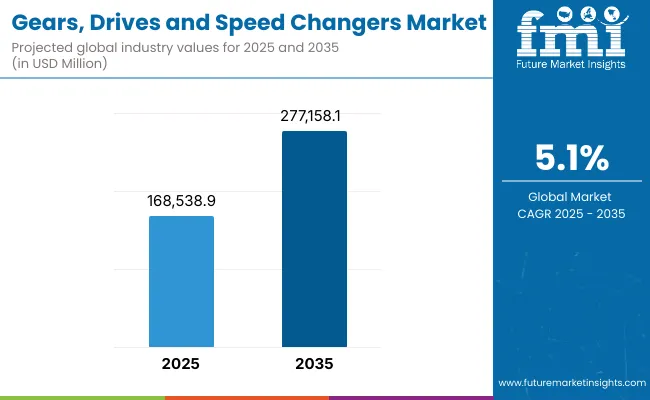

The gears, drives, and speed changers market is expected to grow steadily from 2025 to 2035, driven by rising demand from the automotive, industrial automation, aerospace, and energy sectors. The market is expected to reach USD 1,68,538.9 million in 2025 and USD 2,77,158.1 million by 2035, growing at a compound annual growth rate (CAGR) of 5.1% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,68,538.9 million |

| Industry Value (2035F) | USD 2,77,158.1 million |

| CAGR (2025 to 2035) | 5.1% |

Gears, drives, and speed changers are essential components used in mechanical power transmission to optimize efficiency and accuracy in numerous machinery and industrial processes. The growing adoption of automation, expansion of the electric vehicle (EV) market, and rising emphasis on energy-efficient mechanical systems are the factors propelling the market growth. Moreover, smart gear technology, AI-integrated drives, and lightweight material innovations are driving interest in this market.

Yet, market growth can be impeded by fluctuation in prices of raw materials, high maintenance costs, and supply chain disruptions. To mitigate these challenges, manufacturers are investing in high-precision manufacturing, material optimization, and predictive maintenance solutions. The market by product type, application, and end-user industry are further segmented.

North America is considered one of the key markets for gears, drives and speed changers, wherein the USA and Canada are expected to represent significant share due to the high adoption of automotive and aerospace industries, high-end manufacturing facilities, and increasing investments in industrial automation.

Demand is being fuelled by the transition to electric vehicles and energy-efficient transmission systems. Furthermore, the market is driven by advancements in AI-enabled predictive maintenance for industrial drives. Despite challenges, such as high production costs and supply chain disruptions, ongoing investment in smart equipment technology and sustainable manufacturing practices is predicted to keep sustaining market expansion.

Germany, the UK, and France are major contributors to the European market for gears, drives, and speed changers. The region’s robust automotive and industrial machinery sectors are driving demand for high-tech gear solutions, alongside a growing focus on sustainability and energy efficiency. This is further propelling the growth of the transmission market as lightweight composite materials are on the rise in transmissions.

Furthermore, EU directives on industrial efficiency are propelling high-performance gear solutions. Although, there are some challenges regarding regulatory compliance and extensive R&D costs, future visionary innovations in precision engineering and digital twin technology for gear systems are expected to propel the industry growth in longer continue.

Growth of gears, drives, and speed changers market in Asia-Pacific is supported by factors such as rapid industrialization, rise in automotive production, and increasing manufacturing activities in China, Japan, India, and South Korea. Increasing demand for electric vehicles and automation in industrial plants is expected to boost the market growth.

Also, government stimuli for smart factories and renewable energy adoption are fuelling growth. Challenges including raw material costs, market fragmentation, and varying regulatory frameworks can impede bucket wide adoption. Nonetheless, the growth in regions will be driven by the increasing investments in localizes production and the advancements in technology in terms of precision gear systems.

Challenge

High Production Costs and Supply Chain Constraints

Production of precision-engineered components often incurs high costs, a significant drawback for the gears, drives and speed changers market. In addition, the global raw material costs and tariffs are constantly changing which adds a lot of volatility to the market. Solving these challenges may necessitate investments in efficient manufacturing processes, localized manufacturing, and the creation of alternative lightweight materials.

Opportunity

Expansion of Smart and Energy-Efficient Gear Solutions

Smart and Energy-efficient gear solutions present massive growth opportunities in the market. AI-based gear monitoring, digital twin technologies, self-lubricating gear systems these innovations that drive active efficiency and predictive maintenance align with where the industry is going. Also, the growing trend towards electrification within the automotive industry, as well as industrial automation, is driving the sales of precision gear drives with low energy loss.

With industries increasingly transitioning toward eco-friendly and high-performance mechanical components, the market for precision drives and speed changers is expected to experience substantial growth over the next ten years.

The Gears, Drives, and speed changers market was to grow at a substantial rate from 2020 to 2024 due to growth in automation in manufacturing, growing industrial robotics, and the increasing demand for high-efficiency power transmission systems. In automotive, aerospace, industrial machinery, and renewable energy applications, this trend toward precision-engineered, lightweight, and high-torque gear systems accelerated.

Innovations in 3D-printed gear components, variable-speed drives and AI-fueled predictive maintenance enhanced performance and longevity. However, the higher initial investment for advanced gear and drive systems, fluctuating raw material costs, and complex supply chains created barriers to widespread adoption.

In the coming decade between 2025 and 2035, industrial coatings will evolve into a market built on Artificial Intelligence-powered Real-time diagnostics, self-healing Nano-coatings, and smart adaptive speed changers. The copper-nickel-graphene composite will be released with multiple layers of galvanization for preventive maintenance, and 4D-printed self-adjusting gear mechanisms ,and AI-driven gear optimization software.

Electromagnetic drive breakthrough, quantum computing assisted load distribution and the block chain driven supply chain tracking will all continue to reshape the market. The emergence of zero-friction gear technology, AI-assisted torque optimization, and sustainable, recyclable drive materials will also fuel innovation to deliver more power, longer life, and greener designs.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with ISO 9001, ASME, and DIN standards for gear efficiency and safety. |

| Material Innovation | Use of hardened steel, cast iron, and composite gear materials. |

| Industry Adoption | Growth in automotive, aerospace, robotics, wind energy, and industrial automation sectors. |

| Smart & AI-Enabled Systems | Early adoption of sensor-based predictive maintenance, automated torque control, and real-time load monitoring. |

| Market Competition | Dominated by gear and drive manufacturers, automotive powertrain suppliers, and industrial automation firms. |

| Market Growth Drivers | Demand fueled by industrial automation, rise in renewable energy transmission systems, and increasing need for efficient power transmission. |

| Sustainability and Environmental Impact | Early adoption of energy-efficient gearboxes, improved lubrication techniques, and recyclable drive materials. |

| Integration of AI & Digitalization | Limited AI use in manual diagnostics and maintenance scheduling. |

| Advancements in Manufacturing | Use of traditional CNC machining, forged gear components, and metal-cutting processes. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-driven compliance tracking, sustainability-focused material sourcing, and blockchain-backed quality assurance. |

| Material Innovation | Adoption of graphene-coated, self-lubricating materials, and 4D-printed adaptive gear components. |

| Industry Adoption | Expansion into AI-powered robotic motion systems, smart torque-adjusting speed changers, and self-repairing drive mechanisms. |

| Smart & AI-Enabled Systems | Large-scale deployment of AI-assisted gear optimization, machine learning-driven wear prediction, and autonomous self-healing gear coatings. |

| Market Competition | Increased competition from AI-driven precision motion startups, sustainable gear technology developers, and nanotechnology-based drive material providers. |

| Market Growth Drivers | Growth driven by AI-driven energy-efficient drive solutions, quantum computing-assisted load balancing, and decentralized smart drive systems. |

| Sustainability and Environmental Impact | Large-scale transition to zero-friction gear technologies, AI-assisted energy-saving transmission systems, and fully biodegradable gear components. |

| Integration of AI & Digitalization | AI-powered real-time failure prediction, automated torque optimization, and blockchain-backed predictive maintenance scheduling. |

| Advancements in Manufacturing | Evolution of 3D-printed ultra-lightweight gears, AI-enhanced gear design, and nanotechnology-based self-lubricating drive systems. |

The USA is still a large market for gears, drives, and speed changers due to an increasing demand for industrial automation, a growing adoption of high-efficiency power transmission systems, and the growth of manufacturing and automotive industries. The attention on energy efficiency and precision engineering solutions in industrial machinery is boosting the requirement for energy efficient gear and drive solutions.

Moreover, material science is progressing as well, with lightweight alloys and composite gears flushing out in the market to improve durability as well as provide performance. The attachment of wind energy undertakings and electric vehicle (EV) generation are also in charge of forming the possibility of the market, involved high-torque and low-clamour gear systems burgeoning.

| Country | CAGR (2025 to 2035) |

|---|---|

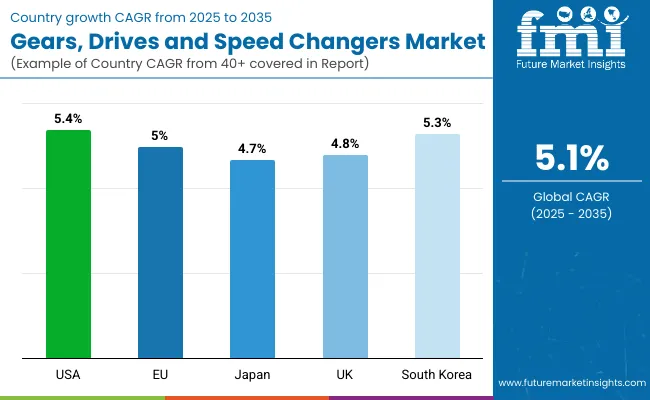

| United States | 5.4% |

Rising investments in aerospace and defense applications, greater adoption of automation in manufacturing, and growing demand for precision gear technology are driving the growth of the UK gears, drives, and speed changers market. The growing renewable energy sector, in particular wind energy, creates demand for high-performance gearboxes and drives. Besides, the market dynamics are shaped with the emergence of Industry 4.0 and increasing implementation of smart drive systems in industrial equipment.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.8% |

As the key industrial automation trends continue to shape the global Gears, Drives and Speed Changers market within the EU, Germany, France and Italy emerge as the three largest markets in the region. The European Union (EU)’s resolution for sustainability and energy-efficient manufacturing is driving the demand for lightweight and low-friction gear solutions. At the same time, the emergence of high-power drive systems at the heart of electric mobility and automated production lines is driving innovations in gear design and materials. Market growth is further supported by the increased implementation of AI-based predictive maintenance and smart factory initiatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.0% |

Rising demand for high-precision and miniaturization of transmission components, high investments in robotics and factory automation, and increasing implementation of AI-integrated drive systems are aiding the growth of the Japan gears, drives, and speed changers market. The country's leadership in micro driver technology innovation for robotics and medical devices. Furthermore, cutting-edge gear coatings and innovative noise-reduction technologies are also improving product performance. The automotive industry continues to be influenced by trends such as the growing prominence of hybrid and electric vehicle (EV) drivetrains.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

South Korea is a fast growing market for gears, drives and speed changers, aided by industrialization, supportive government initiatives for smart manufacturing and an upsurge in demand for advanced motion control systems. Growth in sectors such as semiconductor manufacturing and automation is increasing demand for high-precision gears and drives. Furthermore, the growing property of high-efficiency speed changers in electric mobility and smart grid applications redefines market developments. The integration of AI-assisted diagnostics for real-time performance monitoring, along with the usage of sustainable materials in the manufacture process for gears, is also set to accentuate industry growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.3% |

The Gears & Drives & Speed Changers Market has witnessed leading Manufacturers, automotive players, and industrial equipment providers emphasizing high-performance spur gears and helical gears for precision motion control, power transmission, and speed regulation applications. It is these gear types that are used to achieve efficiency, minimize mechanical wear, and enhance service life in a variety of applications.

Due to increasing demand for robust and high-efficiency gear mechanisms, spur and helical gears are increasingly being adopted across various end-user industries.

The simplicity of the design, high efficiency, and cost-effective manufacturing has made spur gears widely accepted in the industry. Spur gears transmit motion directly, rendering them superior to more complex gear types in applications where precise torque transfer and minimal axial load is essential.

Growing usage of spur gears in industries such as industrial automation, power tools, and automotive not only drives the demand but also fuels the adoption of this type of gear. Now, the rapidly growing advanced materials for spur gears including hardened steel alloys, self-lubricating polymers, and wear-resistant coatings have propelled the market growth from the point of view of durability and operational performance.

Adding to this increased adoption is the implementation of AI-mediated manufacturing methods including precision machining, automated defect detection, and real-time load and efficiency optimization, driven by machine learning, that allow for unified quality and operational effectiveness.

This has furthered the development of machine quality spur gears being sized at the micro scale, positioning the market towards higher precision engineering intended towards robotics, medical devices, and aerospace; providing for diverse applicability to evolving industries.

This approach, along with the use of energy-efficient processes, 3D-printed prototypes and the development of eco-friendly alternatives to traditional lubricant compounds has pushed the market towards growth as industries adopt such solutions in order to reflect changing requirements across the marketplace.

While techniques such as spur gears have advantages such as less complication, cost-effectiveness, and relatively high efficiency, the spur gear segment is also facing some challenges to meet the market demands such as higher noise levels, limited load distribution under high conditions, and wear.

However, new advances in noise-reduction coatings, hybrid material integration, as well as AI-assisted predictive maintenance, are allowing for better reliability, performance and market penetration, thus ensuring steady growth of spur gears around the world.

Leading Gears, Drives, and Speed Changers Market Revenue Share is the for Helical Gears as they have a high load-bearing capacity, smooth engagement and high efficiency in higher-speed application. In contrast to spur gears, helical gears have teeth at an angle in relation to the axis, which results in lower noise level and gradual contact, suitable for demanding industrial and automotive applications.

The increasing demand for helical gears in automotive drivetrains, wind turbines, and industrial conveyor systems has driven adoption. The growing demand for advanced helical gear designs, which include optimized helix angles, low backlash configurations, and customized material compositions, is contributing to an overall strengthened market demand for these models, ensuring improved efficiency and increased service life.

This, coupled with the adoption of AI-powered gear assessments like real-time wear prediction, load distribution optimization, and adaptive gear alignment systems, has increased adoption as well, decreasing maintenance costs while providing greater uptime.

Moreover, the introduction of composite materials, hybrid polymer-metal designs, and the use of high-strength alloy coatings development of lightweight and corrosion-resistant helical gears will provide the necessary impetus to the growth of the market by making it more applicable across numerous industries.

Implementation of advanced lubrication solutions such as synthetic high-performance lubricants with extremely low coefficients of friction, nano-coating technologies, and self-healing lubricant films in helical gears has further sustained market growth by ensuring minimal frictional losses and achieving longer life of gears.

Although the helical gear segment has numerous advantages compared to straight gear, such as high-load transmission, low noise level, and high durability the segment is also challenged by high manufacturing cost, high axial thrust requirement, and complication in assembly procedures.

But recent innovations such as AI-based machine assistance, low-friction gear coatings, and hybrid gear systems are paving the way for viable market sectors by enhancing cost efficiency, as well as overall operational efficiency and scalability for helical gears leading the world over.

The automotive and industrial segments dominate the Gears, Drives, and Speed Changers Market, driven by manufacturers, engineers, and industry leaders looking for advanced gear solutions to improve efficiency, durability, and precision across a spectrum of applications. All these end-use segments are largely engaged in the development of new technologies, enhanced mechanical & performance processes and their need for high-quality gear mechanisms.

Automotive industry has gained considerable market adoption owing to the demand for performance efficient gears used in transmission, differentials and propulsion systems. Automotive gear systems are not the same as industrial applications in terms of having to balance durability and gear system design to achieve fuel-efficient results in a lightweight design for the best vehicle performance.

This growth in adoption has been powered by the increasing demand for fuel-efficient and higher performance cars, especially in the electric and hybrid segment. Increasing advanced gear manufacturing technologies such as computer-controlled gear shaping, high precision grinding, and additive manufacturing are also strengthening market demand by providing high-quality and lightweight solutions for modern vehicles.

The implementation within vehicles of AI-powered vehicle diagnostics has striven for and achieved real-time monitoring of gear wear, automated control of lubrication, and prediction of vehicle maintenance which has bolstered the adoption even further and ensured longer lifetimes of components and reduced vehicle downtimes.

Key hybrid gear systems made from lightweight composite materials, noise-dampening coatings, and thermal-resistant alloys have provided ideal market growth due to increased efficiency and longevity in high-performance automotive applications.

Although exhibiting its benefits in areas of vehicle efficiency, power transmission reliability, and performance optimization, the automotive gear segment faces some challenges such as stringent emission regulations, cost pressures due to light weighting initiatives, and growing complexity in hybrid/electric vehicle powertrains.

Nevertheless, new developments in intelligent gear coatings, AI-powered manufacturing optimization, and steel gears in composite materials with high performance help enhance performance, efficiency, and compliance, securing a sustained upward trend for automotive gears across the globe.

With robust market growth continued in the industrial sector, heavy machinery manufacturers and robotics developers as well as automation integrators are focusing on specialized gear solutions that enable the best power transmission and motion control. Industrial gear systems suffer from excessive loads, continuous operation and high torque demand.

Growth was driven by the rising demand for high-accuracy motion control equipment in industries like manufacturing, aerospace, and energy. To improve efficiency and reliability, more than 60% of industrial automation systems are based on custom-engineered gears, studies show.

Rising adoption of AI-powered automation in industries, such as predictive maintenance of equipment and machinery, robotic assembly; and quality control have bolstered the market demand for AI in the industrial sector as it guarantees optimal production capacity and operational uptime.

Assuring durability in high-load-bearing conditions, the design of high-torque industrial gear solution involved use of specialized alloy compositions and heat-treated materials, advanced lubrication techniques et al., have assisted market growth.

On the other hand, although the industrial gear segment has certain advantages such as high power transfer reliability, efficiency improvement, longer operational life, it is followed by the challenges of high initial investment, complex maintenance requirement, and fluctuating prices of raw materials.

In contrast, emerging innovations in AI-driven process optimization, novel composite material development, and novel gear testing methods will pave the path for scalability, cost efficiency, and adoption, leading to sustained growth for industrial gear solutions globally.

Key factors such as the expanding need for energy-efficient machines & vehicles, growing industrial automation, and increasing durability of mechanical systems, driving the Gears, Drives & Speed Changers Market are the major factors driving the market. The market is consistently growing with its expanding applications in automotive, aerospace and heavy machinery industries.

Precision-engineered gear systems, smart drive solutions, and IoT-enabled monitoring integration are some of the key trends shaping the industry.

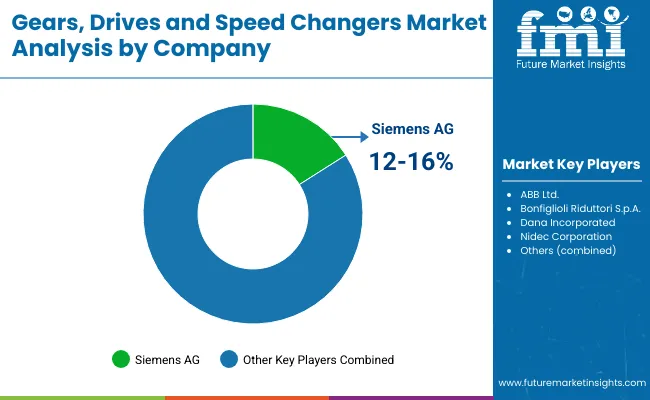

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Siemens AG | 12-16% |

| ABB Ltd. | 10-14% |

| Bonfiglioli Riduttori S.p.A. | 8-12% |

| Dana Incorporated | 6-10% |

| Nidec Corporation | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Siemens AG | Develops high-efficiency drive systems with advanced automation and IoT integration. |

| ABB Ltd. | Specializes in industrial gear drives with enhanced energy efficiency and smart monitoring. |

| Bonfiglioli Riduttori S.p.A. | Offers precision-engineered gearboxes and speed changers for diverse industrial applications. |

| Dana Incorporated | Focuses on high-performance drive systems for automotive and off-highway vehicles. |

| Nidec Corporation | Provides compact, high-torque gear motors and speed control solutions. |

Key Company Insights

Siemens AG (12-16%) Siemens leads in high-efficiency drive and gear solutions, integrating IoT-based performance monitoring and automation.

ABB Ltd. (10-14%) ABB specializes in industrial gear drives with smart technology for optimized energy consumption and durability.

Bonfiglioli Riduttori S.p.A. (8-12%) Bonfiglioli focuses on precision-engineered gearboxes and speed changers, ensuring high performance in industrial applications.

Dana Incorporated (6-10%) Dana provides robust drive solutions tailored for automotive, construction, and agricultural machinery sectors.

Nidec Corporation (4-8%) Nidec pioneers in compact, high-torque gear motors and electric speed control systems, enhancing operational efficiency.

Other Key Players (45-55% Combined) Several mechanical and automation component manufacturers contribute to the expanding Gears, Drives, and Speed Changers Market. These include:

The overall market size for the gears, drives, and speed changers market was USD 1,68,538.9 million in 2025.

The gears, drives, and speed changers market is expected to reach USD 2,77,158.1 million in 2035.

The demand for gears, drives, and speed changers will be driven by increasing industrial automation, rising demand for energy-efficient mechanical systems, growing adoption of high-performance transmission components in automotive and aerospace sectors, and advancements in precision engineering and robotics.

The top 5 countries driving the development of the gears, drives, and speed changers market are the USA, China, Germany, Japan, and India.

The Helical Gears segment is expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

AC Drives Market Size and Share Forecast Outlook 2025 to 2035

Mini Drives Market Analysis Size and Share Forecast Outlook 2025 to 2035

Servo Drives Market Size and Share Forecast Outlook 2025 to 2035

Conveyor Drives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ship Pod Drives Market Size and Share Forecast Outlook 2025 to 2035

Brushless Drives Market Analysis Size and Share Forecast Outlook 2025 to 2035

Automotive Driveshaft Couplings Market

Single-axis Drives Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Drives Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Drives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Industrial Chain Drives Market Size, Growth, and Forecast 2025 to 2035

Automotive Sunroof Drives Market Size and Share Forecast Outlook 2025 to 2035

DC Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

Digital Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

Marine Variable Frequency Drives Market Size and Share Forecast Outlook 2025 to 2035

Large Scale Medium Voltage Drives Market Size and Share Forecast Outlook 2025 to 2035

Electric & Hydraulic Wellhead Drives for Onshore Application Market Insights - Demand, Size & Industry Trends 2025 to 2035

Large Scale Variable Frequency Drives Market Size and Share Forecast Outlook 2025 to 2035

North America Variable Frequency Drives Market Growth – Trends & Forecast 2024-2034

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA