The GCC NFC Reader ICs market is set to reach a market value of USD 1,151.2 million in 2025 and is projected to expand steadily at a CAGR of 16.0%, reaching USD 5,056.5 million by 2035.

| Attributes | Values |

|---|---|

| Estimated Market Size 2025 | USD 1,151.2 million |

| Projected Market Size 2035 | USD 5,056.5 million |

| Value-based CAGR 2025 to 2035 | 16.0% |

The GCC market for NFC Reader ICs is focused on expanding due to the increasing cashless transactions, digital payments and security-based access control systems. Growth in retail, public transportation, and healthcare sectors further propels demand, supported by government-led smart city initiatives and investments in secure and contactless payment infrastructures.

As smartphone penetration and IoT adoption rise across the GCC, NFC-based authentication and identification systems are transforming banking, retail, automotive, and healthcare. The ongoing deployment of 5G and IoT-driven NFC applications is accelerating market adoption, especially in urban and commercial sectors.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

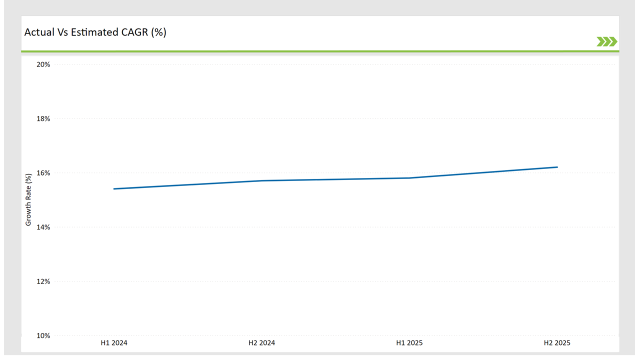

The table below highlights the CAGR trends in six-month intervals, aiding stakeholders in understanding market fluctuations and growth momentum.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 15.4% |

| H2, 2024 | 15.7% |

| H1, 2025 | 15.8% |

| H2, 2025 | 16.2% |

H1 signifies January to June, while July to December analysis is signified through H2.

The consistent increase in CAGR from 15.4% in H1 2024 to 16.2% in H2 2025 reflects growing integration of NFC-based payment systems and the expansion of contactless authentication solutions across industries. Accelerated government initiatives for smart mobility, cashless transactions, and secure access management fuel steady market expansion.

Recent Developments in the GCC NFC Reader ICs Market

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-25 | Saudi Telecom Company (STC) launched NFC-based access control solutions for government and corporate clients. |

| Nov-24 | Emirates NBD partnered with NXP Semiconductors for NFC-based cardless ATM transactions in the UAE. |

| Sep-24 | Kuwait Public Transport launches NFC-enabled ticketing for smart mobility. |

| Jun-24 | Bahrain’s FinTech regulatory sandbox approves multiple NFC-based contactless payment solutions. |

| Mar-24 | Qatar Airways integrates NFC technology for seamless airport check-ins and boarding processes. |

The market is witnessing strong collaborations between financial institutions, transport sectors, and technology providers to advance NFC-based authentication, digital transactions, and secure access solutions across GCC countries.

NFC Transforms Contactless Payments in the GCC

The GCC is expected to become a cashless economy, mating the rise of NFC enabled contactless payments. NFC technology: Financial institutions in the UAE, Saudi Arabia and Qatar are launching NFC-powered mobile wallets and tap-and-go payment capabilities across retail, banking and hospitality.

Smart Transportation and Public Mobility Adoption

In GCC, governments are adopting NFC-enabled smart ticketing for buses, metros and taxis. Kuwait Public Transport, Dubai Metro, and Riyadh Metro have all adopted NFC-based transit payments, minimizing the need to use physical tickets and improving the convenience for commuters.

Healthcare and Secure Authentication Accelerate NFC Adoption

NFC uses cases are revolutionizing healthcare identification and patient records management. NFC-based medical ID systems are being used by hospitals in Saudi Arabia and the UAE, allowing for secure patient verification and access to patient data.

Expansion in Retail and Automotive Sectors

NFC-Enabled Checkout Terminals: Retailers are Using NFC-Powered Checkout Terminals to Improve Customer Experience NFC is rapidly gaining traction in automotive as Saudi Aramco, UAE-based automakers embrace integrated NFC keyless entry and ignition systems in connected cars.

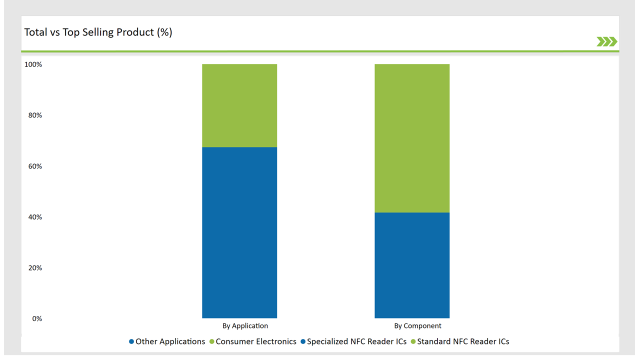

| Component | Market Share (2025) |

|---|---|

| Standard NFC Reader ICs | 58.4% |

| Specialized NFC Reader ICs | 41.6% |

Standard NFC Reader ICs dominate due to their widespread adoption in retail, finance, and transportation. Specialized NFC Reader ICs are witnessing growth in healthcare, automotive, and government security applications.

| Application | Market Share (2025) |

|---|---|

| Consumer Electronics | 32.7% |

| Retail | 24.1% |

| Automotive | 14.6% |

| Healthcare | 12.8% |

| Public Transportation | 9.4% |

| Others | 6.4% |

The consumer electronics sector dominates as smartphones and wearables drive NFC-based payments and secure authentication. Retail and automotive applications follow closely, fueled by contactless checkout solutions and connected vehicle systems.

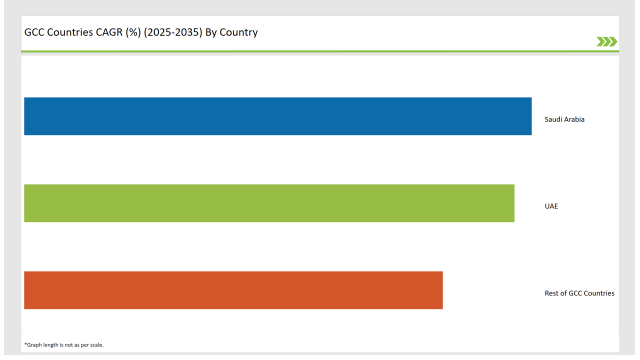

| Countries | CAGR |

|---|---|

| Saudi Arabia | 17.7% |

| UAE | 17.1% |

| Rest of GCC Countries | 14.6% |

Saudi Arabia’s NFC Reader ICs market is growing as businesses and government agencies accelerate smart payment adoption and digital transformation. The Saudi Vision 2030 framework pushes cashless transactions, increasing demand for NFC-based payment solutions in retail and public transport.

Banks and fintech firms integrate NFC-enabled mobile payments, while digital identity programs and e-government services expand NFC reader deployments in banking and security. Consumers prefer contactless payments, and rising smartphone penetration fuels the market. Retailers, financial institutions, and transport operators actively implement NFC technology, creating new opportunities for market players.

The UAE’s NFC Reader ICs market expands as financial institutions, retailers, and transport operators drive contactless payment adoption. The country’s strong financial sector and widespread smartphone use accelerate NFC-enabled transactions across industries.

Government initiatives promote digital wallets and smart transit solutions, increasing NFC technology applications. Banks and fintech companies deploy NFC-based payment systems to enhance customer convenience.

Corporations and public service providers invest in biometric authentication and secure access control, further strengthening demand. As smart city projects advance, businesses and public agencies implement NFC technology, fueling market growth.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

Leading GCC-based vendors drive competition through technological advancements and strategic alliances. Regional technology providers and global NFC component manufacturers contribute to a highly competitive landscape.

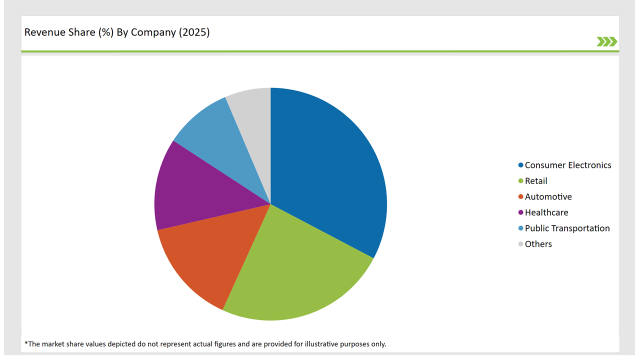

| Vendor | Market Share (2025) |

|---|---|

| Saudi Telecom Company | 26.5% |

| Etisalat | 21.8% |

| Ooredoo | 17.2% |

| Zain Group | 15.6% |

| Others | 18.9% |

The top three vendors control over 65% of the GCC market, benefiting from strong telecom partnerships, financial service expansions, and smart city projects.

Standard NFC Reader ICs and Specialized NFC Reader ICs.

Consumer electronics, retail, automotive, healthcare, public transportation, and others.

Low Frequency (LF), High Frequency (HF), and Ultra High Frequency (UHF).

The GCC NFC Reader ICs market will grow at a CAGR of 16.0% from 2025 to 2035.

By 2035, the market is expected to reach USD 5,056.5 million.

Key drivers include contactless payment adoption, smart city initiatives, transportation digitalization, and NFC-based secure authentication solutions.

Prominent players include Saudi Telecom Company (STC), Etisalat UAE, Ooredoo Qatar, and Zain Group.

Explore Semiconductors Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.