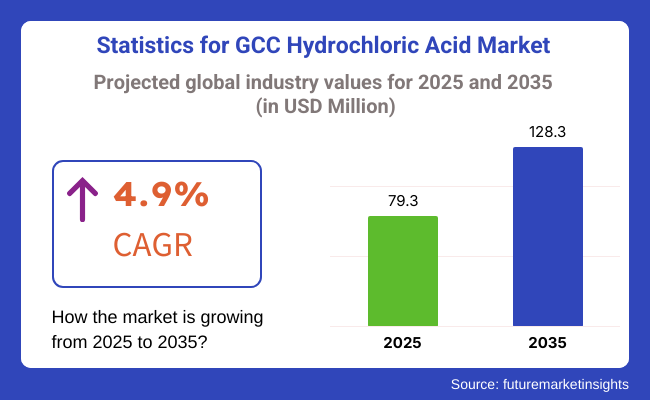

The GCC hydrochloric acid market is set to register USD 79.3 million in 2025. The industry is poised to observe USD 128.3 million by 2035, by witnessing 4.9% CAGR from 2025 to 2035.

The main factor behind the growth is the product’s wide application in the industrial field as well as the increasing need from the oil and gas industry and its utilization in water treatment and chemical processing. HCL is a chemical extensively used in oil well acidizing, steel pickling, food processing, pharmaceuticals, and wastewater treatment. The strong oil and gas sector in the GCC bolsters the demand for HCL in petrochemical refining and operation in the EOR (enhanced oil recovery).

Moreover, desalination and industrial water treatment plants have constantly been employing the product for the prevention of scale and regulation of pH, which, in turn, leads to a hike in the industry demand. For instance, Saudi Aramco and ADNOC regularly apply HCL-based solutions during the oil extraction process.

The requirement for using high-purity acid in the metal industry, construction chemicals, and the electronics sector is on the rise due to the rapidly developing industrialization, the establishment of new factories, and the booming infrastructure sector.

The GCC’s intention to decrease its reliance on oil has also spilled into HCL's use as a production medium in chemicals and specialty chemicals. Despite these opportunities, challenges remain, especially the corrosivity of the product, which demands special handling requirements like storage, transport, and others.

Further, environmental and workplace safety laws in the GCC are tough, therefore, the manufacturers spend a lot of money complying with them, which results in limitations in the disposal of the acid and controlling emissions. Another key barrier is the efficient bulk logistics for shipping the product from the refineries to the industrial clusters. In spite of these obstacles, there is enormous potential growth especially for the oil and gas sector. The continued investments in oil exploration and drilling activities within the GCC region are driving the demand for the product in well stimulation, acid fracturing, and enhanced oil recovery (EOR).

Explore FMI!

Book a free demo

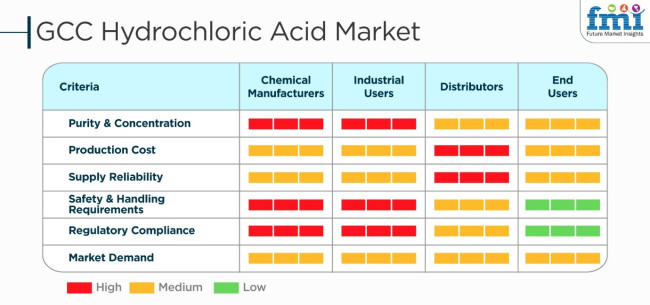

The GCC hydrochloric acid market report also provides glimpse into other market notables such as distribution channels, market performance of companies, and industry related market analysisfor chemical manufactures, industrial users, distributers and end user, which indicates similar nature of priorities.

Distributors, on the other hand, see production cost and supply reliability as must-have criteria (red) since their goal is to procure in a cost-efficient way and keep steady supply chains to meet thedemand. Their role is mainly about controlling distribution efficiency andmaintaining a healthy stock in the market (yellow, medium): purity is somewhat less important to them.

End users (e.g., businesses that use hydrochloric acid in industrial applications) have theirown set of priorities. One of their lowest priorities (green) are regulatory compliance and the safety andhandling requirements of products, meaning that these are concerns handled upstream by manufactures and suppliers. While they care about purity, they place much more weight, in their equation, on market demand, production cost, and supply reliability (medium, yellow) because they need cheap andreadily available hydrochloric acid to help run their facilities.

The GCC hydrochloric acid market between 2020 and 2024 grew steadily due to the increasing demand from industries such as water treatment, chemicals, steel production, and oil & gas. In addition, the increased growth in desalination plants and wastewater treatments has significantly increased consumption, while the use of the product in oil recovery and refining operations has placed it in the oil and gas industry. Nonetheless, industry stability was derailed by supply chain interruptions and volatile raw material prices, leading to investment in domestic manufacturing to mitigate dependence on imports.

Between 2025 and 2035, the industry will be spurred on by advances in acid recovery technology, sustainability trends, and GCC industrial diversification. The hydrogen production and green chemistry influence will affect the use of the product; however, stricter environmental regulations will compel even industries to undertake safer handling and disposal practices. Development of the alternative acid solutions in oil & gas may create a potential impact on the demand, thereby providing a sounder and more resilient industry scenario.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments enforced environmental guidelines on industrial HCL emissions and chemical handling. Adoption of ISO 14001-certified practices became common in manufacturing facilities. | Stricter environmental policies drive the adoption of carbon-neutral and energy-efficient HCL production. Integration of hydrogen chloride recovery systems and green acid production in industries. |

| HCL was extensively used in well-stimulation, acid fracturing, and crude refining. Rising oil prices increased demand for acidizing fluids in enhanced oil recovery (EOR). | Sustainable drilling technologies and CO₂ reduction mandates encourage alternative acidizing solutions. HCL demand shifts toward lithium refining and green hydrogen production. |

| HCL was of primary importance in pH adjustment, scale removal, and chemical dosing in Saudi Arabian, UAE, and Qatari desalination plants. | Growth in advanced membrane desalination and wastewater recycling enhances the need for ultra-pure acid in water treatment. |

| The product was utilized by steel pickling and galvanizing industries for purging impurities and surface preparation of metals. Rising infrastructure projects fueled demand. | Smart steel production and low-carbon construction practices promote acid regeneration and HCL recycling systems in steel plants. |

| Adoption of electrochemical HCL synthesis and automation in acid handling and transport improved safety and efficiency. | AI-driven process optimization and blockchain-enabled acid tracking systems improve production efficiency and sustainability. Growth of solid-state acidification technologies. |

| Growth fueled by oil & gas acidizing, desalination, and industrial processing. Expansion of petrochemical and construction projects increased HCL demand. | Industry expansion was driven by sustainable industrial applications, lithium-ion battery refining, and AI-integrated chemical manufacturing. GCC nations strengthen downstream chemical processing hubs. |

The main risk in the Gulf region hydrochloric acid (HCL) market is the dependence on raw materials. The product is often created as a by-product in many industrial processes, such as chlor-alkali production. Essential industries, such as the chlor-alkali, could be disrupted due to supply chain bottlenecks and regulatory changes that would affect HCL availability and pricing.

Regulatory compliance is a major part of this industry. The product is categorized as a hazardous chemical, hence it is subject to strict control over its handling, transport, and storage. This means that any non-compliance with GCC legal frameworks, like REACH-like requirements in the UAE or Saudi FDA regulations, will have consequences such as fines, operational suspension, or disruption of the supply chain.

The environmental and safety issues are also considerable. HCL is extremely corrosive, leaving the potential of having leaks, spills, and serious ergonomic hazards. Companies would need to invest in proper containment, personal protective equipment, and having emergency response plans in place so as to minimize accidents and ensure business continuity.

Market volatility and demand instability are also the challenges. The product is required in various sectors, including but not limited to the oil and gas industry, water treatment plants, and steel production. Demand can be affected, for example, by economic slowdowns, while other issues like geopolitical situations or industry-specific downturns would result in price instability and over-supply.

Careful evaluation is necessary of the suppliers' financial standing and trustworthiness and also of their shipping and storage systems. The product is a bulk chemical that needs well-planned transportation and storage logistics. A situation where a company relies on few suppliers or has logistical problems often leads to disruptions in the supply chain. Companies should embark on multiple sourcing and enter into long-term agreements with diverse suppliers.

In the GCC hydrochloric acid market, pricing strategies should consider production costs, market demand, and regional competition. HCL, being a commodity chemical, its price is largely determined by the cost of raw materials, logistics, and fluctuations in the global chemical industry. A well-thought-out plan will ensure profitability without affecting competitiveness.

Cost plus pricing is a common plan in this case, where a pre-determined profit margin is included in production costs. This way the company guarantees its consistent profit, more so with the constant fluctuations in raw material prices. On the other hand, in markets where cost is the main target for the customer and suppliers' variations in offer should be cheap, this may be counterproductive.

Dynamic pricing is another option that hinges on real-time industry conditions. For instance, when the rate of sales is all driving the oil and gas sectors to a higher standard of living, then the price can be raised to the level that leads to the most profits. In turn, at the time when the economy is not down turning, price adjustments to do competition may be needed to counter customers leaving and the industry share drop.

Competitive pricing is a significant factor in the Gulf where companies are vying for the business of many industrial users, from the cost standpoint. Selling in bulk with a discount, long-term commitments, or various additional services like storage that is handy and can be adapted are great advantages of the pricing method used.

Penetration pricing is a tactic that is employed when the launch of new products is targeted at new customer segments, or the distribution network is expanded. A company will give the big industrial customers lower prices to enter the new market, thus it will gain the position. However, thoughtful planning is needed to ensure that the company makes profits in the long run and that the low-margin sales do not become non-sustainable.

Synthetic grade acid is the most commonly used in the GCC region because it has high purity as well as wide usage in industrial processes, water treatment, and oil & gas industries. The GCC nations of Saudi Arabia, UAE, and Qatar emphasize petrochemical refining, metal processing, as well as chemical production, where synthetic grade HCL finds vital uses. Its high purity and controlled constitution make it critical to acidize oil wells, a critical process in the oil and gas production industry in the region.

Due to the GCC region being heavily reliant on the oil and gas industry, oil well acidizing is thekey application segment. The product specifically is widely used in well stimulation due to its abilityto dissolve carbonate formations, which helps remove obstructions in oil and gas reservoirs, ultimately increasing the productivity of wells. The GCC region, home to several of the world’s largest oil producers namely Saudi Arabia, UAE and Kuwait, continue to prioritize EOR processes to maximize the extractionof oil from both mature fields and non-conventional reservoirs.

With limited natural freshwater resources, water treatment is an important industry that employs the product in the GCC. HCL is extensively used in desalination plants, which provide much of the region's drinking water. It is used for pH control, membrane cleaning, and scale removal to ensure the efficiency of reverse osmosis and thermal desalination systems. With increasing population needs, desalination capacity increases, and the application of HCL in water treatment increases as well.

| Country | CAGR (%) (2025 to 2035) |

|---|---|

| Saudi Arabia | 4.9% |

| U.A.E. | 4.7% |

| Qatar | 4.8% |

| Kuwait, Oman & Bahrain (Rest of GCC) | 4.6% |

The Saudi Arabian industry is witnessing steady growth with increased industrial applications, increased oil & gas production, and increased demand from the chemical industry and water treatment industry. In the petrochemical and oil refining business, Saudi Arabia widely employs the product in well stimulation, descaling, and refining operations.

Apart from that, growth in Saudi construction and steel industry is primarily propelling the product demand for pickling and cleaning the steel surface. The nation is among the world's largest proven oil reserves and is a major contributor to enhanced oil recovery (EOR) operations like well acidizing where the product is an essential ingredient.

FMI states that the Saudi Arabian hydrochloric acid market will be growing at a 4.9% CAGR throughout the study period.

Growth Drivers in Saudi Arabia

| Drivers | Reason |

|---|---|

| Oil & Gas Drilling and Refining Increase | Ride increased demand for the product in oil & gas well acidizing and refinery operations. Industry growth is being fueled by Saudi Aramco investments in oil & gas projects. |

| Expansion in Water Treatment & Desalination Plants | Surging demand for application in water treatment and pH correction, fueled by Saudi Vision 2030's thrust towards sustainability. |

| Steel & Construction Industry Growth | Surging applications in metal pickling and surface treatment owing to urbanization and infrastructure growth at a fast pace. |

The UAE hydrochloric acid market is moving forward consistently in the light of increasing industrialization, increasing water treatment facilities, and increments in oil refining and chemical manufacturing. The nation's emphasis on sustainable energy and infrastructure development growth has stimulated demand for hydrochloric acid applications in steel processing, industrial cleaning, and desalination facilities.

With the UAE becoming a regional petrochemical and manufacturing hub, the product finds more applications in acidizing oil wells, regeneration of catalysts, and adjustment of pH during chemical synthesis. UAE desalination capacity of close to 42% of the GCC total capacity is a key among hydrochloric acid demand drivers.

The UAE industry will expand at a 4.7% CAGR during the forecast period, estimates FMI.

Growth Drivers in the UAE

| Key Drivers | Detail |

|---|---|

| Oil Refining & Petrochemical Industry Growth | Increased demand owing to increased use of the product for chemical treatment and catalyst regeneration. ADNOC downstream investment drives demand. |

| Water Desalination & Industrial Waste Treatment | Growing application in pH balancing and purification, with the UAE depending on 90% of its drinking water to be desalinated. |

| Steel & Metal Processing Industry Growth | Growing applications of acid pickling and surface treatment to facilitate infrastructure and construction activities. |

Desalination and wastewater treatment in Qatar are stimulating the product use for purification and neutralization. Qatar's energy industry, i.e., natural gas production, applies the product in petrochemical refining and well acidizing. Infrastructure projects on a large scale are being funded in Qatar even before the implementation of economic diversification projects based on Qatar National Vision 2030. As per FMI, the industry in Qatar is set to expand at 4.8% CAGR during the study period.

Growth Drivers in Qatar

| Key Drivers | Detail |

|---|---|

| Expansion of Oil & Gas Industry | Expansion of application of the product for acidizing wells and chemical treatment in the world's leading LNG exporter. |

| Expansion of Water Treatment & Desalination | High dependence on desalination to supply freshwater supply, thus pushing the product demand. |

| Expansion of Steel & Manufacturing Industry | Expansion of demand for acid pickling and metal surface treatment in industrial processes. |

| Fertilizer & Chemical Industry Expansion | Application in chemical production and pH balancing in industrial chemicals and fertilizers. |

| Infrastructure Development & Smart City Plans | The product is used in industrial scale infrastructure development projects for material treatment and industrial cleaning. |

The Omani, Bahraini, and Kuwaiti hydrochloric acid industry is expanding with industrial diversification, increasing oil & gas activity, and increasing desalination projects. With continuous refinery upgradation and expansion in chemical production, hydrochloric acid uses in catalyst rejuvenation, pH balancing, and industrial cleaning are increasing.

The GCC focus on water sustainability has triggered broad investment in desalination and wastewater treatment, thereby creating a safe hydrochloric acid industry demand for softening and treating water. Expanding development in industrial parks, fertilizer plants, and steel processing plants is further boosting the growth of the industry.

Growth Drivers in Kuwait, Oman & Bahrain

| Growth Drivers | Description |

|---|---|

| Oil Refining & Chemicals Production Growth | Increased refining capacity and corresponding hydrochloric acid demand through oil refining, and catalyst regeneration. |

| Faster Desalination & Water Treatment Plants | Strong demand for the product for pH adjustment and purification purposes. |

| Steel & Construction Operations | New application in metal pickling and surface treatment due to emergence of industrial infrastructure. |

GCC hydrochloric acid market is witnessing tough competition on the premise of burgeoning industrial application areas such as oil and gas, water treatment, chemical process development, steel pickling, and food production. Companies in this industry align themselves with the chlorine manufacturing segment, ensuring a stable supply chain and cost efficiency. In addition to this, those leading the industry are inclined towards capacity installation increase and strategic distribution networks to meet an increasing demand that is particularly growing in Saudi Arabia, the UAE, and Qatar due to boosts in the petrochemical activities and desalination projects increasing HCL consumption.

Usually, the companies in this space are differentiated through logistical efficiency, production scalability, or regulatory compliance. Enhanced oil recovery (EOR), industrial pH control, and metallurgy have led to the burgeoning procurement of the product and consequently prompted the manufacturers to develop a stronger industry for downstream applications. As the race heats up, companies investing in new technology, sustainable production practices as well as supply chain resilience will enjoy the long-term competitive advantage in the GCC region.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Saudi Basic Industries Corporation (SABIC) | 15-18% |

| Qatar Petrochemical Company (QAPCO) | 12-14% |

| Gulf Chlorine W.L.L. | 8-10% |

| Oman Chlorine S.A.O.G. | 5-7% |

| Unipar LLC (UAE) | 3-5% |

| Other Companies (combined) | 48-57% |

| Company Name | Key Offerings/Activities |

|---|---|

| Saudi Basic Industries Corporation (SABIC) | Produces high-purity acid for petrochemical, water treatment, and metal processing industries, focusing on integrated chlorine production. |

| Qatar Petrochemical Company (QAPCO) | Manufactures industrial-grade HCL for oil well stimulation, pH control, and chemical processing, serving regional and export markets. |

| Gulf Chlorine W.L.L. | Supplies HCL for industrial applications, including water desalination and petrochemical refining, with a focus on cost-efficient bulk production. |

| Oman Chlorine S.A.O.G. | Develops hydrochloric acid solutions for metal pickling, wastewater treatment, and oilfield services, ensuring high-purity formulations. |

| Unipar LLC (UAE) | Provides the product for food processing, pharmaceuticals, and industrial cleaning, complying with strict GCC regulatory standards. |

Saudi Basic Industries Corporation (SABIC)

SABIC is a regional GCC leader in the product manufacturing high-purity HCL used to refine petrochemicals, treat water, and synthesize chemicals. The firm offers chlor-alkali manufacturing, together with its wide network of petrochemicals, at optimized cost-savings and secured supply.

Qatar Petrochemical Company (QAPCO)

QAPCO is one of the world's largest manufacturers of the product and distributes it mainly for oil well acidizing, pH control, and industrial chemical business. QAPCO is positioned strategically with good export prospects to be the industry leader in GCC and world markets.

Gulf Chlorine W.L.L.

Gulf Chlorine is a specialist in industrial hydrochloric acid solutions, catering to water desalination plants, industrial processing, and petrochemical refining. The company’s bulk production and competitive pricing strategy make it a preferred supplier for large-scale industrial users.

Oman Chlorine S.A.O.G.

Oman Chlorine manufactures the product for metal pickling, water treatment, and oil & gas applications. The company’s focus on high-purity acid production ensures its suitability for specialized industries, including pharmaceuticals and industrial cleaning.

Unipar LLC (UAE)

Unipar LLC supplies the product for food processing, medical, and industrial applications, ensuring compliance with strict safety and quality standards. The firm is focused on sustainable manufacturing and regulatory adherence, serving pharmaceutical and food-grade uses in the GCC region.

Other Key Players

The industry is set to witness USD 79.3 million in 2025.

The industry is predicted to reach a size of USD 128.3 million by 2035.

Key companies include Al Kout Industrial Projects Co., AL Ghaith Industries L.L.C, Union Chlorine LL, BCI Groups, Sachlo, Saudi Basic Industries Corporation (SABIC), Oman Chlorine S.A.O.G., Unipar LLC (UAE), Nama Chemicals, Dub Chem, Muscat Chemical Industry, Gulf Chlorine WLL, Qatar Petrochemical Company, and KLJ Organic Qatar W.L.L.

Synthetic grade is being widely used.

Saudi Arabia, slated to grow at 4.9% CAGR during the study period, is poised for fastest growth.

In terms of grade, the industry is divided into synthetic grade and product grade.

Key applications include oil well acidizing, food processing, steel pickling, ore processing, pool sanitation, calcium chloride production, and others.

The industry serves industries such as petroleum, food & beverages, mining, steel, textile, water treatment, chemical industry, and others.

The industry spans the United Arab Emirates, the Kingdom of Saudi Arabia, Kuwait, and the rest of the GCC.

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Asia Pacific Industrial Solvents Market Growth - Trends & Forecast 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Growth - Trends & Forecast 2025 to 2035

Diamond Wire Market Size & Outlook 2025 to 2035

Thioesters Market Growth & Trends 2025 to 2035

The Self-Healing Materials Market is segmented by product, technology, and application from 2025 to 2035.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.