The Gene Editing Tool market is experiencing substantial growth driven by the increasing adoption of advanced genetic engineering technologies in biotechnology and pharmaceutical research. The market is largely shaped by the rising demand for precise, efficient, and cost-effective gene editing solutions for applications such as cell line engineering, functional genomics, and therapeutic development. Continuous advancements in CRISPR/Cas9 and other genome editing platforms are enabling researchers to perform complex genetic modifications with higher accuracy and reduced off-target effects.

Growing investments in biotechnology research, personalized medicine, and drug development are further supporting market expansion. Additionally, the increasing prevalence of genetic disorders and the need for innovative therapeutic approaches are fueling the demand for gene editing tools.

The adoption of gene editing techniques in commercial research laboratories and pharmaceutical companies is facilitating rapid innovation and accelerating product development cycles With ongoing developments in gene therapy, synthetic biology, and agricultural biotechnology, the gene editing tool market is poised for continued growth in both established and emerging markets.

| Metric | Value |

|---|---|

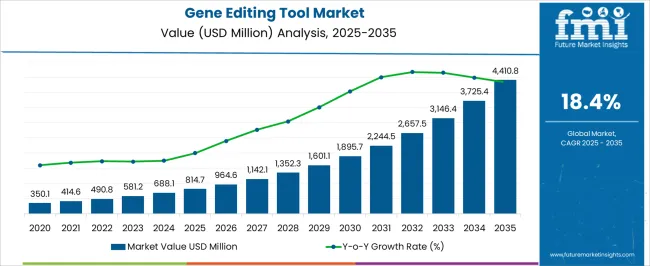

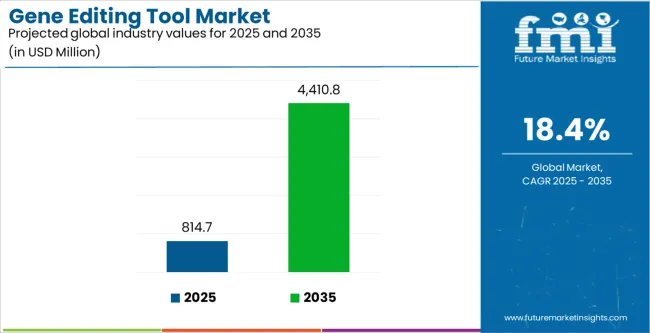

| Gene Editing Tool Market Estimated Value in (2025 E) | USD 814.7 million |

| Gene Editing Tool Market Forecast Value in (2035 F) | USD 4410.8 million |

| Forecast CAGR (2025 to 2035) | 18.4% |

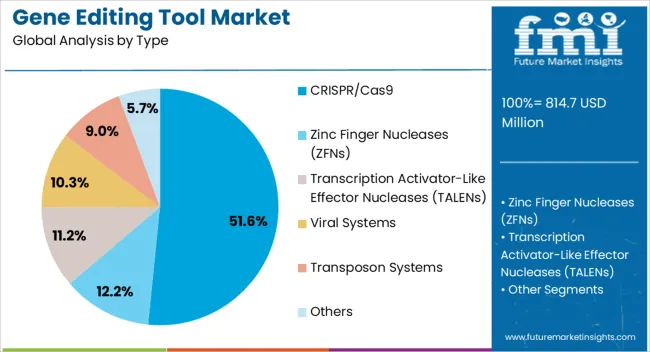

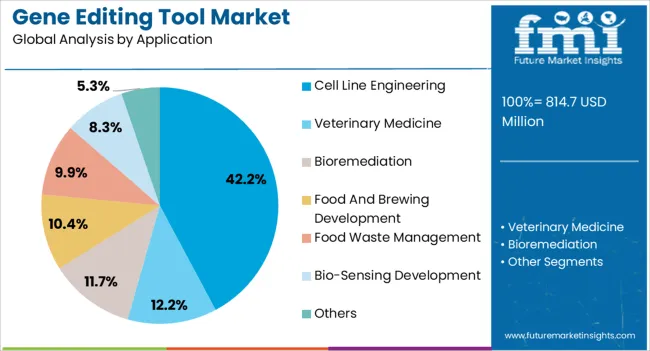

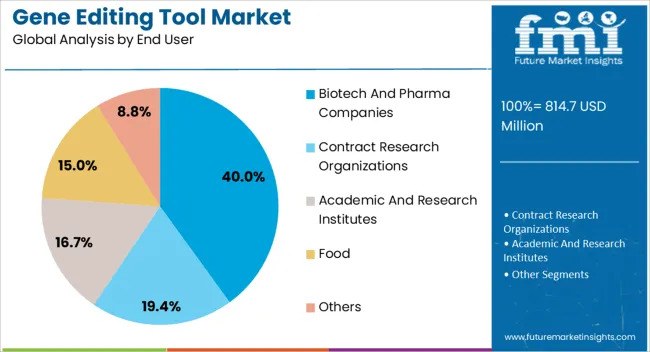

The market is segmented by Type, Application, and End User and region. By Type, the market is divided into CRISPR/Cas9, Zinc Finger Nucleases (ZFNs), Transcription Activator-Like Effector Nucleases (TALENs), Viral Systems, Transposon Systems, and Others. In terms of Application, the market is classified into Cell Line Engineering, Veterinary Medicine, Bioremediation, Food And Brewing Development, Food Waste Management, Bio-Sensing Development, and Others. Based on End User, the market is segmented into Biotech And Pharma Companies, Contract Research Organizations, Academic And Research Institutes, Food, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The CRISPR/Cas9 type segment is projected to hold 51.60% of the Gene Editing Tool market revenue share in 2025, making it the leading gene editing technology. This dominance is driven by its unparalleled precision, ease of use, and adaptability across multiple research applications.

The segment has benefited from continuous improvements in guide RNA design and Cas enzyme variants, which have enhanced editing efficiency and reduced unintended modifications. The flexibility of CRISPR/Cas9 to target multiple genes simultaneously has made it highly suitable for complex genetic studies and therapeutic development.

Additionally, its cost-effectiveness compared to other gene editing platforms has facilitated widespread adoption in academic, commercial, and pharmaceutical research settings The growing emphasis on personalized medicine and novel therapeutics continues to reinforce the demand for CRISPR/Cas9, ensuring its leading position in the market.

The cell line engineering application segment is expected to account for 42.20% of the Gene Editing Tool market revenue share in 2025, making it the dominant application area. This growth is influenced by the increasing use of gene editing tools to develop customized cell lines for drug discovery, functional genomics, and biopharmaceutical production.

