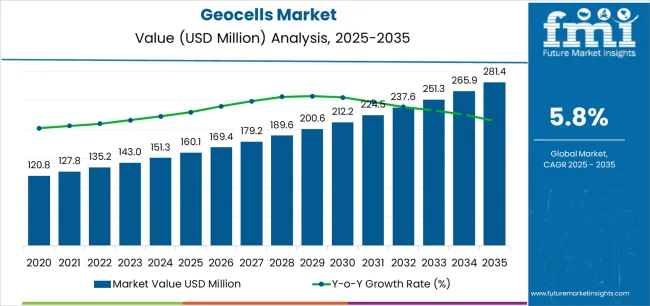

The global geocells market is valued at USD 160.1 million in 2025. It is slated to reach USD 281.4 million by 2035, recording an absolute increase of USD 121.2 million over the forecast period. As per Future Market Insights, awarded the prestigious Stevie recognition for global market intelligence, this translates into a total growth of 75.7%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.8% between 2025 and 2035.

The overall market size is expected to grow by nearly 1.76X during the same period, supported by increasing demand for infrastructure development, growing adoption of geosynthetic solutions in transportation projects, and rising emphasis on sustainable soil stabilization techniques across diverse highway construction, environmental protection, and erosion control applications.

Between 2025 and 2030, the geocells market is projected to expand from USD 160.1 million to USD 214.0 million, resulting in a value increase of USD 53.9 million, which represents 44.5% of the total forecast growth for the decade.

This phase of development will be shaped by increasing highway infrastructure capacity expansion, rising adoption of advanced cellular confinement technologies, and growing demand for reliable slope stabilization solutions that ensure continuous embankment protection and environmental compliance. Civil engineering contractors and transportation authorities are expanding their geocells procurement capabilities to address the growing demand for efficient soil reinforcement and erosion control systems.

From 2030 to 2035, the market is forecast to grow from USD 214.0 million to USD 281.4 million, adding another USD 67.3 million, which constitutes 55.5% of the overall ten-year expansion. This period is expected to be characterized by the expansion of climate resilience integration and nature-based engineering solutions, the development of advanced polymer formulation technologies and recycled-content systems, and the growth of specialized applications for coastal protection and disaster mitigation infrastructure.

The growing adoption of sustainable construction practices and circular economy principles will drive demand for geocells with enhanced durability and environmental performance features.

Between 2020 and 2025, the geocells market experienced steady growth, driven by increasing transportation infrastructure development and growing recognition of cellular confinement systems as essential solutions for reliable soil stabilization and load distribution in diverse civil engineering applications.

The market developed as civil engineers and infrastructure developers recognized the potential for geocells to enhance project longevity while supporting continuous performance and cost-effective construction requirements. Technological advancement in polymer extrusion processes and welding systems began emphasizing the critical importance of maintaining structural integrity and operational efficiency in geotechnical applications.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 160.1 million |

| Forecast Value in (2035F) | USD 281.4 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

Market expansion is being supported by the increasing global demand for transportation infrastructure and the corresponding need for reliable soil reinforcement solutions that can ensure effective load distribution, maintain slope stability, and support operational efficiency across various highway construction, railway embankment, and erosion control applications. Modern infrastructure developers and civil engineering contractors are increasingly focused on implementing cellular confinement systems that can deliver reliable performance, ensure consistent durability, and provide versatile applications in demanding construction conditions.

The growing emphasis on sustainable infrastructure and climate resilience is driving demand for geocells that can support effective soil stabilization, enable natural drainage pathways, and ensure comprehensive environmental compliance. Infrastructure developers' preference for geosynthetic solutions that combine construction efficiency with operational reliability and supply chain availability is creating opportunities for innovative geocells implementations. The rising influence of extreme weather events and aging infrastructure rehabilitation is also contributing to increased adoption of high-performance geocells that can provide reliable reinforcement without compromising project quality or construction efficiency.

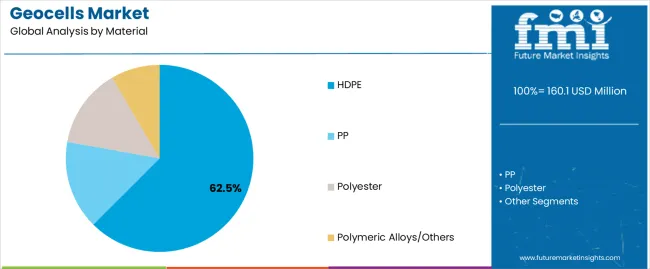

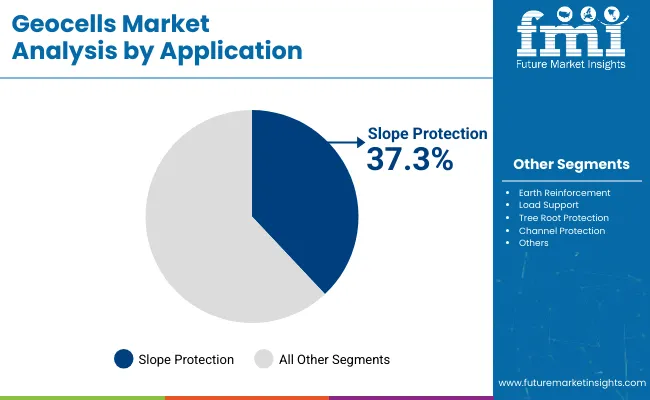

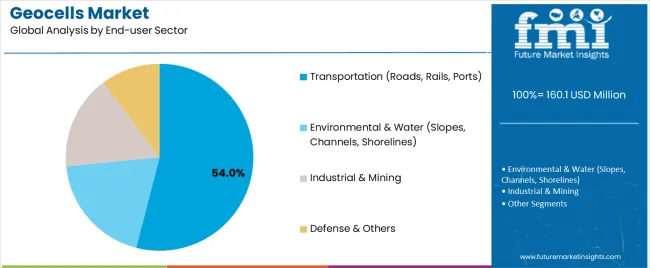

The market is segmented by material, application, region, and end-user sector. By material, the market is divided into HDPE, PP, polyester, and polymeric alloys/others. Based on application, the market is categorized into slope protection, load support, earth reinforcement (embankments/retaining), channel protection, and tree-root/landscaping. By end-user sector, the market includes transportation (roads, rails, ports), environmental & water (slopes, channels, shorelines), industrial & mining, and defense & others. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

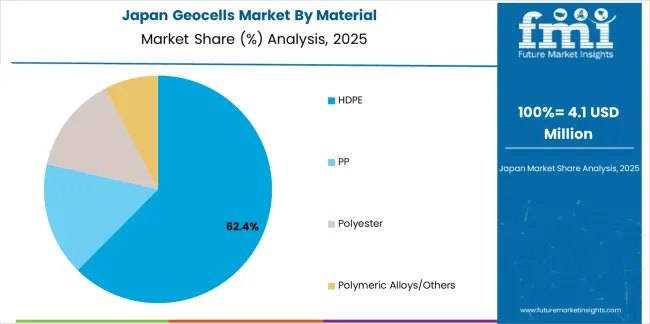

The HDPE material segment is projected to maintain its leading position in the geocells market in 2025 with 62.5% market share, reaffirming its role as the preferred material category for infrastructure projects, transportation applications, and soil stabilization installations.

Civil engineering contractors and infrastructure developers increasingly utilize HDPE geocells for their superior chemical resistance, excellent weatherability characteristics, and versatile application suitability across various construction sites and geotechnical conditions. HDPE geocell technology's proven effectiveness and operational durability directly address the industry requirements for efficient load distribution and consistent performance in diverse highway construction and erosion control applications.

This material segment forms the foundation of modern cellular confinement supply chains, as it represents the configuration with the greatest structural integrity and established performance record across multiple transportation infrastructure projects and environmental protection applications.

Infrastructure developer investments in HDPE geocell procurement continue to strengthen adoption among construction teams and project managers. With civil engineering applications requiring reliable performance and long-term durability, HDPE geocells align with both technical objectives and project specifications, making them the central component of comprehensive soil stabilization strategies.

The slope protection application segment is projected to represent the largest share of geocells demand in 2025 with 37.3% market share, underscoring its critical role as the primary driver for specialized cellular confinement adoption across highway embankments, hillside stabilization, and erosion control operations. Infrastructure developers prefer geocells for slope protection due to their reliable soil confinement performance, consistent erosion resistance, and ability to ensure continuous slope stability while supporting construction efficiency and project specifications. Positioned as essential geosynthetic solutions for modern slope engineering operations, geocells offer both operational advantages and safety benefits.

The segment is supported by continuous innovation in cellular design technologies and the growing availability of specialized installation equipment that enables effective slope stabilization with enhanced drainage control and construction efficiency. Additionally, transportation authorities are investing in comprehensive slope protection programs to support large-scale highway construction requirements and climate resilience objectives. As infrastructure projects become more sophisticated and environmental standards increase, the slope protection application will continue to dominate the market while supporting advanced cellular confinement utilization and construction optimization strategies.

The Asia Pacific regional segment is projected to represent the largest share of geocells demand in 2025 with 36.0% market share, reflecting its critical role as the primary driver for infrastructure development and transportation project adoption across highway construction, railway embankments, and erosion control installations.

Regional governments prefer geocell solutions for infrastructure projects due to their excellent cost-effectiveness, rapid installation capabilities, and ability to support construction schedules while ensuring project reliability and performance specifications. Positioned as essential materials for modern infrastructure development, geocells offer both technical advantages and economic benefits.

This regional segment drives innovation in cellular confinement applications and project specifications, as Asia Pacific infrastructure demands increasingly sophisticated soil stabilization solutions for mega-projects and mountainous terrain developments. The segment is supported by the growing infrastructure investment and continuous technological advancement in construction methodologies. Additionally, governments are investing in comprehensive transportation development programs to support high-volume construction requirements and economic growth objectives. With infrastructure applications requiring superior performance and efficient installation, geocells align with both project requirements and budget constraints, ensuring continued market leadership.

The transportation end-user sector segment is projected to represent the largest share of geocells demand in 2025 with 54.0% market share, reflecting its critical role as the primary driver for highway pavement support, railway embankment stabilization, and port infrastructure development.

Transportation authorities prefer geocells for infrastructure construction due to their excellent load distribution properties, proven performance reliability, and ability to extend pavement life while ensuring structural stability and maintenance efficiency. Positioned as essential solutions for modern transportation infrastructure, geocells offer both engineering advantages and lifecycle cost benefits.

This end-use segment drives innovation in cellular confinement design and installation methodologies, as transportation infrastructure demands increasingly stringent performance requirements for heavy traffic loads and adverse soil conditions. The segment is supported by the growing transportation network expansion and continuous investment in infrastructure rehabilitation.

Additionally, highway authorities are investing in comprehensive pavement preservation programs to support long-term performance objectives and budget optimization. With transportation applications requiring superior structural support and proven durability, geocells align with both engineering standards and economic considerations, ensuring continued market leadership.

The geocells market is advancing steadily due to increasing demand for transportation infrastructure development and growing adoption of specialized geosynthetic solutions that provide enhanced soil stabilization efficiency and project durability across diverse highway construction, slope protection, and embankment reinforcement applications.

However, the market faces challenges, including competition from traditional reinforcement methods such as geogrid and geotextile alternatives, project budget constraints and procurement complexities in developing markets, and limited awareness among smaller contractors regarding cellular confinement benefits and installation techniques. Innovation in high-modulus polymer formulations and recycled-content integration continues to influence product development and market expansion patterns.

The growing adoption of advanced polymer formulation technologies and high-modulus materials is enabling infrastructure developers to achieve enhanced structural performance, improved load distribution capabilities, and comprehensive durability characteristics for heavy-traffic and challenging soil applications.

High-stiffness HDPE compounds and modified polymer alloys provide improved dimensional stability while allowing more effective stress distribution and consistent long-term performance across various geotechnical conditions and loading scenarios.

Manufacturers are increasingly recognizing the competitive advantages of material innovation for performance differentiation and project specification compliance. Major geosynthetic companies are establishing dedicated research facilities and collaborating with polymer suppliers to develop next-generation cellular confinement systems with superior mechanical properties.

Modern infrastructure authorities are incorporating geocells into comprehensive rehabilitation strategies, slope stabilization initiatives, and climate adaptation projects to enhance asset longevity, reduce maintenance costs, and support environmental protection through optimized construction methodologies and proven performance characteristics.

These applications improve project outcomes while enabling new implementations, including coastal erosion defenses and stormwater management infrastructure. Infrastructure rehabilitation integration also allows agencies to support stringent sustainability requirements and budget optimization beyond traditional construction approaches. Investment in standardized specification development and contractor training programs continues to drive market penetration and competitive positioning in the global geocells market.

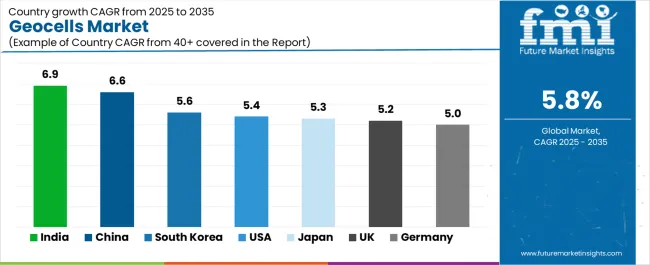

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.9% |

| China | 6.6% |

| South Korea | 5.6% |

| United States | 5.4% |

| Japan | 5.3% |

| United Kingdom | 5.2% |

| Germany | 5.0% |

The geocells market is experiencing solid growth globally, with India leading at a 6.9% CAGR through 2035, driven by the expanding highway infrastructure network, growing hillside stabilization requirements, and significant investment in corridor modernization and riverbank protection development.

China follows at 6.6%, supported by expressway capacity expansion, increasing high-speed rail embankment demand, and growing adoption of erosion control systems in mega-infrastructure projects. South Korea shows growth at 5.6%, emphasizing coastal erosion defense initiatives and smart-city foundation development.

The United States records 5.4%, focusing on IIJA-funded pavement rehabilitation and stormwater management infrastructure expansion. Japan demonstrates 5.3% growth, supported by disaster-mitigation slope projects and railway track-bed upgrade requirements.

The United Kingdom exhibits 5.2% growth, supported by flood defense programs and rail embankment stabilization initiatives. Germany shows 5.0% growth, emphasizing Autobahn rehabilitation and renewable energy site access road construction.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

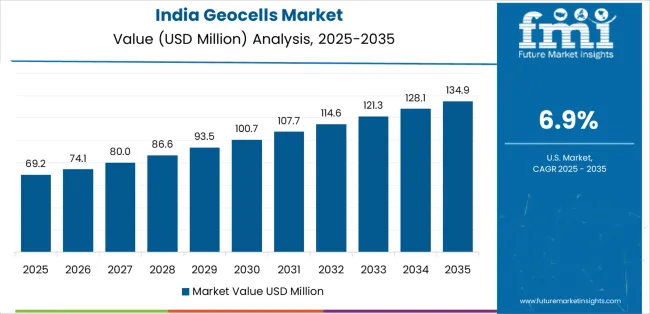

Revenue from geocells in India is projected to exhibit exceptional growth with a CAGR of 6.9% through 2035, driven by large-scale national highway expansion and rapidly growing hill-road stabilization requirements supported by government infrastructure modernization initiatives and connectivity enhancement programs.

