The GCC Network Function Virtualization (NFV) market is poised for significant growth over the next decade, driven by increasing cloud adoption, rising demand for scalable telecom solutions, and the expansion of 5G networks across the region. The market is projected to reach USD 1,955.5 million in 2025 and is expected to expand at a CAGR of 25.8%, reaching USD 19,411.7 million by 2035.

Market Attributes and Growth Projections

| Attributes | Values |

|---|---|

| Estimated GCC Market Size in 2025 | USD 1,955.5 million |

| Projected GCC Market Size in 2035 | USD 19,411.7 million |

| Value-based CAGR from 2025 to 2035 | 25.8% |

Explore FMI!

Book a free demo

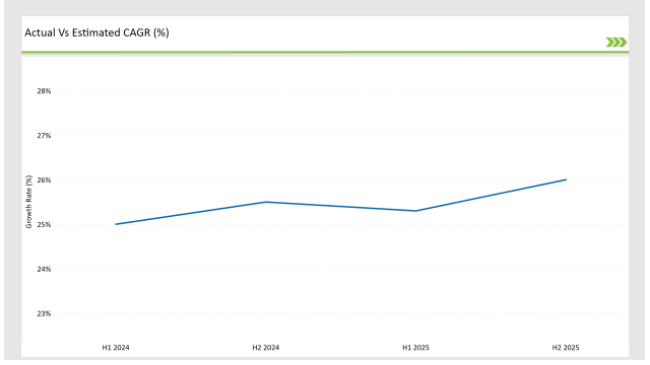

The table below outlines the semi-annual growth rate of the market, providing insights into industry trends.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 25.0% (2024 to 2034) |

| H2 2024 | 25.5% (2024 to 2034) |

| H1 2025 | 25.3% (2025 to 2035) |

| H2 2025 | 26.0% (2025 to 2035) |

The CAGR for the NFV industry in the GCC region shows moderate fluctuations. The market experienced a 50 BPS increase from H1 2024 (25.0%) to H2 2024 (25.5%), indicating growing confidence in the industry. However, a slight market adjustment led to a 20 BPS decline in H1 2025 (25.3%) before rebounding in H2 2025 (26.0%), reflecting renewed investment in virtualized network functions.

| Date | Development / M&A Activity & Details |

|---|---|

| Jan-25 | Etisalat partners with Cisco to enhance NFV infrastructure for cloud-based networking services. |

| Oct-24 | STC acquires a regional NFV provider to expand its presence in virtualized networking. |

| Mar-24 | Ooredoo deploys NFV-based solutions to improve its 5G rollout efficiency. |

| Sep-24 | Batelco announces an investment in AI-driven NFV solutions to optimize network performance. |

| Dec-23 | UAE Telecom Regulatory Authority introduces policies to promote NFV adoption across telecom sectors. |

5G Expansion Accelerating NFV Adoption

The NFV becomes one of the most required enablers for the handling of the 5G networks, facilitating their performance, scalability and economy. As 5G gains traction, telcos are implementing NFV-based architectures that deliver greater agility in service delivery and ease network operations. Telco NFV Use Cases in the Middle EastMajor Telco Providers like STC (Saudi Telecom Company), Etisalat, and Ooredoo are actively embracing NFV for:

The growth of mobile broadband penetration has created an ongoing need for NFV-based cellular network management. Telecom operators are adopting NFV as well in virtualized radio access networks (vRANs), making it possible to expand networks flexibly and cost-effectively in urban and rural areas.

NFV offers virtualization of network functions that previously relied on physical hardware and enables better performance and CapEx/Cuts while also improving 5G network resiliency.

Growing Demand for Cloud-Native NFV Architectures

The enterprises are shifting towards hybrid cloud and multi-cloud environments, there is a need for cloud-native NFV architectures for scalability, efficiency and automation. NFV facilitates an easy integration of cloud computing resources to organizations, which allows organizations to maintain the overall infrastructure while improving network flexibility. Industries like banking, healthcare, and manufacturing have implemented NFV-based solutions for real-time data analytics, automated IT infrastructure management, and software-defined networking (SDN).

Additionally, the application of AI and ML in NFV services is fueling predictive analytics which enables organizations to predict network congestion, security threats, and performance bottlenecks. Self-optimizing network functions powered by AI-driven automation capabilities minimizes manual intervention and operational costs for telco service providers.

With the rise of edge computing, the importance of NFV becomes evident as organizations find themselves needing to better distribute workload between cloud and edge, allowing for increased real-time processing capabilities for mission-critical applications.

Government Initiatives Supporting NFV Deployment

Telecom infrastructure powered by a micro service approach is being heavily invested upon by governments in the Middle East to align with their digital transformation and smart city goals, specifically in the UAE, Saudi Arabia and Qatar countries. Saudi Arabia Vision 2030, UAE Smart Dubai project and Qatar National Vision 2030 all rest on world-class telecom infrastructure for supporting IoT, AI and next-generation mobile connectivity. Such initiatives are driving demand for NFV-based virtualized networks, with seamless service delivery and economical infrastructure management.

Governments are also heading up public-private partnerships (PPPs) to encourage telecom virtualization and software-defined networking (SDN) initiatives, enabling telecom providers to embrace next-generation networking technologies with governmental support take Saudi Telecom Company (STC) as an example, working with global tech players to develop the 5G core networks based on NFV, which guarantees the agility and performance of the entire network.

Etisalat also boosted the capabilities of 5G coverage and enterprise connectivity services leveraging NFV on cloud-native network function in the UAE. Such government-led digital initiatives further drive the proliferated adoption of NFV solutions over a range of industries.

Security Concerns Driving NFV Innovation

Security challenges are becoming a major concern as such NFV adoption penetrates, paving the way for sophisticated security innovations in virtualized networks. With software-defined networking (SDN) and NFV-enabled cloud deployment becoming more common, networks are becoming more vulnerable to cyber threats, data breaches, and hacking. Telecom providers and NFV vendors are investing in the following to mitigate these risks:

Furthermore, the integration of automated security orchestration into NFV management platforms is facilitating the enforcement of security policies in real time and the ability to respond to threats instantly. This provides resiliency to NFV-powered networks from cyber threats and protects their mission critical applications and sensitive enterprise data. Conclusion: As NFV adoption continues to grow, so too does the critical need for effective cybersecurity measures that protect both service providers and their customers from an increasing array of threats.

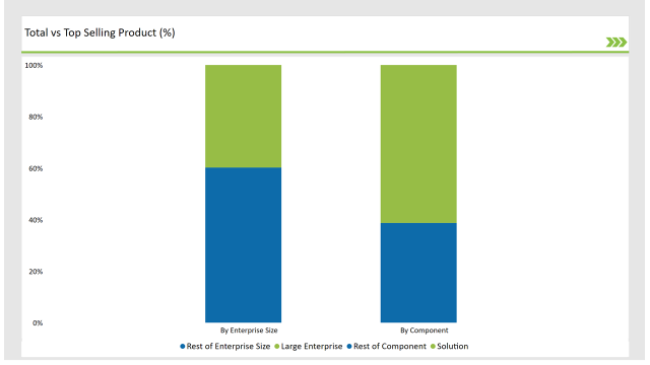

| Type | Market Share (2025) |

|---|---|

| Solution | 61.3% |

| Services | 38.7% |

| Enterprise Size | Market Share (2025) |

|---|---|

| Large Enterprise | 39.8% |

| Others | 60.2% |

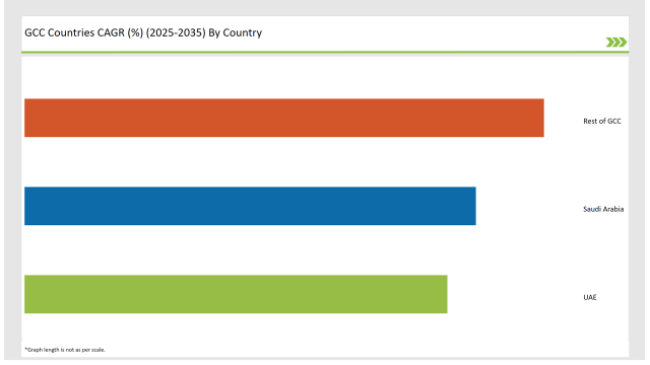

| Countries | CAGR |

|---|---|

| Saudi Arabia | 28.5% |

| UAE | 26.7% |

| Rest of GCC | 32.8% |

The Saudi Arabia Network Function Virtualization (NFV) market is driven by the ongoing Vision 2030 initiative which encourages a shift towards digitalization and smart infrastructure. The aggressive rollout of 5G by the country’s three main carriers — STC, Mobily and Zain - is boosting demand for virtualized network functions to increase efficiency and scalability of the networks.

NFV adoption is being propelled further by the government's push for smart cities, such as NEOM and the Riyadh digital twin projects. Cloud-based NFV solutions are also backed by investments in cloud computing companies, such as Google Cloud, Oracle, and Huawei Cloud.

NFVs are also supported by the increased enterprise virtualization, emergence of edge computing, and deployment of AI-driven network automation in Saudi Arabia, generating a vital market for NFV to provide cost-benefit, agile, and scalable telecom networks.

Advanced ecosystem of telecom sector and smart city developments has fueled rapid expansion of NFV market in the UAE. 5G deployments for Etisalat and du are already leading the charge on virtualization using NFV to deliver scalable and high-performance network functions.

The United Arab Emirates’ (UAE) digital economy strategy advancements would foster Ultra-Light and virtualized network infrastructure enabling cloud-native 5G services, IoT applications and enterprise connectivity solutions. The country’s development of smart cities, like Dubai’s Smart City 2025 initiative and Abu Dhabi’s AI-enabled infrastructure, will require flexible, software-defined networks, which also drives NFV demand.

In addition, NFV adoption is also being driven by cloud computing investments from Microsoft Azure, AWS, and Google Cloud, enabling low-latency, software-based network management for enterprises and telecom operators.

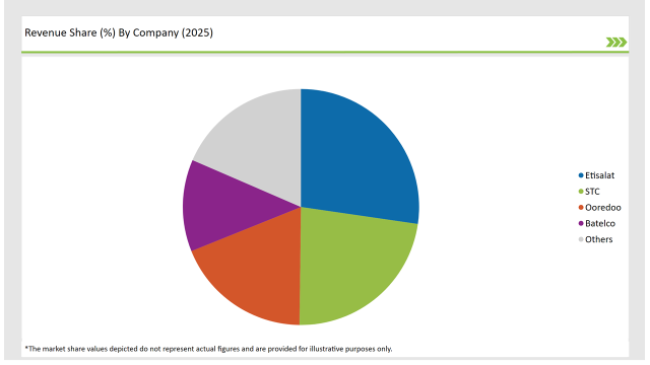

The GCC Network Function Virtualization (NFV) market is highly competitive, with several key players investing in innovation and expansion.

| Vendors | Market Share (2025) |

|---|---|

| Etisalat | 27.3% |

| STC | 22.9% |

| Ooredoo | 18.7% |

| Batelco | 12.6% |

| Others | 18.5% |

The GCC NFV market will grow at a CAGR of 25.8% from 2025 to 2035.

The industry is projected to reach USD 19,411.7 million by 2035.

Major growth drivers include 5G expansion, cloud transformation, and digitalization initiatives.

UAE and Saudi Arabia lead in NFV deployment, driven by advanced telecom infrastructure and smart city projects.

Etisalat, STC, Ooredoo, and Batelco dominate the GCC NFV market.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.