The genomic urine testing market will be worth USD 137.0 million in 2025. The market will acquire a total valuation of USD 293.6 million by 2035, reflecting a CAGR of 7.9% throughout the forecast period between 2025 and 2035.

In 2024, the genomic urine testing market made tremendous breakthroughs through tech innovations and a growing focus on non-invasive diagnostic approaches. One of the developments included the launch of at-home digital urinary tract infection (UTI) tests by firms such as Vivoo.

It introduced a test in January 2024 that allows one to do a urine test within two minutes, and the results are made available immediately through a smartphone application. This innovation obviated the necessity for visits to laboratories, providing greater convenience and responding to the increasing consumer demand for personalized, point-of-care diagnostics.

The industry also experienced an increase in the use of genomic urine testing for cancer early detection and monitoring.

The industry for genomic urine testing is expected to continue growing throughout the forecast period between 2025 and 2035. Some major drivers are continuous technological developments, including innovations in next-generation sequencing (NGS) and polymerase chain reaction (PCR) technologies, which improve test accuracy and scalability. Also, the increasing use of genomic urine testing outside oncology for cardiovascular disorders, genetic diseases, infectious diseases, and neurological disorders is likely to continue driving industry growth.

Despite this, challenges still exist in the form of the need for advanced data analysis programs with which to decipher complex genomic data and standardization across labs to provide consistent and reliable results.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 137.0 million |

| Industry Value (2035F) | USD 293.6 million |

| CAGR | 7.9% |

The genomic urine testing market is on a steady growth path. It is driven by increasing demand for non-invasive, early diagnosis technologies in oncology and chronic disease management. Advances in genomic sequencing and mobile health platforms are driving adoption and use cases. Diagnostic firms and digital health disruptors will gain the most, while traditional lab-based testing firms will lose ground if they fail to adapt.

Invest in At-Home Diagnostic Platforms

Leverage the consumer move toward convenience through the development or acquisition of easy-to-use, smartphone-enabled genomic urine tests. Focus on ease of UX, fast turnaround, and remote physician connectivity to acquire a competitive advantage.

Align with Precision Medicine and Early Detection Trends

Enhance product functionality to accommodate early-stage diagnosis and tailored treatment planning, particularly in oncology and the management of chronic diseases. Make sure to be interoperable with genomic information platforms and electronic medical records in order to keep up with healthcare ecosystem development.

Establish Strategic Alliances and Increase R&D Presence

Align with biotech companies, digital health companies, and research institutions to drive innovation and verification. Ponder strategic M&A to in-license IP, add test menus, or secure industry access in important geographies.

| Risk | Probability - Impact |

|---|---|

| Regulatory Delays or Reclassifications | Medium - High |

| Data Privacy and Security Breaches | High - High |

| Technological Obsolescence or Platform Incompatibility | Medium - Medium |

| Priority | Immediate Action |

|---|---|

| At-Home Test Commercialization | Run feasibility study on direct-to-consumer genomic urine test rollout . |

| Clinical Integration Expansion | Initiate a feedback loop with health systems on genomic test adoption barriers . |

| Channel & Distribution Strategy | Launch pilot incentive program for digital health and telehealth partners |

To remain ahead, the roadmap now has to incorporate accelerated product iteration cycles, regulatory interaction strategies, and a systematic process of entering new clinical verticals like oncology and nephrology. The executives should consider this moment as not only a growth opportunity but also as an opportunity to rethink the company's positioning in the future of precision diagnostics.

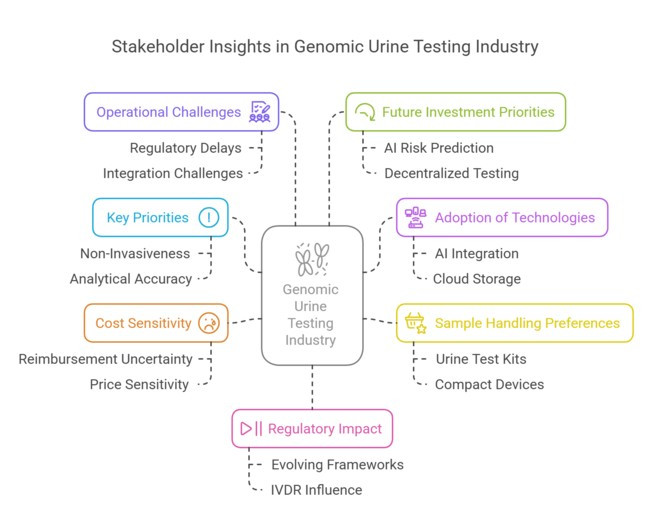

(Surveyed Q4 2024, n=475 stakeholder participants evenly distributed across diagnostic companies, hospital networks, digital health firms, and lab technicians in the US, Western Europe, Japan, and South Korea)

