The increasing digitalization, use of social media and the need for enterprises to protect their online reputation, the GCC enterprise internet reputation management market is expected to witness significant growth in the coming years. The market is projected to be USD 67.0 million in 2025 and is expected to grow at a CAGR of 17.1%, to reach USD 323.6 million by 2035.

Market Attributes & Growth Outlook

| Attributes | Values |

|---|---|

| Estimated GCC Industry Size in 2025 | USD 67.0 million |

| Projected GCC Industry Size in 2035 | USD 323.6 million |

| Value-based CAGR (2025 to 2035) | 17.1% |

The growing need for enterprises to handle online reputation management due to the factors such as increasing online reviews, social media influence, and cyber threats. The growing adoption of reputation management solutions by governments and private enterprises across different GCC countries in a bid to safeguard their digital presence, build consumer trust, and mitigate reputational risks.

Explore FMI!

Book a free demo

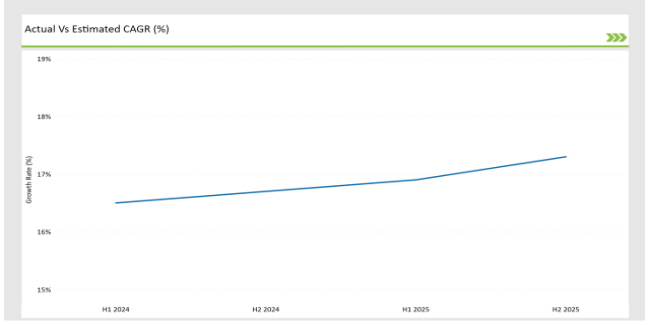

The table below illustrates the compound annual growth rate (CAGR) in six-month intervals, showcasing market trends and investor confidence in reputation management solutions.

| Period | Value CAGR |

|---|---|

| H1, 2024 | 16.5% (2024 to 2034) |

| H2, 2024 | 16.7% (2024 to 2034) |

| H1, 2025 | 16.9% (2025 to 2035) |

| H2, 2025 | 17.3% (2025 to 2035) |

The market growth is fueled by the increasing implementation of AI-driven reputation management tools, proactive engagement by businesses in online brand monitoring, and regulatory frameworks enhancing data protection and privacy in the GCC region.

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-25 | UAE-based Etisalat introduces AI-driven reputation analytics for businesses. |

| Oct-24 | Saudi Telecom Company (STC) partners with Microsoft to develop cloud-based reputation repair solutions. |

| Mar-24 | Bahrain's Batelco launches "Reputation Shield," a cybersecurity-based brand monitoring tool. |

| Sep-24 | Ooredoo Qatar acquires a stake in a digital reputation management startup. |

| Dec-23 | The UAE introduces new regulatory guidelines on digital brand protection and privacy. |

Major providers are leveraging partnerships, AI technology, and cloud computing to deliver advanced reputation management services. These initiatives enhance enterprises’ ability to manage online perceptions, mitigate risks, and improve brand trust.

Reputation Monitoring Enhances Brand Protection

GCC are focused on investment in reputation monitoring solutions as a means of tracking and managing their online presence. Sophisticated AI-powered analytics tools enable businesses to identify detrimental sentiments and mitigate potential reputation threats.

Cloud-based Reputation Management Gains Momentum

Enterprise reputation management solutions are increasingly moving to cloud, as they can be cost-effective, customizable and readily accessible. Such factors are surging demand for online reputation management tools by the rising adoption of cloud services by industries like BFSI, healthcare, and retail.

Social Media Influence and Crisis Management

The internet fragmentation has also become more common along with a rapid rise in social media usage, demanding businesses to handle their digital footprint adequately. Crisis Management Solutions: Enterprises are adapting to crisis management solutions to address customer grievances, negative media coverage, and cyber threats instantly.

Cybersecurity and Data Protection Drive Growth

Due to strict cybersecurity regulations in the GCC region, the enterprises are now adding data protection framework built within a reputation management strategy. Cloud infrastructure integrated with the latest security tools and AI-fueled solutions are helping to defend against online threats.

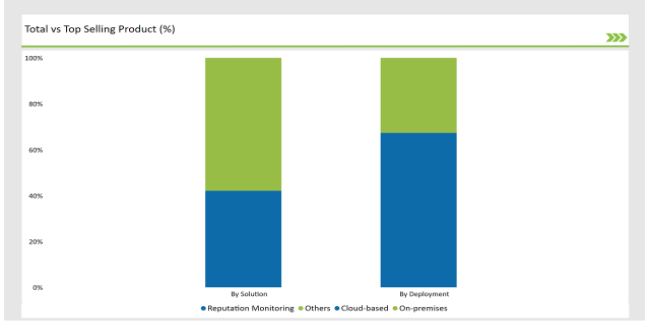

| Solution | Market Share (2025) |

|---|---|

| Reputation Monitoring | 42.1% |

| Others | 57.9% |

Reputation monitoring dominates the market as enterprises focus on safeguarding brand perception. Reputation repair and analysis solutions are also gaining traction due to rising cyber threats and fake online reviews affecting businesses.

| Deployment | Market Share (2025) |

|---|---|

| Cloud-based | 67.3% |

| On-premises | 32.7% |

Cloud-based solutions lead the market, offering flexibility, automation, and real-time updates. On-premises deployment remains significant for industries with stringent data security requirements, such as BFSI and government sectors.

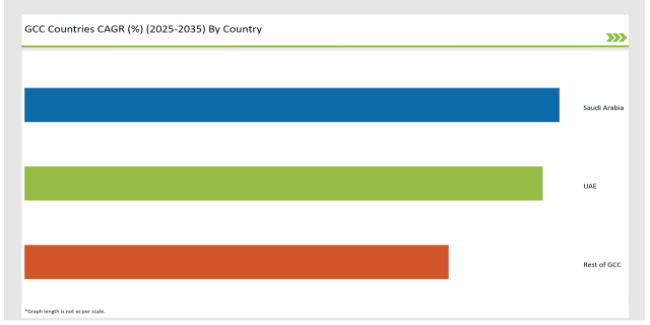

| Countries | CAGR |

|---|---|

| Saudi Arabia | 19.3% |

| UAE | 18.7% |

| Rest of GCC | 15.3% |

Saudi Arabia enterprise internet reputation management market is driven by the digital transformation mandate from Vision 2030. This has led businesses to prioritize their online reputation as part of their investment strategies to comply with the National Transformation Program. This growth is aided by the rising adoption of AI-based reputation analytics and social media monitoring tools. Reputation management is in high demand in the banking, healthcare, and tourism sectors.

Investment is further driven by government efforts to enhance digital transparency and regulatory compliance. Protecting their reputation helps large enterprises build brand trust, especially given the scrutiny faced by global investors and the growing power of digital customer reviews.

Due to the UAE's robust digital economy the enterprise internet reputation management market is booming. Dubai and Abu Dhabi digital initiatives need also cybersecurity and corporation reputation working online monitoring. Companies hire AI-powered reputation management software to combat misinformation and improve their brand image. UAE business-friendly authorities and competitive corporate environments urge companies to fortify the security of its digital identity.

Industries including financial services, retail and hospitality readily embrace reputation management solutions. Also, government laws and regulations are helping to enhance data security and media transparency in the enterprise during certain key aspects of production, thereby increasing the market for enterprise reputation monitoring services.

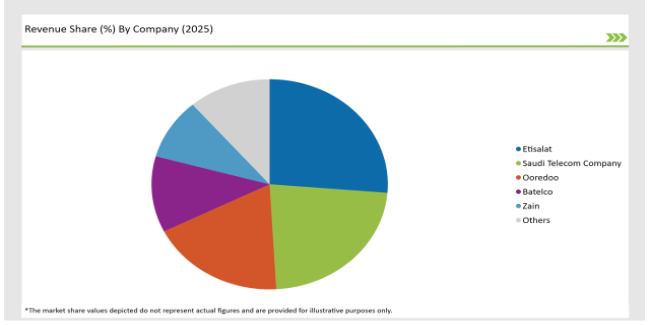

Leading vendors in the GCC enterprise internet reputation management market are expanding their service offerings through strategic partnerships, AI-driven innovations, and cloud technology adoption.

| Vendors | Market Share (2025) |

|---|---|

| Etisalat | 26.3% |

| Saudi Telecom Company | 22.8% |

| Ooredoo | 18.5% |

| Batelco | 11.7% |

| Zain | 9.4% |

| Others | 11.3% |

Etisalat and STC lead the market with robust AI-driven reputation monitoring solutions. Ooredoo and Batelco are strengthening their foothold through acquisitions and cloud-based services. The market remains competitive as vendors introduce new reputation management features tailored to different industries.

The GCC enterprise internet reputation management market is projected to grow at a CAGR of 17.1% from 2025 to 2035.

By 2035, the market is estimated to reach USD 323.6 million.

Key growth drivers include increasing digital transformation, cybersecurity threats, online consumer engagement, and AI-driven reputation analytics.

UAE and Saudi Arabia lead in adoption due to advanced digital infrastructure, regulatory frameworks, and growing e-commerce penetration.

Leading players include Etisalat, STC, Ooredoo, Batelco, and Zain.

Reputation Monitoring, Reputation Repair, Reputation Analysis, and Others. Reputation Monitoring leads due to the rising importance of brand management.

Cloud-based and On-premises. Cloud-based deployment is favored for its efficiency and cost benefits.

BFSI, Healthcare, Retail & E-commerce, IT & Technology, Government & Public Sector, Media & Entertainment, and Others. BFSI and Healthcare sectors lead in adoption.

Catenary Infrastructure Inspection Market Insights - Demand & Forecast 2025 to 2035

Category Management Software Market Analysis - Trends & Forecast 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Residential VoIP Services Market Insights – Trends & Forecast 2025 to 2035

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Safety Mirrors Market - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.