The GCC aerial imaging market is projected to reach USD 392.4 million in 2025 and will grow steadily at a CAGR of 13.4%, reaching USD 1,380.0 million by 2035.

| Attributes | Values |

|---|---|

| Estimated GCC Industry Size in 2025 | USD 392.4 million |

| Projected GCC Industry Size in 2035 | USD 1,380.0 million |

| Value-based CAGR from 2025 to 2035 | 13.4% |

Growing drone technology adoption, geospatial mapping need and infrastructure development projects has boosted demand for the GCC aerial imaging market. The vast applications of aerial imaging in defense, urban planning, and disaster management sectors drive its penetration in the market. Demand is further propelling the GCC governments’ large investments in smart city initiatives, real estate and environmental conservation.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

The table below compares the compound annual growth rate (CAGR) for the GCC market over six-month intervals, providing stakeholders with precise trends to guide decision-making.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 12.8% (2024 to 2034) |

| H2, 2024 | 13.2% (2024 to 2034) |

| H1, 2025 | 13.3% (2025 to 2035) |

| H2, 2025 | 13.8% (2025 to 2035) |

The increasing investments in defense and security, rapid urbanization, and growing geospatial intelligence applications are expected to sustain this growth pattern, with a steady rise from 12.8% in H1 2024 to 13.8% in H2 2025.

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-25 | Saudi Arabia launches a national aerial surveillance program to enhance border security and infrastructure monitoring. |

| Oct-24 | The UAE’s Ministry of Energy partners with a domestic imaging company to monitor energy resources using drone-based aerial imaging. |

| Mar-24 | Oman invests in smart city planning with geospatial mapping using aerial imaging technology. |

| Sep-24 | Qatar's defense sector integrates AI-powered aerial imaging for security and intelligence. |

| Dec-23 | Kuwait implements aerial mapping for environmental conservation and climate monitoring. |

Growing Defense & Security Intelligence Applications

Aerial imaging is a key technology area that is receiving extensive investment in the GCC countries for national security and defence. Across the region, governments are using high-resolution aerial imaging against security issues like border surveillance, law enforcement, and counterterrorism. By using aerial imaging, the relevant authorities can better survey remote and sensitive locations, quickly spot unauthorized activity, and get real-time insights about the situation.

It had turned out to be essential devices for Intelligence collection and they can collect data in a high-speed format along with improved intelligence collection process. UAV based imaging systems are gradually incorporated into military forces to enhance homeland security and to secure immediate response to possible countermeasures in nations; hence, much of these military forces have been counted in GCC nations. Additionally, these innovations in aerial imaging enhance strategic planning, operational efficiency, and regional security resilience.

Geospatial Mapping and Urban Development Accelerate Demand

The growing focus on smart city development across the GCC is driving demand for high-resolution aerial imaging. Aerial imagery harnessed by cities including Riyadh, Dubai and Doha for infrastructure planning, urban sprawl and sustainable development efforts This accurate geospatial data enables urban planners to make better decisions about land utilization as well as transportation networks and public infrastructure that needs to be resilient.

So, aerial imaging is becoming increasingly useful in mobility solutions, road network expansion and environmental sustainability as the governments focus on improving public utilities. This allows them to leverage these geospatial mapping to make data-driven decisions for better city planning and resource allocation. The aerial imaging and data analytics of the region is also becoming an essential part of urban governance as the region keeps prioritizing smart city development.

Disaster Management & Environmental Monitoring

Disaster management and environmental monitoring show rising use of aerial imaging in the GCC region. Natural disasters plaguing governments and wildlife, like floods, sandstorms, and oil spills, are getting years of aerial data, which is being used to make these disasters more visible. If no one is prepared in an effective manner and when emergency services are busy evaluating the extent of damage in wounded areas, can easily mitigate the risk areas through the usage of high-scale images.

Aerial imaging technology is also helping environmental monitoring efforts. Tracking desertification, monitoring coastal erosion and looking at changes in land use all help policymakers make sound decisions about implementing on-the-ground climate change efforts.

Governments can thus avoid both of these pitfalls by incorporating aerial imaging into their environmental management planning, which can help to maintain species diversity, minimize harmful environmental consequences, increase sustainable practices and promote long-term ecological balance in the region.

Energy & Natural Resource Management

Aerial Imaging in GCC Oil and Gas New Age Digital Transformation Tools and Technologies The oil and gas sector in the GCC is embracing aerial imaging at an accelerated pace to improve resource management, operational safety, and infrastructure monitoring.

Drone-based imaging is fast becoming a critical method to track pipeline breaches, monitor soil conditions, and measure seismic activity. Real-time two-dimensional and three-dimensional images capture high-resolution data, enabling energy companies to avoid expensive accidents, improve maintenance operations and monitor compliance with regulations.

Outside oil and gas, aerial imaging is also being used for natural resource management, including water conservation, farming, and mineral exploration. Continuous advancements in imaging and remote sensing technology allow industries to conduct soil processes, monitor terrain changes, manage land and improve efficiency in harvesting resources. Moreover, as the GCC updates its energy and natural resource industries, aerial imaging is poised to be instrumental in advancing operational improvements and sustainability.

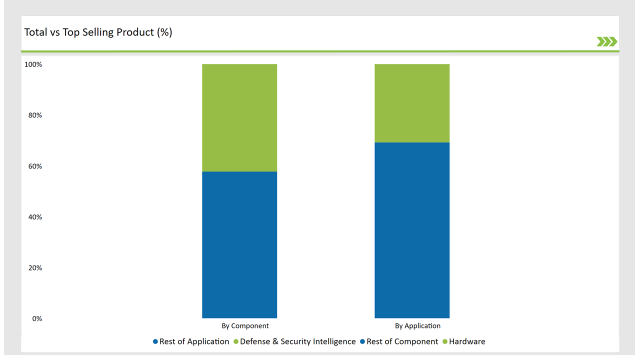

| Component | Market Share (2025) |

|---|---|

| Hardware | 42.3% |

| Others | 57.7% |

The hardware segment, including drones and high-resolution cameras, dominates due to the growing adoption of UAVs. Software solutions for image processing and AI analytics are also rapidly growing, enhancing data interpretation capabilities.

| Application | Market Share (2025) |

|---|---|

| Defense & Security Intelligence | 30.8% |

| Others | 69.2% |

Defense and security intelligence lead the market due to heightened investments in aerial surveillance and reconnaissance. Urban planning and geospatial mapping also hold significant shares as GCC countries emphasize smart city development.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

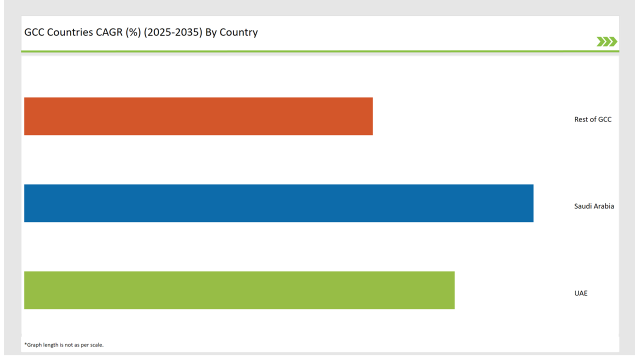

| Countries | CAGR |

|---|---|

| Saudi Arabia | 16.8% |

| UAE | 14.2% |

| Rest of GCC | 11.5% |

Saudi Arabia's aerial imaging market is on the rise with Vision 2030 initiatives driving the development of smart cities such as NEOM and other infrastructure megaprojects. But the demand for high-resolution geospatial data to be used for urban planning, for oil exploration or for agriculture is increasing. Govt agencies and private enterprise are spending on drone based imaging for security, environmental monitoring, construction projects.

Aerial imaging involved mapping and surveillance that can be improved by the integration of AI and remote sensing. Saudi Arabia's partnerships with global aerial imaging firms and the increasing demand for advanced imaging technologies in defense applications are key drivers of the country's prominent role in the global market.

Aerial imaging market in UAE is growing at a rapid pace owing to numerous smart infrastructure projects, and large scale urban planning. The government's focus on AI-Powered Geospatial Analytics strengthens the applications in construction, real estate, and environmental monitoring. The defense industry uses aerial imaging in improving the security and conducting surveillance. In Dubai and Abu Dhabi where there is smart city program implementations, accurate aerial data is required for planning and design.

The expanding market is also fueled by potential applications in commercial spaces i.e. tourism, disaster and oil exploration. The UAE’s position on this front is bolstered by partnerships with global aerial imaging firms and greater investments into drone technology.

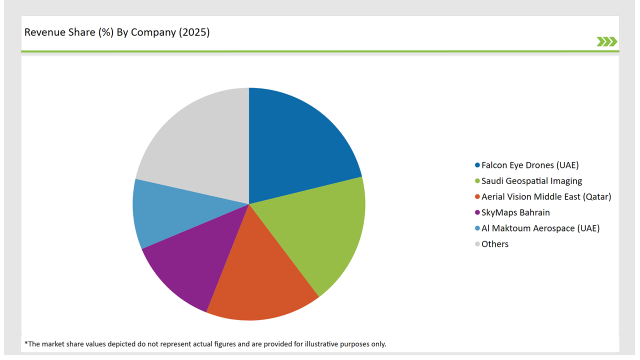

The GCC aerial imaging market is moderately fragmented, with key players focusing on strategic partnerships, acquisitions, and technology innovations. Leading players dominate through investments in AI-driven aerial imaging and cloud-based geospatial analytics.

| Vendors | Market Share (2025) |

|---|---|

| Falcon Eye Drones (UAE) | 21.2% |

| Saudi Geospatial Imaging | 18.5% |

| Aerial Vision Middle East (Qatar) | 16.3% |

| SkyMaps Bahrain | 12.7% |

| Al Maktoum Aerospace (UAE) | 9.8% |

| Others | 21.5% |

Companies in the region are developing autonomous drone imaging solutions, integrating AI and machine learning for enhanced image processing. Collaboration between governments and private enterprises is fostering innovation in the aerial imaging space.

Hardware, Software, and Services.

Defense & Security Intelligence, Geospatial Mapping, Urban Planning & Development, Disaster & Response Management, Energy & Natural Resource Management, and Others.

Government, Military & Defense, Agriculture & Forestry, Energy & Mining, Media & Entertainment, Construction & Engineering, and Others.

The market will grow at a CAGR of 13.4% from 2025 to 2035.

By 2035, the industry will reach USD 1,380.0 million.

Key drivers include rising demand for geospatial intelligence, increased defense investments, and smart city initiatives.

Saudi Arabia and the UAE lead in aerial imaging adoption due to large-scale infrastructure projects and national security investments.

Prominent players include Falcon Eye Drones, Saudi Geospatial Imaging, Aerial Vision Middle East, and SkyMaps Bahrain.

Explore Digital Transformation Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.