Regional Variance:

ROI Perspective:

Consensus:

Variance:

Diagnostic Providers:

Digital Health Players:

Lab Technicians:

Alignment:

Regional Focus:

High Consensus:

Key Divergences:

Strategic Insight:

| Countries | Regulatory Impact and Mandatory Certifications |

|---|---|

| United States |

|

| European Union (EU) |

|

| Germany |

|

| France |

|

| Japan |

|

| South Korea |

|

The USA industry for genomic urine testing is steadily growing, fueled by the progress made in personalized medicine and a strong focus on non-invasive diagnostic technologies. The inclusion of genomic information in standard clinical practices has been eased through favorable regulatory environments and heavy investment in healthcare technology. The fact that the industry is supported by top biotech companies and research centers also helps fuel innovation and adoption. Data privacy issues and the requirement for standardized protocols remain some of the issues holding back the industry.

FMI projects that USA genomic urine testing sales are likely to expand at a CAGR of 4.9% between 2025 to 2035

India's industry for genomic urine testing is in its infancy but has high potential based on a vast population base and rising awareness for genetic disorders. Healthcare infrastructure growth and the government's efforts towards biotechnology research drive growth. The developing prevalence of chronic diseases coupled with an expanding middle class ready to spend on sophisticated diagnostics drive industry growth. However, the difficulties involve restricted access to high-tech healthcare facilities in rural regions and a lack of professional expertise.

FMI forecasts that India's genomic urine testing sales will grow at a CAGR of approximately 7.5% from 2025 to 2035.

China's genomic urine testing industry is growing quickly, fueled by huge investments in biotechnology and government emphasis on precision medicine. The nation's vast population and rising prevalence of chronic diseases create a need for sophisticated diagnostic technologies. Partnerships between local and foreign firms are boosting technological prowess. Regulatory changes to speed up the approval process for new medical technologies further aid industry growth.

FMI projects that China's genomic urine testing sales will grow a CAGR of 8.5% by 2035.

The UK genomic urine testing industry is supported by a strong healthcare system and programs such as the 100,000 Genomes Project, which embed genomics in everyday care. Strong partnerships between the National Health Service (NHS), academia, and private industry fuel innovation.

Public understanding and acceptance of genetic testing are fairly high, making adoption easier. Challenges, however, include dealing with complicated regulatory environments after Brexit and maintaining data privacy compliance.

FMI projects that U.K. genomic urine testing sales are likely to expand at a CAGR of 5.0% between 2025 to 2035

Germany's genomic urine testing industry is dominated by a high focus on research and development, backed by a well-developed healthcare infrastructure. The nation's interest in precision medicine and personalized healthcare creates demand for sophisticated diagnostic equipment.

University, research institute, and biotech firm collaborations drive innovation. Stringent regulatory standards and the necessity for extensive clinical validation can be challenging to industry entry, though.

FMI projects that Germany genomic urine testing sales are likely to expand at a CAGR of 6.5% between 2025 to 2035

South Korea's industry for genomic urine testing is expanding with the support of government policies favoring biotechnology and precision medicine. The high-tech healthcare infrastructure and high level of new technology adoption in the country make industry penetration easier. There are frequent collaborations between research institutions and biotech companies, which improve research and development capabilities. Challenges lie in overcoming regulatory approvals and responding to ethical concerns over genetic testing.

FMI projects that South Korea genomic urine testing sales are likely to expand at a CAGR of 7.9% between 2025 to 2035

Japan's industry for genomic urine testing is growing because of an aging populace and a high emphasis on early detection of disease. Public policies favoring genomic investigation and individualized medicine programs drive industry development. Foreign collaborations with research centers accelerate technological development. Cultural sentiments for genetic testing and data confidentiality concerns might influence levels of adoption.

FMI projects that Japan genomic urine testing sales are likely to expand at a CAGR of 8.2% between 2025 to 2035

France's genomic urine testing industry is supported by robust government backing for genomic studies and incorporation in healthcare. Projects such as the French Plan for Genomic Medicine 2025 set out to make the nation a hub of personalized medicine. Public coverage of genetic tests increases availability. Bureaucratic procedures and regulatory hurdles, nonetheless, may hamper the adoption of new technology.

FMI projects that France's genomic urine testing sales are likely to expand at a CAGR of 5.5% between 2025 to 2035

Italy's genomic urine testing industry is emerging, driven by growing awareness of personalized medicine and government efforts to update healthcare services. University-biotech collaborations are driving innovation. Economic limitations and regional differences in healthcare infrastructure could slow adoption.

FMI projects that Italy genomic urine testing sales are likely to expand at a CAGR of 5.0% between 2025 to 2035

The Australian and New Zealand industry for genomic urine testing is expanding due to developed healthcare systems and robust research environments. Government initiatives toward genomic research funding and prioritization of personalized medicine drive the growth of the industry.

Increased public awareness and acceptability of genetic testing aid in adoption. Nonetheless, ensuring fair access to remote locations and dealing with regulatory harmonization across the two nations remain challenges.

FMI projects that Australia-NZ genomic urine testing sales are likely to expand at a CAGR of 6.0% between 2025 to 2035

Between 2025 and 2035, Bladder Cancer Surveillance will be the most profitable application segment in the genomic urine testing industry. This is mainly fueled by the rising global incidence of bladder cancer, which requires non-invasive and reproducible testing techniques for monitoring the disease over the long term.

In contrast to primary detection, which may be a single or occasional occurrence, bladder cancer surveillance involves continuous testing over a period of months or years, and so presents itself as a recurring revenue stream for diagnostic companies.

Clinical guidelines are also increasingly incorporating genomic urine assays for post-treatment surveillance to minimize the use of invasive procedures such as cystoscopy. Health systems are willing to embrace these methods based on better patient compliance, diminished procedural risk, and long-term cost savings.

With the help of increased sensitivity of genomic assays and wider awareness among physicians, the Bladder Cancer Surveillance industry is expected to register a CAGR of about 8.9% from 2025 through 2035, higher than the industry CAGR of 7.9%.

Between 2025 and 2035, Mail Order Pharmacies will be the highest-paying distribution channel for genomic urine testing, driven by their scalability, ease of use, and fit with digital health trends. With great momentum expected for remote diagnostic models-particularly after COVID-mail-order systems are facilitating effortless sample logistics between patients and laboratories without the necessity of an office visit.

This model is particularly beneficial for genomic urine tests, as they are non-invasive and self-collectable. In addition, collaborations between mail-order services and diagnostic firms are shortening test turnaround times and improving access in rural or underserved communities. Regulators in a number of countries also promote decentralized testing channels for easing hospital burden.

All things considered, Mail Order Pharmacies are predicted to develop at a CAGR of around 8.5% from 2025 to 2035, surpassing other channels in the expansion of volume and margin.

The genomic urine testing industry is moderately consolidated, with dominant players using tactics like innovation, strategic alliances, and geographic growth to consolidate their positions. Major players are competing by investing in cutting-edge genomic technologies, collaborating to improve diagnostic capabilities, and growing their presence in emerging economies.

Key Developments in 2024

Primary Detection, Bladder Cancer Surveillance

Hospital Pharmacies, Mail Order Pharmacies and Speciality Pharmacies

North America, Latin America, Europe, East Asia, South Asia, Oceania and the Middle East and Africa

Rising cancer rates and demand for non-invasive diagnostics are fueling rapid adoption.

Advanced genomic tools and liquid biopsy tech have boosted test accuracy and clinical use.

Bladder cancer surveillance leads due to recurring need and clinical utility.

Mail-order and at-home collection are surging due to convenience and telehealth alignment.

Genomic urine testing is set to become routine in cancer care with global uptake and expanded panels.

Table 01: Global Market Analysis 2018 to 2022 and Forecast 2023 to 2033, by Application

Table 02: Global Market Analysis 2018 to 2022 and Forecast 2023 to 2033 by Distribution Channel

Table 03: Global Market Analysis 2018 to 2022 and Forecast 2023 to 2033, by Region

Table 04: North America Market Value (US$ Million) Analysis 2018 to 2022 and Forecast 2023 to 2033, by Country

Table 05: North America Market Value (US$ Million) Analysis 2018 to 2022 and Forecast 2023 to 2033, by Application

Table 06: North America Market Value (US$ Million) Analysis 2018 to 2022 and Forecast 2023 to 2033, by Distribution Channel

Table 07: Latin America Market Value (US$ Million) Analysis 2018 to 2022 and Forecast 2023 to 2033, by Country

Table 08: Latin America Market Value (US$ Million) Analysis 2018 to 2022 and Forecast 2023 to 2033, by Application

Table 09: Latin America Market Value (US$ Million) Analysis 2018 to 2022 and Forecast 2023 to 2033, by Distribution Channel

Table 10: Europe Market Value (US$ Million) Analysis 2018 to 2022 and Forecast 2023 to 2033, by Country

Table 11: Europe Market Value (US$ Million) Analysis 2018 to 2022 and Forecast 2023 to 2033, by Application

Table 12: Europe Market Analysis 2018 to 2022 and Forecast 2023 to 2033by Distribution Channel

Table 13: East Asia Market Value (US$ Million) Analysis 2018 to 2022 and Forecast 2023 to 2033, by Country

Table 14: East Asia Market Value (US$ Million) Analysis 2018 to 2022 and Forecast 2023 to 2033, by Application

Table 15: East Asia Market Value (US$ Million) Analysis 2018 to 2022 and Forecast 2023 to 2033, by Distribution Channel

Table 16: South Asia Market Value (US$ Million) Analysis 2018 to 2022 and Forecast 2023 to 2033, by Country

Table 17: South Asia Market Value (US$ Million) Analysis 2018 to 2022 and Forecast 2023 to 2033, by Application

Table 18: South Asia Market Value (US$ Million) Analysis 2018 to 2022 and Forecast 2023 to 2033, by Distribution Channel

Table 19: Oceania Market Value (US$ Million) Analysis 2018 to 2022 and Forecast 2023 to 2033, by Country

Table 20: Oceania Market Value (US$ Million) Analysis 2018 to 2022 and Forecast 2023 to 2033, by Application

Table 21: Oceania Market Analysis 2018 to 2022 and Forecast 2023 to 2033by Distribution Channel

Table 22: Middle East & Africa Market Value (US$ Million) Analysis 2018 to 2022 and Forecast 2023 to 2033, by Country

Table 23: Middle East & Africa Market Value (US$ Million) Analysis 2018 to 2022 and Forecast 2023 to 2033, by Application

Table 24: Middle East & Africa Market Analysis 2018 to 2022 and Forecast 2023 to 2033 by Distribution Channel

Figure 01: Global Market Value (US$ Million) Analysis, 2018 to 2022

Figure 02: Global Market Forecast & Y-o-Y Growth, 2023 to 2033

Figure 03: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2023 to 2033

Figure 04: Global Market Value Share (%) Analysis 2022 and 2033, by Application

Figure 05: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Application

Figure 06: Global Market Attractiveness Analysis 2023 to 2033, by Application

Figure 07: Global Market Value Share (%) Analysis 2022 and 2033, by Distribution Channel

Figure 08: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Distribution Channel

Figure 09: Global Market Attractiveness Analysis 2023 to 2033, by Distribution Channel

Figure 10: Global Market Value Share (%) Analysis 2022 and 2033, by Region

Figure 11: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Region

Figure 12: Global Market Attractiveness Analysis 2023 to 2033, by Region

Figure 13: North America Market Value (US$ Million) Analysis, 2018 to 2022

Figure 14: North America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 15: North America Market Value Share, by Application (2023 E)

Figure 16: North America Market Value Share, by Distribution Channel (2023 E)

Figure 17: North America Market Value Share, by Country (2023 E)

Figure 18: North America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 19: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 20: USA Market Value Proportion Analysis, 2022

Figure 21: Global Vs. USA Growth Comparison

Figure 22: USA Market Share Analysis (%) by Application, 2022 & 2033

Figure 23: USA Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 24: Canada Market Value Proportion Analysis, 2022

Figure 25: Global Vs. Canada. Growth Comparison

Figure 26: Canada Market Share Analysis (%) by Application, 2022 & 2033

Figure 27: Canada Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 28: Latin America Market Value (US$ Million) Analysis, 2018 to 2022

Figure 29: Latin America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 30: Latin America Market Value Share, by Application (2023 E)

Figure 31: Latin America Market Value Share, by Distribution Channel (2023 E)

Figure 32: Latin America Market Value Share, by Country (2023 E)

Figure 33: Latin America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 34: Latin America Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 35: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 36: Mexico Market Value Proportion Analysis, 2022

Figure 37: Global Vs Mexico Growth Comparison

Figure 38: Mexico Market Share Analysis (%) by Application, 2022 & 2033

Figure 39: Mexico Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 40: Brazil Market Value Proportion Analysis, 2022

Figure 41: Global Vs. Brazil. Growth Comparison

Figure 42: Brazil Market Share Analysis (%) by Application, 2022 & 2033

Figure 43: Brazil Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 44: Argentina Market Value Proportion Analysis, 2022

Figure 45: Global Vs Argentina Growth Comparison

Figure 46: Argentina Market Share Analysis (%) by Application, 2022 & 2033

Figure 47: Argentina Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 48: Europe Market Value (US$ Million) Analysis, 2018 to 2022

Figure 49: Europe Market Value (US$ Million) Forecast, 2023 to 2033

Figure 50: Europe Market Value Share, by Application (2023 E)

Figure 51: Europe Market Value Share, by Distribution Channel (2023 E)

Figure 52: Europe Market Value Share, by Country (2023 E)

Figure 53: Europe Market Attractiveness Analysis by Application, 2023 to 2033

Figure 54: Europe Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 55: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 56: UK Market Value Proportion Analysis, 2022

Figure 57: Global Vs. UK Growth Comparison

Figure 58: UK Market Share Analysis (%) by Application, 2022 & 2033

Figure 59: UK Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 60: Germany Market Value Proportion Analysis, 2022

Figure 61: Global Vs. Germany Growth Comparison

Figure 62: Germany Market Share Analysis (%) by Application, 2022 & 2033

Figure 63: Germany Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 64: Italy Market Value Proportion Analysis, 2022

Figure 65: Global Vs. Italy Growth Comparison

Figure 66: Italy Market Share Analysis (%) by Application, 2022 & 2033

Figure 67: Italy Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 68: France Market Value Proportion Analysis, 2022

Figure 69: Global Vs France Growth Comparison

Figure 70: France Market Share Analysis (%) by Application, 2022 & 2033

Figure 71: France Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 72: Spain Market Value Proportion Analysis, 2022

Figure 73: Global Vs Spain Growth Comparison

Figure 74: Spain Market Share Analysis (%) by Application, 2022 & 2033

Figure 75: Spain Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 76: Russia Market Value Proportion Analysis, 2022

Figure 77: Global Vs Russia Growth Comparison

Figure 78: Russia Market Share Analysis (%) by Application, 2022 & 2033

Figure 79: Russia Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 80: BENELUX Market Value Proportion Analysis, 2022

Figure 81: Global Vs BENELUX Growth Comparison

Figure 82: BENELUX Market Share Analysis (%) by Application, 2022 & 2033

Figure 83: BENELUX Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 84: East Asia Market Value (US$ Million) Analysis, 2018 to 2022

Figure 85: East Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 86: East Asia Market Value Share, by Application (2023 E)

Figure 87: East Asia Market Value Share, by Distribution Channel (2023 E)

Figure 88: East Asia Market Value Share, by Country (2023 E)

Figure 89: East Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 90: East Asia Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 91: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 92: China Market Value Proportion Analysis, 2022

Figure 93: Global Vs. China Growth Comparison

Figure 94: China Market Share Analysis (%) by Application, 2022 & 2033

Figure 95: China Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 96: Japan Market Value Proportion Analysis, 2022

Figure 97: Global Vs. Japan Growth Comparison

Figure 98: Japan Market Share Analysis (%) by Application, 2022 & 2033

Figure 99: Japan Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 100: South Korea Market Value Proportion Analysis, 2022

Figure 101: Global Vs South Korea Growth Comparison

Figure 102: South Korea Market Share Analysis (%) by Application, 2022 & 2033

Figure 103: South Korea Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 104: South Asia Market Value (US$ Million) Analysis, 2018 to 2022

Figure 105: South Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 106: South Asia Market Value Share, by Application (2023 E)

Figure 107: South Asia Market Value Share, by Distribution Channel (2023 E)

Figure 108: South Asia Market Value Share, by Country (2023 E)

Figure 109: South Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 110: South Asia Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 111: South Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 112: India Market Value Proportion Analysis, 2022

Figure 113: Global Vs. India Growth Comparison

Figure 114: India Market Share Analysis (%) by Application, 2022 & 2033

Figure 115: India Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 116: Indonesia Market Value Proportion Analysis, 2022

Figure 117: Global Vs. Indonesia Growth Comparison

Figure 118: Indonesia Market Share Analysis (%) by Application, 2022 & 2033

Figure 119: Indonesia Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 120: Malaysia Market Value Proportion Analysis, 2022

Figure 121: Global Vs. Malaysia Growth Comparison

Figure 122: Malaysia Market Share Analysis (%) by Application, 2022 & 2033

Figure 123: Malaysia Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 124: Thailand Market Value Proportion Analysis, 2022

Figure 125: Global Vs. Thailand Growth Comparison

Figure 126: Thailand Market Share Analysis (%) by Application, 2022 & 2033

Figure 127: Thailand Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 128: Oceania Market Value (US$ Million) Analysis, 2018 to 2022

Figure 129: Oceania Market Value (US$ Million) Forecast, 2023 to 2033

Figure 130: Oceania Market Value Share, by Application (2023 E)

Figure 131: Oceania Market Value Share, by Distribution Channel (2023 E)

Figure 132: Oceania Market Value Share, by Country (2023 E)

Figure 133: Oceania Market Attractiveness Analysis by Application, 2023 to 2033

Figure 134: Oceania Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 135: Oceania Market Attractiveness Analysis by Country, 2023 to 2033

Figure 136: Australia Market Value Proportion Analysis, 2022

Figure 137: Global Vs. Australia Growth Comparison

Figure 138: Australia Market Share Analysis (%) by Application, 2022 & 2033

Figure 139: Australia Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 140: New Zealand Market Value Proportion Analysis, 2022

Figure 141: Global Vs New Zealand Growth Comparison

Figure 142: New Zealand Market Share Analysis (%) by Application, 2022 & 2033

Figure 143: New Zealand Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 144: Middle East & Africa Market Value (US$ Million) Analysis, 2018 to 2022

Figure 145: Middle East & Africa Market Value (US$ Million) Forecast, 2023 to 2033

Figure 146: Middle East & Africa Market Value Share, by Application (2023 E)

Figure 147: Middle East & Africa Market Value Share, by Distribution Channel (2023 E)

Figure 148: Middle East & Africa Market Value Share, by Country (2023 E)

Figure 149: Middle East & Africa Market Attractiveness Analysis by Application, 2023 to 2033

Figure 150: Middle East & Africa Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 151: Middle East & Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 152: GCC Countries Market Value Proportion Analysis, 2022

Figure 153: Global Vs GCC Countries Growth Comparison

Figure 154: GCC Countries Market Share Analysis (%) by Application, 2022 & 2033

Figure 155: GCC Countries Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 156: Türkiye Market Value Proportion Analysis, 2022

Figure 157: Global Vs. Türkiye Growth Comparison

Figure 158: Türkiye Market Share Analysis (%) by Application, 2022 & 2033

Figure 159: Türkiye Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 160: South Africa Market Value Proportion Analysis, 2022

Figure 161: Global Vs. South Africa Growth Comparison

Figure 162: South Africa Market Share Analysis (%) by Application, 2022 & 2033

Figure 163: South Africa Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 164: Northern Africa Market Value Proportion Analysis, 2022

Figure 165: Global Vs Northern Africa Growth Comparison

Figure 166: Northern Africa Market Share Analysis (%) by Application, 2022 & 2033

Figure 167: Northern Africa Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Genomics Market Size and Share Forecast Outlook 2025 to 2035

Metagenomics Market Trends - Industry Analysis & Forecast 2025 to 2035

Nutragenomics Market Size and Share Forecast Outlook 2025 to 2035

Nutrigenomic Market Outlook - Growth, Demand & Forecast 2024 to 2034

CRISPR Genomic Cure Market

Synthetic Genomics Market

Tissue-Based Genomic Profiling Market Size and Share Forecast Outlook 2025 to 2035

Molecular Diagnostics In Pharmacogenomics Market Size and Share Forecast Outlook 2025 to 2035

Urine Monitoring Systems Market Analysis - Size, Trends & Forecast 2025 to 2035

Urine Analyzers Market

Taurine Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Taurine Market Size and Share Forecast Outlook 2025 to 2035

Taurine Industry Analysis in South Korea - Trends, Market Insights & Applications 2025 to 2035

Taurine Industry in Western Europe - Trends, Market Insights & Applications 2025 to 2035

Demand for Taurine in EU Size and Share Forecast Outlook 2025 to 2035

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA