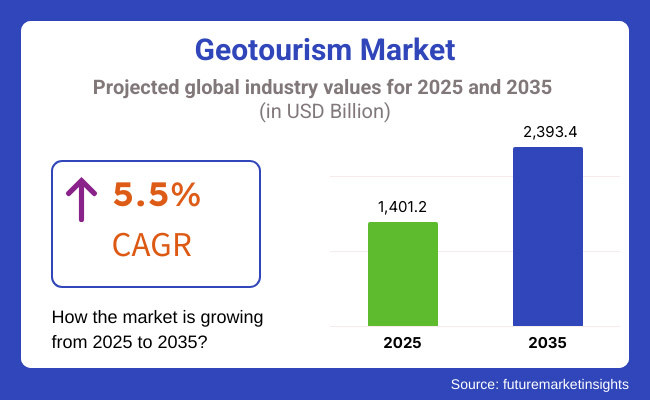

The Geotourism Market is projected to witness robust growth between 2025 and 2035, driven by the rising preference for sustainable and experience-based travel. The market is estimated to be valued at USD 1401.2 billion in 2025 and is expected to grow to USD 2393.4 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.5% during the forecast period.

A key factor fueling this expansion is the increasing awareness and demand for responsible tourism, which emphasizes cultural preservation, environmental conservation, and local economic benefits. Travelers are increasingly seeking immersive experiences that connect them with local heritage, landscapes, and traditions. This shift is prompting industry players to adopt sustainable practices, promote eco-friendly accommodations, and enhance infrastructure to cater to the growing number of geotourists.

The industry is divided by direct providers such as airlines, hotel operators, car rental operators, railway services, tour operators, and even government agencies. Because accommodation plays a central role in geotourism, hotel operators are the largest in the industry. The increasing desire among tourists for venues that merge into nature and cultural heritage has led to a demand for eco-lodges, heritage hotels and green resorts." Hotel chains are pouring money into green initiatives, reducing carbon footprints, and working with local communities to enhance authentic traveling experiences. Besides, the trend of sharing economy between smart technology and tailored services is turning out the hospitality of hotels within the geotourism company.

Explore FMI!

Book a free demo

With its magnificent natural wonders, national parks and the emphasis on sustainable tourism, north America is the world’s largest geotourism market. World-famous geotourism sites such as the Grand Canyon, Yellowstone National Park, and the Canadian Rockies exist in the United States of America and Canada appealing to tens of millions of tourist’s year after year. The area is rich with existing policies, infrastructure, and systems of ecotourism that promote sustainable visitation, conservancy, and community engagement. Besides, increasing demand for nature-based outdoor recreation and sustainable tourism requires fuel market expansion. However, strict environmental regulations guarantee that tourism growth is sustainable, with companies embracing sustainable accommodation, low-impact transport, and heritage practice protection.

Europe is in great demand in the geotourism sector, supported by the world-class geological heritage, UNESCO geoparks, and sustainable good practice. Italy, France, and Germany are among a number of countries that are hosting geotourists to sites such as the Dolomites, the Auvergne Volcanoes, and the Eifel. The policy of sustainable tourism by the European Union promotes geo-conservation activities and arranges for sustainable tourism growth. Specialized cultural and geological experiences have created demand that has been strengthening geo-tour guides, geological museums, and community tourism. However, more stringent environment regulation calls on tour operators and host governments to embrace environmentally friendly methods of tourism that reduce ecological footprints and maximize socio-economic benefits to the populace.

The Asia-Pacific area will witness most growth in geo-tourism business through swift growth of the tourism activity within China, India, Japan, and Australia. It has a diversified landscape ranging from the Great Barrier Reef and Mount Fuji to Himalayan mountain ranges and Zhangjiajie National Forest Park with millions of geotourists every year. Geotourism facilities, such as eco-lodges, eco-tourism initiatives, and internet tourism sites, are increasingly being sponsored by regional authorities and private entities. Nevertheless, the growing impetus of tourism development is causing new concerns over pollution and overcrowding, and thus tighter regulations on maintaining sustainable growth are becoming necessary. Innovation technology in digital geotour instruments, including virtual reality experience tours and artificially intelligent geotour guides, is making it possible to synchronize tourism development with conservation responsibilities.

Challenge: Environmental Impact and Over-Tourism

Environmental sustainability is a growing major concern resulting from the fast-growing popularity of geotourism. Fragile geological locations, national parks, and cultural sites traditionally face unsustainable visitor flows, causing soil erosion, contamination, and loss of their ecosystems. Deterioration of local infrastructure and communities results from poorly planned tourism, therefore disrupting their ecological and cultural balance. Governments and the stakeholders need to adopt responsible tourist models, curtail tourist visitation, and promote eco-responsible travel ways in a bid to control adverse impacts of mass tourism.

Opportunity: Integration of Technology in Geotourism

Technology advancements provide a significant opportunity within the geotourism industry. Application of AR, VR, and AI-based tourist guides maximizes the experience of tourists while limiting physical contact with sensitive ecosystems. Virtual geotourism websites enable tourists to experience geosite locations virtually, raising awareness and education without causing direct environmental impact. Additionally, improvements in geospatial mapping technologies and AI-guided tour recommendations are improving the market and management of geotourism sites within a sustainable and experiential tourism system.

From 2020 to its projected growth in 2024, the geotourism industry development was incredibly rapid as tourists transitioned toward sustainable, nature-based and conservation-minded tourist activities. The growing awareness of environmental conservation, cultural heritage preservation, and sustainable tourism has led to development of geotourism activities, such as visits to geological sites, ecotourism, and adventure tourism. Scheme of UNESCO Global Geoparks and government sponsored conservation efforts boosted the geotourism business which contributed significantly to the local economies with the emphasis on rural and underdeveloped economies.

Between 2025 to 2035, the geotourism industry will experience paradigmatic change on the pretext of AI-enabled itinerary arrangements, regenerative tourism actions and intelligent geotourism infrastructure. From block chain-based eco-travel passports and AI-driven crowd control systems at sensitive geological sites, to zero emissions tourism transport, sustainable tourism practices will be fundamentally transformed. The change to decentralized tourism platforms will empower local communities providing direct-to-traveler geotourism experiences, reducing reliance on mass travel operators. The future of geotourism will incorporate AI-enabled environmental monitoring, satellite-guided conservation tracking, and machine learning-based visitor impact analysis to reduce ecological harm. The mass market for smart geotourism wearables providing real-time geological information, eco-friendly route planning, and carbon offset tracking will increase traveler participation while encouraging responsible tourism practices. Bio-sensitive hotels, AI-governed eco-resorts, and self-sustaining tourism infrastructure will become the norm for geotourism destinations.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | More stringent eco-tourism regulations, tourism caps on vulnerable geological locations, and carbon offset programs. |

| Technological Advancements | AR/VR-enabled virtual geological discovery, AI-informed travel suggestions, and drone-aided site mapping. |

| Industry Applications | National parks, UNESCO Global Geo-parks, and community-led eco-tourism projects. |

| Adoption of Smart Equipment | Block chain-based eco-certification, IoT-enabled site monitoring, and drone-assisted conservation planning. |

| Sustainability & Cost Efficiency | Carbon-neutral travel incentives, community-led sustainable tourism, and eco-friendly tour infrastructure.. |

| Data Analytics & Predictive Modeling | AI-driven visitor flow analysis, geospatial tourism planning, and block chain-sustainable tracking. |

| Production & Supply Chain Dynamics | COVID-19 travel impairments, over-tourism issues, and sparse eco-friendly travel infrastructure. |

| Market Growth Drivers | Driving growth by increased interest in sustainable travel, investments in eco-tourism, and post-pandemic travel rebound. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-compliant conservation, block chain-pioneered sustainable tourism certification, and climate-resilient tourism policy. |

| Technological Advancements | AI-empowered environmental monitoring, satellite-based conservation tracking, and block chain-based eco-tourism platforms. |

| Industry Applications | Growth into AI-fueled regenerative tourism, zero-emission adventure tourism, and intelligent geo-exploration wearables. |

| Adoption of Smart Equipment | Smart geotourism wearables, AI-assisted visitor management, and solar-powered sustainable exploration vehicles. |

| Sustainability & Cost Efficiency | AI-optimized waste management, bio-sensitive eco-lodging, and climate-adaptive regenerative tourism projects. |

| Data Analytics & Predictive Modeling | Quantum-led conservation modeling, predictive environmental effect assessments, and AI-driven regenerative tourism surveillance. |

| Production & Supply Chain Dynamics | AI-optimized geo-tourism logistics, block chain-secure eco-tourism supply chains, and decentralized tourism service networks. |

| Market Growth Drivers | AI-driven regenerative tourism, climate-resilient conservation travel, and growth of smart geo-tourism sites. |

Driven by increasing interest in sustainable tourism, national park tourism and adventure-based travel, the USA's geotourism market is growing steadily. As the government and private sector continue their strong efforts to promote eco-friendly travel, responsible tourism activities are in increasing demand. Key pull factor includes the Grand Canyon, Yellowstone and Yosemite, while growth in market is further driven by community-based tourism activities.

The resulting growth in demand for nature experiences is one of several market expansion drivers; the USA. National Park System serves over 300 million visitors annually. Low environmental footprint geotourism activities are liked by ecofriendly tourists. Initiatives like the National Park Service’s Centennial Initiative encourage the expansion of conservation and tourism. Expanding popularity of specific geological locations, like the Appalachian Trail and Badlands National Park, etc.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

The UK geotourism industry is growing as a result of growing government initiatives to develop sustainable tourism, high demand for heritage sites, and investment in eco-tourism infrastructure. Places such as the Jurassic Coast and Scottish Highlands are popular among geotourists who are interested in geological exploration. There are numerous market growth drivers such as the Jurassic Coast (UNESCO site) and Lake District are big geotourism destinations. The UK Sustainable Tourism Strategy encourages low-impact tourism. Development of Eco-Friendly Accommodations, greater availability of green hotels, eco-lodges, and sustainable tourism operators. Adventure & Outdoor Activities, Increasing market for hiking, cave tourism, and coastal geotourism activities. UNESCO Geoparks & Conservation Efforts, The North West Highlands Geopark facilitates regional geotourism development.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.1% |

The geotourism market in the EU is flourishing owing to vast geological diversity, well-developed eco-tourism policies, and robust investments in conservation-oriented travel. France, Germany, and Italy are some of the key markets, and UNESCO Geoparks contribute heavily to attracting geotourists. UNESCO Geoparks Expansion, Eco-Tourism Regulations & Green Initiatives Adventure & Nature-Based Tourism, Cross-Border Geotourism Programs, Cultural & Geological Integration are some of the market growth drivers here.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.8% |

Japan's geotourism sector is developing steadily, driven by high demand for volcanic tourism, visits to national parks, and adventure tourism. The nation's distinctive geological features, such as active volcanoes, hot springs, and sea cliffs, draw both domestic and foreign tourists. Some Market Growth Drivers in japan include Mount Fuji, Aso Caldera, and Beppu hot springs are major tourist attractions. Japan's Ministry of Environment promotes geotourism activities. There is growing demand for hiking and geological tourism. Japan's UNESCO Geoparks and national parks fuel eco-tourism. The blend of natural scenery with cultural activities boosts geotourism appeal.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.0% |

South Korea is experiencing growing demand for geotourism because of growing awareness of sustainable tourism, government investment in eco-tourism, and promotion of UNESCO Geoparks. Destination hotspots such as Jeju Island and Seoraksan National Park are major drivers of market growth. Some of the growth drivers of the South Korean market are the island's volcanic scenery and lava tubes are a draw for eco-tourists. National parks and green travel initiatives are encouraged by the Korean government. Growing demand for hiking, caving, and coastal geotourism activities. Nature-based tourism is becoming a priority for South Korean tourists. Blended geotourism activities, such as historical and geological discovery.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.3% |

The segments of the hotel company and airlines have a commanding market share in geotourism because ecotourist travelers are demanding sites that maintain natural and cultural heritage along with practicing responsible tourism patterns. The geotourism activities are imperative in enhancing traveling experiences, local community support, and long-term ecological sustainability, and therefore they are vital for airlines, hotel chains, tourism boards, and tour and travel service operators in adding environmental integrity to business expansion.

Airlines have become one of the quickest-growing sectors in the geotourism industry, with specialized travel itineraries, carbon offset schemes, and direct flights to remote eco-places. Differently from regular tourism, geotourism focuses on sustainability, and because of this, airlines are introducing green air programs, decreasing carbon trails, and fostering ecotourism ventures.

Growth in demand for nature-based tourism to protected areas, national parks, and UNESCO world heritage sites has propelled airline uptake, as passengers opt for flight routes that are less environmentally degrading while providing access to geotourism destinations. Research shows that more than 60% of geotourists look at carbon-efficient flight options when making eco-travel arrangements, thus fortifying demand for the same.

The growth in the use of sustainable aviation fuel (SAF), including biofuel flights, carbon-neutral airline alliances, and electric-hybrid plane research, has consolidated market demand, promising lower emissions and higher sustainability.

The integration of digital geotourism platforms, including AI-driven carbon footprint calculators, block chain-supported eco-travel certification, and real-time environmental impact tracking, has also increased adoption, promising more transparency and traveler interaction.

The creation of conservation programs supported by airlines, which include wildlife preservation projects, forestation collaborations, and ecotourism sensitization campaigns, has maximized market expansion with more ecological protection and traveler participation in sustainability.

While its implementation has supported market growth, green loyalty schemes including carbon-offset promotions, environmentally friendly travel rewards and sustainable tourism offers, are promising more of essential support for globally responsible tourism practices.

Although impacting lower-impact travel, supporting conservation efforts, and enhancing accessibility to distant wildlife tourism spots, the airline industry faces hurdles like lofty operational costs for production of sustainable fuel, lack of green aviation infrastructure, and orbiting inconsistencies in policy around the world. However, exciting developments in AI-powered flight efficiency optimization, electricity in aircraft technology, and block chain-enhanced carbon offset tracking are driving green growth, cost efficiency, and traveler trust, ensuring green airline travel continues to boom around the globe.

Hotel groups have gained extensive market penetration, particularly among environmentally friendly resort owners, boutique ecological lodges, and big hospitality companies with green activities, as demand for green accommodation has been growing. Geotourism-supported lodges (the hotels or resorts that are supported by geotourism) typically have minimal environmental impact, promote local culture, and help visitors interact better with the natural environment compared to traditional resorts.

As tourists look for real and sustainable accommodation solutions, this has contributed to the popularity of environmentally friendly hotel practices: Sustainable accommodations, nature-integrated resorts, eco-certified lodges and green hospitality certification are increasingly in demand. Studies indicate that over 70% of geotourists select hotels that possess sustainability certification, indicating significant demand for this segment.

Market adoption has grown with an increase in compliance with conservation standards, as regenerative tourism practices, for example; zero-waste hotel operations, eco-lodging projects, resort operations based on clean energy, etc.

Integration with AI-based sustainability monitoring in hospitality (for e.g. intelligent energy management, real-time environment monitoring, and, waste reduction automation) has played a major role in Increased adoption of hospitality technology with higher operational efficiency & environmental stewardship.

This has established hotel-led conservation alliances, which includes ecotourism education initiatives, local biodiversity initiatives, sustainable infrastructure investments and have resulted in the maximum potential market growth by encouraging travelers to participate more in geotourism activities.The technologies behind sustainable guest experience such as farm-to-table organic vegetarian cuisine, carbon-neutral transportation or cultural immersion experiences are making their way to the market and aligning further with traveler demand for responsible tourism.

Although relatively experienced in customer satisfaction, cultural preservation, and sustainability, the hotel sector is confronted with imperatives like the high upfront cost of green infrastructure, resistance to sustainable transformation in conventional hospitality models, and geographical differences in eco-certification standards.

New innovations in block chain-based sustainability authentication, artificial intelligence-based guest experience customization, and carbon footprint measurement tools, however, are enhancing transparency, efficiency, and traveler participation, guaranteeing further expansion for eco-friendly hotel companies globally.

The online travel agencies (OTAs) and traditional travel agencies segments represent two major market drivers, as geotourists increasingly integrate digital convenience and expert-guided travel planning into their eco-tourism experiences.

The online travel agencies (OTAs) and traditional travel agencies markets are two significant market drivers, as digital ease and personalized professional travel planning are increasingly part of the geotourism experience.

The sector of online travel agencies has become one of the most commonly used geotourism planning schemes through which travelers can reserve eco-tours, sustainable travel accommodations, and nature tourism experiences using virtual platforms and block chain-secured reservation networks. While traditional travel booking is not real-time and does not allow the tracking of sustainability, OTAs are real-time, track sustainability, and offer customized eco-tour itineraries based on traveler values.

Growing need for AI-driven geotourism suggestions, including customized eco-travel packages, nature immersion experiences, and community-based tourism activities, has driven online booking adoption, with geotourists focusing on digital convenience and organized travel planning. Research suggests that more than 75% of geotourists in developed economies use online websites to organize their sustainable travel experiences, reflecting robust demand for this category.

In spite of its strengths in accessibility, AI-based personalization, and real-time booking transparency, the online travel agencies segment is challenged by cybersecurity threats, greenwashing issues in sustainability assertions, and regulatory inconsistency in eco-tourism certifications. Nevertheless, new developments in block chain-based sustainability verification, AI-based eco-tour curation, and immersive digital geotourism experiences are enhancing credibility, efficiency, and traveler engagement, ensuring sustained market growth for digital geotourism booking platforms globally.

The conventional travel agencies segment has found robust market adoption, especially from travelers in search of expert-handpicked eco-tourism travel, tailor-made sustainable tours, and participative cultural immersion at environmentally rich sites. Conventional travel agencies are different from digital travel sites as they offer immediate consultation, one-on-one service, and in-depth cultural awareness, making them guarantee high-value geotourism.

Increased demand for tailored geotourism travel packages with eco-aware adventure travel, authentic indigenous cultural immersion, and off-the-beaten-path nature retreats has fueled growth of traditional travel agencies, as geotourists demand intensive planning and specialist-provided sustainability expertise.

Despite its strengths in bespoke eco-tour planning, direct tourist engagement, and cultural validity, the old travel agency industry is constrained by inefficiencies of operation in hand travel planning, elevated expense compared to internet sites, and inadequate scalability to market segments in specialty eco-tourism. Still, innovative solutions through AI-enabled itinerary automation, block chain-based geotourism certifications, and mixed-mode digital-legacy travel counseling schemes are enhancing efficiency, availability, and tourist happiness, underlining future growth prospects for specialized expert-guided geotourism holiday tours across the globe.

The geotourism industry is significantly dynamic, buoyed by heightened demand for sustainable travel, nature-based tourism, and cultural heritage discovery. Global and regional competitors actively endorse responsible travel practices and utilize environmental-friendly accommodations, community-based tourism, and digital marketing techniques to entice environmentally friendly tourists. Governments and non-profit institutions continue to invest in geoparks, conservation initiatives, and sustainable infrastructure, fueling market growth even further

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| National Geographic Expeditions | 12-16% |

| TUI Group | 10-14% |

| G Adventures | 9-13% |

| Intrepid Travel | 7-11% |

| Responsible Travel | 5-9% |

| Other Companies (combined) | 45-55% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| National Geographic Expeditions | Provides nature-oriented tours centered on biodiversity, conservation, and cultural heritage. |

| TUI Group | Offers sustainable holidays packages, environmentally-friendly resorts, and guided nature travel. |

| G Adventures | Operates small group adventure travel and emphasizes local communities and eco-tourism. |

| Intrepid Travel | Promotes low-impact travel through carbon-neutral trips and wildlife conservation projects. |

| Responsible Travel | Crafts ethical tourism experiences with low environmental footprint and local benefits. |

National Geographic Expeditions (12-16%)

National Geographic Expeditions leads the geotourism market, offering expert-led expeditions centered on nature conservation, cultural immersion, and scientific exploration. The company partners with local organizations and research institutions to promote sustainable travel and environmental awareness.

TUI Group (10-14%)

TUI Group focuses on eco-friendly resorts and adventure tourism, catering to the rising demand for low-impact travel experiences. Through its sustainability initiatives, TUI integrates renewable energy solutions, marine conservation programs, and carbon offset policies into its operations.

G Adventures (9-13%)

G Adventures specializes in community-based geotourism, providing authentic cultural experiences while supporting local economies. The company emphasizes responsible tourism, reducing ecological footprints by limiting group sizes and collaborating with indigenous communities.

Intrepid Travel (7-11%)

Intrepid Travel pioneers carbon-neutral tourism, designing itineraries that include protected nature reserves, geological sites, and eco-lodges. Its "Impact Initiatives" ensure that tourism revenue directly supports wildlife conservation and sustainable development projects.

Responsible Travel (5-9%)

Responsible Travel curates a diverse range of ethical tourism experiences, ensuring that travel benefits local communities, preserves natural landscapes, and respects indigenous cultures. The company actively promotes low-carbon travel options, such as train-based tourism and cycling tours.

Other Key Players (45-55% Combined)

Several smaller players contribute to the expansion of sustainable geotourism through specialized offerings and regional expertise. Key companies include:

The market is estimated to reach a value of USD 1401.2 billion by the end of 2025.

The market is projected to exhibit a CAGR of 5.5% over the assessment period.

The market is expected to clock revenue of USD 2393.4 billion by end of 2035.

Key companies in the Geotourism market include TUI Group, G Adventures., Intrepid Travel, Responsible Travel, National Geographic Expeditions

On the basis on direct suppliers, airlines and hotel companies to command significant share over the forecast period.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.