The world GDS technology market is projected to witness strong growth during 2025 to 2035 due to the large-scale digitization of travel bookings, growth in business travel demand, and increased customer demand for end-to-end seamless multi-channel travel experiences.

Real-time hotel inventory availability, car rental inventory availability, and airline inventory availability by GDS platforms are now a strict necessity for travel agencies, corporate booking platforms, and OTAs. The drive for more integrated travel management platforms, along with the promise of AI-based personalization and real-time analytics, is also accelerating the prospects for market growth.

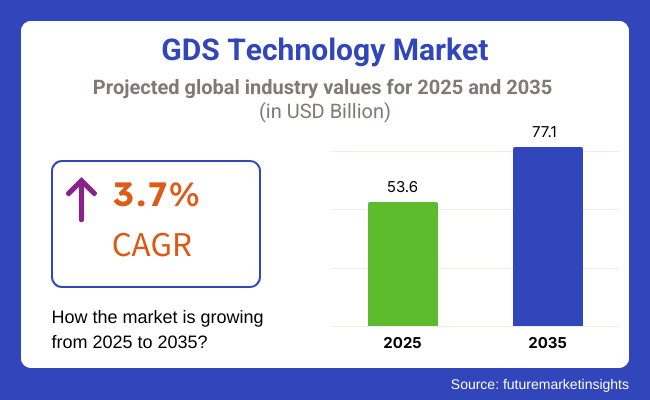

GDS technology market size was approximately USD 53.6 Billion in 2025. Market size would be approximately USD 77.1 Billion in 2035. CAGR would be 3.7% It is an indication of growing demand for content aggregation in centers of gravity and for machine-driven booking, and accelerated uptake of next-generation distribution technology by mature and emerging markets.

North America has the most powerful geography for GDS technology, complemented by an established travel market and strong online travel agency penetration. The United States, for example, is an excellent target destination for corporate holiday and vacation bookings, with high-end GDS providers having offices in the United States.

Further, increased implementation of new distribution capabilities (NDC) on the part of airlines and travel management companies has led to continued growth in the industry. Attention on corporate travel platforms, combined booking capabilities, and analytics has placed it ahead of the global competition in the technology of GDS.

Europe continues to be one of the prominent players in the GDS technology space due to its advanced tourism infrastructure, intraregional travel demand, and highly concentrated full-service carrier base that relies on GDS systems nearly exclusively. Larger carriers and travel agencies in Europe are still migrating toward NDC-based systems and dynamic pricing algorithms, which have augmented the value proposition of GDS products.

Further, growth of the region's focus on enhancing travel experience with AI personalization, multilingual booking pages, and increasing content providers is complementing long-term market growth.

The Asia-Pacific region is experiencing unprecedented growth in the GDS technology market because of rising disposable incomes, enhancing internet penetration, and an active tourism and traveling economy. Geographies such as China, India, and Southeast Asia have witnessed increased business and recreational travel, and hence online travel agencies and travel agencies are consolidating GDS platforms to make inventory easily accessible.

In addition, with increased penetration by low-cost airlines and business travel picking up momentum in post-pandemic times, there is a larger demand for streamlined booking and distribution systems. The dynamic and rapidly changing travel culture of Asia-Pacific and digitalization thrust are driving the technology penetration of the GDS throughout the region.

Challenge

Legacy System Integration and Cybersecurity Concerns

The global distribution system (gds) technology market challenges in the Global Distribution System (GDS) Technology Market include the integration of legacy systems with modern travel technologies, data security concerns, and the need to adapt to evolving consumer expectations.

Since the majority of travel agencies, airlines and hospitality companies operate on legacy booking platforms, it prevents seamless integration with AI-driven automation, blockchain secured transactions and dynamic pricing engines. Moreover, the increasing cyber attacks against sensitive travel data necessitated better cybersecurity compliance to protect our personal and financial information.

In response to this, GDS providers need to focus on API-based connectivity, AI-surge fraud prevention approach and de-centralized encryption of data to enhance security and interoperability across the travel networks.

Opportunity

Expansion of AI-Driven Travel Distribution and Personalization

GDS technology market are Surging due to the increased need for smooth, personalized, and automated travel booking experiences. The distribution of inventory by airlines, hotels, and travel agencies has transformed as the usage of AI-based recommendation engines, real-time fare optimization, and predictive analytics is on the rise.

And we are also seeing the pilot projects of a blockchain-based environment for transparent settlement of fares and the NFT-based ticketing systems in the travel distribution. Meanwhile, the emergence of mobile-based first booking platforms and voice-activated travel assistants are further improving user interaction.

The next phase of innovation within the GDS technology market will be driven by companies who are investing in AI-driven search algorithms, hyper-personalized travel experiences and cloud-based booking ecosystems.

The year range from 2020 to 2024, saw massive changes in the dynamics of the GDS Technology Market with the emergence of digital-first travel experiences, the transformation of direct airline distribution channels, and the implementation of contactless payment solutions. Airlines and hotels began to harness AI for better pricing and inventory management, and blockchain-based verification systems bolstered booking security.

However, various challenges including high system maintenance costs, the complexities of the regulatory environment, and the monopoly of traditional GDS providers restricted innovation. To address these issues, businesses led the way in cloud-native distribution strategy, AI-assisted pricing, and open-source API integration to create effective and agile solutions.

The next transformative stages within the air travel ecosystem air pricing, or AI-based fare optimization and decentralized travel marketplace catered by hyper-personalization of booking experience will prevail between 2025 to 2035. This will revolutionise global travel distribution, as smart contracts for travel bookings, AI-powered trip planning assistants, and secure identity verification will be even more commonplace.

Moreover, real-time price predictions, quantum computing for ultra-fast search requests, and fully autonomous customer care systems will increase the efficiency. The GDS Technology Market, At A Glance: Next-Gen Artificial Intelligence & Emerging Decentralized Travel Ecosystems as Future Trends.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with data privacy laws and industry standards |

| Technological Advancements | Growth in AI-powered pricing engines and predictive analytics |

| Industry Adoption | Increased focus on cloud-based booking systems and mobile apps |

| Supply Chain and Sourcing | Dependence on traditional airline and hotel partnerships |

| Market Competition | Dominance of legacy GDS providers and airline direct booking channels |

| Market Growth Drivers | Demand for automated travel solutions and seamless booking experiences |

| Sustainability and Energy Efficiency | Early adoption of eco-friendly travel options and green hotel bookings |

| Integration of Smart Monitoring | Limited use of real-time traveler behavior tracking and personalized recommendations |

| Advancements in Travel Distribution | Use of traditional airline and hotel booking aggregation |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of blockchain-secured transactions, AI-driven compliance monitoring, and digital identity verification. |

| Technological Advancements | Widespread adoption of smart contracts, real-time fare optimization, and quantum computing-powered search algorithms. |

| Industry Adoption | Expansion into AI-curated travel planning, NFT-based ticketing, and decentralized booking networks. |

| Supply Chain and Sourcing | Shift toward dynamic, API-driven inventory distribution, peer-to-peer travel marketplaces, and blockchain-based ticketing. |

| Market Competition | Rise of AI-native travel distribution platforms, hyper-personalized travel engines, and decentralized booking solutions. |

| Market Growth Drivers | Increased investment in AI-driven personalization, predictive analytics, and sustainable, low-cost travel distribution. |

| Sustainability and Energy Efficiency | Large-scale implementation of AI-powered carbon footprint tracking, sustainable travel algorithms, and energy-efficient booking ecosystems. |

| Integration of Smart Monitoring | AI-enhanced traveler analytics, real-time dynamic pricing adjustments, and cloud-based travel security monitoring. |

| Advancements in Travel Distribution | Development of AI-powered conversational booking assistants, blockchain-secured travel itineraries, and decentralized smart travel marketplaces. |

The United States GDC technology market is witnessing a steady growth owing to an increasing demand for lightweight automotive components, growing adoption in aerospace manufacturing, and improvements in die casting automation. The gravity die-cast Aluminum and magnesium components are widely used in the automotive sector driven by the production of EVs and fuel efficiency regulations.

Aerospace and defense sectors are developing high-stiffness, Lightweight Cast Components to increase fuel efficiency and lower emissions. As technology continues to improve with AI-driven process optimization tools and smart casting solutions that include die, process, and repair expert system-enabled systems, production efficiency also improves.

The USA GDC technology market is forecasted to grow over the years with the demand for exquisite metal components and growing automation investment.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.0% |

The United Kingdom GDC technology market is expanding with the rising investments in sustainable manufacturing as well as increasing from the automotive sector demand and the growing use of Aluminum die-casting in electric vehicle production. The UK’s goals for carbon emissions reductions are driving lightweight materials and newer casting methods.

Have you considered how the renewable energy industry is contributing to precision-cast Aluminum demand - specifically in the wind turbines and battery storage systems? In addition, automation and robotics advancements are enhancing casting efficiency and lowering production costs.

The UK GDC technology market is expected to make a stable growth on account of increasing investments in green manufacturing coupled with rising requirement for high-performance casting solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.5% |

USA The European Union GDC technology market is growing at a steady pace as an outcome of rising automotive production, demand from industrial machinery industries, and new stringent environmental regulations are bolstering the European Union GDC technology market. Germany, France and Italy are early adopters of gravity die casting for lightweight automotive and aerospace components

Use of recycled Aluminium and ecological casting material, encouraged by EU sustainability principles. Furthermore, increasing automation in die casting plants is improving productivity and minimizing wastage.

The EU GDC technology market should grow at a respectable pace due to robust policy support for energy-efficient manufacturing in the government and demand for lightweight metallic components.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.8% |

High demand across various industries including automotive, electronics, and industrial equipment manufacturing is driving the growth of the Japanese GDC technology market. Japan automotive, housing the likes of Toyota, Honda and Nissan, is one of the largest consumer of gravity die-cast components for lightweight vehicles frames and powertrain systems.

The growth of the Global market, especially in the field of electronics, especially in the precision cast parts for semiconductors and circuit boards, are driving the electronics sector. Japan's focus on miniaturization and high-precision casting technologies is also a key contributor to innovation within the GDC sector.

Alternatively, the stable growth trend in Japan's GDC technology market will continue to be driven by advances in automation as well as growing demand for high-quality (accurate and homogenous) metal components.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.6% |

The South Korean GDC technology market is projected to grow at Fuishimi rate with the growing automotive production, increased adoption in electronics manufacturing and government initiatives in support of industrial automation. Demand for gravity die cast Aluminum housings and enclosures are driven by South Korea's strong position in EV battery and semiconductor industries.

Shipbuilding and heavy machinery sectors, which require durable and corrosion-resistant metal components, are also propelling market growth. Moreover, the trend of smart factories and digital twin in casting process is enhancing efficiency and minimizing defects.

The South Korean GDC technology market is expected to grow steadily, with ongoing investments in the automation of manufacturing and the growing demand for high-performing cast components.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.7% |

The GDS technology market segmented, by domestic and international has significant share in the GDS technology market as travel service providers, online booking platforms and other tourism operators are incorporating automated reservation systems for travel booking optimization, improving global reach, and providing seamless connectivity between supplier and consumer. These two key divisions are crucial for the modern travel and tourism sector as they help distribute travel-related services like airline tickets, hotel reservations, car rentals, and tour packages.

This is one of the facts that has led domestic GDS technology to become one of the most active and diverse sectors, providing travellers access to local travel inventory, customized booking management systems, and enriched distribution channels for national travel operators. Domestic systems are designed specifically for these regional platforms providing you with the travel services within a specific area with faster transaction speed, localized integration of content, and personalized offerings for regional travellers.

As regional airlines, rail networks and bus operators increasingly pursue efficient ticketing and end-to-end travel distribution, the demand for digital travel solutions - with AI-powered itinerary planning, domestic flight booking in real time and last mile transport integration - has driven the uptake of domestic GDS technology. Researchers suggest that more than 65% of regional travel agencies and hospitality providers use domestic GDS to help them leverage sales channels and meet the market demand for localized distribution solutions.

The proliferation of budget air carriers and regional travel networks - encompassing low-cost air carriers, intercity bus travel options and high-speed rail access - has solidified travel market demand, leading to an increased proliferation domestically of GDS (Global Destination System) technology to enable dynamic pricing approaches and real-time fare updates.

AI-enabled customer analytics offering tailored travel suggestions and automated rebooking options for domestic passengers has also driven greater adoption and better user engagement and optimization of the booking experience.

The evolution of mobile first GDS platforms, an extensive use of app-based domestic bookings, digital payment enhancements, and voice-assisted itinerary handling improved growth in the market that guarantees improved accessibility and convenience for customers.

The expansion of the market has been supported by the growing adoption of sustainable travel solutions with environmentally friendly hotel and transport offers embedded within domestic GDS platforms led to improvements and better alignment with global sustainability initiatives.

For all its benefits in optimizing localized service, accelerating transaction processing, and delivering targeted content, the domestic GDS segment will be up against challenges of limited cross-border connectivity, dependency on national carrier partnerships, and regulatory restrictions in regional travel markets. Despite growing market potential for domestic GDS solutions, emerging use cases for block chain based ticketing, artificial intelligence for travel demand forecasting, and GDS and online travel agency (OTA) hybridization are improving efficiency, cost-effectiveness, and scalability.

The strength of the International GDS technology adoption has come as a result of large-scale penetration among airline alliances, multinational hotel companies, and international tour operators as travel providers look to invest heavily in centralised global distribution infrastructure to maximize short haul reach and make cross border transactions seamless. International systems work with a single database for global travel, connecting service providers that work in different countries to their customers, unlike domestic GDS platforms.

Studies indicate that the need to issue a single-journey ticket to help multi-destination bookings, with integrated flight-hotel packages, real-time visa assistance, and cross-border payment processing, is propelling the demand for international GDS technology, as global travel agencies and multinational corporations prioritize centralized booking solutions. More than 70% of international travel bookings are made through GDS technology for seamless global connectivity, and other cross-border reservation portal demand remains consistently strong.

The increase of business travel among corporate travel management solution, dynamic fare negotiation, and saving corporate data, which provides advantages to effectively track overall travel at the enterprise level has been driving the demand in the market, ensuring a higher adoption of international GDS for large scale business travel logistics.

Adoption is further encouraged through AI-enabled fare optimization, including features such as real-time price tracking, automated seat selection, and predictive analysis for forecasting international travel demand, which have made effective pricing transparency and competitive advantage available to travel providers.

Multi-currency GDS payment gateways, block chain-backed International transaction security, AI enabled fraud detection for transaction safety and security has accelerated the growth of multi-currency GDS payment gateways to achieve high trust and financial transparency during cross-border travel bookings.

Indispensable Adoption of AI Based Multilingual Support, providing real time translation services & chabot assisted booking guidance for international travellers has strengthened the markets expansion, allowing Non-English Speaking Travelers better accessibility.

While the international GDS segment is benefitted from global market access, centralized inventory distribution, and cross-border travel facilitation, it faces challenges related to varying rules and regulations of countries, multi-national transaction cybersecurity risk, and dependency on airline and hospitality partnerships.

That said, the new innovations in AI-enabled travel automation, smart contract-based booking confirmation, and real-time worldwide flight disruption alerts are increasing efficiency, scalability, and security, ensuring that international GDS solutions continue to grow.

Two of the significant market drivers got a mention in the budget and premium GDS technology segments, as the travel providers prepare to integrate the customized booking solutions in order to attain optimization in price segmentation, diverse preferences of travellers, and more enhanced dynamic fare management.

As one of the fastest-growing segments in technology, these budget GDS technology solutions provide low-cost travel distribution, bookable options for price-sensitive customers, and efficient inventory for budget travellers. Budget systems focus on cost-effectiveness, last-minute deals, and real-time fare changes, unlike high-end GDS platforms, to optimize seat occupancy rates and hotel occupancy rates.

Increasing demand for low-cost airfares, cheap hotels and economical holiday packages is driving the uptake of budget GDS technology, as travel companies adjust pricing models to appeal to price-conscious travellers. Travellers expect value for their trip and studies show over 65% of travellers are looking to travel cheaper, Signifying strong market demand for simple GDS solution.

The booming of low-cost carriers (LCC) and budget travel operator which includes direct GDS connectivity of budget airlines, dynamic fare bundling has fuelled the market demand contributes to the much higher uptake of their budget GDS platforms.

While the budget GDS sector offers cost savings, affordability, and the ability to make volume reservations, challenges such as lower profit margins, extensive OTA competition, and limited available premium travel perks face it.

Nonetheless, new technological breakthroughs, particularly AI-powered suggestions for budget travel, dynamic pricing algorithms that adjust at the last minute, and block chain solutions to cut costs, are boosting efficiency, making it more accessible than ever while also offering the prospect of increased profitability, so that budget GDS technology is set for sustained expansion.

The market for premium GDS technology has grown significantly, particularly among high-end hotel chains, first-class airline cabins, and VIP travel as HNWIs and corporations seek premium travel solutions that offer premium booking features. Ojo parts a premium system with exclusive travel services, places focus on a customer experience, itinerary planning, and high-end travel concierge services, unlike budget GDS platforms.

Increased demand for luxury travel including first-class upgrades, five-star hotel stays, and tailored travel packages is driving adoption of premium distribution technology with premium GDS systems focused on VIP services for travel agents and luxury tour operators.

And the growth of elite loyalty programs, along with these GDS' AI-assisted premium travel recommendations, exclusive discounts, and white-glove concierge services will create higher market demand and thus higher adoption of premium GDS platforms.

While helpful for gaining customer loyalty, high-margin revenues, and premium integrations, the premium GDS segment struggles with high service costs, limited reach for middle-tier travellers, and competition against personalized OTA offerings. But as AI technology emerges to customize luxury travel experiences, predict high-end travellers’ booking behaviour, and provide real-time elite travel concierge, efficiency, engagement and profitability are on the rise, making sure that premium GDS solutions continue to grow.

The growing demand for automated travel booking solutions, real-time fare aggregation, and AI-powered travel management systems drives the growth of the GDS technology market. To create better efficiency, cost-effectiveness, and personalization in the travel and tourism sector, companies are paying attention to cloud-based GDS platforms, AI-powered dynamic pricing, and NDC (New Distribution Capability) integration.

It encompasses international GDS providers, travel tech corporations, and corporate travel management organizations, all of which are playing a role in the development of technology in airline reservation systems, hotel booking APIs, and intelligent travel analytics.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Amadeus IT Group | 35-40% |

| Sabre Corporation | 25-30% |

| Travelport Worldwide Ltd. | 15-20% |

| TraveloPro | 5-9% |

| Other Companies (combined) | 10-15% |

| Company Name | Key Offerings/Activities |

|---|---|

| Amadeus IT Group | Develops AI-powered GDS solutions, dynamic pricing engines, and cloud-based travel distribution systems. |

| Sabre Corporation | Specializes in end-to-end travel booking solutions, real-time fare aggregation, and NDC-powered airline retailing. |

| Travelport Worldwide Ltd. | Manufactures next-generation travel retailing systems, smart booking APIs, and multi-source content aggregation. |

| TraveloPro | Provides customizable travel software solutions with white-label GDS integration for travel agencies and OTAs. |

Key Company Insights

Amadeus IT Group (35-40%)

Amadeus has been a leader in GDS technology, providing AI-enabled flight searches, hotel bookings, and corporate travel management solutions.

Sabre Corporation (25-30%)

Sabre focuses on real-time pricing intelligence, airline retailing and personalized travel distribution technologies.

Travelport Worldwide Ltd. (15-20%)

Travelport is a technology company providing critical services to the global travel and tourism industry, including multi-GDS aggregation, smart travel booking APIs, next-gen hotel and car rental distribution systems.

TraveloPro (5-9%)

TraveloPro develops for small to mid-sized travel agencies, TraveloPro develops budget-friendly white-label travel booking platforms with GDS integration.

Other Key Players (10-15% Combined)

Next-gen GDS innovations, artificial intelligence (AI)-driven personalization, and cloud-based distribution solutions benefit from several travel tech companies and digital travel platforms. These include:

The overall market size for GDS Technology Market was USD 53.6 Billion in 2025.

The GDS Technology Market is expected to reach USD 77.1 Billion in 2035.

The demand for the GDS (Global Distribution System) technology market will grow due to increasing airline and hotel bookings, rising adoption of online travel agencies, advancements in real-time inventory management, and the growing need for seamless connectivity between travel service providers and consumers.

The top 5 countries which drives the development of GDS Technology Market are USA, UK, Europe Union, Japan and South Korea.

Domestic and International GDS Technology Drive Market to command significant share over the assessment period.

Table 01 : Capital Investment by Country (US$ Million)

Table 02 : Total Tourist Arrivals (Million), 2022

Table 03 : Total Spending (US$ Million) and Forecast (2018 to 2033)

Table 04 : Number of Tourists (Million) and Forecast (2018 to 2033)

Table 05 : Spending per Traveller (US$ Million) and Forecast (2018 to 2033)

Figure 01 : Total Spending (US$ Million) and Forecast (2023 to 2033)

Figure 02 : Total Spending Y-o-Y Growth Projections (2018 to 2033)

Figure 03 : Number of Tourists (Million) and Forecast (2023 to 2033)

Figure 04 : Number of Tourists Y-o-Y Growth Projections (2018 to 2033)

Figure 05 : Spending per Traveller (US$ Million) and Forecast (2023 to 2033)

Figure 06 : Spending per Traveller Y-o-Y Growth Projections (2018 to 2033)

Figure 07 : Current Market Analysis (% of demand), By Nationality, 2022

Figure 08 : Current Market Analysis (% of demand), By Type, 2022

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Key Players & Market Share in GDS Technology Market

Travelport GDS Systems Market Trends - Growth & Forecast 2025 to 2035

4K Technology Market Size and Share Forecast Outlook 2025 to 2035

5G technology market Analysis by Technology Type, Application, Vertical, and Region – Growth, trends and forecast from 2025 to 2035

8K Technology Market

Nanotechnology Photocatalysis Surface Coating Industry Analysis in AMEA Size and Share Forecast Outlook 2025 to 2035

Nanotechnology Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nanotechnology for food packaging Market

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Smart-Technology Anti-Wrinkle Peptides Market Size and Share Forecast Outlook 2025 to 2035

Laser Technology Market Size and Share Forecast Outlook 2025 to 2035

Green Technology And Sustainability Market Size and Share Forecast Outlook 2025 to 2035

Camera Technology Market Analysis – Trends & Forecast 2025 to 2035

Battery Technology Market Size and Share Forecast Outlook 2025 to 2035

Airline Technology Integration Market Size and Share Forecast Outlook 2025 to 2035

Food Biotechnology Market Size and Share Forecast Outlook 2025 to 2035

IO-Link technology Market Size and Share Forecast Outlook 2025 to 2035

Scaffold Technology Market Size and Share Forecast Outlook 2025 to 2035

Ablation Technology Market Size, Share, and Forecast Outlook 2025 to 2035

Sapphire Technology Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA