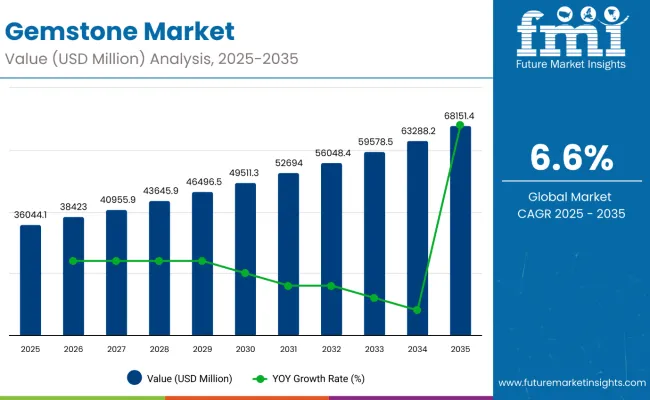

The global gemstone market is poised for substantial expansion, increasing from USD 36,044.1 million in 2025 to USD 68,151.4 million by 2035. The market is expected to grow at a CAGR of 6.6% from 2025 to 2035.

Gemstones are highly prized for beauty rarity and cultural significance across countless generations and global demand drives market growth rapidly upward. Markets cater broadly worldwide across economic segments with gemstones such as diamonds rubies emeralds sapphires.

Rising demand for bespoke jewelry coupled with growing disposable incomes drives market growth upward rapidly. Modern shoppers crave distinctive styles with custom gemstones that boost the appeal of one-off handmade creations. Growing demand for colored gemstones fueled by shifting fashion trends and high-profile endorsements fuels market expansion rapidly nowadays.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 36,044.1 million |

| Industry Value (2035F) | USD 68,151.4 million |

| CAGR (2025 to 2035) | 6.6% |

The investment potential of gemstones, especially diamonds and rare-colored stones, also contributes to market growth. High-net-worth individuals consider gemstones as pretty stable assets that gain value over time leading to boosted sales via auction houses.

Gemstone healing and wellness products gain popularity rapidly among spiritually inclined consumers seeking profound metaphysical benefits. Digital platforms revolutionize the gemstone market giving consumers easy access to certified gemstones through transparent pricing and detailed product information online. Millennials and Gen Z consumers rapidly drive up online gemstone sales with their strong affinity for e-commerce platforms.

Per capita spending on gemstones reflects cultural preferences, income levels, and the influence of luxury and fashion trends. While gemstones are traditionally associated with fine jewelry, they are increasingly being used in customized accessories, collectibles, and even alternative investments. The market includes both natural and lab-grown stones, and spending varies significantly between developed and emerging regions.

The global trade of gemstones is shaped by a complex network of mining, processing, and distribution centers, serving markets ranging from luxury jewelry to industrial applications. Trade flows are influenced by factors such as gemstone origin, certification standards, ethical sourcing concerns, and the growing popularity of lab-grown stones. Both natural and synthetic gemstones contribute to vibrant international trade activity.

The below table presents the expected CAGR for the gemstone industry over semi-annual periods spanning from 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.6% |

| H2 (2024 to 2034) | 7.2% |

| H1 (2025 to 2035) | 7.8% |

| H2 (2025 to 2035) | 5.5% |

The CAGR exhibits a fluctuating trend, initially increasing by 56 BPS from H1 (2024 to 2034) to H2 (2024 to 2034), indicating stronger growth momentum in the latter half. However, a slight increase of 78 BPS in H1 (2025 to 2035) suggests temporary market stabilization or external constraints. Growth rebounds in H2 (2025 to 2035) with a 55 BPS decrease, reflecting renewed demand or industry expansion. This pattern suggests cyclical variations, with stronger growth in the second half of each period, possibly driven by evolving market conditions and strategic investments.

Rising Demand for Personalized and Luxury Jewelry Drives Gemstone Market Growth

The global gemstone market experiences pretty rapid growth because of the escalating desire for bespoke luxury jewelry pieces. Consumers seek unique gemstone pieces that reflect individual style and status in deeply personal ways. Wealthy folks flock towards exceptionally rare gemstones such as diamonds and rubies which fuel luxury segment growth rapidly underground.

Manufacturers respond with bespoke jewelry designs featuring unusually cut gemstones that boost the visual appeal of pieces. The growing popularity of colored gemstones influenced by fashion trends drives market growth rapidly due to celebrity endorsements. Digital platforms with virtual try-ons and customization options significantly boost buyer experience thereby fueling rapid market growth rapidly online.

Growing Popularity of Gemstones as Investment Assets Boosts Market Expansion

The growing interest in gemstones as an alternative investment boosts the global market for these precious stones. Investors view high-quality diamonds and rare-colored stones as a fairly solid backup plan financially speaking due to uncertainty. Auction houses witness heightened demand for rare gemstones which drives market prices upwards rapidly every year somehow.

Additionally, market players offer certified gemstones via bespoke platforms ensuring buyers of inherent value and authenticity somehow. Blockchain technology enhances transparency in gemstone certification and provenance tracking considerably thereby boosting consumer confidence suddenly. Investment-driven demand will likely propel market growth in subsequent years at an amazingly rapid pace.

Ethical Sourcing and Sustainability Concerns Propel Demand for Lab-Grown Gemstones

Rising awareness of environmental issues prompts consumers to favor lab-grown gemstones over traditional mining practices slowly. Environmentally conscious buyers seek luxury products that are remarkably sustainable and remarkably eco-friendly. Lab-grown diamonds possess similar properties as natural stones yet have lower environmental impact due to advanced manufacturing processes somehow. Transparency in sourcing boosts consumer trust due to sustainable practices under certifications like Kimberley Process which fuels demand for ethically sourced gemstones. Sustainability trends profoundly alter gemstone market dynamics rapidly.

Digital Platforms and E-commerce revolutionize the Gemstone Buying Experience

Digital platforms rapidly transform the global gemstone market giving consumers easy access via myriad certified gemstones at transparent prices somehow. Millennials and Gen Z consumers rapidly opt for virtual marketplaces thereby measurably increasing sales of precious stones online daily.

Virtual try-on features detailed product descriptions and customer reviews significantly enhance online buying experience thereby driving market growth rapidly. Social media platforms significantly impact buying decisions due to brands leveraging influencer marketing through targeted advertising campaigns. Digital platforms offer vast variety and convenience which will likely keep driving gemstone market expansion rapidly over time.

The global gemstone market saw robust growth from 2020 to 2024 with notably high annual gains of 4.9% overall. Market expansion occurred steadily reaching USD 34,110.1 million by 2024 up from USD 28,119.9 million in 2020. Growth accelerated rapidly due to rising demand for luxury jewelry and the surging popularity of colored gemstones amidst increasing incomes.

Momentum built rapidly as gemstones gained popularity somehow as investment assets fueling market growth enormously over time. The COVID-19 pandemic has had somewhat mixed effects overall on market trends lately. Retail disruptions initially impacted sales but demand for high-end gemstones facilitated a remarkably swift market rebound via online platforms somehow. Consumers sought alternative investment options boosting demand for high-value gemstones like diamonds and exceptionally rare colored stones

The global gemstone market will likely surge upwards rapidly from 2025 reaching USD 68,151.4 million by 2035 at a CAGR of 6.6% annually. Several factors are expected to drive this growth, including increasing consumer preference for bespoke and colored gemstone jewelry, rising investment interest, and growing awareness of ethical sourcing. The emergence of lab-grown gemstones as eco-friendly alternatives will probably boost market expansion rapidly catering to buyers who prioritize the environment.

Technological advancements in gemstone cutting certification and digital platforms enhance the consumer buying experience deeply fueling market growth rapidly online. Fashion trends significantly impact market dynamics nowadays so substantial growth emerges rapidly over forthcoming years.

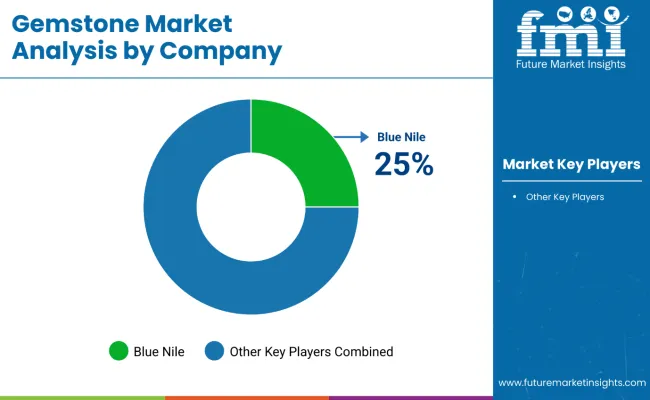

Tier-1 players dominate the global gemstone market with a share of 35-40%, leveraging advanced sourcing networks and extensive global reach. These companies boast robust distribution networks with luxury jewelry brands and substantial brand equity enabling them capture big market shares. They offer high-quality certified gemstones including rare investment-grade stones that attract affluent customers and sophisticated investors. Notable Tier-1 players in the gemstone market include De Beers Group, Gemfields Group, and Alrosa among others.

Tier-2 companies hold a significant regional market share of 30-35%, often dominating local markets by offering a balanced mix of quality and affordability. These firms cater to mid-range consumers seeking personalized and fashionable gemstone jewelry. They maintain robust sourcing networks and adhere to industry standards, ensuring product authenticity and moderate innovation in design and cutting techniques. Notable Tier-2 players include Chow Tai Fook, Titan Company (Tanishq), and Gitanjali Group among others.

Tier-3 players mostly work in specialized areas focusing on budget-friendly friendly gemstone solutions for specific client groups. These firms usually work within small regional markets holding roughly 15 to 20% market share competing fiercely on flexible pricing options. Budget-friendly shoppers seek out stylish gems and trendy accessories at discounted prices. Notable Tier-3 players in the gemstone industry include JTV (Jewelry Television), Blue Nile, Angara, and several local jewelers and online retailers worldwide.

| Countries | Population (millions) |

|---|---|

| United States | 345.4 |

| China | 1,419.3 |

| India | 1,450.9 |

| Japan | 123.2 |

| United Arab Emirates | 10.2 |

| Countries | Estimated Per Capita Spending (USD) |

|---|---|

| United States | 3.25 |

| China | 2.85 |

| India | 1.95 |

| Japan | 2.50 |

| United Arab Emirates | 4.10 |

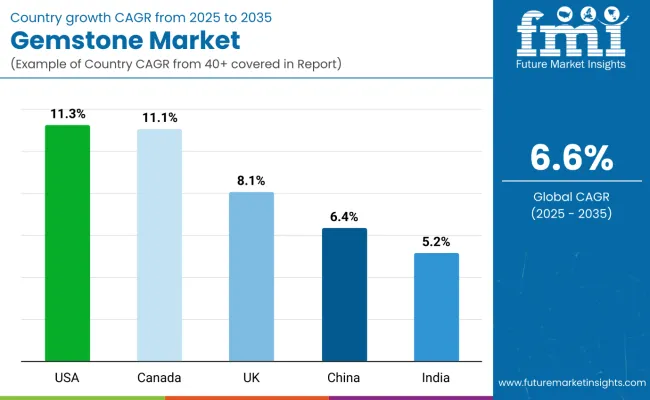

The USA gemstone market, valued at USD 7,673.7 million, thrives due to high consumer spending on luxury jewelry and investment-grade gemstones. Strong demand for diamonds, emeralds, and sapphires drives market growth, fueled by consumer preferences for personalized and high-value jewelry.

China’s gemstone market, valued at USD 1,345.6 million, benefits from rising disposable incomes, urbanization, and cultural significance of gemstones in traditional ceremonies. Demand for jade, ruby, and sapphire jewelry is particularly high among affluent buyers.

India’s gemstone market, valued at USD 1,328.1 million, is expanding rapidly due to cultural significance and rising middle-class incomes. Traditional preferences for emeralds, rubies, and sapphires in wedding jewelry and astrological beliefs drive consistent demand.

Japan’s gemstone market, valued at USD 1,663.8 million, is driven by demand for high-quality and minimalist jewelry designs. Consumers prioritize premium gemstones like diamonds, pearls, and colored sapphires, reflecting cultural preferences for understated luxury.

The UAE’s gemstone market, valued at USD 784.4 million, thrives on luxury spending and cultural affinity for high-value jewelry. Diamonds, emeralds, and rubies are particularly popular among affluent consumers.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

| Canada | 7.3% |

| UK | 5.9% |

| China | 11.1% |

| India | 11.4% |

The USA gemstone market is expected to grow at a CAGR of 4.2% from 2025, driven by the rising demand for certified and ethically sourced gemstones. Consumers prioritize authenticity, and transparency now leading to preference for gemstones with verified certifications from agencies somehow gaining trust rapidly. Heightened awareness of conflict-free sourcing supports this trend pretty strongly alongside environmental sustainability efforts lately.

Personalized jewelry's surge in popularity alongside remarkably vibrant colored gemstones fuels market expansion significantly every day. Consumers seek unique jewelry pieces driving demand for bespoke gemstone designs with intricate details and subtle flair. Digital platforms amplify gemstone accessibility for somewhat younger consumers who frequently browse websites. Rising social media influence accelerates demand for high-quality gemstones via fashion influencers and celebrity endorsements shaping market trends rapidly nowadays

The UK gemstone market is anticipated to expand at a CAGR of 5.9% over the next decade, fueled by growing consumer awareness of sustainability and responsible sourcing. The demand for ethically sourced gemstones rises rapidly now that consumers increasingly favor transparency in supply chains and support eco-friendly brands. Younger generations prioritize ethical considerations in purchasing decisions thus wielding significant influence over this shift.

Customized jewelry fuels market growth as consumers seek unique pieces with sentimental value through bespoke birthstone engagement rings. Personalized jewelry gains momentum as bespoke gemstone creations surge in popularity gradually over time for special occasions.

Shopping online for gemstones has become ridiculously easy nowadays because consumers prefer convenience and access to a wider variety of designs. Millennial buyers flock rapidly towards vibrant gemstones like sapphires and emeralds which escalates market activity and expands buyer options significantly.

India's gemstone market is expected to grow at a CAGR of 11.4% from 2025 to 2035, driven by the cultural importance of gemstones, particularly for astrological and spiritual purposes. Gemstones hold significant cultural value in India symbolizing power prosperity and protection driving demand fiercely among numerous consumer groups. Gemstones are highly sought after for sacred ceremonies and notable events which greatly boosts market expansion somehow.

Higher spending on luxury items occurs due to rising disposable incomes alongside rapidly increasing urbanization patterns. Consumers shift gradually from old jewelry designs incorporating precious stones in fresh unusual ways. E-commerce platforms render certified gemstones highly accessible broadly across urban regions rapidly gaining traction online nowadays. Affluent consumers are driving up demand for high-value gemstones like diamonds and emeralds as status symbols and investment opportunities skyrocket rapidly.

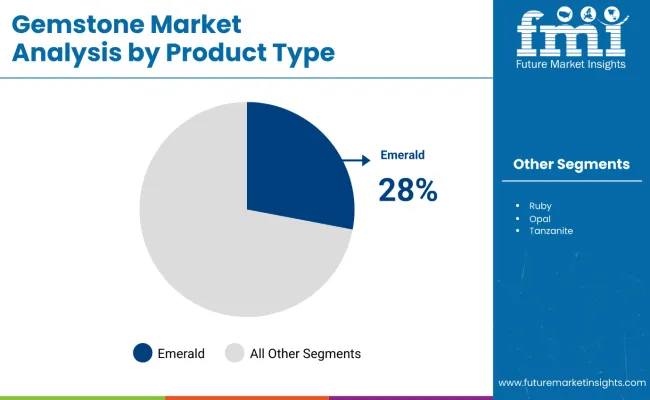

| Product Type | CAGR (2025 to 2035) |

|---|---|

| Emerald | 4.5% |

The emerald segment, in terms of product type, dominates the gemstone industry and is expected to witness robust growth with a CAGR of 4.5% from 2025 to 2035. This growth stems from the demand for high-quality emeralds in luxury jewelry due to their strong cultural significance as a highly sought-after gemstone.

Advancements in mining techniques coupled with escalating demand for conflict-free gems fuel rapid growth somehow beneath surface-level activity. Sustainable unique gemstone products garner significant attention supporting emerald segment dominance globally amidst burgeoning demand somehow.

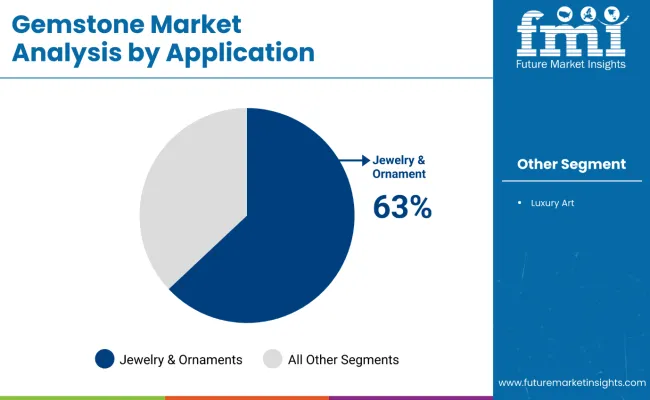

| Application | CAGR (2025 to 2035) |

|---|---|

| Jewelry & Ornaments | 6.4% |

The jewelry and ornaments segment dominates gemstone market sales in terms of application, and it is expected to experience significant growth, with a market CAGR of 6.4% from 2025 to 2035. This growth is driven by increasing global demand for luxury jewelry and rising incomes fuel personalized jewelry trends rapidly worldwide now.

Gemstones' aesthetic appeal and use in cultural contexts fuel segment expansion rapidly beneath surface-level scrutiny. Sustainable gemstones sourced ethically contribute strongly to online retail growth boosting jewelry ornaments segment growth potential significantly faster now.

The global gemstone market faces intense competition from key players such as De Beers, Tiffany & Co., Gemfields, Chow Tai Fook, and Blue Nile, each dominating the industry with their unique offerings. De Beers is a leading brand recognized for its high-quality diamonds and innovative approaches to sustainable sourcing, particularly in its ethical diamond programs. Tiffany & Co. is renowned for luxury and timeless designs, offering a range of premium gemstones with a focus on craftsmanship and exclusivity.

In addition to these major brands, emerging players such as Brilliant Earth and James Allen are redefining the market with innovative offerings and personalized gemstone experiences. Brilliant Earth focuses on ethically sourced gemstones and offers customization services, enabling consumers to create unique jewelry pieces with certified diamonds and colored stones.

James Allen stands out for its online platform that provides 360-degree views of gemstones, allowing customers to make informed decisions from the comfort of their homes. Brands emphasizing sustainability, ethical practices, and transparency in their sourcing are witnessing significant growth as consumers demand greater accountability.

In terms of product type, the industry is divided into emerald, ruby, opal, sapphire, spinel, tanzanite, zircon, and others.

The industry is further divided by applications that are luxury art, and jewelry & ornaments.

Key countries of North America, Latin America, Europe, East Asia, South Asia, Middle East and Africa (MEA), and Oceania have been covered in the report.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Product Format, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Product Format, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Format, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Product Format, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Format, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product Format, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Product Format, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Product Format, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Product Format, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by Product Format, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by End User, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Product Format, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by Product Format, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Product Format, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Product Format, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Product Format, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Product Format, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Product Format, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by End User, 2023 to 2033

Figure 23: Global Market Attractiveness by Product Format, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Product Format, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Product Format, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Product Format, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Product Format, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Product Format, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by End User, 2023 to 2033

Figure 47: North America Market Attractiveness by Product Format, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Product Format, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Product Format, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Product Format, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Product Format, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Product Format, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Product Format, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Product Format, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Product Format, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by Product Format, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Product Format, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Product Format, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by End User, 2023 to 2033

Figure 95: Europe Market Attractiveness by Product Format, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Product Format, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Product Format, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by Product Format, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Product Format, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Format, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by End User, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Product Format, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Product Format, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Product Format, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by Product Format, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Product Format, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Product Format, 2023 to 2033

Figure 141: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by End User, 2023 to 2033

Figure 143: MEA Market Attractiveness by Product Format, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

The global gemstone industry is projected to witness a CAGR of 6.6% between 2025 and 2035.

The global gemstone industry stood at USD 34,110.1 million in 2024.

The global gemstone industry is anticipated to reach USD 68,151.4 million by 2035 end.

The GCC region is set to record the highest CAGR of 6.3% in the assessment period.

The key players operating in the global gemstone industry include Gemfields, Rio Tinto, Tiffany & Co., Chow Tai Fook Jewellery Group, Signet Jewelers, Blue Nile, Harry Winston, and Graff, among others.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA