The Genitourinary Prosthetics Market is anticipated to be valued at USD 634.70 million in 2025 and is expected to reach USD 1,014.3 million by 2035, registering a CAGR of 4.8%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 634.70 Million |

| Industry Value (2035F) | USD 1,014.3 Million |

| CAGR (2025 to 2035) | 4.8% |

The Genitourinary Prosthetics Market is experiencing significant growth, driven by the increasing prevalence of urological disorders such as erectile dysfunction and urinary incontinence. Advancements in prosthetic technologies, including the development of biocompatible materials and minimally invasive surgical techniques, are enhancing patient outcomes and satisfaction.

The aging global population further contributes to market expansion, as age-related genitourinary conditions become more common. Healthcare providers are increasingly adopting these prosthetics to improve patients' quality of life, supported by favorable reimbursement policies in developed regions.

Emerging markets are also witnessing growth due to improved healthcare infrastructure and rising awareness of treatment options. The market's future outlook is positive, with continuous innovation and increased investment in research and development expected to introduce more effective and patient-friendly solutions. Collaborations between medical device companies and healthcare institutions are anticipated to further drive advancements, making genitourinary prosthetics more accessible and efficient in addressing patient needs.

Prominent manufacturers in the Genitourinary Prosthetics Market include Boston Scientific Corporation, Coloplast Group, Zephyr Surgical Implants, Promedon, and UroMed. These companies are actively engaged in research and development to introduce innovative products that address unmet clinical needs.

In Feb 2024, UroMems, announced that it has successfully met the six-month primary endpoint for the first-ever female patient implanted with the UroActive™ System, the first smart automated artificial urinary sphincter (AUS) to treat SUI.

"We are elated to reach this critical achievement contributing to the demonstration of the feasibility of the UroActive System to successfully treat women suffering from debilitating SUI, the compelling results of this first-in-female implant show the high potential of our technology, bringing us one step closer to delivering on the massive unmet need for women and physicians desperately seeking a better SUI treatment option." said Hamid Lamraoui, UroMems chief executive officer and co-founder.

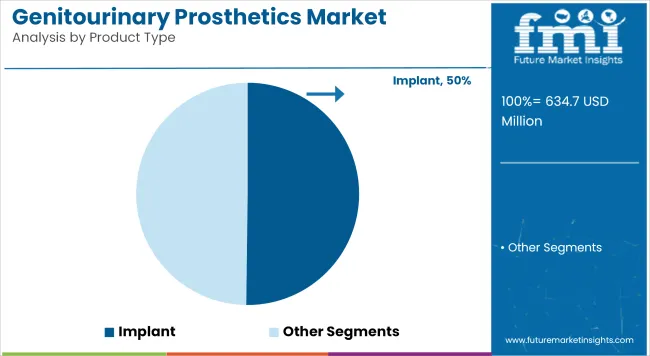

The implant segment has been observed to command the largest share 50.20% of total market revenue in 2025 within the genitourinary prosthetics market. This leadership position has been attributed to the rising incidence of urinary incontinence, erectile dysfunction, and testicular disorders among the aging male population.

Increased awareness about the availability of advanced prosthetic solutions, especially Artificial Urinary Sphincter (AUS) and Inflatable Penile Implants (IPP), has encouraged adoption among patients seeking long-term, quality-of-life improvements. Growth has also been supported by clinical endorsements and improved success rates in urological implant procedures.

Moreover, reimbursement support in developed economies has made such procedures more accessible. Technological advancements such as remote-controlled implants and antibiotic-coated devices have further enhanced clinical outcomes and reduced infection risks. These factors have collectively contributed to the dominance of this segment, with demand projected to grow steadily in both hospital and outpatient settings across North America and Europe.

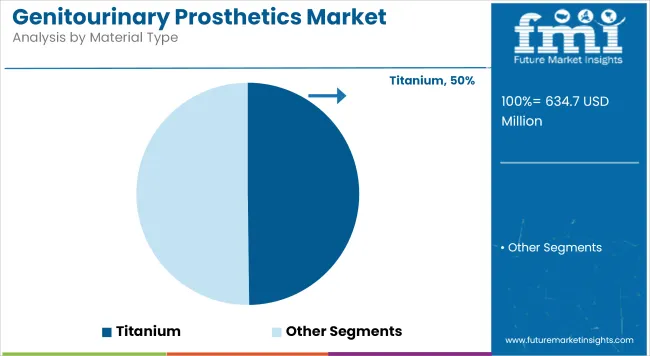

The titanium material segment is projected to account for 49.80% of the market revenue in 2025, establishing it as the leading material type used in genitourinary prosthetic devices. Its preference has been driven by its high tensile strength, resistance to corrosion, and superior biocompatibility, which minimizes the risk of rejection or inflammation when implanted in the human body.

Titanium has been widely adopted in penile and urinary sphincter implants, where durability and long-term structural integrity are critical. Its light weight and ability to integrate well with human tissues have made it a material of choice for manufacturers focused on improving patient safety and procedural efficiency.

Additionally, regulatory bodies such as the FDA have favored titanium-based prosthetics due to their strong safety profiles, further enhancing clinician confidence. As the trend toward minimally invasive urological interventions gains momentum, titanium’s mechanical and biological advantages are expected to drive sustained demand in both high- and middle-income countries.

Limited Awareness and Social Stigma hinders their Market Growth

One of the major challenges found in the genitourinary prosthetics market is the prevalent lack of awareness and social stigma concerning urological disorders, such as erectile dysfunction and urinary incontinence.This has led to an attitude of delayed diagnosis and treatment, which narrows prospects for the marketing of such life-enhancing devices.

Furthermore, ignorance among the patient population and the first-contact clinicians could also result in advanced prosthetic options being poorly referred. Without adequate awareness and specialty outreach, a large number remain afflicted in silence, constricting the global adoption of genitourinary prosthetics, even though the devices prove to be clinically effective and affordable.

Technological Advancements and Product Innovationposese new business opportunities in the market

The market for genitourinary prosthetics represents an area of excellent opportunity because of constant technological advancement and product development. Newer appliances are better accepted biologically, carry a lower infection risk, or confer more user comfort, so inherently they are more agreeable to both the patient and the surgeon. More recently, newer inflatable penile prosthesis and artificial urinary sphincters facilitate surgery better and have greater durability, thus lowering the rate of complications.

Moreover, through the synergy of antimicrobial coating and by minimally invasive implantation techniques, they allow for better postoperative recovery and outcomes. This potential change is eminent with more and more manufacturers developing these technologies and pursuing R&D and clinical trials for efficacy and safety. Surgeon education and patient awareness programs are also on the rise in the marketplace and both of these will contribute towards building confidence in the advanced prosthetic solutions in the emerging and developed markets.

Rising Demand for Penile Prostheses in Erectile Dysfunction Treatmentanticipates the Growth of the Market

An increasing number of patients with erectile dysfunction (ED) particularly in increasing the demand for penile prosthesis among the aged and in those suffering from co-morbidity (such as diabetes) or post-prostatectomy will soon be cured by such devices. Penile prosthesis provides patients with long-term functional efficacy when pharmacotherapy has been inadequate.

Urologists are more likely to prescribe inflatable penile implants because they offer more functionality with increased patient satisfaction. Further, insurance reimbursement gains in several countries are improving access. Firms are also investing in the advanced hydraulic systems and infection-resistant materials to lengthen their implants' duration.

The international market also has huge activities in the USA and certain areas of Europe, where access and awareness of specialized urologic care are more commonly realized; indeed, stronghold this segment as an important contributor to the entire genitourinary prosthetics market.

Growth in Urinary Sphincter Implants for Incontinence Managementdemonstrating Growth of the Market

Artificial urinary sphincters (AUS) are increasingly used in urinary incontinence, particularly post-prostatectomy stress incontinence in men. Prosthetics restore continence successfully and gain more advantages in both developed and developing markets as awareness and training among the prescribers increase.

Manufacturers design devices with enhancements in cuff durability, modes of pressure regulation, and reductions in surgical complexity to limit complications and revisions. Moreover, health systems recognize how AUS has become cost-effective to improve quality of life or to avoid dependence for long periods with absorbent products or catheters. The USA leads in adoption with strong clinical protocols; slow market penetration by Europe and Asia-Pacific follows due to changing new reimbursement environments and increasing volumes of urological surgeries.

Focus on Infection-Resistant and Biocompatible Materials

One of the key trends which is affecting the market of genitourinary prosthetics is the growing emphasis on the development of infection-resistant and highly biocompatible materials for implants. Post-operative infections have remained a major risk factor associated with the use of prostheses-penile prostheses and artificial urinary sphincters.

To combat this problem, manufacturers are launching antibiotic-coated and hydrophilic coated implants, which minimize the risk of bacterial colonization. Materials such as medical grade silicone and polyurethane with enhanced tissue compatibility are being used to minimize immune reactions and extend the life of the implant.

Regulatory bodies are becoming increasingly interested in such innovation due to their effect to improve surgical outcome. This movement, which is part of the larger industry trend, is about safer and durable prosthetic solutions in recovery and minimizing complication or revision rates.

Expansion of Minimally Invasive Surgical Techniques

Surgeons and medical professionals have, over time, been doing lesser trauma operations with procedures such as that of implanting artificial urinary sphincters and penile prostheses. This includes advanced laparoscopic techniques and even reduced incisions using improved surgical instruments, especially those developed specifically for urologic procedures.

Such methods not only lessen the scarring and postoperative pain but also provide minimal risk of infection and reduced operating times. Over the years, workshops and fellowships in such procedures are increasing worldwide to fuel the skill of surgeons. The trend has wider objectives in urology: better results, faster recovery back to normal activity, and patient satisfaction with prosthetic implantation.

Growing diseased incidence emergency within the United States from erectile dysfunction, facilitates insurance coverage, and vast networks of urologists are major impetus. The strong demand sustainability established by the presence of the top-notch manufacturers with continued innovation on device design, examined combined with the aforementioned, will further be influential. Increase outpatient procedures and the spread of physician-owned clinics are assets that have added on to their growth with regard prosthetic coverage toward suburbs.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

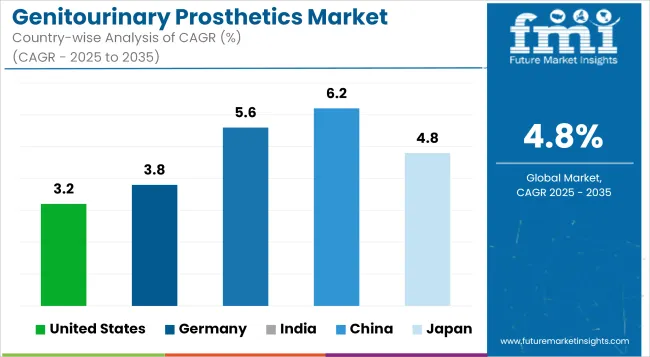

| United States | 3.2% |

Market Outlook

High rates of age-related incontinence and prostate procedures fuel the market in Germany. Strong reimbursement schemes support the continuation of procedural development, while urologist-led outpatient treatment models sustain this development. The technological advancement concerning preference among patients for among the best minimal invasive prosthesis places Germany right at the forefront of high quality prosthetic treatment in the European market.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.8% |

Market Outlook

The market is growing in India due to better health infrastructure, growing awareness of genitourinary diseases, and an emerging middle class willing to seek elective treatments. Historically underpenetrated by urbanization and better training of surgeons, access is now much wider. Prosthetics will become more widely accessible in years to come due to local manufacturing initiatives and innovations driven by affordability.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

Fast rising chronic diseases in the country, a large ageing male population, and even having increased prostate cancer surgeries have contributed to the increase in the genitourinary prosthetics market in China. The efforts of the government towards increasing the accessibility of surgeries and the continuous urological trainings held by the clinicians have in fact opened the doors for rural markets. Local manufacture and product clearances are also part of the driving forces in increasing adoption by an unmapped area of patient pool.

Market Growth Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.2% |

Japan has a super aged population and strong national health coverage, and there is increasing demand for urinary sphincter and penile implants. Long-run outlook is stable as societal attitudes and advocacy by physicians are changing perception about conservative uptake which was historically influenced by traditional attitudes. Rigorous surgical arrangements based on precision and calling into consideration quality of improvement in life are key determinants in the building of a stable long term market outlook.

Market Growth Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

The players in the market are continuously innovating material usage, patient-controlled devices, and implantation procedures to stay abreast with technology. The two pillars that have to ensure regulation in terms of safety and efficacy are FDA (Food and Drug Administration) and EMA (European Medicines Agency), which ultimately drive the future of product development.

The MNEs are ahead of the local manufacturers with robust clinical pipelines and more involvement with surgeons. However, local manufacturers have fastened their seatbelts on this front because they will provide affordable implants custom-made for the locality. Price consciousness in developing markets makes it worse-off competition, and both multinationals and local players feel compelled to strengthen value-based offerings and extend geographic reach.

The market is segmented into Devices (Catheter, Electronic Stimulator Device, and Stent), Implants (Artificial Urinary Sphincter Implants (AUS), Inflatable Penile Implant (IPP), Testicular Prosthetic Implants), and Grafts (Synthetic Mesh, Biological Mesh, Allograft, Xenograft, and Suture Anchors).

The market is segmented into Silicon, Titanium, and Apatite.

The market is segmented into Hospitals, Clinics, Rehabilitation Centers, and Outpatient Surgical Centers.

Regionally Market is analyzed across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

The overall market size for genitourinary prosthetics market was USD 634.70 Million in 2025.

The genitourinary prosthetics market is expected to reach USD 1,014.3 Million in 2035.

Rising prevalence of urological disorders and technological advancements in prosthetics anticipates the growth of the genitourinary prosthetics market.

The top key players that drives the development of genitourinary prosthetics market are Boston Scientific Corporation, Zephyr Surgical Implants SÀRL, Coloplast Care, Promedon and UroMed

Devices segment by product type is expected to dominate the market during the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Prosthetics and Orthotics Market - Growth & Future Trends 2025 to 2035

Competitive Overview of Neuroprosthetics Companies

Passive Prosthetics Market

Orthopedic Prosthetics Market Size and Share Forecast Outlook 2025 to 2035

Upper Limb Prosthetics Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Prosthetics Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Prosthetics Market Analysis - Size, Share, and Forecast 2025 to 2035

Implant-Borne Prosthetics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthotics-Prosthetics Market Growth – Trends & Forecast 2025 to 2035

Carbon Fiber Composites for Prosthetics Market 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA