The GCC wireless telecommunication services industry is projected to reach a market value of USD 85,650.6 million in 2025, growing steadily at a CAGR of 8.3%, and reaching USD 1,89,238.6 million by 2035.

| Attributes | Values |

|---|---|

| Estimated Industry Size 2025 | USD 85,650.6 million |

| Projected Industry Size 2035 | USD 1,89,238.6 million |

| Value-based CAGR 2025 to 2035 | 8.3% |

The industry is driven by growing adoption of 5G networks, IoT devices penetration and government-supported digital transformation initiatives. As demand for seamless wireless connectivity is increasing in BFSI, healthcare, and retail.

In fact, some of the world's richest countries like Saudi Arabia, UAE and Qatar who have made significant investments in building up of digital infrastructure and see wireless connectivity as creating the foundation of their economy.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

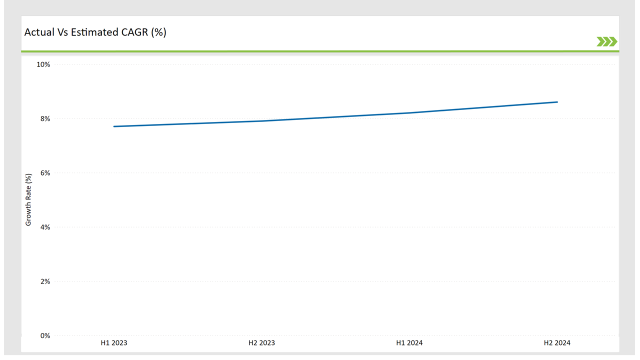

The table below highlights the compound annual growth rate (CAGR) of the GCC wireless telecom sector over semi-annual periods.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 7.7% |

| H2, 2024 | 7.9% |

| H1, 2025 | 8.2% |

| H2, 2025 | 8.6% |

H1 signifies January to June, while July to December analysis is signified through H2.

The sector is expected to maintain stable expansion, from 7.7% CAGR in H1 2024 to 8.6% CAGR in H2 2025, supported by the adoption to accelerate 5G, improving telecom services in the cloud, and rising enterprise demand for digital solutions.

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-25 | STC launched 5G-powered enterprise solutions in Saudi Arabia. |

| Oct-24 | Etisalat partnered with Microsoft to expand cloud services for businesses in UAE. |

| Mar-24 | Ooredoo Qatar unveils a new 5G Edge Computing Platform for industries. |

| Sep-24 | Zain Kuwait acquired a local broadband service provider to expand rural connectivity. |

| Dec-23 | TRA Bahrain introduced a new policies for small telecom operators to enhance competition. |

5G Revolutionizes Connectivity

Across Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, and Oman, 5G is revolutionizing the wireless telecommunications landscape. Telcom giants STC, Etisalat, Ooredoo, and Zain are expanding 5G infrastructure to enable ultra-fast speeds and low latency for next-gen apops. Key benefits include:

Cloud Services Dominate the Market

The growing cloud security and real-time communications, cloud-based telecom services are adopting much faster across GCC markets, particularly in the BFSI, healthcare, and IT segments. Cloud-based managed services are forecast to grow at a 8.0% CAGR, outstripping traditional telecom services.

IoT and Smart Cities Expand Opportunities

Wireless connectivity is in demand as governments in the GCC invest in smart city projects:

Investments in Rural Connectivity Increase

Massive investments in high-speed wireless infrastructure are closing the broadband gap in rural communities. Ooredoo, Zain and STC are expanding their 4G and 5G services to underserved regions to support digital inclusivity.

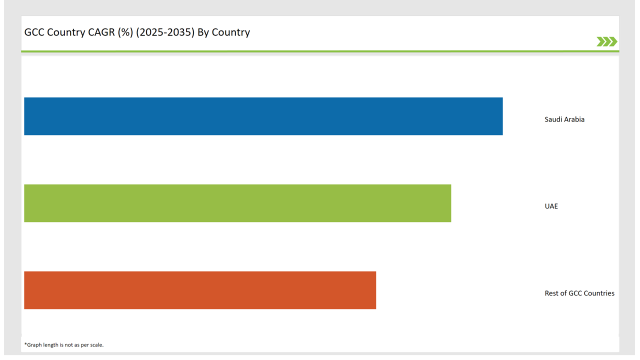

The following table shows the estimated growth rates of the market. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market CAGR |

|---|---|

| Saudi Arabia | 10.2% |

| UAE | 9.1% |

| Rest of GCC Countries | 7.5% |

STC and Mobility also increase 5G coverage and invest in fiber-optic infrastructure as wireless telecommunication market expands in Saudi Arabia. Vision 2030 is another factor propelling demand for moving to the cloud and adopting IoT solutions, as the government continues to push digital transformation. Telecom projects are financed by the Public Investment Fund (PIF) and regulatory bodies invite foreign investments. AI in the Enterprise: AI-driven Connectivity Solutions Boosting Wireless Demand Adopting these techniques, Telecom operators are expanding their networks to rural areas, which are expected to boost accessibility and strengthen market expansion.

Etisalat and du further build upon 5G infrastructure and implement AI-driven network optimizations. The government pushes forward the initiative of Dubai being a Smart City, further increasing the demand for super-fast wireless services.

Mobile subscriptions are driven by tourists and expatriates, while enterprises invest in respectively IoT and private 5G. The global telecom players were attracted by favorable regulatory policies and financial incentives. The fintech, autonomous Transport and Industrial automation grows with the help of High-speed Connectivity ensuring the market has never gone back.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

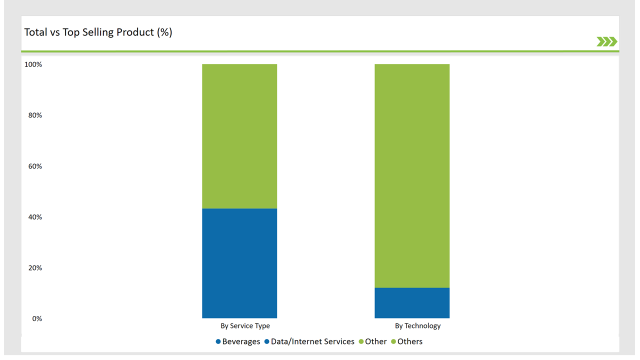

| Service Type | Market Share (2025) |

|---|---|

| Data/Internet Services | 43.2% |

| Fixed Voice Services & Messaging | 20.1% |

| Telecom Managed Services | 18.5% |

| Cloud Services | 18.2% |

Data/Internet Services hold the largest market share due to the increasing demand for high-speed internet in households and businesses. The rise of remote work, online education, and content streaming further drive this segment’s dominance.

| Technology | Market Share (2025) |

|---|---|

| 3G | 12.0% |

| 4G | 50.0% |

| 5G | 38.0% |

3G usage is gradually declining as telecom providers phase out older networks in favor of faster technologies. However, it still holds a small share in rural and underserved areas.

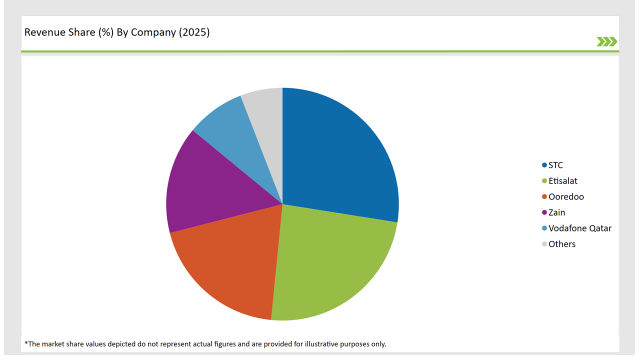

The GCC wireless telecom market is highly competitive and the major giants are STC, Etisalat, Ooredoo, Zain and Vodafone Qatar. The investment in digital transformation and build strategic partnerships to lead the market.

| Vendors | Market Share (2025) |

|---|---|

| STC | 28.0% |

| Etisalat | 24.5% |

| Ooredoo | 19.8% |

| Zain | 15.2% |

| Vodafone Qatar | 8.3% |

| Others | 6.0% |

Data/internet services, fixed voice services & messaging, telecom-managed services, and cloud services dominate. Data services lead due to high-speed internet reliance.

The market spans 3G, 4G, and 5G technologies. The rapid shift from 4G to 5G highlights growing connectivity and smart device usage.

BFSI, healthcare, retail & eCommerce, IT & telecom, travel & hospitality, and government are key industries. BFSI and healthcare dominate, needing robust wireless solutions.

The market will poised at a CAGR of 8.3% from 2025 to 2035.

By 2035, the industry will reach USD 1,89,238.6 million.

5G adoption, IoT integration, smart city development, and cloud-based telecom solutions.

Saudi Arabia and UAE lead wireless telecom adoption due to urbanization and technology-driven economies.

Major players include STC, Etisalat, Ooredoo, Zain, and Vodafone Qatar.

Explore Semiconductors Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.