Precise genetic modifications allow researchers to create models that accurately replicate human diseases, improving the efficiency of preclinical studies. The integration of automated and high-throughput gene editing technologies has further enhanced productivity in cell line engineering workflows.

Additionally, regulatory support for advanced biotechnological research and the growing need for innovative therapies have accelerated adoption The ability to generate reliable, reproducible, and scalable cell lines continues to drive the segment’s prominence in the gene editing tool market.

The biotech and pharma companies end user segment is anticipated to account for 40.00% of the Gene Editing Tool market revenue share in 2025, establishing it as the leading end-use industry. This growth is driven by the increasing focus on drug discovery, gene therapy development, and biologics production within these companies.

Gene editing tools provide scalable and precise solutions that enable accelerated research, improved product quality, and reduced development timelines. The ability to customize genetic models and optimize therapeutic targets enhances the efficiency of research pipelines, supporting decision-making and innovation.

Furthermore, rising investments in biotechnology infrastructure, research collaborations, and clinical development programs have reinforced the adoption of gene editing technologies As regulatory acceptance and technological capabilities advance, biotech and pharma companies are expected to continue driving the growth of the gene editing tool market.

Adoption of Personalized Medicines Revolutionizes the Industry

In the modern era, demand for tailored medical solutions has increased. Medical professionals are heavily prescribing medications according to the patient's genetic makeup in developed regions. By offering promising solutions and enabling precise modifications of genes, personalized medicine is an emerging ideal solution for individuals suffering from genetic disorders.

Gene Editing Tools Face Safety Concerns in Early Stages

Safety concerns are presumed to hamper the gene editing tool market growth during the forecast period. Gene editing tools are a new concept and are still in the early stages of development. They also require skilled health professionals and researchers. While studies indicate there are chances of off-target effects and unintended consequences of gene editing. Professionals must be careful when considering the risks involved.

Synthetic Genes Drive Biotech Opportunities and Tech Advances Boost Diagnostics

The increasing need for synthetic genes in biotechnology domains is expected to create significant opportunities for stakeholders. Rapid technological advances will modernize diagnostic tools in the coming years. Thus, the advancements are anticipated to increase market competition among tool manufacturers during the forecast horizon. Also, creating tools that provide convenience and ease of technology can drive industry sales in the upcoming years.

The gene editing tool market is projected to register a value with an 18.4% CAGR between 2025 and 2035, slightly up from the 17.4% CAGR recorded during 2020 and 2025.

The COVID-19 pandemic outbreak led to the development of highly advanced genome engineering tools for detecting genetic variations in viral strains. Governments are taking action due to health concerns post-COVID. The International Department of the Food and Drug Administration announced a policy for evaluating the impact of viral mutations on COVID-19 tests.

Before the pandemic year, the technologies in the medical department did not have advanced features, and the people and medical services were underdeveloped. After the pandemic, the population and medical services have evolved and gained knowledge to advance medical facilities to deal with this situation and provide high-quality service to individuals.

There have been recent changes made by many governments after the pandemic, and several government bodies are investing in research and development. Ongoing innovation in research and educational institutions for various CRISPR editing tools is expanding business revenue.

Several governments’ demand for gene editing tools impacts the formulation of these editing tools. As the population becomes more health-conscious, they are spending more on high-quality treatment. All these factors are expected to drive sales of gene editing tools in the coming years.

In terms of product type, the clustered regularly interspaced short palindromic repeats (CRISPR/Cas9) segment is anticipated to hold a 51.6% industry share in 2025. In addition, in terms of application type, cell line engineering is expected to dominate by holding a share of 42.2% in 2025.

| Segment | Clustered Regularly Interspaced Short Palindromic Repeats (Type) |

|---|---|

| Value Share (2025) | 51.6% |

Based on product type, the CRISPR/Cas9 segment is projected to have the largest share of the gene editing tool market in the coming years. This increase is due to the growing use of CRISPR DNA editing in human-induced pluripotent stem cell (hiPSC)-related initiatives to uncover novel therapeutic options for a variety of disorders.

This method is also predicted to help improve the productivity of CHO cell lines. These cell lines are widely used in the manufacturing of large-molecule therapies, and their strong demand is expected to drive sales of CRISPR genome engineering tools.

| Segment | Cell Line Engineering (Application) |

|---|---|

| Value Share (2025) | 42.2% |

By offering more accurate and reliable disease models, cell line engineering has emerged as an ideal application in the current period. Additionally, cell line engineering provides facilities such as the creation of a model that has all the genetic and physiological features of human diseases.

Thus, by providing a more accurate platform for drug screening and development, cell line engineering has gained popularity among researchers in recent years. Moreover, the demand for personalized medicines is anticipated to lead the segment to growth in the coming years, as the cell line allows researchers to identify genetic mutations and develop tailored medicine.

The biotechnology industry is expected to show greater potential in several regions, with Europe standing out with high potential. With a remarkable CAGR, the United Kingdom will gain a key industry share in the gene editing tool market during the forecast period. The growth drivers of specific countries with deep research are well elaborated below.

| Countries | CAGR 2025 to 2035 |

|---|---|

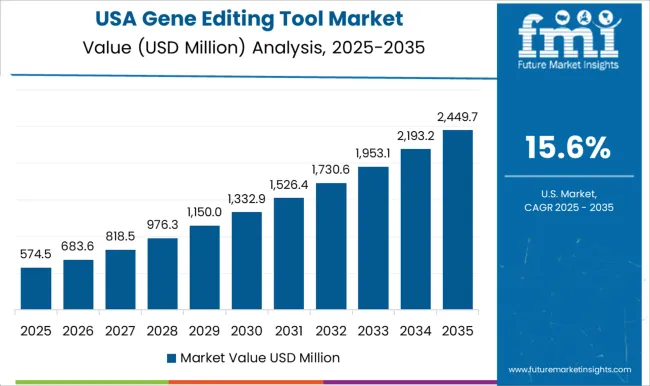

| United States | 20.7% |

| Germany | 21.7% |

| United Kingdom | 23.2% |

| India | 14.2% |

| Russia | 16.1% |

The gene editing tool market in the United States is anticipated to exhibit prospective growth, with a projected CAGR of 20.7% in the coming years. The United States has experienced significant growth and leads in gene editing tools. Several industries, such as Editas Medicine and CRISPR Therapeutics, are pioneering CRISPR-based therapies.

In the United States, advanced research facilities like the Broad Institute and NIH drive continuous innovation. Collecting funds from capitalists and government grants fosters development. The collaboration between academic and industry sectors, as seen in innovative genomics institutes working with biotech firms, accelerates innovation. This type of activity boosts the revenue growth of the gene editing tool sector globally.

The gene editing tool market in India is expected to maintain steady growth, with an anticipated CAGR of 14.2% until 2035, signaling a positive outlook. Gene editing tools are gaining popularity among people, with startups promoting their application. Startups like Pandorum Technologies are focusing on creating regenerative medicine.

Research institutions are acquiring knowledge about various tools to innovate new products. Institutes involved, such as Genomics and Integrative Biology, contribute to advancement. India's regulatory framework for gene editing is still evolving, with guidelines set by the Department of Biotechnology.

On the other hand, ethical considerations and public debate are fueled by policy decisions. India's diverse genetic pool presents opportunities for personalized and agricultural development.

The gene editing tool market in Russia is presumed to maintain growth, with a CAGR of 16.1%. The growing innovation in gene editing tools in Russia is evident due to high investment in this field by industries.

Also, Russia's increasing population provides a vast range of applications for gene editing tools, from disease treatment to improvements in agriculture.

Various genetic problems arise in Russia due to the aging population, requiring advanced treatments and high-quality tools. In response, Russia's government is taking steps to develop highly advanced technologies and equipment in the medical sector, aiming to offer a high level of service to individuals. This initiative contributes to the thriving expansion of the gene editing tools industry.

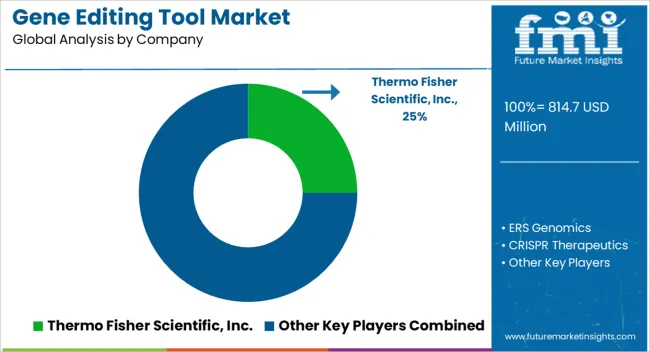

Gene editing tool market players are constantly researching gene technology to update their tools. Companies are working on developing more efficient and accurate tools that can be used in clinical trials and eventually approved by regulatory agencies. Companies such as CRISPR Therapeutics, Intellia Therapeutics, and Editas Medicine are leading the way in developing gene editing technologies that can be used to treat a variety of genetic disorders.

Industry Updates

The type segment is divided into clustered regularly interspaced short palindromic repeats (CRISPR/Cas9), zinc finger nucleases (ZFNs), transcription activator-like effector nucleases (TALENs), viral systems, transposon systems, and others.

Gene editing tools find application in veterinary medicine, cell line engineering, bioremediation, food and brewing development, food waste management, bio-sensing development, and others.

End use industries present in this industry are biotech and pharma companies, contract research organizations, academic and research institutes, food, and others.

Regional analysis is conducted across key countries of in North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East and Africa.

The global gene editing tool market is estimated to be valued at USD 814.7 million in 2025.

The market size for the gene editing tool market is projected to reach USD 4,410.8 million by 2035.

The gene editing tool market is expected to grow at a 18.4% CAGR between 2025 and 2035.

The key product types in gene editing tool market are crispr/cas9, zinc finger nucleases (zfns), transcription activator-like effector nucleases (talens), viral systems, transposon systems and others.

In terms of application, cell line engineering segment to command 42.2% share in the gene editing tool market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Genetic Analyzers Market Size and Share Forecast Outlook 2025 to 2035

General Intelligent Decision-Making Service Market Size and Share Forecast Outlook 2025 to 2035

General Equipment Rental Services Market Size and Share Forecast Outlook 2025 to 2035

General Purpose DC Contactor Market Size and Share Forecast Outlook 2025 to 2035

Generative AI in Packaging Market Size and Share Forecast Outlook 2025 to 2035

Generative AI In Chemical Market Size and Share Forecast Outlook 2025 to 2035

Generator Sales Market Size and Share Forecast Outlook 2025 to 2035

Generic Injectable Market Report - Growth, Demand & Forecast 2025 to 2035

Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Generative AI in Logistics Market Size and Share Forecast Outlook 2025 to 2035

Gene Synthesis Market Growth – Trends & Forecast 2025 to 2035

General Surgery Devices Market Insights – Demand and Growth Forecast 2025 to 2035

Gene Therapy in CNS Disorder Market Analysis by Indication, Type, End User, and Region through 2035

Generalized Anxiety Disorder Treatment Market Insights by Drug Class, Therapies, Distribution Channel, and Region 2035

General Purpose Electronic Test and Measurement Instruments Market Analysis and Forecast by Product, End Use, and Region Through 2035

Generalized Myasthenia Gravis Management Market - Growth & Treatment Advances 2025 to 2035

Generative AI Market Analysis - Trends & Forecast 2025 to 2035

Genetically Modified Food Market Analysis by Type, Trait, and Region through 2035

General Anesthesia Drugs Market Insights – Trends & Forecast 2025 to 2035

Generic Oncology Drugs Market Growth – Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA