The GCC Tower Mounted Amplifier (TMA) market is projected to reach a market value of USD 414.5 million in 2025 and grow steadily at a CAGR of 7.0%, reaching USD 815.5 million by 2035.

Market Attributes and Growth Projection

| Attributes | Values |

|---|---|

| Estimated GCC Market Size in 2025 | USD 414.5 million |

| Projected GCC Market Size in 2035 | USD 815.5 million |

| Value-based CAGR from 2025 to 2035 | 7.0% |

The GCC Tower Mounted Amplifier market is driven by the factors such as escalating investments in telecom infrastructure, urbanization, and the rollout of fifth generation (5G) cellular networks in the region. Factors such as rapidly increasing mobile data traffic and demand for better network coverage in urban and rural areas help drive the market.

The introduction of Next Gen wireless technologies by telecom operators and Infrastructure providers is expected to provide new opportunities for growth of single-band and multi-band TMAs. They are essential for reducing noise, optimizing data transmission, and maintaining high-quality communications, especially in urban settings and rural environments.

Explore FMI!

Book a free demo

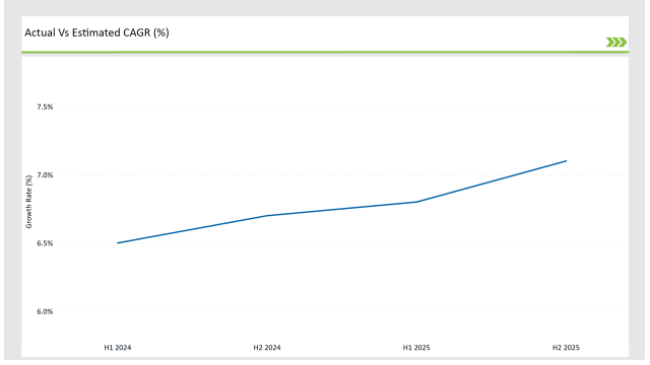

The table below illustrates the semi-annual growth trends in the GCC Tower Mounted Amplifier market, highlighting the gradual acceleration in demand.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 6.5% (2024 to 2034) |

| H2, 2024 | 6.7% (2024 to 2034) |

| H1, 2025 | 6.8% (2025 to 2035) |

| H2, 2025 | 7.1% (2025 to 2035) |

H1 refers to January to June, while H2 represents July to December

The steady rise in CAGR from 6.5% in H1 2024 to 7.0% in H2 2025 indicates strong investment in telecom infrastructure upgrades and the increasing adoption of digital communication networks in the GCC region.

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-25 | Etisalat UAE expands its 5G coverage by deploying advanced TMAs. |

| Oct-24 | STC (Saudi Telecom Company) partners with Ericsson to develop next-gen tower amplifiers. |

| Mar-24 | Ooredoo Qatar launches high-efficiency TMAs to support its nationwide 5G rollout. |

| Sep-24 | Batelco Bahrain integrates digital TMAs to enhance network coverage in rural areas. |

| Dec-23 | du (UAE) announces a collaboration with Huawei to modernize its network with digital amplifiers. |

Major telecom providers are prioritizing partnerships and technology to optimize signal quality, boost network efficiency, and minimize power consumption through tower-mounted amplifiers. Such moves are obsolete of strategic importance and poised to enhance mobile connectivity and integration throughout the region for consumers and businesses alike.

5G Expansion Driving Market Growth

The growing number of high-performance tower-mounted amplifiers is supported by the recent increase of 5G networks. 5G deployments are supported by telecom operators such as STC, Etisalat, and Ooredoo, which in turn will drive demand for multi-band TMAs that improve signal coverage and data transmission rates.

Digital TMAs Transform Network Efficiency

The TMAs and digital TMAs become increasingly popular with their better filtering and signal processing capability as well as better power efficiency compared to analog TMAs. Telecom operators shift to digital TMAs; to optimize bandwidth, decrease energy consumption, and lead to more sustainable and cost-effective networks.

Rural and Remote Connectivity Initiatives

GCC governments and telecom operators are focused on Rural connectivity investments to bridge the digital divide. TMAs are essential to network coverage for desert, hilly, and low-density population areas, which are difficult to achieve using traditional network infrastructure.

Infrastructure Providers' Strategic Role

For the infrastructure providers, Huawei, Ericsson and Nokia are working with telecom operators in deploying intelligent TMAs that improve network resilience, responsible for lowering latency and supporting even higher traffic for mobile data services and IoT applications.

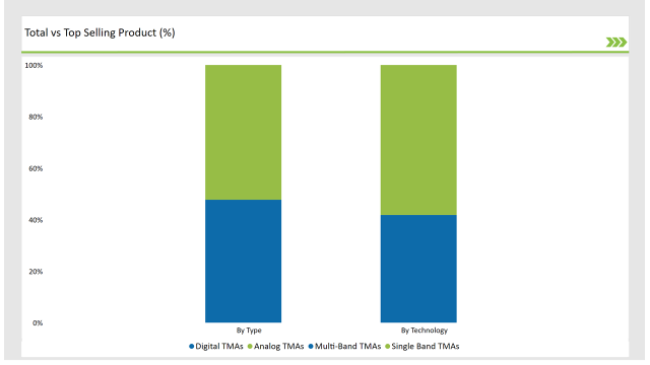

| Type | Market Share (2025) |

|---|---|

| Single Band TMAs | 52.3% |

| Multi-Band TMAs | 47.7% |

Single-band TMAs continue to dominate due to their lower cost and widespread use in existing 4G networks, while multi-band TMAs are gaining traction as telecom providers transition to 5G.

| Technology | Market Share (2025) |

|---|---|

| Analog TMAs | 58.2% |

| Digital TMAs | 41.8% |

Analog TMAs still hold the majority share due to their affordability and compatibility with legacy networks, but digital TMAs are expected to grow rapidly as telecom providers modernize their infrastructure.

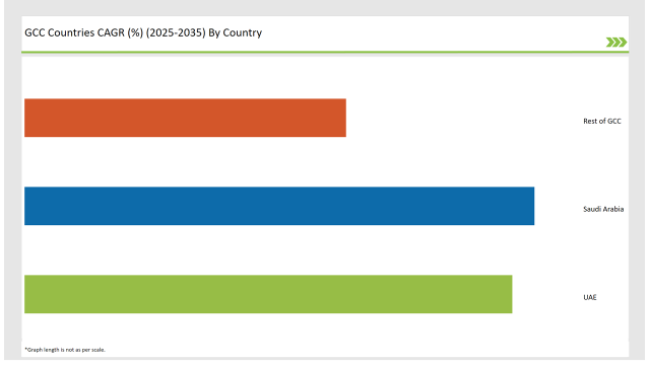

| Countries | CAGR |

|---|---|

| Saudi Arabia | 9.2% |

| UAE | 8.8% |

| Rest of GCC | 5.8% |

Advancements across verticals within and outside of the telecom segment have driven demand for tower-mounted amplifiers (TMAs), with Saudi Arabia's rapid deployment of 5G networks being a key driver. To ensure quality of coverage and minimum signal loss in high frequency bands, a large number of telecom operators are pouring investment into network infrastructure such as STC, Mobily.

Digital transformation is being accelerated by Vision 2030, effectively supporting telecom investments. Increasing number of global vendor partnerships for advanced radio access technologies support TMA adoption. The market is also driven by the government push for smart cities and expansion in IoT. As more spectrum allocates and infrastructure upgrades, the country’s TMA market will continue to grow.

The UAE’s rapid 5G deployment in the hands of first movers such as Etisalat and du adds to the demand for tower-mounted amplifiers. Stirring telecom infrastructure investments - prompted by the government's keen interest in smart city projects, indubitably, in connection with the legacy developments of the Expo 2020 Dubai. Urban centers operate under high data traffic and operate increasingly on wireless communication, which warrants advanced TMA solutions.

Moreover, partnerships with global technology providers optimize network performance and expand coverage. The UAE's regulatory framework innovation in telecom fuels the market growth at a faster pace. As the country makes further investments into network expansion and modernization, it is the single biggest market for TMA players and ecosystem suppliers.

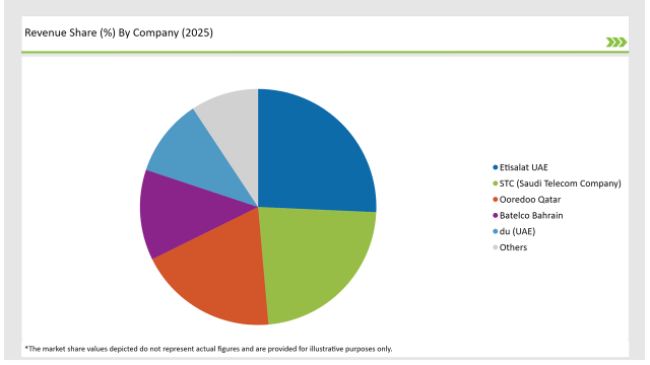

The GCC TMA market is highly competitive, with telecom giants and infrastructure providers driving innovation. Market players focus on R&D investments, strategic alliances, and advanced product offerings to maintain market dominance.

| Vendors | Market Share (2025) |

|---|---|

| Etisalat UAE | 25.7% |

| STC (Saudi Telecom Company) | 22.9% |

| Ooredoo Qatar | 19.1% |

| Batelco Bahrain | 12.4% |

| du (UAE) | 10.6% |

| Others | 9.3% |

Etisalat, STC, and Ooredoo are the dominant players, leveraging their extensive networks and aggressive 5G rollouts. Emerging vendors and regional infrastructure providers are also making strides by offering cost-effective solutions and niche services.

The market will grow at a CAGR of 7.0% from 2025 to 2035.

By 2035, the market will reach USD 815.5 million.

The key drivers include 5G expansion, digital TMA adoption, and investments in rural connectivity.

Saudi Arabia and UAE lead the market due to extensive telecom investments and urban development.

Key players include Etisalat UAE, STC Saudi Arabia, Ooredoo Qatar, Batelco Bahrain, and du UAE.

Electric Switches Market Insights – Growth & Forecast 2025 to 2035

Electrical Bushings Market Trends – Growth & Forecast 2025 to 2035

Edge Server Market Trends – Growth & Forecast 2025 to 2035

Eddy Current Testing Market Growth – Size, Demand & Forecast 2025 to 2035

3D Motion Capture Market by System, Component, Application & Region Forecast till 2035

IP PBX Market Analysis by Type and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.