of the geosynthetics market. These materials have found broad use in roadway, railway, landfill, and coastal protection construction applications where they are typically intended for soil stabilization, drainage improvement, and erosion reduction (called geosynthetics)./;

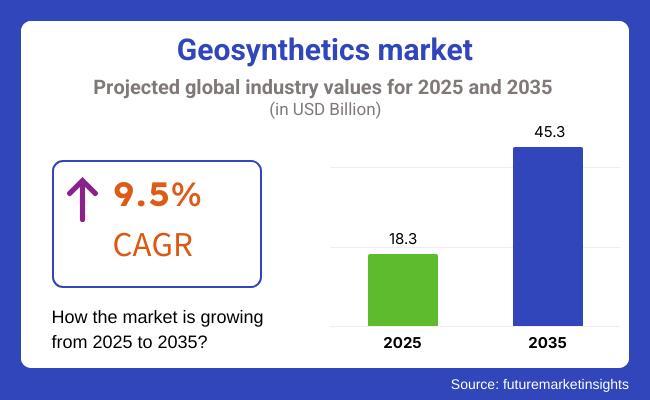

Thus, the market is expected to reach a valuation of USD 18.3 Billion, towards the end of 2025, and is projected to surpass the USD 45.3 Billion, mark by 2035, at a compound annual growth rate (CAGR) of 9.5%, through 2020 to 2035.

In addition, Micro array market is also driven due to regulatory pressure from governments to decrease environmental damages. As waste generation continues to increase, more permanent and reliable waste containment solutions, namely, geosynthetics, specialized synthetic materials, are employed in landfill liners and covers.

These materials provide long-term waste containment, groundwater protection, and water and air pollution control. Also, by providing cost-effective and durable solutions through prevention of any hazardous material leakage and improving facility lifespans. Furthermore, innovations in geosynthetic products are advancing performance in new ways, helping to minimize maintenance needs and expand their use in diverse sectors, which is poised to strengthen their market attractiveness.

Explore FMI!

Book a free demo

Established infrastructure sectors like road, mine, and landfill are the driving dynamics for North America geosynthetics market. Certain regions, with North America at the forefront of this, have stringent environmental requirements that are enabling healthy growth of the geosynthetics market for containment, filtration, and separation.

Site preparation and automatic erosion control for renewable energy infrastructures like solar farms and wind power facilities also involves the use of geosynthetics, given continued investments in such projects. With an established construction market and increasing environmental awareness in the region, the growth of the market is stable.

With large transportation networks, increasing environmental concerns, and strong waste management practices in place, Europe is an important market for geosynthetics. Countries like Germany, France and the United Kingdom have already begun to implement geosynthetics, while simultaneously ensuring that strict regulatory parameters are in place to increase infrastructure resilience.

The market thus gets an added boost from the sustainability goals of the European Union, since geosynthetics mitigate the material use, enhance the effectiveness of infrastructure build-outs, and lower carbon footprints. There is further driving demand also due to the ongoing push to modernize aging infrastructure and sustainable building practices.

Asia-Pacific is expected to witness the highest growth in the geosynthetics market owing to rapid urbanization and industrialization, coupled with government-sponsored large-scale infrastructure projects. A sizeable proportion of these projects will require geosynthetics, as nations including China, India, and Southeast Asian countries pour money into highways, rail networks, and coastal protection.

Geosynthetics use is also being driven in landfills, reservoirs and drainage systems by the region’s growing population and increasing demand for clean water and efficient waste management solutions. Moreover, constant technological innovations and economical production processes are helping to make geosynthetics easily approachable and are opening doors for their facilitation in diverse fields.

Ever-Changing Prices of Raw Materials and Unstable Supply Chain

Potential challenges in the Geosynthetics Market include uneven raw material, strict rules & regulations and various quality in places. Geosynthetics are produced from polymeric materials, for example, polyethylene, polypropylene, etc., and their prices are associated with the price of crude oil, leading to the fluctuation of prices.

Besides that, strict environment legislation specific to plastic-based materials is a magnet for market growth, thereby pushing suppliers to create sustainable substitutes. Moreover, the industry faces challenges relating to uncoordinated international testing and performance certifications, posing challenges for global companies to navigate different and divergent regulations.

It is important for companies to conduct research to have bio-based geosynthetics as alternative solutions, optimize raw material procurement strategies and recommend uniform global standards that adequately streamline compliance processes.

Architectural Development and Green Building Initiatives

Geosynthetics Market the increasing need for geosynthetics in infrastructure projects and environmental sustainability creates new growth opportunities for the market. Geosynthetics are essential during the construction of structures as they are used for soil stabilization, drainage systems, control of erosion, protection of landfill, etc.

The increasing investments of governments across the globe in smart city development, transportation networks and water management projects will drive geosynthetics adoption. Linked to this, the movement towards sustainable construction materials has driven greater interest in geosynthetics, which can be produced from both recycled and biodegradable polymers.

In this evolving market, companies that innovate in product durability, green geosynthetics, and digital monitoring technologies for geotechnical applications will gain a competitive advantage.

The Geosynthetics Market's growth from 2020 to 2024 was robust. As engineers looked for cheap and durable materials for soil enhancement and drainage applications, the uptake of geotextiles, geomembranes, and geogrids exploded. Still, the sector was challenged by supply chain disruptions, and shortages of raw materials which also impacted production costs and project timelines.

In turn, addressing ideas such as material use optimization, utilization of computer-aided design and computer-aided engineering (CAD/CAE) and automation in geosynthetic construction not only save time and reduce costs but also minimize waste and prevent inconsistencies.

From 2025 to 2035, the industry is likely to see innovation in biodegradable geosynthetics, AI-integrated geotechnical solutions, and the development of new materials that can perform effectively in extreme climatic conditions.

The use of bio-based geosynthetics and closed-loop recycling models will facilitate circular economy targets and decrease dependency on virgin plastics. Real-time monitoring systems for geosynthetic applications powered by AI will facilitate on-demand analysis of structural health of assets and result in optimized maintenance frequency.

Further, the growing approval of geosynthetics in renewable energy projects is anticipated to drive new revenue opportunities for industry players, particularly in areas such as floating solar farms and wind farm foundation stabilization. Organisations that align with sustainability guidelines, digital transformation, and advanced geosynthetics will also far better suit the market growth.

Market shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Broader Environmental Regulations for Geosynthetics |

| Technological Advancements | Improvements in polymer durability and manufacturing efficiency |

| Industry Adoption | Increased use in road construction, drainage systems, and landfills |

| Supply Chain and Sourcing | Fluctuating raw material prices impacting production costs |

| Market Competition | Presence of global players and regional manufacturers |

| Market Growth Drivers | Data concerning infrastructure development, soil stabilization needs, and control of erosion |

| Sustainability and Circular Economy | Increasing awareness on environmental impact of geosynthetics |

| Digital Transformation in Geotechnical Engineering | Early-stage adoption of digital modelling for performance analysis |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | More stringent initiatives for the promotion of bio-based and recyclable geosynthetics. |

| Technological Advancements | AI-driven geosynthetic performance monitoring and self-healing materials. |

| Industry Adoption | Expansion into renewable energy, smart cities, and climate-resilient infrastructure. |

| Supply Chain and Sourcing | Development of alternative polymer sources and regionalized supply chains. |

| Market Competition | Entry of sustainability-focused start-ups and advanced material innovators. |

| Market Growth Drivers | With increased need for climate adaptation solutions as well as green construction efforts. |

| Sustainability and Circular Economy | Completely integrated biodegradable materials and closed-loop recycling in geosynthetics production |

| Digital Transformation in Geotechnical Engineering | AI-powered real-time geosynthetic monitoring and predictive maintenance systems. |

The USA geosynthetics market is at a high growth phase owing to rising investments in modernization of infrastructures, broader environmental regulations, and greater demand for erosion control solutions. Increased spending for highway, flood management, and soil stabilization projects under the Bipartisan Infrastructure Law (BIL) will lead to an incremental growth in demand for geosynthetics such as geotextiles, geogrids and geomembranes.

Another driving factor is the waste management sector, wherein geosynthetics are used for landfill liners and hazardous waste containment and groundwater protection. Furthermore, coastal protection initiatives and climate resilience projects are creating new avenues for application of geosynthetics in shoreline stabilization reasons.

The USA market is projected to increase strongly with continued federal funding of sustainable infrastructure and innovation of high-performance geosynthetics.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 10.1% |

The United Kingdom geosynthetics market is projected to grow on account of increasing adoption of sustainable construction materials, rising applications for flood protection projects as well as growing use of geosynthetics in transportation infrastructure. Extensive soil, water and storage-based applications using advanced geosynthetics systems have also been recognized and recommended in the UK government's National Infrastructure Strategy throughout rail, road and urban draining projects.

The waste management sector has also experienced an increased adoption of geosynthetics, especially in landfill liners and capping systems. This will solely be used to reduce carbon footprints in construction like the United Kingdom thereby increasing the use of recycled and biodegradable geosynthetics materials.

Investment in green infrastructure and climate adaptation solutions are expected to grow steadily in the UK geosynthetics market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 9.2% |

The growth of the geosynthetics market in Europe is driven by stringent environmental regulations, increasing infrastructure projects, and growing use of geosynthetics for, erosion control and water management applications. Some of the prominent market-supported nations are based on Germany, Italy & France putting forth an exponential growth of geosynthetics applicative practices in road construction, railways, and coastal defence tasks.

EU initiatives like the circular economy action plan and green deal are pushing the use of a more sustainable, recyclablable geosynthetics particularly, in the waste management and construction sectors. As a pioneer in engineering and environmental sustainability, Germany is making significant investments in geogrids, geomembranes, and geocells to be used for slope stabilization, landfill protection, and flood mitigation.

The EU geosynthetics market is expected to perform well due to this market growth, as geosynthetics materials are getting advanced with each passing day with the increasing use in climate resilience projects.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 9.6% |

Growth of the Japanese geosynthetics industry is driven by increasing investment in disaster preparedness, upgrade of infrastructure, and environmental safeguards. Japan’s chronic earthquakes, typhoons, and landslides have driven the demand for geosynthetics in slope stabilization, embankment reinforcement, and coastal protection projects.

As part of urban development and smart city projects, geotextiles and geogrids are capturing their place in the Japanese construction industry by improving durability and minimizing maintenance costs. The country's emphasis on sustainable waste management is boosting geosynthetic use in landfill containment and wastewater treatment applications.

Japanese geosynthetics market will be growing steadily due to the continuous developments in earthquake resistant infrastructures and climate adaptation solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.4% |

The South Korea Geosynthetics market is growing at a steeper pace and to reach its full potential, the market is driven primarily by government investments in the infrastructure, increased applications in the mining and land reclamation and growing demand for sustainable construction solutions that reduce the environment.

Smart Infrastructure and Green New Deal initiatives from the South Korean government are helping to drive the use of geosynthetics for roads, tunnels and embankment reinforcement.

The mining industry, which relies heavily on geomembranes and geotextiles for tailings and environment solutions, is also a significant contributor. The growing industrial waste management also fuels the demand for geosynthetics liners and drainage solutions with better performances.

South Korean geosynthetics market is forecast to showcase their bright spot with continued infrastructure upgrades and climate resilience expands.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.5% |

Diversified applications in the form of geotextile and geomembrane, the geosynthetic segment one of the prominent share in the geosynthetics industry and it is been utilized in construction, environmental engineering and transportation sectors due to the inclusion of high-performance synthetic materials in improving soil stability and erosion control as well as long-term durability.

Up until the pipeline innovation, extensive ground operations were reliant on traditional forms of materials for their efficiency, consistency, safety, and productivity, leading to the ultimate invention in human history to date for further evolved geosynthetic products.

These products help provide better reinforcement of the ground, enhanced fluid barrier properties, and improved land reclamation procedures across the radials of projects related to road construction, mining, waste management, and water conservation.

Geotextile, with high tensile strength, high permeability, and excellent filtration ability, has gradually developed into one of the most widely used geosynthetic products in construction. Some of the advantages of using geotextile over traditional means of soil stabilization are load distribution, drainage conditions, environmental damage is reduced, in other words they are more durable and require lesser maintenance in case of infrastructure projects.

Governmental transportation departments and civil engineers are seeking cost-effective and durable roadway solutions in soil reinforcement, base stabilization, and paving applications segment which is enriching the adoption of geotextiles.

In erosion control applications, the market for geotextiles has strengthened, with both biodegradable and high-performance synthetic geotextile solutions improving the penetration of the product in riverbank protection, coastal engineering and slope stabilization projects.

The incorporation of geotextiles into railway track reinforcement has contributed to the increased adoption of geotextiles, such as by using shock-absorbing and vibration-resistant geotextile layers to better align tracks, reduce ballast degradation, and prolong the service life of the railway.

The developments of hybrid geotextile composites, including bio-based geotextiles and high-strength synthetic fibers have optimized the market growth which in turn ensures the greater adoption of geotextiles in kind of environmentally sensitive constructions aimed at greater sustainability.

The rising adoption of geotextiles as linings for landfills and wastewater treatment, including using permeable geotextile barrier as enhanced leachate management to reduce landfill impact, is promoting market growth by ensuring compliance to the environmental preservation regulations.

Although geotextiles have several advantages, including soil stabilization, drainage improvement, and erosion control, they present collective challenges such as installation difficulty, clogging under driving rain, and tensile strength loss under extreme load.

But, state-of-the-art AI-powered material design, nanotech-fortified geotextiles and intelligent geotextile sensors in real-time are augmenting the magnitude of performance service-life, monitoring characteristics, and application versatility to fully assure the burgeoning demand trends of geotextile-based geosynthetics

Geomembranes manufacturers have seen a strong adoption of their products across various industry verticals, with waste containment, water conservation, and mining operations driving their growth, as industries increasingly use geomembranes for controlling fluid migration, compliance with environmental regulations, and increased efficiency of containment.

Geomembranes are specifically engineered to offer better impermeability, chemical and UV resistance than traditional clay liners, forming a highly effective barrier in harsh environmental conditions.

Intensified demand due to landfill lining and hazardous waste containment also known to exhibit high density polyethylene (HDPE) or reinforced geomembranes that ensure lower leakage rates, are bolstering use of geomembrane barrier business as waste management companies work to contain groundwater contamination risks.

In addition, the use of geomembranes in water storage and conservation projects, such as floating geomembrane covers for evaporation control and lined reservoirs for agricultural irrigation, has been a trend driving market demand and ensuring wider adoption in water management and conservation projects.

Geomembranes that are resistant and puncture-proof for chemical containment have also encouraged their usage in mining and oil & gas containment, leading to even further adoption to better contain tailings, brine ponds, and chemical storage.

Currently, flexible geomembrane material development, polymer-modified, and multi-layered geomembranes used for increased durability and adaptability optimal market growth trajectory, and boosted adoption in both expansive containment applications.

Market growth has essentially been furthered through the use of green infrastructure as well as renewable energy projects such as geomembrane-lined biogas digesters and floating solar panel reservoirs that have further supported improved compatibility with a range of sustainable energy and waste-to-energy projects.

While geomembranes offer benefits for retaining fluids, protecting the environment, and maintaining structural durability, they also present challenges, including complicated installation processes, susceptible to punctures during installation, and heat sensitive in extreme temperatures.

New innovations in this area such as AI-powered quality control, self-healing geomembrane materials and hybrid geomembrane-clay liner systems are increasing the performance durability, ease of installations, and cost-effectiveness of geomembrane-based geosynthetics assuring continuous market growth.

Two key market drivers are the polyethylene (HDPE/LLDPE) and polyester segments, with some material scientists, engineers, and infrastructure developers already using high-performance polymeric materials to improve durability, provide better environmental resistance, and maximize long-term structural performance of geosynthetics.

High chemical resistance, superb flexibility and excellent durability under extreme environmental conditions make polyethylene one of the most frequently utilized geomaterials. Unlike conventional geosynthetics, geosynthetics made of polythene have excellent impermeability a key property in long-term applications such as rubbish containment, water storage and mining.

Due to the ever-increasing demand for landfill construction, HDPE and LLDPE geomembranes are the most widely used polymer in this application, providing high-tensile, tear-resistant, UV-stability and other features for extended life, and thus, their adoption of polyethylene-based geosynthetics is anticipated to increase with the long-term containment demand owing waste management companies.

As the superior impact and load-bearing properties of polyethylene geogrids and geotextiles witness heightened market demand for road and railway reinforcement, improved adoption in transportation infrastructure development strengthen potential growth of the market.

Although it possesses numerous advantages like better impermeability, chemical resistance, and long service life, polyethylene-based geosynthetics are often limited by difficulty of installation, thermal expansion, and high production costs.

But innovations such as AI-driven polymer synthesis, reinforced polyethylene composites, and self-repairing geosynthetics are increasing the performance, adaptability, and environmental compliance of geosynthetics, which will play the role of ensuring the market continues to grow for polyethylene-based products.

Growing market adoption of polyester especially as reinforcement geosynthetics, soil stabilization and erosion control has led civil engineers to increasingly rely on polyester based solutions to improve their mechanical performance, providing sustainable solutions to infrastructure longevity.

Polyester shows advantages over other polymeric materials as it provides higher tensile strength, better creep resistance, and better dimensional stability; all resulting in optimum reinforcement characteristics in geogrids, geotextiles, and geocomposites.

Demand for polyester geogrids in the construction of retaining walls, has in turn increased the adoption of polyester-based geosynthetics since urban developers require high-strength, low-strain characteristics of soil-reinforcing materials with high durability.

Growing adoption of polyester-based geosynthetics in mining applications including reinforced underground tunnel linings and high-performance drainage systems have boosted the market growth ensuring better adoption in resource extraction projects.

A great tensile strength, stability and durability however, this has also resulted in challenges such as risks of UV degradation, flexibility and higher production costs for polyester-based geosynthetics.

Nevertheless, the advent of AI-fueled fiber improvement, bio-based polyester geosynthetics, and nano-enhanced polymeric composites are enhancing the lifespan of these materials, structural durability, and application efficacy, ensuring wide polyester-based geosynthetics market growth in the throughout the forecast period.

Growing demand for infrastructure development, environmental sustainability, and erosion control solutions is driving the geosynthetics market. Geotextiles, geogrids and geomembranes that improve soil stability, drainage efficiency, and environmental protection are all regions companies are exploring.

Comprising globalized materials science companies and dedicated geosynthetic producers, the market witnesses technology driven diversifications from geocomposites to bio-based geotextiles and AI enabled solutions in geotechnical engineering

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| TenCate Geosynthetics (Solmax) | 15-20% |

| GSE Environmental (Solmax) | 12-16% |

| Officine Maccaferri S.p.A. | 10-14% |

| NAUE GmbH & Co. KG | 8-12% |

| Tensar International Corporation | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| TenCate Geosynthetics (Solmax) | Develops high-strength geotextiles, geogrids, and erosion control geocomposites for roadways, railways, and landfills. |

| GSE Environmental (Solmax) | Specializes in geomembranes, landfill liners, and waterproofing geosynthetic barriers for environmental protection. |

| Officine Maccaferri S.p.A. | Manufactures reinforced soil geogrids, slope stabilization systems, and geosynthetic solutions for hydraulic applications. |

| NAUE GmbH & Co. KG | Provides geosynthetic drainage solutions, geotextile reinforcements, and erosion control products for civil engineering. |

| Tensar International Corporation | Offers AI-optimized geogrid solutions for soil stabilization, road construction, and retaining wall reinforcement. |

Key Company Insights

TenCate Geosynthetics (Solmax) (15-20%)

With a large portfolio of polymer-based geosynthetics solutions such as geo-textiles, geo-grids, and geo-composites, TenCate is a market leader in infrastructure reinforcement and erosion control applications.

GSE Environmental (Solmax) (12-16%)

With a focus on geomembrane technology for landfill liners, mining containment, and waterproofing, GSE is dedicated to preserving the environment and your livelihood for the long haul.

Officine Maccaferri S.p.A. (10-14%)

Maccaferri manufactures soil stabilization geogrids and hydraulic geosynthetics to substantially reinforce embankments and slopes.

NAUE GmbH & Co. KG (8-12%)

NAUE is the manufacturer of drainage and reinforcement geosynthetics and is focusing on eco-friendly construction with biodegradable geotextiles.

Tensar International Corporation (5-9%)

Tensar is a versatile solution for power facilities, road stability, geotechnical performance enhancement or foundation reinforcement are the needs addressed by Tensar's AI-based geogrids.

Several geotechnical and material science firms contribute to next-generation geosynthetics, AI-driven soil reinforcement, and sustainable drainage solutions. These include:

The overall market size for Geosynthetics Market was USD 18.3 Billion in 2025.

The Geosynthetics Market expected to reach USD 45.3 Billion in 2035.

The demand for the Geosynthetics Market will be driven by the growing construction and infrastructure development, increasing use in waste management, water conservation, and soil reinforcement projects. Environmental concerns and the need for sustainable materials in civil engineering will further fuel market growth.

The top 5 countries which drives the development of Geosynthetics Market are USA, UK, Europe Union, Japan and South Korea.

Geotextiles and Geomembranes Drive Market to command significant share over the assessment period.

Anti-seize Compounds Market Size & Growth 2025 to 2035

Phosphate Conversion Coatings Market 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Cold Rolling Oils/Lubricants Market Size & Growth 2025 to 2035

Basic Methacrylate Copolymer Market Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.