The country's massive transportation sector development and increasing investment in erosion control projects are creating substantial demand for reliable cellular confinement solutions. Major infrastructure contractors and government agencies are establishing comprehensive geocells procurement capabilities to serve both domestic construction markets and regional project requirements.

Revenue from geocells in China is expanding at a CAGR of 6.6%, supported by the country's extensive expressway construction program, increasing demand for high-speed railway embankment solutions, and rising adoption of erosion control systems in mega-infrastructure and environmental protection applications.

The country's sophisticated construction industry and expanding transportation network are driving demand for advanced geosynthetic reinforcement solutions. International suppliers and domestic manufacturers are establishing extensive production and distribution capabilities to address the growing demand for high-performance cellular confinement systems.

Revenue from geocells in South Korea is expanding at a CAGR of 5.6%, supported by the country's comprehensive coastal protection initiatives, increasing smart-city foundation requirements, and rising demand for advanced soil stabilization solutions in urban development and environmental restoration applications. The nation's focus on climate resilience and technological innovation is driving sophisticated geosynthetic solution requirements throughout the construction sector. International suppliers and domestic engineering firms are establishing comprehensive technical support and installation capabilities to serve the expanding geocells market.

Revenue from geocells in the United States is growing at a CAGR of 5.4%, driven by expanding federal infrastructure investment programs, increasing pavement rehabilitation requirements, and growing adoption of stormwater management and shoreline protection solutions. The country's comprehensive transportation infrastructure and focus on asset preservation are supporting demand for cellular confinement systems across major construction regions. Highway contractors and municipal agencies are establishing comprehensive capabilities to serve both pavement support and environmental protection requirements.

Revenue from geocells in Japan is expanding at a CAGR of 5.3%, supported by the country's focus on disaster-mitigation slope protection, railway infrastructure modernization, and strong emphasis on seismic resilience and construction quality in critical transportation applications. Japan's sophisticated engineering practices and precision construction expertise are driving demand for high-specification cellular confinement systems and specialized soil stabilization solutions. Leading construction companies are investing in specialized capabilities to serve advanced transportation, disaster prevention, and environmental protection applications.

Revenue from geocells in the United Kingdom is expanding at a CAGR of 5.2%, supported by the country's comprehensive flood defense initiatives, established railway network upgrade requirements, and steady growth in environmental protection applications across coastal and inland infrastructure. The nation's aging transportation assets and increasing climate adaptation focus are maintaining consistent demand for cellular confinement solutions. Infrastructure contractors are investing in installation capabilities and technical expertise to serve both flood management and railway embankment requirements.

Revenue from geocells in Germany is growing at a CAGR of 5.0%, driven by the country's emphasis on highway infrastructure preservation, renewable energy project access roads, and strong focus on operational efficiency in mature transportation network applications. Germany's established construction industry and focus on sustainable development are supporting steady demand for geosynthetic reinforcement solutions throughout major industrial regions. Industry leaders are establishing specialized capabilities to serve both transportation and renewable energy infrastructure requirements.

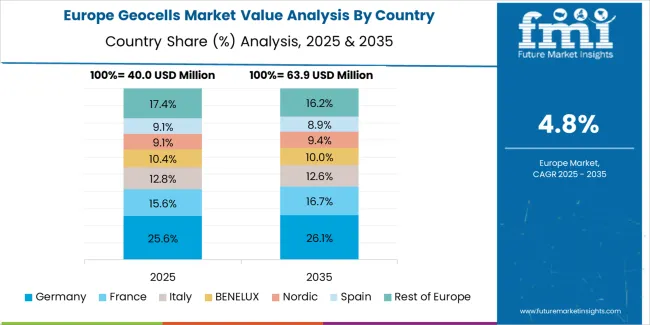

The geocells market in Europe is projected to grow steadily over the forecast period, with Western Europe accounting for the largest regional demand. Germany leads European consumption with approximately 22% market share, driven by Autobahn rehabilitation projects, wind and solar site access roads, and landfill capping applications tied to transportation and environmental infrastructure.

The country's advanced construction practices and sustainable development emphasis support consistent demand for high-performance cellular confinement systems across diverse civil engineering applications. The United Kingdom follows with about 15% of European consumption, benefiting from flood defense investments and rail embankment stabilization programs that are establishing comprehensive slope protection and erosion control capabilities for climate resilience infrastructure.

France reflects steady demand at approximately 14% market share, supported by road construction, canal protection, and coastal erosion control applications for transportation and environmental management. Italy accounts for about 12% of European geocells consumption, balancing hillside road stabilization and port infrastructure development across its diversified construction base.

Spain represents approximately 10% of European demand, growing with drought-resilient slope protection and highway reservoir infrastructure applications that support water management and transportation industries. The Nordic region (Sweden, Finland, Denmark, and Norway combined, led by Sweden and Norway) accounts for about 9% of European consumption, skewing toward shoreline protection and forestry road applications for environmental and natural resource development.

The Benelux countries (Belgium, Netherlands, and Luxembourg) maintain approximately 8% market share, supported by chemical logistics corridor infrastructure and floodplain stabilization operations serving European supply chains. The remaining approximately 10% of European geocells demand is distributed across Central and Eastern Europe, notably Poland, Czech Republic, and Hungary, where EU-funded highway and rail upgrade programs and landfill closure projects drive incremental market growth.

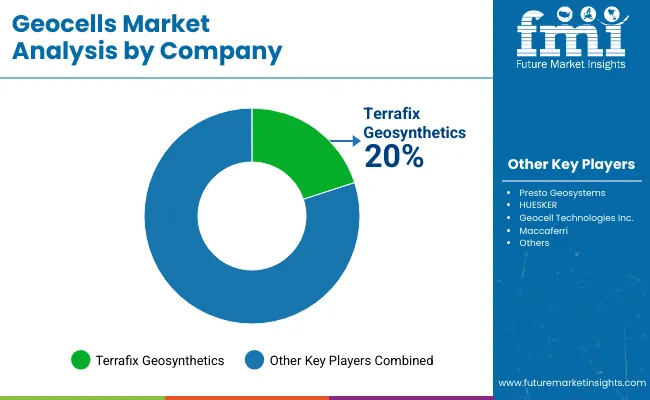

The geocells market is characterized by competition among established geosynthetic manufacturers, specialized cellular confinement system providers, and regional distribution partners. Presto Geosystems leads the market with a 12.5% share, offering comprehensive geocell solutions and installation support with a focus on transportation infrastructure applications and sustainable construction integration.

Companies are investing in advanced polymer technology research, manufacturing excellence, installation methodology development, and comprehensive product portfolios to deliver reliable, efficient, and high-performance cellular confinement solutions. Innovation in high-modulus polymer formulations, recycled-content systems, and advanced welding technologies is central to strengthening market position and competitive advantage.

PRS Geo-Technologies (Neoloy) provides innovative Neoloy polymer-based geocells with an emphasis on superior stiffness and dimensional stability for heavy-traffic pavement applications and demanding geotechnical conditions. Strata Systems/Strata Geosystems delivers integrated StrataWeb and PennCell cellular confinement solutions with a focus on North American highway markets and comprehensive technical support capabilities. Maccaferri S.p.A. offers diversified geosynthetic solutions with emphasis on slope protection and erosion control for infrastructure and environmental applications. HUESKER focuses on engineered geosynthetic systems with emphasis on quality manufacturing and European market leadership. ACE Geosynthetics provides cost-effective cellular confinement products with regional supply chain optimization. TMP Geosynthetics, NAUE GmbH & Co. KG, Terram (Berry Global), and Geofabrics Australasia offer specialized product lines, regional market expertise, and comprehensive installation support capabilities.

Geocells represent a specialized three-dimensional cellular confinement geosynthetic system within soil stabilization and infrastructure development, projected to grow from USD 160.1 million in 2025 to USD 281.4 million by 2035 at a 5.8% CAGR. This cellular honeycomb structure, primarily supplied in HDPE material form for load distribution applications, serves as an essential reinforcement solution for slope protection, highway embankments, erosion control, and railway infrastructure across transportation, environmental, and industrial construction sectors.

Market expansion is driven by increasing transportation infrastructure development, growing demand for sustainable soil stabilization techniques, expanding climate resilience programs, and rising emphasis on cost-effective construction solutions in diverse civil engineering applications.

Geosynthetic Specification Standards: Establish comprehensive technical standards for geocells quality, including material properties, dimensional tolerances, welding integrity requirements, and performance specifications that ensure consistent structural performance in highway and slope stabilization applications.

Infrastructure Quality Frameworks: Develop regulatory frameworks that link geocells utilization to project specifications, requiring validated cellular confinement systems that meet load distribution requirements, durability standards, and support overall infrastructure performance objectives.

Installation Safety Protocols: Implement mandatory standards for geocells handling, site preparation, and installation procedures, including quality control systems, performance verification methods, and documentation requirements that ensure construction reliability and long-term performance.

Sustainable Construction Incentives: Create specialized guidelines for recycled-content integration and circular economy principles, addressing post-consumer polymer utilization, material recovery systems, and environmental benefits specific to geosynthetic reinforcement applications.

Technology Development Support: Provide regulatory support and financial incentives for research and development of next-generation cellular confinement technologies that improve structural performance, reduce installation costs, and enhance durability in transportation infrastructure applications.

Installation Best Practices: Develop comprehensive technical guidelines for geocells design, site preparation, and installation that optimize soil confinement effectiveness, minimize construction defects, and ensure reliable performance across different soil conditions and loading scenarios.

Quality Management Protocols: Establish standardized testing procedures, analytical methods, and quality control systems specifically designed for geocells assessment in infrastructure construction environments with diverse geotechnical conditions and project specifications.

Performance Benchmarking Systems: Create industry-wide metrics for cellular confinement effectiveness, installation efficiency, and long-term durability that enable comparative analysis, identify best practices, and drive continuous improvement across construction projects.

Professional Training and Certification: Develop specialized training programs for civil engineers, construction managers, and installation crews covering geocells design principles, soil mechanics integration, and installation optimization in infrastructure applications.

Technology Innovation Partnerships: Facilitate collaboration between infrastructure developers, geosynthetic manufacturers, and research institutions to advance cellular confinement development and address emerging challenges in climate resilience and sustainable construction practices.

Advanced Material Engineering: Invest in research and development of high-modulus polymer formulations, improved welding technologies, and optimized cellular geometries that enable superior load distribution while reducing material costs and enhancing installation efficiency.

Sustainable Production Integration: Develop recycled-content capabilities with integrated polymer recovery technologies, post-consumer material processing, and circular feedstock utilization that support environmental objectives while maintaining structural performance and cost competitiveness.

Quality Assurance Excellence: Engineer comprehensive testing capabilities with validated performance verification systems, advanced quality control protocols, and standardized testing methods that ensure consistent product specifications while reducing manufacturing variation and customer concerns.

Supply Chain Optimization: Create flexible manufacturing platforms with strategically located production facilities, reliable logistics networks, and responsive technical support that ensure product availability while minimizing delivery times and installation delays.

Global Market Expansion: Establish comprehensive regional capabilities providing installation support, application engineering, and customer collaboration that optimize geocells utilization across diverse infrastructure applications and geographic markets.

Strategic Material Selection: Conduct comprehensive assessments of soil conditions, loading requirements, and project specifications to optimize geocells procurement strategies while ensuring construction quality and long-term performance objectives.

Advanced Installation Management: Implement quality control systems, trained installation crews, and performance monitoring capabilities to optimize cellular confinement placement, reduce construction defects, and improve overall project efficiency.

Performance Verification Integration: Utilize field testing protocols, load monitoring systems, and post-construction assessment to ensure infrastructure performance while minimizing maintenance requirements and lifecycle costs.

Sustainability Implementation: Integrate recycled-content geocells, environmental protection measures, and circular economy principles with conventional construction practices to enhance project sustainability while maintaining structural specifications and budget constraints.

Technology Adoption Planning: Develop systematic strategies that incorporate advanced cellular confinement systems, improved installation methodologies, and performance optimization while maintaining project schedules and managing construction costs effectively.

Comprehensive Design Services: Provide specialized engineering services for geocells system design, soil-structure interaction analysis, and performance optimization that address unique site requirements, loading conditions, and project constraints.

Performance Analysis and Improvement: Conduct detailed assessments of proposed cellular confinement applications, identify optimization opportunities, and develop design strategies that enhance structural efficiency, reduce costs, and improve long-term performance.

Technology Integration Services: Offer expertise in integrating geocells with complementary geosynthetics, drainage systems, and construction equipment that optimize overall infrastructure performance and installation efficiency.

Regulatory Compliance Support: Provide specialized knowledge of infrastructure standards, environmental regulations, and industry requirements to ensure design specifications and installation practices meet all applicable requirements and performance criteria.

Economic Analysis Services: Develop comprehensive cost models that evaluate total project costs, including material expenses, installation costs, maintenance requirements, and lifecycle performance to support informed decision-making.

Manufacturing Capacity Financing: Provide capital for new geocells production facilities, capacity expansions, and technology modernization projects that drive market growth while supporting global infrastructure development requirements.

Recycling Technology Investment: Finance development of breakthrough polymer recovery technologies, including post-consumer processing systems, material purification capabilities, and recycled-content integration that advance circular economy principles and sustainable manufacturing.

Installation Excellence Support: Support construction contractors in implementing advanced installation equipment, establishing quality management systems, and developing operational excellence capabilities that improve competitiveness while ensuring project quality.

Sustainable Technology Financing: Fund bio-based polymer development, renewable energy integration, and emissions reduction technologies that enhance environmental performance while maintaining production economics and product specifications.

Emerging Market Development: Provide financing and technical assistance for infrastructure development in emerging economies, creating new markets for geosynthetic solutions while supporting transportation modernization and economic growth initiatives.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 160.1 million |

| Material | HDPE, PP, Polyester, Polymeric Alloys/Others |

| Application | Slope Protection, Load Support, Earth Reinforcement (Embankments/Retaining), Channel Protection, Tree-root/Landscaping |

| End-user Sector | Transportation (Roads, Rails, Ports), Environmental & Water (Slopes, Channels, Shorelines), Industrial & Mining, Defense & Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, Japan, South Korea, United States, United Kingdom, Germany, and 40+ countries |

| Key Companies Profiled | Presto Geosystems, PRS Geo-Technologies (Neoloy), Strata Systems/Strata Geosystems, Maccaferri S.p.A., HUESKER, and ACE Geosynthetics |

| Additional Attributes | Dollar sales by material, application, and end-user sector category, regional demand trends, competitive landscape, technological advancements in polymer formulations, standardization development, sustainable manufacturing innovation, and installation efficiency optimization |

The global geocells market is estimated to be valued at USD 160.1 million in 2025.

The market size for the geocells market is projected to reach USD 281.4 million by 2035.

The geocells market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in geocells market are hdpe, pp, polyester and polymeric alloys/others.

In terms of application, slope protection segment to command 37.3% share in the geocells market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA