The GCC Countries Supplier Quality Management Applications market is set to reach a market value of USD 1,109.7 million in 2025 and is projected to grow steadily at a CAGR of 12.1%, reaching USD 3,469.7 million by 2035.

| Attributes | Values |

|---|---|

| Estimated GCC Industry Size 2025 | USD 1,109.7 million |

| Projected GCC Industry Size 2035 | USD 3,469.7 million |

| Value-based CAGR from 2025 to 2035 | 12.1% |

Strict regulatory compliance requirements for suppliers, accelerated digitization of supply chains, and a surge in demand for more effective risk management solutions are driving the growth of the market. Demand for supplier quality management applications is driven by the region's emphasis on boosting industrial productivity and regulatory compliance in primary sectors, including automotive, aerospace, healthcare, and food & beverage. Moreover, cloud-based solutions are trending widely due to their flexibility, scalability, and cost-effectiveness.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

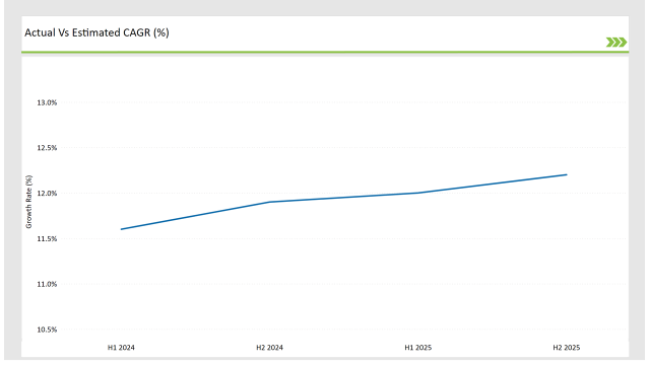

The table below illustrates the compound annual growth rate (CAGR) for the GCC market over six-month intervals, providing stakeholders with insights into market momentum.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 11.6% |

| H2, 2024 | 11.9% |

| H1, 2025 | 12.0% |

| H2, 2025 | 12.2% |

(H1 represents January to June, and H2 represents July to December.)

The growth trajectory highlights the increasing adoption of cloud-based solutions, rising investments in digital transformation, and enhanced supplier quality monitoring processes across the GCC region.

Leading technology and software vendors in the GCC are forming strategic partnerships and investing in AI-driven analytics, cloud-based platforms, and blockchain solutions to enhance supplier quality and compliance monitoring.

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-2025 | Saudi Arabia’s Vision 2030 initiatives drive digital transformation, increasing demand for supplier quality management applications in industrial sectors. |

| Oct-2024 | UAE-based Etisalat and IBM collaborate on AI-powered quality management solutions for regional manufacturers. |

| Mar-2024 | Bahrain’s Ministry of Industry introduces new supplier compliance regulations, boosting the adoption of supplier quality management software. |

| Sep-2024 | Qatar Airways partners with SAP for an end-to-end supplier quality and risk management platform. |

| Dec-2023 | Dubai’s Smart Industry Initiative launches incentives for businesses adopting digital supplier quality control systems. |

Digital Transformation in Supplier Quality Management

All the GCC industries are focused on heavy investments in digitalization aimed to enhance the supplier management process and compliance to international quality standards. Contemporary AI and IoT based approaches ensures on the spot monitoring of suppliers thereby decreasing mistakes and inconsistencies.

Cloud-based Solutions Gain Prominence

As industries shift towards cost-effective and scalable supplier quality management solutions, the adoption of cloud-based applications is seeing an upward trend. Cloud solutions have many advantages for retail procurement teams like real-time collaboration, remote access and integration with ERP and procurement systems of record.

AI and Blockchain Enhance Transparency and Compliance

AI and Blockchain are imperatively influencing supplier quality management by automating risk assessments and improving end-to-end visibility and compliance with regulatory frameworks. These technologies are empowering industries where stringent quality control processes must be followed such as healthcare, aerospace, food & beverage.

Increased Regulatory Compliance Measures

Industries in the GCC region have prioritized supplier quality compliance because of new regulations and ISO certification requirements. To monitor supplier performance and adherence to quality benchmarks, there is a growing need for automated solutions.

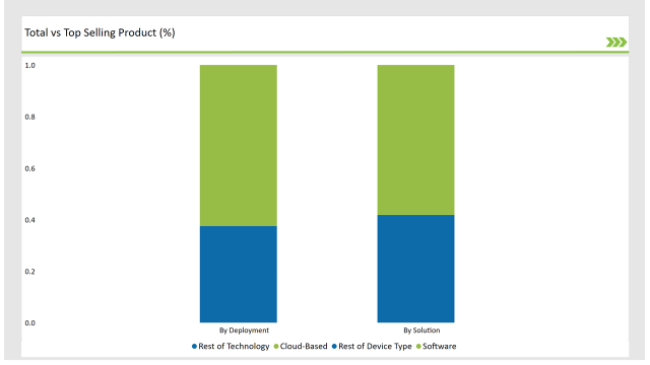

| Solution | Market Share (2025) |

|---|---|

| Software | 58.2% |

| Services | 41.8% |

Different software-based solutions are now dominating the market as these solutions automate the process of tracking vendor compliance, maintain documentation, and track performance. Services remain critical for enterprises adopting such systems, including: Training implementations.

| Deployment | Market Share (2025) |

|---|---|

| Cloud-based | 62.5% |

| On-premises | 37.5% |

The industry is adapting into cloud-based solutions with most solutions prioritizing scalability, real-time accessibility, and cost efficiency. However, On-premises solutions are still preferred in industries with strict data security requirements, such as defense and healthcare.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

| Countries | CAGR |

|---|---|

| Saudi Arabia | 15.5% |

| UAE | 14.5% |

| Rest of GCC | 9.2% |

Increased need for supplier quality management applications is driven by government initiatives such as Vision 2030 that will push for digital transformation in manufacturing and supply chain management. SASO (Saudi Standards, Metrology and Quality Organization) also sets quality standards, which forces the industry to adopt modern solutions to meet the required standards.

Moreover, the rising number of industrial sectors such as oil & gas, automotive, and pharmaceuticals is also escalating its adoption. Local and international software vendors apply AI and cloud-based analytics tools for compliance and operational efficiency. Moreover, increasing investment in smart factories and Industry 4.0 technologies accelerates the demand for enterprise wide supplier quality management applications across verticals.

The focus of the UAE towards smart manufacturing solutions, through initiatives like Operation 300bn, drives demand for supplier quality management applications. Heavily regulated frameworks, such as those established by Emirates Authority for Standardization and Metrology (ESMA), encourage firms to elevate the status of supplier compliance.

The swift growth of industrial free zones like JAFZA and KIZAD encourages global manufacturers to plant themselves there, requiring advanced tools for quality management. Real-time monitoring and predictive analytics are enabled through cloud-based and AI-driven solutions, gaining traction in various domains.

Moreover, strategic sectors of the economy, including aerospace, construction, and healthcare are witnessing digital transformation, which also drives demand for supplier quality management applications, owing to the UAE’s strong logistics infrastructure.

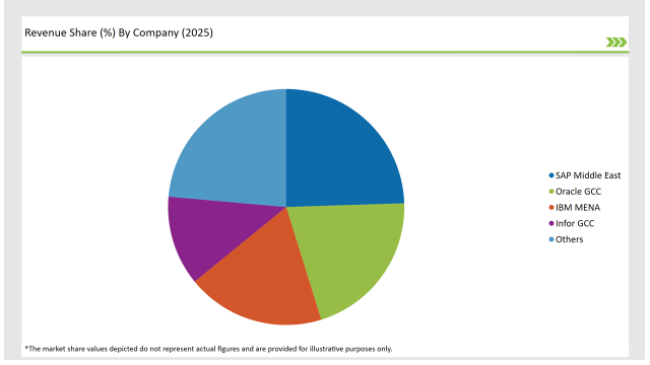

Key players in the GCC Supplier Quality Management Applications Market focus on innovation, partnerships, and cloud-based service expansion to maintain their competitive edge.

| Vendors | Market Share (2025) |

|---|---|

| SAP Middle East | 24.5% |

| Oracle GCC | 20.7% |

| IBM MENA | 18.9% |

| Infor GCC | 12.3% |

| Others | 23.6% |

SAP and Oracle dominate the market with their comprehensive cloud and AI-powered supplier quality management platforms. IBM and Infor focus on industry-specific solutions tailored for automotive, aerospace, and healthcare applications.

Software solutions dominate due to automation needs, while services such as consulting and implementation remain vital.

Cloud-based solutions lead due to their flexibility and cost-effectiveness, but on-premises solutions remain relevant in industries requiring stringent security measures.

Automotive, aerospace & defense, electronics, and healthcare are the major adopters of supplier quality management applications.

The market is expected to grow at a CAGR of 12.1% from 2025 to 2035.

The GCC Supplier Quality Management Applications Market will reach USD 3,469.7 million by 2035.

Increasing regulatory compliance requirements, digital transformation, AI-based analytics, and cloud adoption.

The UAE and Saudi Arabia lead in supplier quality management application adoption, driven by digitalization initiatives and industrial expansion.

SAP Middle East, Oracle GCC, IBM MENA, and Infor GCC are among the leading vendors in the GCC Supplier Quality Management Applications Market.

| Estimated Size, 2025 | USD 14,061.6 million |

| Projected Size, 2035 | USD 38,081.4 million |

| Value-based CAGR (2025 to 2035) | 10.5% CAGR |

Explore Vertical Solution Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.