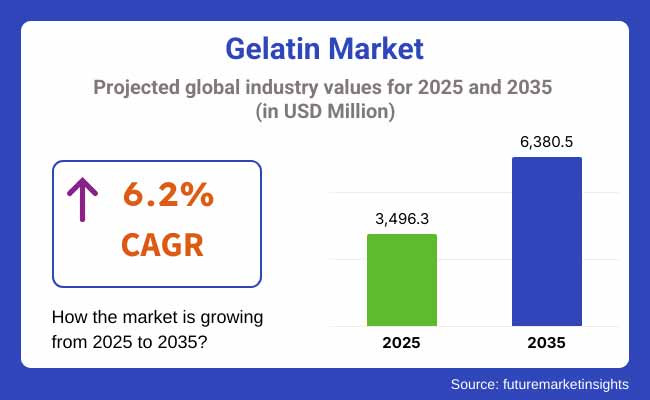

The Gelatin Market is projected to experience significant growth between 2025 and 2035, driven by the increasing demand for protein-enriched foods and nutraceuticals. The market is expected to reach USD 3,496.3 million in 2025 and is estimated to expand to USD 6,380.5 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.2% over the forecast period.

A major factor propelling the market expansion is the rising consumer preference for clean-label and functional foods. Gelatin, derived from collagen, plays a crucial role in multiple food applications due to its gelling, stabilizing, and thickening properties. With the increasing awareness of health benefits associated with collagen consumption, gelatin is witnessing strong demand in functional foods, dietary supplements, and protein-enriched products. The growing trend of high-protein diets and sports nutrition further fuels market growth.

Within the Nature segment, Conventional Gelatin reigns supreme, as it is more inexpensive as well as more readily available than organic counterparts. As consumers rely more on sustainable, clean-label food products, the demand for organic gelatin is increasing, but conventional gelatin remains the go-to for mass food production due to its low cost and established supply chain.

The market for the End-Use Application segment is led by Food & Beverage, due to its extensive utilization in confectionery, dairy foods & meat processing. It plays an important part in the making of gummy candies, marshmallows, yogurts, and jellies, so a cornerstone of the food business. As such, it is also a functional protein ingredient in meat and poultry processing to promote texture and water retention. Additionally, the increasing consumer demand for protein-enriched and protein-rich food further supports the requirement for gelatin in the food & beverage industry.

North America represents one of the most lucrative markets of gelatin, which can be attributed to its applications in the food & beverage, pharmaceutical and nutraceutical sectors. The geographical distribution of gelatin manufacturing plants and units is usually spread across different regions, with high numbers concentrated in both the United States of America and Canada, on account of favorable processing technology and availability of high-quality raw materials.

Growing demand for clean-label ingredients, functional foods, and protein supplements has significantly boosted the consumption of gelatin. Gelatin is widely used in soft gel capsules, wound dressings and in drug delivery systems on a large scale in the pharmaceutical industry in the region.

Concerns among consumers concerning health benefits associated with collagen and gelatin-based products are increasing, and producers are emphasizing innovations such as hydrolyzed gelatin for better bioavailability. However, the growing concerns surrounding the usage of animal-based products have led to the rising demand for plant-based products which is posing a threat to the traditional gelatin manufacturers.

Europe holds a significant portion of the global gelatin market, particularly from Germany, France, and the Netherlands. With leading players focusing on sustainable and quality production processes, the continent boasts a long history of using gelatin in confectionery, dairy, and desserts.

The consumption of gelatin for medical use, beauty products, and encapsulation industries in Europe serves the cosmetics and pharmaceutical industries and the demand for gelatin. However, the market is subject to scrutiny in the form of EU regulations related to animal-derived products and sustainability issues.

European manufacturers are paying closer attention to traceability, ethical sourcing, and sustainable production of gelatin. Gelatin derived from fish - to meet the growing demand for alternatives to bovine and porcine gelatin, especially among consumers with dietary restrictions - is also showing growth in the market.

The fastest growing gelatin market by region is the Asia-Pacific which is growing due to increasing utilization in food, pharmaceutical, and personal care industries. Japan, China, India, and South Korea are giant consumers and producers of gelatin, with massive livestock industries that provide enormous raw materials. China is the leading region, owing to the increasing requirement for gelatin in health and nutrition supplements, dairy, and traditional medicine.

The growth of India's pharmaceutical industry is also a factor driving the market growth as they are extensively used in capsule manufacturing. This demand across the globe is currently catalyzed by the booming beauty and personal care industry associated with countries like South Korea, which are now utilizing gelatin in collagen-based skincare, anti-aging products, and so on, further driving the increase in gelatin market size as well.

However, religious and cultural food habits of the region, and specifically, porcine and bovine gelatin issues have encouraged the manufacturers to explore fish and plant-based gelatin alternatives to cater to a wider base of consumers.

Challenge: Ethical and Religious Concerns Over Animal-Based Gelatin

It is one of the major problems in the animal based ingredients market is the ethical and religious complications with the animal based ingredients. Traditional gelatins are mostly made from cow and pig by-products, which means that it’s not used by certain religious individuals, vegetarians, and vegans.

Animal cruelty and disease outbreaks, such as BSE (mad cow disease), have resulted in increased regulatory pressure and evolving consumer attitude. This has driven the need for alternative sources, causing traditional gelatin manufacturers to broaden their product portfolios and apply tight quality controls.

Opportunity: Growth of Alternative and Specialty Gelatin Products

The need to find a replacement for gelatin derived from plants and fish can create a high growth opportunity. Advances in collagen peptides and hydrolyzed gelatin as well as vegan gelatin substitutes have expanded the food, pharmaceutical, and cosmetics application range. Advancements in bioengineering and fermentation technologies are also developing the potential for cruelty free and sustainable synthetic and cultured gelatin alternatives.

Also, the growing health-conscious consumer pool, coupled with the need for functional and clean-label ingredients, is further helping the non-gelatin segments of the premium and specialty gelatin products. The collaboration between research organizations and industry players will accelerate the development of next generation gelatin products that will meet evolving market trends.

Between 2020 and 2024, the gelatin market witnessed steady growth, driven by rising demand in food & beverages, pharmaceuticals, cosmetics, and nutraceuticals. The increasing preference for clean-label ingredients, functional foods, and protein-rich diets spurred gelatin consumption.

The expansion of the pharmaceutical sector, particularly in soft gel capsules, wound healing, and tissue engineering applications, further bolstered demand. Additionally, the surge in collagen-based products, including dietary supplements and beauty-enhancing formulations, played a crucial role in market expansion.

Between 2025 and 2035, the gelatin market will undergo a transformative shift driven by sustainable production techniques, plant-based alternatives, and technological advancements in food science and pharmaceuticals. The adoption of bioengineered gelatin, produced via precision fermentation and recombinant DNA technology, will redefine sustainability and ethical considerations. The growing consumer preference for cruelty-free, non-GMO, and eco-friendly gelatin sources will further accelerate this transition.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter quality and safety regulations, ethical sourcing mandates, and allergen labeling requirements. |

| Technological Advancements | Hydrolyzed gelatin for solubility, encapsulation technologies, and plant-based alternatives research. |

| Industry Applications | Food & beverage, pharmaceuticals, cosmetics, and nutraceuticals. |

| Adoption of Smart Equipment | Automated gelatin extraction processes, high-throughput purification, and enhanced gelatin encapsulation. |

| Sustainability & Cost Efficiency | Ethical sourcing initiatives, halal/kosher-certified gelatin, and price volatility challenges. |

| Data Analytics & Predictive Modeling | AI-assisted gelatin formulation research, supply chain analytics, and demand forecasting. |

| Production & Supply Chain Dynamics | COVID-19-induced raw material shortages, dependency on animal-derived gelatin, and price fluctuations. |

| Market Growth Drivers | Increasing demand for functional foods, rising collagen-based product consumption, and pharmaceutical expansion. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-driven regulatory compliance, blockchain-based gelatin traceability, and sustainability-focused sourcing regulations. |

| Technological Advancements | Precision fermentation-based gelatin, AI-assisted ingredient formulation, and smart hydrogel technologies. |

| Industry Applications | Expansion into regenerative medicine, 3D bio printing, and nanotechnology-infused skincare. |

| Adoption of Smart Equipment | AI-optimized gelatin synthesis, smart hydrogel-enabled drug delivery, and bioengineered gelatin for personalized nutrition. |

| Sustainability & Cost Efficiency | Lab-grown and fermentation-based gelatin, zero-waste production strategies, and biodegradable gelatin-based packaging. |

| Data Analytics & Predictive Modeling | Quantum-enhanced gelatin structural modeling, blockchain-enabled gelatin sourcing records, and decentralized AI-driven gelatin R&D. |

| Production & Supply Chain Dynamics | Decentralized gelatin production using precision fermentation, AI-optimized supply chain management, and blockchain-enabled quality assurance. |

| Market Growth Drivers | AI-powered personalized nutrition, sustainable bioengineered gelatin solutions, and expansion into high-tech biomedical applications. |

The USA gelatin industry is growing steadily on the back of increasing demand for functional foods, growing applications in pharmaceuticals, and the rising demand for protein-rich ingredients. The growing nutraceutical industry, together with consumer demand for collagen-based nutritional supplements, is driving market demand. The pharmaceutical industry's dependence on gelatin for making capsules and the development of food processing technologies are also driving market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.0% |

The UK gelatin market is also experiencing strong growth, led mainly by growing demand for clean-label food products, higher consumption of confectionery and dairy foods, and increased application of gelatin in medical applications. Product innovation is being driven by the trend toward plant-based and alternative gelatin sources. Stringent food safety legislation and the use of high-quality gelatin in the pharmaceutical industry are also influencing market trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.9% |

The EU gelatin market is growing with the strong establishment of gelatin producers, substantial demand for protein-dense food supplements, and rising applications across pharmaceutical and cosmetics sectors. Germany, France, and Italy are at the forefront of collagen-based product innovation. Besides this, strict EU food standards and the development of bio-based gelatin substitutes are shaping market scenarios. The growth in gelatin-based cosmetics and personal care products is also fueling expansion.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.5% |

The Japanese market for gelatin is supported by, among other things, advances in food processing technology, the increased application of gelatin in traditional foods and functional foods, and increasing applications in the pharmaceutical and life sciences sectors. The rising geriatric population in the country will lead to an increase in sales for gelatin-based health food supplements and collagen-fortified products. Increased demand for fish gelatin as an alternative source of gelatin also propels growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

The South Korean gelatin industry is expanding growing with an increasing application of gelatin in food and beverage products, beauty and well-being supplements, and increasing prescribed medicines. The lively cosmetics industry in the country is driving demand for collagen products, and market expansion is also being propelled by the rapid consumption of functional and fortified foods. Moreover, government measures backing food safety regulations are also affecting gelatin manufacturing and importation.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.3% |

Food & beverage is the fastest-outpacing gelatin application as food makers continue to incorporate gelatin into an increasingly wider range of consumables, including dairy products, meat products, and protein-fortified beverages. Unlike synthetic stabilizers and thickeners, gelatin provides natural binding properties that enhance food quality and meet consumer demand for clean-label ingredients.

Rising consumer inclination toward protein-rich functional foods is driving the market demand for gelatine-based dairy and meat products. Steady rise of protein-fortified beverages, coupled with gelatin-based stabilization for textural and shelf-life enhancement, forced the market on the frontlines, as the best product performance was report for nutrition beverages and dairy-based ingredients.

The increasing adoption of gelatin in health-oriented food products such as collagen-fortified protein powders, meal replacement beverages, and functional dairy foods is also further driving the increased adoption considering improved product texture and nutritional value. The production of food-grade gelatin with optimal processing characteristics, such as enhanced solubility, better thermal stability, and balanced gelling strength, was another key factor governing the growth of the market as it offered its possible application in wide range of food formulations.

Sustainable sourcing practices, such as ethical uses of animal by-products, green processing techniques, and transparent supply chains, have also driven market growth to meet consumer demand for responsibly produced food ingredients. Its strengths include improved texture, stability and clean-label appeal, but the food & beverage category faces tighter pricing on raw materials, regulatory scrutiny of animal-derived ingredients, and rivalry from plant-based gelatin agents.

However, innovations such as hydrolyzed gelatin for instant solubility, bioengineered gelatin substitutes to replace conventional gelatin are emerging, supply chains are supported with block chain verification for efficient movement across consumers, manufacturers and retailer, which strengthens application penetration in the food industry which undoubtedly guarantees growth in future of gelatin based food applications across the globe.

The confectionery segment is the fastest-growing segment, gaining notable market momentum as it is used in many soft-textured confectionery sweets such as gummies, marshmallows, and fruit chews across rich chocolate against premium candy makers and large-scale food processors. Unlike synthetic thickeners, gelatin provides an improvement in mouthfeel, elasticity and stability that is indispensable in the manufacture of premium confectionery.

Increasing consumer demand for chewy and gelatin-based sweets like sugar-free and fortified products has led to adoption in the confectionery market as brands seek to offer better texture and extended shelf life. According to research, more than two-thirds of confectionery users consume gummies, with gelatin-based products being the preference owing to their unique texture, hence this category will always remain in demand.

The development of high-end confectionery product lines, which incorporate quality gelatin preparations to deliver improved mouthfeel, flavor release, and color stability tonality, sauntering the attributes for market demand, thus ensuring the product differentiation within competitive candy markets.

In addition to this, the incorporation of gelatin in functional confectioneries such as gummies fortified with vitamins, chews containing herbs, and sweets enhanced by protein has also spurred adoption owing to nutritional benefits and to play to health-conscience consumer trends.

The development of organic and halal certified gelatin that can be used in confectionery, in response to consumers demanding ethically sourced and dietary compliant sweets has maximized market growth ensuring widespread acceptance across varying demographics.

The use of new processing methods, including enzymatic hydrolysis for controlled gelling behavior and hybrid formulations combining gelatin with natural fruit pectin’s, has supported market growth, guaranteeing enhanced product quality and improved manufacturing efficiency.

Despite its benefits in elasticity, stability, and confectionery texture upgrade, the gelatin-based confectionery category is marred by some challenges, including issues with animal-derived material concerns, increasing demand for plant-based solutions, and regulatory intricacies of dietary certifications.

Nonetheless, new innovations in microbial fermentation-derived gelatin, precision fermentation to allow sustainable manufacture, and artificial intelligence -enabled confectionery formulation optimization are enhancing scalability, consumer compliance, and product performance, guaranteeing sustained growth for gelatin-based sweets globally.

The dairy products segment has become a significant driver of gelatin market growth, with uses ranging from yogurt stabilization to dessert cream-based formulations. In contrast to artificial stabilizers, gelatin gives a natural thickening response that enhances the sensory qualities of foods based on dairy. Growing demand for gelatin-fortified dairy products, such as low-fat yogurt, whipped toppings, and desserts made from milk, has spurred segment growth as consumers seek out texture-improved and shelf-stable dairy products.

Though it holds a competitive edge in dairy formulation, the sector is challenged by competition from substitute carrageenan and agar alternatives, stringent regulation of dairy processing, and instability in gelatin supply. That said, new technology in gelatin blends for dairy compatibility, enzymatic alteration for enhanced solubility, and environmentally friendly gelatin harvesting methods are enhancing functionality, consumer acceptability, and market viability.

The meat & poultry products business segment has developed significant momentum as gelatin remains the key to stabilization, emulsification, and texture improvement of processed meat. In contrast to synthetic emulsifiers, gelatin provides protein-binding functionality with natural origin, enhancing moisture holding and meat quality.

Increasing popularity for high-end processed meats with gelatin-formulated offerings for enhanced juiciness and shelf-life extension has fueled business growth, guaranteeing enhanced product uniformity and consumer satisfaction.

Though it has its strengths in meat processing, the segment is threatened by price volatility in animal-derived gelatin, meat labeling regulatory barriers, and increasing plant-based meat alternatives. Nevertheless, technological advancements in cold-water soluble gelatin, hybrid protein-gelatin emulsification technologies, and environmentally friendly collagen extraction processes are enhancing adoption, market efficiency, and industry compliance, and thus the growth in meat & poultry gelatin applications across the globe.

Growth of Gelatin market is benefiting from increasing demand due to food & beverages, pharma, and nutraceuticals industries. Gelatin, a gelling agent, stabilizer and thickening agent comes from collagen found in animal bones and connective tissue. The demand for protein-based and clean-label ingredients and advancements in extraction and processing technologies are propelling the market.

In addition, the growing usage of dietary supplements and functional foods will also accelerate the gelatin consumption. The leading players are also focusing on sustainable sourcing, increasing production capacity, and product innovation to improve their market footprint.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Gelita AG | 18-22% |

| Darling Ingredients Inc | 15-19% |

| Nitta Inc. | 12-16% |

| Sterling Biotech Limited | 8-12% |

| India Gelatine & Chemicals | 6-10% |

| Tessenderlo Group | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Gelita AG | Specializes in high-quality gelatin for food, pharmaceutical, and technical applications. |

| Darling Ingredients Inc | Produces gelatin and collagen peptides with a focus on sustainable sourcing. |

| Nitta Inc. | Offers premium gelatin products for various industries, emphasizing innovation and quality. |

| Sterling Biotech Limited | Supplies pharmaceutical-grade gelatin for capsule production and food-grade gelatin. |

| India Gelatine & Chemicals | Manufactures gelatin for food, pharmaceutical, and industrial applications. |

| Tessenderlo Group | Focuses on sustainable and high-quality gelatin production, catering to multiple industries. |

Key Company Insights

Gelita AG (18-22%)

As a global leader in gelatin production, Gelita AG provides high-quality gelatin solutions for the food, pharmaceutical, and cosmetic industries. The company focuses on innovation, sustainability, and expanding its product portfolio to cater to evolving consumer preferences.

Darling Ingredients Inc (15-19%)

A major player in the gelatin and collagen market, Darling Ingredients emphasizes sustainability and upcycling animal by-products into high-value gelatin and collagen solutions. The company invests in expanding production capacity and advancing its processing technologies.

Nitta Inc. (12-16%)

Specializing in high-quality gelatin production, Nitta Inc. serves diverse industries, including food, pharmaceuticals, and photography. The company is known for its commitment to innovation, with ongoing research into improved processing techniques and novel applications.

Sterling Biotech Limited (8-12%)

A key supplier of gelatin, Sterling Biotech focuses on pharmaceutical-grade and food-grade gelatin for capsules, confectionery, and dairy applications. The company is expanding its footprint in emerging markets.

India Gelatine & Chemicals (6-10%)

This company produces gelatin primarily for the food and pharmaceutical industries. With a strong presence in India, it is focusing on increasing exports and enhancing product quality to cater to global demand.

Tessenderlo Group (5-9%)

A leader in sustainable gelatin production, Tessenderlo Group provides gelatin solutions for food, pharmaceuticals, and industrial applications. The company is actively engaged in sustainable sourcing and innovative production methods.

Other Key Players (30-40% Combined)

The gelatin market also includes various regional and emerging companies, such as:

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by End-Use Application, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Source, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Functionality, 2018 to 2033

Table 12: Global Market Volume (MT) Forecast by Functionality, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by End-Use Application, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 22: North America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by Functionality, 2018 to 2033

Table 24: North America Market Volume (MT) Forecast by Functionality, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 32: Latin America Market Volume (MT) Forecast by End-Use Application, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 34: Latin America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Functionality, 2018 to 2033

Table 36: Latin America Market Volume (MT) Forecast by Functionality, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Western Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: Western Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 41: Western Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 42: Western Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 43: Western Europe Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 44: Western Europe Market Volume (MT) Forecast by End-Use Application, 2018 to 2033

Table 45: Western Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 46: Western Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 47: Western Europe Market Value (US$ Million) Forecast by Functionality, 2018 to 2033

Table 48: Western Europe Market Volume (MT) Forecast by Functionality, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Eastern Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 52: Eastern Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 53: Eastern Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 54: Eastern Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 55: Eastern Europe Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 56: Eastern Europe Market Volume (MT) Forecast by End-Use Application, 2018 to 2033

Table 57: Eastern Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 58: Eastern Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 59: Eastern Europe Market Value (US$ Million) Forecast by Functionality, 2018 to 2033

Table 60: Eastern Europe Market Volume (MT) Forecast by Functionality, 2018 to 2033

Table 61: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: South Asia and Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 64: South Asia and Pacific Market Volume (MT) Forecast by Type, 2018 to 2033

Table 65: South Asia and Pacific Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 66: South Asia and Pacific Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 67: South Asia and Pacific Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 68: South Asia and Pacific Market Volume (MT) Forecast by End-Use Application, 2018 to 2033

Table 69: South Asia and Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 70: South Asia and Pacific Market Volume (MT) Forecast by Source, 2018 to 2033

Table 71: South Asia and Pacific Market Value (US$ Million) Forecast by Functionality, 2018 to 2033

Table 72: South Asia and Pacific Market Volume (MT) Forecast by Functionality, 2018 to 2033

Table 73: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 74: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 75: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 76: East Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 77: East Asia Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 78: East Asia Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 79: East Asia Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 80: East Asia Market Volume (MT) Forecast by End-Use Application, 2018 to 2033

Table 81: East Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 82: East Asia Market Volume (MT) Forecast by Source, 2018 to 2033

Table 83: East Asia Market Value (US$ Million) Forecast by Functionality, 2018 to 2033

Table 84: East Asia Market Volume (MT) Forecast by Functionality, 2018 to 2033

Table 85: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 86: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 87: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 88: Middle East and Africa Market Volume (MT) Forecast by Type, 2018 to 2033

Table 89: Middle East and Africa Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 90: Middle East and Africa Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 91: Middle East and Africa Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 92: Middle East and Africa Market Volume (MT) Forecast by End-Use Application, 2018 to 2033

Table 93: Middle East and Africa Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 94: Middle East and Africa Market Volume (MT) Forecast by Source, 2018 to 2033

Table 95: Middle East and Africa Market Value (US$ Million) Forecast by Functionality, 2018 to 2033

Table 96: Middle East and Africa Market Volume (MT) Forecast by Functionality, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Functionality, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 12: Global Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 16: Global Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 20: Global Market Volume (MT) Analysis by End-Use Application, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 24: Global Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by Functionality, 2018 to 2033

Figure 28: Global Market Volume (MT) Analysis by Functionality, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 31: Global Market Attractiveness by Type, 2023 to 2033

Figure 32: Global Market Attractiveness by Nature, 2023 to 2033

Figure 33: Global Market Attractiveness by End-Use Application, 2023 to 2033

Figure 34: Global Market Attractiveness by Source, 2023 to 2033

Figure 35: Global Market Attractiveness by Functionality, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Functionality, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 48: North America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 52: North America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 56: North America Market Volume (MT) Analysis by End-Use Application, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 60: North America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by Functionality, 2018 to 2033

Figure 64: North America Market Volume (MT) Analysis by Functionality, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 67: North America Market Attractiveness by Type, 2023 to 2033

Figure 68: North America Market Attractiveness by Nature, 2023 to 2033

Figure 69: North America Market Attractiveness by End-Use Application, 2023 to 2033

Figure 70: North America Market Attractiveness by Source, 2023 to 2033

Figure 71: North America Market Attractiveness by Functionality, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Functionality, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 84: Latin America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 88: Latin America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 92: Latin America Market Volume (MT) Analysis by End-Use Application, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 96: Latin America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by Functionality, 2018 to 2033

Figure 100: Latin America Market Volume (MT) Analysis by Functionality, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 105: Latin America Market Attractiveness by End-Use Application, 2023 to 2033

Figure 106: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 107: Latin America Market Attractiveness by Functionality, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 110: Western Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 111: Western Europe Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 113: Western Europe Market Value (US$ Million) by Functionality, 2023 to 2033

Figure 114: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Western Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 120: Western Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 121: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 122: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 123: Western Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 124: Western Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 125: Western Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 126: Western Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 127: Western Europe Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 128: Western Europe Market Volume (MT) Analysis by End-Use Application, 2018 to 2033

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 131: Western Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 132: Western Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 133: Western Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 134: Western Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 135: Western Europe Market Value (US$ Million) Analysis by Functionality, 2018 to 2033

Figure 136: Western Europe Market Volume (MT) Analysis by Functionality, 2018 to 2033

Figure 137: Western Europe Market Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 138: Western Europe Market Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 139: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 140: Western Europe Market Attractiveness by Nature, 2023 to 2033

Figure 141: Western Europe Market Attractiveness by End-Use Application, 2023 to 2033

Figure 142: Western Europe Market Attractiveness by Source, 2023 to 2033

Figure 143: Western Europe Market Attractiveness by Functionality, 2023 to 2033

Figure 144: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 146: Eastern Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 147: Eastern Europe Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 148: Eastern Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 149: Eastern Europe Market Value (US$ Million) by Functionality, 2023 to 2033

Figure 150: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: Eastern Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 153: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 156: Eastern Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 157: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 158: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 159: Eastern Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 160: Eastern Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 164: Eastern Europe Market Volume (MT) Analysis by End-Use Application, 2018 to 2033

Figure 165: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 166: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 167: Eastern Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 168: Eastern Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 169: Eastern Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 170: Eastern Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 171: Eastern Europe Market Value (US$ Million) Analysis by Functionality, 2018 to 2033

Figure 172: Eastern Europe Market Volume (MT) Analysis by Functionality, 2018 to 2033

Figure 173: Eastern Europe Market Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 174: Eastern Europe Market Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 175: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 176: Eastern Europe Market Attractiveness by Nature, 2023 to 2033

Figure 177: Eastern Europe Market Attractiveness by End-Use Application, 2023 to 2033

Figure 178: Eastern Europe Market Attractiveness by Source, 2023 to 2033

Figure 179: Eastern Europe Market Attractiveness by Functionality, 2023 to 2033

Figure 180: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 181: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 182: South Asia and Pacific Market Value (US$ Million) by Nature, 2023 to 2033

Figure 183: South Asia and Pacific Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 184: South Asia and Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 185: South Asia and Pacific Market Value (US$ Million) by Functionality, 2023 to 2033

Figure 186: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: South Asia and Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 189: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 192: South Asia and Pacific Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 196: South Asia and Pacific Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 197: South Asia and Pacific Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 198: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 199: South Asia and Pacific Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 200: South Asia and Pacific Market Volume (MT) Analysis by End-Use Application, 2018 to 2033

Figure 201: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 202: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 203: South Asia and Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 204: South Asia and Pacific Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 205: South Asia and Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 206: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 207: South Asia and Pacific Market Value (US$ Million) Analysis by Functionality, 2018 to 2033

Figure 208: South Asia and Pacific Market Volume (MT) Analysis by Functionality, 2018 to 2033

Figure 209: South Asia and Pacific Market Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 210: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 211: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 212: South Asia and Pacific Market Attractiveness by Nature, 2023 to 2033

Figure 213: South Asia and Pacific Market Attractiveness by End-Use Application, 2023 to 2033

Figure 214: South Asia and Pacific Market Attractiveness by Source, 2023 to 2033

Figure 215: South Asia and Pacific Market Attractiveness by Functionality, 2023 to 2033

Figure 216: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 217: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 218: East Asia Market Value (US$ Million) by Nature, 2023 to 2033

Figure 219: East Asia Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 220: East Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 221: East Asia Market Value (US$ Million) by Functionality, 2023 to 2033

Figure 222: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 223: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 224: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 227: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 228: East Asia Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 229: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 230: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 231: East Asia Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 232: East Asia Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 233: East Asia Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 234: East Asia Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 235: East Asia Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 236: East Asia Market Volume (MT) Analysis by End-Use Application, 2018 to 2033

Figure 237: East Asia Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 239: East Asia Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 240: East Asia Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 241: East Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 242: East Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 243: East Asia Market Value (US$ Million) Analysis by Functionality, 2018 to 2033

Figure 244: East Asia Market Volume (MT) Analysis by Functionality, 2018 to 2033

Figure 245: East Asia Market Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 246: East Asia Market Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 247: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 248: East Asia Market Attractiveness by Nature, 2023 to 2033

Figure 249: East Asia Market Attractiveness by End-Use Application, 2023 to 2033

Figure 250: East Asia Market Attractiveness by Source, 2023 to 2033

Figure 251: East Asia Market Attractiveness by Functionality, 2023 to 2033

Figure 252: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 253: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 254: Middle East and Africa Market Value (US$ Million) by Nature, 2023 to 2033

Figure 255: Middle East and Africa Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 256: Middle East and Africa Market Value (US$ Million) by Source, 2023 to 2033

Figure 257: Middle East and Africa Market Value (US$ Million) by Functionality, 2023 to 2033

Figure 258: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 260: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 261: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 262: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 263: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 264: Middle East and Africa Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 265: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 266: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 267: Middle East and Africa Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 268: Middle East and Africa Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 272: Middle East and Africa Market Volume (MT) Analysis by End-Use Application, 2018 to 2033

Figure 273: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 274: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 275: Middle East and Africa Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 276: Middle East and Africa Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 277: Middle East and Africa Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 278: Middle East and Africa Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 279: Middle East and Africa Market Value (US$ Million) Analysis by Functionality, 2018 to 2033

Figure 280: Middle East and Africa Market Volume (MT) Analysis by Functionality, 2018 to 2033

Figure 281: Middle East and Africa Market Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 282: Middle East and Africa Market Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 283: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 284: Middle East and Africa Market Attractiveness by Nature, 2023 to 2033

Figure 285: Middle East and Africa Market Attractiveness by End-Use Application, 2023 to 2033

Figure 286: Middle East and Africa Market Attractiveness by Source, 2023 to 2033

Figure 287: Middle East and Africa Market Attractiveness by Functionality, 2023 to 2033

Figure 288: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

The overall market size for gelatin market was USD 3,496.3 Million in 2025.

The gelatin market is expected to reach USD 6,380.5 Million in 2035.

The increasing demand for protein-enriched foods and nutraceuticals fuels Gelatin Market during the forecast period.

The top 5 countries which drives the development of Gelatin Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of application, food & beverage to command significant share over the forecast period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.