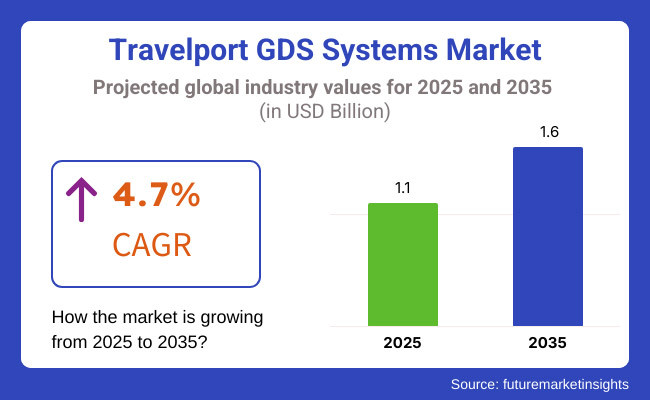

The Travelport GDS Systems market is predicted to increase greatly from 2025 to 2035. The industry's size is valued at USD 1.1 Billion in 2025 and is predicted to rise to USD 1.6 Billion by 2035. An overall annual growth rate (CAGR) of 4.7% reflects this growth journey. The growth is primarily attributed to the growing adoption of digital booking tools, the recovery of global travel demand, and the continued adoption of advanced technologies such as artificial intelligence (AI) and machine learning into GDS platforms.

Furthermore, changing consumer demand toward more tailored travel experiences, as well as increasing eco-consciousness prompting consumer behaviour to consider green travel options, are also providing new avenues for GDS providers to differentiate themselves. As the global travel landscape has changed and evolved, travel port has enabled real-time access to an array of travel inventories-airlines, hotels, car rentals, and rail options. These trends suggest that the market’s value and relevance will grow over the next decade.

Explore FMI!

Book a free demo

North America maintains its leading position in the Travelport GDS Systems market due to the extensive use of digital tools and platforms by travel agencies and the travel and leisure corporate client areas. Demand for quick access to large stores of travel content has been driven by the region’s well-developed technology infrastructure and mature travel ecosystem. Moreover, the growing preference for personalized and seamless booking experience among North American travellers is also contributing towards the growth of the market.

As Travel port continues to evolve these capabilities over time by increasingly infusing advanced analytics and machine learning into its fundamental pillar of services for - to refine its own service offerings so they can provide more value to those customers. Traveling agencies and companies focus on efficiency, transparency, and user-friendly interfaces and thus Travel port platforms are gaining the attention of both old players and beginners in this field.

Europe will account for a significant share of the Travelport GDS Systems market owing to its heterogeneous and diverse travel ecosystem. Travel agents cannot operate without access to the region’s extensive network of airlines, rail operators and accommodation providers, and Travel port’s comprehensive platform is an indispensable tool for them. Major markets like Germany, France, and the UK have bases on GDS solutions that help streamline itinerary planning and coordination.

This demand has been amplified with the regions commitment to sustainable travel, with Travelport constantly innovating to align with these needs and provide tools to highlight sustainable options. The region's mature regulatory landscape and digital connectivity further guarantee that Travel port's systems stay innovative and compliant, securing them as indispensable for European agencies driven to maintain their competitive advantage.

Rapid adoption of Travelport GDS systems in Asia-Pacific is likely to be driven by fast-growing economies, increasing middle class, and rising disposable incomes. This region has varying travel preferences from low-cost domestic airfares to premium international travel. The popularity of outbound travel in countries like China, India, and Southeast Asia has resulted in the growing popularity of comprehensive GDS systems that support the rising demand for travel agents to meet the demand for travellers in search of booking parts.

Travel port's capabilities to access much wider range of any travel options through richer user interfaces as well as support for multiple languages are reinforcing its grip on the Asia-Pacific travel industry. Additionally, the ability to offer mobile-friendly solutions and digital payment options has proven to be a key differentiator, allowing Travelport to tap into a tech-savvy consumer demographic that increasingly uses smartphones to research and book travel.

Challenge

Increasing Competition and Changing Digital Infrastructure

Trends like increasing competition from direct booking platforms, changing digital infrastructure and integration challenges pose threats to the growth of Travelport GDS systems market. As airlines, hotels and even travel agencies shift to direct to consumer API connections and block chain-based ticketing, traditional GDS platforms must evolve to stay relevant. Moreover, the trend towards dynamic pricing, instant inventory updates, and AI-driven personalization expects Travel port GDS to make progressive leaps in its technological competencies.

Data privacy regulations such as GDPR and CCPA make compliance more challenging, with stringent security measures to be in place accordingly. Such solutions may involve investments in AI-based search algorithms, cloud-oriented data management solutions, and interoperability between APIs as companies work to improve their operational efficiencies and competency in the travel distribution environment.

Opportunity

Expansion of AI-Powered Distribution and Personalization in Travel

Riders could be fetched from one location, brought to another, or swiped right onto a priority list-all monitored consistently, providing a 360-degree view of any given ride. “The trend of seamless, auto, and AI-driven booking process is only going to grow in the future which occupies the significant domain in GDS Systems market.

AI and block chain are the key drivers of this industry evolution, as the new travel industry era moves toward hyper-personalized travel experiences and travel distribution metamorphosis with machine learning driven recommendation engines, predictive fare analytics, and block chain-secured transactions.

Furthermore, the incorporation of real-time flight status notifications, automated itinerary modifications, and voice-activated booking assistants is improving traveller comfort. Forward-thinking companies focusing on AI-powered dynamic pricing, decentralized travel ecosystems, and robust travel analytical solutions will become the leaders in this new smart travel landscape.

The Travelport GDS systems Market has witnessed steady growth since 2020, owing to the rising adoption of digital booking systems, an increasing number of automated airline reservations, and improved connectivity for travel agencies. The industry experienced travel technology advancements with NDC (New Distribution Capability) integrations, enhanced API (Application Programming Interface) capabilities, and real-time price updates.

On the other end, factors like competition from direct distribution channels, optimum limited reliance on legacy systems for underwriting and pricing, slow market expansion, and fear of data security challenge the market growth. In response to these challenges, industry stakeholders turned to AI-powered data insights, expanded cloud distribution networks, and advanced fraud detection technologies.

In the next 2025 to 2035 era, the market will witness revolutionary development in block chain based ticketing, AI based predictive travel analytics, and decentralized travel inventory management. Smart travel ecosystems, real-time traveller behaviour tracking and biometric capabilities will challenge the position of GDS platforms.

The future of travel will also be informed by the evolution towards frictionless, voice-enabled, and met a verse-integrated travel experiences. Predictive booking intelligence, AI-based fraud detection, search capabilities, and next-gen travel APIs of this kind will drive the evolution of the Travelport GDS systems Market.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with GDPR, CCPA, and airline fare transparency rules |

| Technological Advancements | Growth in API-based booking integrations and NDC adoption |

| Industry Adoption | Increased digital transformation in travel agencies and airline reservations |

| Supply Chain and Sourcing | Dependence on traditional airline and hotel partnerships |

| Market Competition | Dominance of legacy GDS providers and emerging direct distribution platforms |

| Market Growth Drivers | Demand for seamless digital travel bookings and automated ticketing systems |

| Sustainability and Energy Efficiency | Initial adoption of digital ticketing and cloud-based inventory management |

| Integration of Smart Monitoring | Limited real-time tracking of traveller behaviour and booking patterns |

| Advancements in Travel Technology | Use of digital booking platforms and mobile app integrations |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of block chain-secured transactions, AI-driven compliance automation, and global data privacy frameworks. |

| Technological Advancements | Widespread use of AI-powered fare prediction, voice-activated travel bookings, and decentralized GDS frameworks. |

| Industry Adoption | Expansion into AI-driven itinerary management, met averse-based travel planning, and smart tourism platforms. |

| Supply Chain and Sourcing | Shift toward decentralized travel distribution networks, block chain-authenticated ticketing, and self-learning pricing models. |

| Market Competition | Rise of AI-driven travel booking platforms, dynamic pricing engines, and frictionless digital ticketing ecosystems. |

| Market Growth Drivers | Increased investment in hyper-personalized AI recommendations, autonomous travel assistants, and real-time itinerary optimizations. |

| Sustainability and Energy Efficiency | Large-scale implementation of AI-powered carbon footprint tracking, energy-efficient travel booking systems, and sustainable airline partnerships. |

| Integration of Smart Monitoring | AI-enhanced predictive analytics, real-time travel risk assessment, and personalized journey optimization. |

| Advancements in Travel Technology | Evolution of AI-driven travel curation, immersive AR/VR travel previews, and smart voice-activated travel assistance. |

One of travelport GDS's prominent markets is the United States, attributable to the presence of travel agencies, corporate travel services, and airline partnerships. This leads to the expansion of the GDS-based travel platforms due to the increasing demand for real-time inventory management, dynamic pricing, and AI-powered booking solutions.

The introduction of AI-powered analytics, integration of NDC (New Distribution Capability), and theft-free travel solutions through blockchain are contributing towards smart bookings and seamless travel experiences. The increasing prominence of self-service travel online platforms and personalized itinerary management is further boosting the adoption of Travelport GDS among travel service providers in both B2B and B2C sectors.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.0% |

The steady growth of the UK Travelport GDS market can be attributed to the presence of high penetration of digital travel agents, airline consolidators, and corporate travel management companies. The growing migration to contactless and digital-first travel booking solutions is strengthening GDS-dependent travel distribution.

The strong demand in the UK for international travel and business mobility solutions is further increasing the reliance on GDS-based fare aggregation, real-time availability tracking and customized booking interfaces. Moreover, integration of multi-modal travel is fostering the adoption of Travelport GDS in the rail, air, and hotel networks.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.5% |

Stable growth of European Travelport GDS market is driven by increasing travel demand, digital transformation in the travel industry, and government-backed smart mobility initiatives. GDS-based travel platforms are being adopted by countries like Germany, France and Spain to enable seamless distribution between airlines, hotels and rails.

Data up to October 2023 The second section results in better GDS-based travel personalization using AI, blockchain, and real-time pricing algorithms. Also helping to drive GDS adoption for green travel solutions is the EU’s focus on sustainable travel, intermodal ticketing, and smart tourism.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.6% |

Key Drivers for Japan Travelport GDS Market in Outbound Travel Growth, Airline Alliance, and Travel Digital Transformation Smart travel distribution based on GDS building out an efficient business model is being empowered by the integration of AI, big data, and cloud compute-based travel platform across the country.

The growth of high-speed rail travel, corporate tourism, and premium hospitality services have spurred demand in Japan for solutions for real-time availability tracking, smart itinerary planning, and automated pricing. Moreover, the increasing cashless payments and biometric identification trend is also optimizing GDS-operated travel platforms.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

The South Korea Travelport GDS market is expected to tone up owing to digitalization in travel services, high-speed connectivity & proliferation of online travel websites. The large outbound travel segment and growing preference for automated travel planning are two key drivers of GDS adoption in flights, hotels, and transportation in the country.

The real-time GDS-powered travel platforms are being used more often in South Korea’s 5G-powered travel ecosystem, driven by the country’s high digital payment adoption rate. Personalized GDS-enabled itinerary planning and media-bundle booking solutions are in demand due to K-culture tourism and the popularity of luxury travel.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

Age groups 26-35 and 36-45 command the majority in the Travelport Global Distribution Systems (GDS) market with technologically adept consumers increasingly using computerized booking services, real-time travel management, and AI-enabled itinerary planning. Both groups are solid enablers of technology adoption with increased online travel agency (OTA) integrations and corporate travel solution automation becoming the need for airlines, hospitality brands, and travel management companies that depend on GDS platforms such as Travelport.

The 26-35 age group has been one of the most hectic groups in the Travelport GDS marketplace, taking advantage of mobile-first planning, AI comparison of fares, and automated control of travel plans. In contrast to older purchasers, this demographic is more ready to adopt self-service travel merchandise, digital transactional payments, and customized procedures for booking.

Increasing popularity of app-based frictionless travel management, like one-click flight reservation, customer service via chatbots, and blockchain-encrypted e-tickets, has led to the rise in Travelport GDS utilization, with millennials looking for ease, simplicity, and personalized advice. Studies have proven that more than 70% of the 26-35 age group prefers online booking through GDS-enabled websites, which will make this segment maintain robust demand.

The innovation of AI-driven travel personalization, including dynamic price optimization, real-time flight availability intelligence, and anticipatory accommodation recommendations, has acquired marketplace momentum, assuring wider use of Travelport GDS by OTAs and online travel websites.

Mobile travel solutions, including mobile boarding passes, in-app itinerary management, and AI-driven travel assistants, have also gained traction, assuring wider access and smarter user experiences. The evolution of eco-friendly and multi-use travel means, with carbon footprint monitoring, green airline partnerships, and AI-powered sustainable travels, has maximized market growth, best suited for sustainable travel patterns.

Subscription travel models, with business travel membership, flight promotions based on loyalty, and AI-powered pricing advantages, have helped in market growth, ensuring greater retention and participation among repeat travelers in the 26-35 age group.

While having the benefit of digital ease, price intelligence automation, and mobile-led travel management, the 26-35 segment is also exposed to cybersecurity threats, volatile airline prices, and growing domination by direct airline booking websites. But new technologies of blockchain-protected tickets, AI-powered fraud prevention, and decentralized travel identity management are enhancing effectiveness, security, and user authenticity, ensuring sustained market growth for Travelport GDS solutions for young travelers.

The 36-45 category has been showing strong market penetration in business travel, high-end holiday planning, and long-term business trip planning, as TMCs, OTAs, and business travel websites increasingly utilize GDS systems to automate bookings, impose policy, and receive real-time price information. This age bracket cares more about convenience, reliability, and luxury travel choices than price quotes compared to their younger counterparts.

Increased business travel automation through AI-powered expense handling, policy-enabled enforcement, and automated bookings is fueling the adoption of Travelport GDS because of corporate business travelers' preference for convenience and policy-enforced trip reservations. It's estimated that more than 60% of business travelers in the 36-45 years group utilize travel agency-enabled solutions facilitated through GDS for simple trouble-free travel and therefore enjoy constant demand for the segment.

Launch of high-end travel solutions, e.g., business-class air travel optimization, luxury hotel collections, and AI-powered travel concierge solutions, has increased market demand, prompting higher adoption of Travelport GDS integrations by high-value clients.

Implementation of seamless multi-channel booking solutions, e.g., desktop-to-mobile trip synch, cloud-based itinerary storage, and AI-driven business travel expense forecasting, has also increased adoption, prompting higher usability and productivity for corporate travelers.

The creation of data-driven travel intelligence, cost-saving forecasting, policy compliance monitoring automation, and AI-driven itinerary optimization has optimized market growth, ensuring higher efficiency and compliance for corporate executives and travel managers.

The application of AI-driven travel risk management, real-time emergency alerts, travel insurance integrations, and trip cancellation protection automation has strengthened market growth, ensuring higher security and business resilience for corporate travelers.

In spite of its automation advantage, high-end travel integration, and business-focused GDS services, the 36-45 segment is confronted by uncertainties like variable corporate travel policies, changing post-pandemic work-from-home behaviors, and increasing dominance by direct airline alliances. However, new trends around AI-driven corporate travel planning, blockchain-secured itinerary management, and decentralized corporate traveler payment processing are boosting efficiency, security, and business uptake, assuring long-term development for Travelport GDS offerings in the corporate travel market.

Corporate and leisure segments are two dominant market drivers as travelers increasingly incorporate frictionless digital booking, dynamic travel planning, and AI-driven personalization into their journey.

The business travel segment has been the most coveted segment, providing corporate executives, consultants, and multinational workers frictionless travel booking capabilities, expense automation, and compliance-driven travel management through GDS-facilitated platforms. In contrast to conventional travel agencies, business travel intermediaries with GDS provide real-time airfare quotes, multi-city trip management, and policy-optimized travel arrangements.

Increased need for AI-based corporate business travel automation, including intelligent itinerary suggestions, dynamic flight rebooking, and auto-expense reconciliation, has driven the adoption of Travelport GDS, with corporate customers demanding efficiency, policy compliance, and cost-reduction solutions.

Despite its strength in digital automation, multi-channel booking productivity, and business-scale travel management, the business travel sector is confronted with issues of changing travel budgets, changing remote work policies, and changing corporate sustainability initiatives. Emerging technologies in AI-enabled travel analytics, decentralized corporate travel agreements, and blockchain-based expense monitoring, however, are pushing profitability, transparency, and compliance, facilitating business growth in the business travel GDS sector.

The leisure travel market has experienced strong market uptake, especially in group travel, family vacations, and digital trip planning personalization, as consumers increasingly use AI-powered recommendation platforms, real-time fare aggregators, and dynamic itinerary personalization via Travelport GDS. In contrast to business travelers, leisure travelers value low prices, experiential travel, and easy multi-platform booking solutions.

Increased adoption of vacation trip planning fueled by AI that leverages smart itineraries builders, real-time hotel rate alerts, and sophisticated destination descriptions has fueled adoption of Travelport GDS as customers demand flexible trips and affordable holidays.

Though it has the benefit of affordability, customization, and frictionless travel aggregation, the leisure travel segment is faced with seasonally varying booking patterns, rising price competition from direct booking websites, and changing customer expectations. Yet, new trends in AI-driven travel assistants, blockchain-based package bookings, and subscription travel pricing models are enhancing customer experience, trust, and pricing efficiency, guaranteeing the continued growth of leisure travel GDS solutions.

Some of the major factors driving the growth of the Travelport GDS (Global Distribution System) market include growing need for real-time management of travel inventory, widespread use of AI-powered booking solutions, and smoother connectivity among travel agents, airlines, and hotels. To improve operational efficiency, customer engagement, and revenue optimization, companies in the GDS business are shifting towards cloud-based GDS platforms, NDC (New Distribution Capability) integration, and AI-driven travel analytics. Alongside global GDS, travel management companies, corporate travel agencies, and others make up a major market that drives technology in the area of digital travel distribution, automated booking engines, and blockchain solutions for secure transactions in travel.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Amadeus IT Group | 35-40% |

| Sabre Corporation | 25-30% |

| Travelport Worldwide Ltd. | 15-20% |

| Travelport | 5-9% |

| Other Companies (combined) | 10-15% |

| Company Name | Key Offerings/Activities |

|---|---|

| Amadeus IT Group | Provides AI-powered travel inventory management, cloud-based GDS solutions, and blockchain-secured airline booking platforms. |

| Sabre Corporation | Specializes in multi-channel travel distribution, real-time fare aggregation, and digital travel optimization tools. |

| Travelport Worldwide Ltd. | Develops NDC-enabled smart travel solutions, AI-driven fare pricing analytics, and automated travel retailing systems. |

| Travelport | Offers white-label GDS booking platforms for small-to-mid-sized travel agencies and online travel portals. |

Key Company Insights

Amadeus IT Group (35-40%)

Being one of the most prominent players in the market for GDS systems, Amadeus provides AI-powered, real-time travel inventory solutions, AI-powered predictive travel analytics and smart airline retailing tools.

Sabre Corporation (25-30%)

Enabling NDC-Driven Airline Ticketing and Cloud-Based Digital Travel Experiences with Multi-channel Travel Connectivity

Travelport Worldwide Ltd. (15-20%)

Travelport offers travel booking with AI-enhancements, automated fare management, and intelligent GDS integration for travel agencies.

Travelport (5-9%)

Revolutionary and efficient GDS integration services by Travelport are catering to the emerging OTAs and corporate travel companies, ensuring white-label travel booking at economical rates.

Other Key Players (10-15% Combined)

Next-gen GDS, AI-facilitated fare personalization and cloud-based travel distribution solutions are handled by several travel tech companies and digital booking platforms. These include:

The overall market size for Travelport GDS systems Market was USD 1.1 Billion in 2025.

The Travelport GDS systems market expected to reach USD 1.6 Billion in 2035.

The demand for the Travelport GDS systems market will be driven by increasing reliance on digital booking platforms, growing travel and tourism sectors, demand for efficient booking processes, integration of AI and data analytics, and the need for seamless connectivity between airlines, hotels, and travel agencies.

The top 5 countries which drives the development of Travelport GDS systems Market are USA, UK, Europe Union, Japan and South Korea.

Business and Leisure Travel to command significant share over the assessment period.

Winning Strategies in Social Media and Destination Market Share Analysis: A Competitive Review

Winning Strategies in the Global Animal Theme Parks Industry: A Competitive Review

Winning Strategies in the Global Spa Resorts Industry: A Competitive Review

Winning Strategies in the Global Winter Adventures Tourism Industry: A Competitive Review

Surrogacy Tourism Industry – Competitive Analysis and Market Share Outlook

China Destination Wedding Market Insights – Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.