The connected TVs in GCC countries are expected to grow because of the booming of internet usage, high definition quality for scale that's smart home formed. The market is expected to be worth USD 1,468.4 million in 2025, growing at a compound annual growth rate (CAGR) of 15.0%, and reach a market size of USD 5,940.6 million by 2035.

| Attributes | Values |

|---|---|

| Estimated GCC Industry Size 2025 | USD 1,468.4 million |

| Projected GCC Industry Size 2035 | USD 5,940.6 million |

| Value-based CAGR from 2025 to 2035 | 15.0% |

The region is witnessing growth of connected TVs on account of increase in number of content streaming platforms, demands for premium quality displays and rise in disposable income. Market expansion is further fostered by rapid urbanization and government-led digital transformation initiatives.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

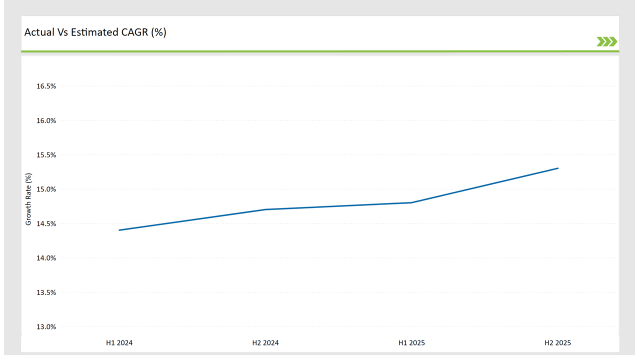

The table below illustrates the compound annual growth rate (CAGR) over six-month intervals, offering key trends for stakeholders.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 14.4% |

| H2, 2024 | 14.7% |

| H1, 2025 | 14.8% |

| H2, 2025 | 15.3% |

H1 signifies January to June, while H2 signifies July to December.

Rising of high speed broadband penetration and increasing consumer shift towards over-the-top (OTT) is driving market growth. Transitioning from traditional cable to digital streaming services also provides momentum in the right direction for growth.

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-2025 | Saudi Arabia's STC launches a new smart TV brand with integrated streaming services. |

| Oct-2024 | UAE-based Etisalat enters the connected TV market with a new line of QLED models. |

| Mar-2024 | Kuwait’s leading electronics retailer partners with Samsung for exclusive OLED TV launches. |

| Sep-2024 | Qatar Telecom introduces a new streaming device with AI-powered content recommendations. |

| Dec-2023 | The UAE government announces digital transformation plans that include smart home technology expansion. |

Prominent GCC providers are already making strategic alliances and collaborations to improve their end-to-end connected TV capabilities and the trends towards AI-powered recommendations, voice assistants, and 8K resolution.

Smart TVs Dominate the Market

Support for on-demand content and seamless streaming, as well as the trend toward smart home integration have led consumers in the Gulf Cooperation Council (GCC) region to seek out smart TVs. Antenal internet connected televisions is on the rise, and demand is growing ever since consumers want something more engaging and immersive.

To this end, top manufacturers including Samsung, LG, and Hisense are working to fill this need, introducing premium models with features like OLED and QLED display technology as well as AI-based image processing and onboard voice assistants like Google Assistant and Alexa.

Such features improve viewing experiences, by providing more accurate colors, deeper contrast, and customized content suggestions. With [high-speed internet connectivity] and the availability of over-the-top (OTT) streaming services in the region, smart TVs are rapidly becoming the default option for home entertainment.

Streaming Devices Gain Traction

Streaming devices including Apple TV, Google Chromecast and Amazon Fire Stick are demonstrating mass appeal in the GCC, allowing consumers to convert traditional TVs to smart TVs. These boxes allow people to stream services from Netflix and Disney+ to Shahid et cetera - no smart TV required.

These plug-and-play streaming devices are becoming more popular with consumers who already have non-smart TVs, or who want an affordable way to upgrade their home entertainment experience. The small form-factor and relatively straightforward installation of such devices also make them an appealing method to work around upgrading an entire TV unit entirely.

With regional customers increasingly consuming content through digital streaming services, streaming devices segment will garner a significant market share with growing consumer base looking for an affordable means to access high-quality content.

Technology Shift to OLED & QLED

OLED and QLED display technologies have rapidly evolved to replace conventional LCD and LED screens due to superior picture quality and increased brightness with deeper contrast levels. UAE and Saudi consumers are noticeably gravitating towards premium television displays boasting ultra-high-definition (UHD) and 4K or even 8K resolution capability.

With self-emissive pixels and perfect blacks, consumers of higher-end devices take pleasure in higher quality visual clarity and a cinematic experience. As for QLED, the technology is perfect for any buyer looking for an LED panel: it delivers high brightness and rich colors, making it ideal for those who want vibrant and high-contrast images, especially in well-lit rooms. In contrast, LCD technology played a key role in shaping the market in the GGC but OLED and QLED TVs will be a showcase of premium features.

Commercial Segment Sees Higher Adoption

The businesses in GCC are also implementing connected TVs, propelled by the need for digital signage, interactive displays, and video conferencing solutions. Today, smart TVs are being employed amongst dining and retail businesses, corporate environments, and hospitality venues as a means to increase customer engagement, streamline communication, and facilitate collaboration between coworkers.

Connected TVs powered by SSMS are being used by hotels and resorts to provide personalized in-room entertainment, while digital signage solutions are used by shopping malls and retail stores as advertising and promotional displays. In corporate environments, companies are rolling out large-screen smart TVs for video conferencing, presentations, and group workspaces.

This can be attributed to the surge in digital transformation initiatives and the growing adoption of interactive and dynamic content in commercial applications, which drives demand for connected TVs across a multitude of sectors in the GCC.

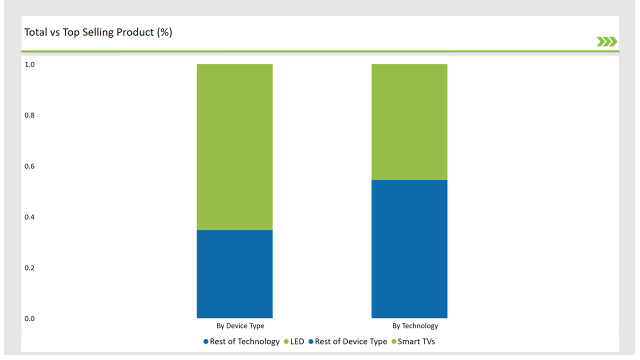

| Device Type | Market Share (2025) |

|---|---|

| Smart TVs | 65.3% |

| Others | 34.7% |

Smart TVs dominate the market, driven by growing demand for internet-enabled entertainment, gaming, and smart home integration.

| Technology | Market Share (2025) |

|---|---|

| LED | 45.6% |

| Others | 54.4% |

While LED technology holds the highest share, OLED and QLED are growing rapidly due to superior color accuracy and energy efficiency.

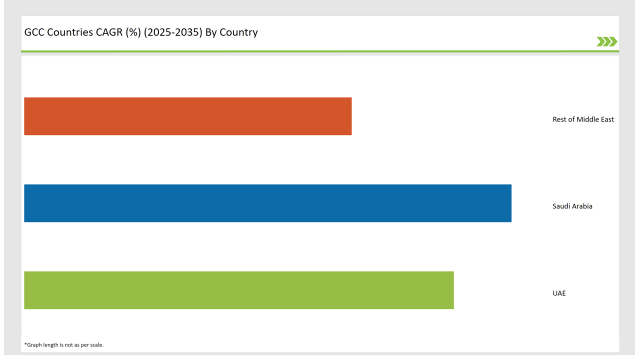

| Countries | CAGR |

|---|---|

| Saudi Arabia | 18.6% |

| UAE | 16.4% |

| Rest of Middle East | 12.5% |

Saudi Arabia Connected TV is mainly driven by growing internet penetration, government-backed digital initiatives, and rise in smart entertainment user preference. This has triggered a significant growth in digital infrastructure with the Vision 2030 initiative, which is greatly accelerating the adoption of smart homes. 4K and OLED smart TVs are purchased due to high disposable income and demand for premium content.

Growing market thanks to streaming platforms: Netflix, Shahid, StarzPlay Extra and Jarir among retailers and e-commerce platforms offering smart TV convenience Furthermore, partnerships between TV manufacturers and telecom operators improve the attractiveness of bundled services and contribute to the expansion of Connected TV market. All these factors are several reasons behind the faster growth of the market through both the residential and the commercial segments.

The UAE Connected TV Market is facilitated by robust digital infrastructure, high-speed internet connectivity, and growing consumer interest in smart home technologies. High expatriate populations fuel demand for international and regional OTT platforms, including OSN+, StarzPlay, and Amazon Prime Video.

Government-sponsored smart city initiatives and luxury real estate developments introduce smart TVs in modern-day living. Online shopping sites such as Noon and Amazon UAE turn out to make it easy to get your hands on the latest smart TV models.

This is further enhanced with telecom companies such as Etisalat and Du offering attractive bundled services that enhance affordability. Together, these factors further reinforces UAE’s Connected TV market for sustained growth and innovation.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

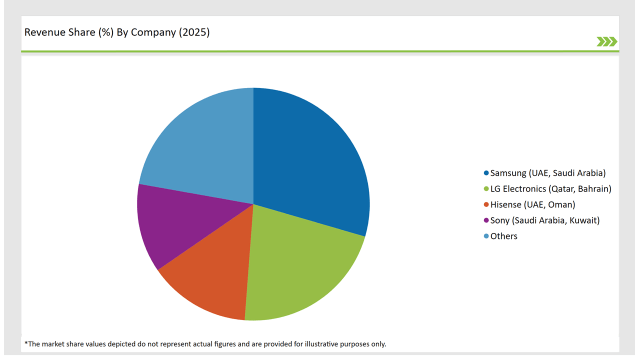

The GCC connected TVs market is highly competitive, with global and regional players investing in innovation and technology partnerships.

| Vendors | Market Share (2025) |

|---|---|

| Samsung (UAE, Saudi Arabia) | 29.5% |

| LG Electronics (Qatar, Bahrain) | 21.7% |

| Hisense (UAE, Oman) | 14.2% |

| Sony (Saudi Arabia, Kuwait) | 12.4% |

| Others | 22.2% |

Samsung and LG lead the market, leveraging their strong distribution networks and technological advancements. Hisense and Sony are expanding their presence, particularly in OLED and QLED TV segments.

Smart TVs, Streaming Devices, and Others.

LED, LCD, OLED, and QLED.

Residential and Commercial.

The GCC connected TVs market will grow at a CAGR of 15.0% from 2025 to 2035.

By 2035, the industry is projected to reach USD 5,940.6 million.

Key drivers include rising internet penetration, growing demand for smart home devices, and increased consumption of streaming content.

The UAE and Saudi Arabia lead the market due to high disposable incomes and strong adoption of digital entertainment.

Samsung, LG, Hisense, and Sony dominate the market, with several regional distributors enhancing the competitive landscape.

| Estimated Size, 2025 | USD 16,978.4 million |

| Projected Size, 2035 | USD 60,110.2 million |

| Value-based CAGR (2025 to 2035) | 13.5% CAGR |

Explore Electronics & Components Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.