The retail glass packaging industry in the GCC is witnessing robust growth, driven by increasing demand for premium, recyclable, and sustainable packaging solutions across sectors such as food, beverages, personal care, and pharmaceuticals.

Key growth drivers include stringent government regulations promoting sustainability, rising consumer preference for eco-friendly packaging, and the region's expanding food and beverage sector.

Manufacturers are focusing on lightweight designs, enhanced durability, and decorative finishes to cater to premium product segments. Partnerships with leading beverage producers, luxury brands, and pharmaceutical companies are further accelerating market expansion.

Explore FMI!

Book a free demo

Summary

This analysis highlights the positioning of major players in the GCC retail glass packaging industry. Ardagh Group leads with innovative and recyclable glass solutions but faces challenges with high energy costs in the region. Verallia excels in decorative glass designs but struggles with scalability in GCC markets.

Middle East Glass focuses on regional customization and durable materials but encounters competition from international players. Opportunities lie in leveraging sustainability trends and expanding partnerships with local beverage and food brands, while threats include regulatory changes and material costs.

Ardagh Group

Ardagh Group demonstrates strengths in its innovative use of recyclable glass materials and decorative technologies. However, high energy costs remain a challenge in the GCC region. Opportunities include collaborations with luxury beverage and cosmetic brands. Threats stem from increasing competition and regional economic fluctuations.

Verallia

Verallia is known for its premium and decorative glass packaging, catering to luxury product segments. However, the company faces challenges in scaling operations within the GCC due to infrastructure constraints. Opportunities exist in expanding partnerships with premium food and beverage producers. Threats include rising operational costs and competitive pressures.

Middle East Glass

Middle East Glass excels in catering to local market demands with durable and cost-effective glass packaging solutions. However, it has limited technological advancements compared to international competitors. Opportunities include government support for local manufacturing. Threats arise from global competition and fluctuating raw material prices.

| Category | Market Share (%) |

|---|---|

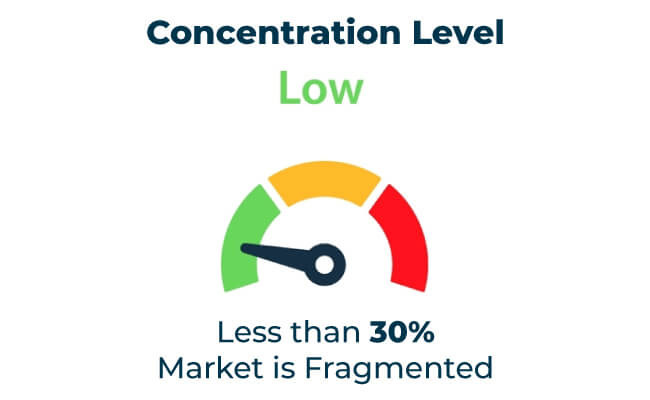

| Top 3 Players (Ardagh Group, Verallia, Middle East Glass) | 16% |

| Rest of Top 5 Players | 06% |

| Next 5 of Top 10 Players | 07% |

Type of Player & Industry Share (%)

| Type of Player | Market Share (%) |

|---|---|

| Top 10 Players | 29% |

| Next 20 Players | 45% |

| Remaining Players | 26% |

Year-on-Year Leaders

GCC governments are enforcing stringent regulations to promote sustainability and reduce plastic consumption. Initiatives supporting local manufacturing and sustainable practices create significant opportunities for the glass packaging industry.

Emerging markets in Africa and South Asia present significant growth potential for GCC-manufactured glass packaging. Affordable and high-quality glass packaging solutions are increasingly sought after in these regions to meet sustainability and branding requirements.

In-House vs. Contract Manufacturing

Regional dynamics are crucial in the GCC retail glass packaging industry. The UAE and Saudi Arabia lead in adopting premium and sustainable packaging, while smaller GCC countries show steady growth due to rising investments in manufacturing. Export opportunities to nearby regions further drive market expansion.

| Region | UAE |

|---|---|

| Market Share (%) | 40% |

| Key Drivers | Sustainability regulations and premium demand. |

| Region | Saudi Arabia |

|---|---|

| Market Share (%) | 35% |

| Key Drivers | Growth in food and beverage sectors. |

| Region | Other GCC |

|---|---|

| Market Share (%) | 25% |

| Key Drivers | Investments in local manufacturing. |

The GCC retail glass packaging industry will expand through material innovations, enhanced sustainability, and partnerships with regional brands. Companies focusing on lightweight, decorative, and energy-efficient designs will gain a competitive edge. Investment in recycling infrastructure will further accelerate adoption.

| Tier | Key Companies |

|---|---|

| Tier 1 | Ardagh Group, Verallia, Middle East Glass |

| Tier 2 | Frigoglass, Vidrala |

| Tier 3 | Consol Glass, Hindusthan National Glass |

The GCC retail glass packaging industry is poised for steady growth, driven by sustainability goals, regional manufacturing initiatives, and increasing demand for premium solutions. Companies prioritizing innovative, eco-friendly, and culturally tailored designs will lead this evolving market.

Key Definitions

Abbreviations

Research Methodology

This report is based on primary research, secondary data analysis, and market modeling. Insights were validated through industry expert consultations.

The retail glass packaging industry in GCC encompasses recyclable and premium glass solutions tailored for food, beverage, cosmetics, and pharmaceutical sectors.

Rising demand for sustainable and premium packaging solutions.

The market is projected to grow at a compound annual growth rate (CAGR) of 7.1%, reaching USD 1772.64 million by 2035.

Leading players include Ardagh Group, Verallia, and Middle East Glass.

Key challenges include high energy costs, fragility concerns, and logistical barriers.

Opportunities lie in material innovations, government support, and regional partnerships.

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.