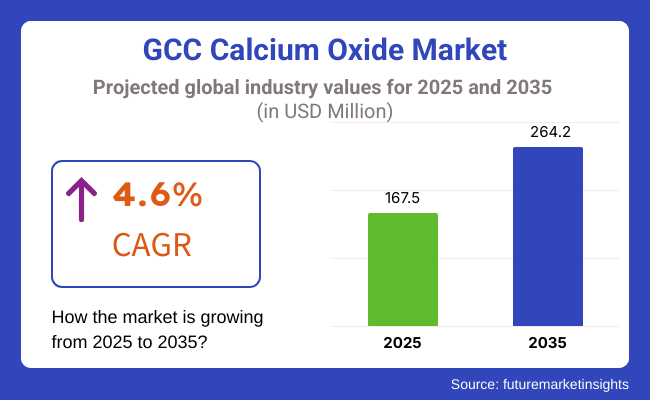

As per FMI analysis, the GCC calcium oxide market is slated to reach USD 167.5 million to in 2025, witnessing 4.6% CAGR from 2025 to 2035 to hit USD 264.2 million by 2035. Calcium oxide, which is present in the form of calcium and oxygen elements, is an inorganic compound that is widely recognized as quicklime. Quicklime is the main component of this alkaline material.

It is a chemical compound that is mainly used in the quicklime process, cement production, steel manufacturing, flue gas desulfurization, and soil stabilization. The region's transition to smart cities, which includes highways and industrial projects, is the prime driver for the increased demand for quicklime, and the fast pace of this transition is visible evidence of this.

The other side of the coin is, that the stress on green and sustainable solutions such as the employment of building materials which have low environmental impacts, waste management, and production methods which are energy-efficient serves as a doorway for the high-purity quicklime to be used by the various industries.

The growing infrastructure projects with backing from the GCC governments would lead to the eventual rise in cement and industrial processes, such as wastewater treatment. The rising activities in both the metal refining and chemical sectors are the drivers for the increased demand for quicklime for pH control, acid neutralization, and fluoride gas desulfurization (FGD) applications.

Quicklime, which is the major consumer of the steel and cement sectors, is being increased in production capacity to meet infrastructure and energy savings targets. Also, the movement of the industry toward environmental compliance has become a significant factor, and thus the use of quicklime in wastewater treatment plants and other pollution control technologies has gained traction.

The introduction of new kiln technologies, diversification of fuel sources, and installation of carbon capture systems are becoming the crucial means of producing eco-friendly and sustainable quicklime in the region. The ongoing increase in investments in industrial water treatment and desalination units in the GCC region is also boosting the demand of quicklime in water neutralization, softening, and sludge handling.

As the companies embrace green chemistry and the principles of the circular economy, quicklime is becoming an essential material in acid neutralization, solidification of hazardous waste as well as pollution control, which in turn ensures long-term growth in the market in this area.

Explore FMI!

Book a free demo

The GCC Quicklime market grew consistently from 2020 to 2024 with increased construction, steel production, water treatment, and environmental operations. (CaO) use in steel melting, cement production, and flue gas desulfurization was felt in the Gulf Cooperation Council (GCC).

Infrastructure, energy, and industrial waste treatment investment growth fueled demand for the product. Supply chain dormancy, improved energy efficiency in lime kilns, and CO₂ emission sustainability in lime production pose threats to the market.

In the context of the future 2025 to 2035, the GCC market will be subject to transformational change based on sustainability aspirations, green building, and industrial processing tech innovation. Carbon capture technology in lime kilns, AI-optimized kiln scalability, and low-carbon lime manufacturing with alternative fuels will redefine industry trends. Applications in hydrogen production, advanced wastewater treatment, and high-performance building products will develop new markets.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| GCC nations adopted more stringent emission control practices in cement and steel sectors. | Carbon-free lime manufacturing becomes the norm, with industries embracing CCUS technologies. |

| It was extensively applied in cement production, stabilization of soil, and high-strength concrete. | Growth in green building materials drives demand for low-carbon cement and CO₂-absorbing construction products. |

| Used in steel refining, slag conditioning, and desulfurization to remove impurities. | Hydrogen-based steel production emerges as a low-carbon alternative, influencing Quicklime demand. |

| Quicklime was used for neutralizing acidic industrial waste, softening water, and treating hazardous sludge in desalination plants. | Expansion of advanced water treatment technologies, including AI-optimized pH control systems. |

| Initial adoption of alternative fuels in lime kilns and waste heat recovery systems. | Fully circular production models gain traction with closed-loop CO₂ capture from lime kilns. |

| Kiln efficiency improvements reduced energy consumption and emissions. | AI-driven real-time process control in lime kilns. |

| Growth fueled by construction expansion, steel industry demand, and environmental applications. | Market expansion driven by sustainable cement production, smart manufacturing, and CO₂ capture technologies. |

Additional aspects affecting the pricing of calcium oxide in GCC are raw material costs, energy prices, and market demand. GCC production costs, particularly in Saudi Arabia and the UAE, are low owing to large limestone reserves and energy subsidies Qatar and Oman, which have strategic industrial zones, charge competitive prices but depend on energy efficiency to protect margins.

Limestone, in particular, not only is a raw material but also affects pricing as high-purity limestone is needed for quality calcium oxide to be produced. Production costs are heavily influenced by energy costs, particularly natural gas and industrial electricity tariffs, making price movements an important factor for operating profitability.

GCC production costs are considerably lower than global markets thanks to low energy and raw material prices. Revenue streams are also stabilized thanks to long-term supply contracts with industrial consumers. Likewise, manufacturers are also implementing alternative fuels and process automation in an effort to preserve cost efficiency while preparing for price stability.

| Innovation/Trend | Impact/Development |

|---|---|

| Technological Advancements in Production | Kiln technologies enhance yield and lower emissions through energy-efficient processing and improved purification. |

| Renewable Energy Adoption in Production | Adoption in Production Solar Energy / Green Hydrogen Integration Reduce Carbon Footprints, Make Production of Calcium Oxide Greener |

| New Applications in Clean Energy & Carbon Capture | Other emerging uses include CO2 absorption, battery materials, and hydrogen storage adding to its role in clean energy applications. |

| Automation & AI in Quality Control | Intelligent sorting, automated kiln operation, and real-time quality monitoring reduce production costs and improve efficiency. |

| R&D Investments in GCC | Major funding in GCC for the use of industrial calcium oxide in major development projects, water purification, and green building materials. |

The commercial grade product is leading the market. It has major applications in construction, manufacturing of iron, steel and also in water treatment. Because of its high reactivity and cost-effectiveness, it is the preferred choice for cement production, steel smelting, and flue gas desulfurization.

Commercial-grade calcium oxide demand has been growing rapidly, owing to the booming construction sector in the region, driven by megaprojects such as NEOM in Saudi Arabia, Expo 2020 legacy projects in the UAE, and FIFA World Cup infrastructure in Qatar. Also, calcium oxide in the steel industry is used for slag conditioning, desulfurization, and metal refining, making it a significant part of GCC economic diversification initiatives.

The biggest share of calcium oxide use is within the construction sector within the GCC. Outside of cement production, calcium oxide is used in lime plasters, mortars, and soil stabilization, where it increases the hardness and strength of building materials. The increasing focus on energy-efficient and sustainable construction practices has further increased the demand for the product in green cement formulations.

| Countries | CAGR (2025 to 2035) |

|---|---|

| Saudi Arabia | 4.8% |

| UAE | 4.6% |

| Qatar | 4.7% |

| (Rest of GCC) | 4.5% |

Demand in Saudi Arabia is still on the rise fueled by growing demand from steel manufacturing, water treatment, and construction activities. Expansion in Saudi Arabian steel and cement manufacturing, with assistance from Vision 2030 development projects, is contributing significantly to the demand for Quicklime for steel refining, cement production, and flue gas desulfurization.

Growing industrialization and urbanization of Saudi Arabia have also led to higher applications in chemical processing, soil stabilization, and lime water treatment plants. Higher sulphur removal and chemical synthesis applications are also being driven by growth in petrochemical and refineries industries. FMI is of the opinion that the Saudi Arabian market is set to experience 4.8% CAGR during the study period.

Growth Factors in Saudi Arabia

| Key Factor | Detail |

|---|---|

| Cement & Construction Industry Growth | Increased use in cement manufacturing and soil stabilization. |

| Steel & Metallurgical Processing | Removal of impurities and metallurgical processing of steel production. |

| Water Treatment & Environmental Legislation | Growing application for industrial effluent neutralization as well as pH correction. |

| Petrochemical & Refinery Industry | Application to gas treatment and desulfurizing. |

| Government Infrastructure & Industrial Development | Ongoing requirement for mass-scale urbanization leading to increased lime production. |

The UAE market is expanding consistently, driven by increasing demand in water treatment applications, industrial processing, and infrastructure growth. The Dubai and Abu Dhabi building boom is driving the use in cement and concrete applications. The expansion of UAE's industrial wastewater treatment and water desalination plants is also propelling market demand for quicklime for purification and pH balancing purposes.

Steel manufacturing, chemical industry, and environmental remediation activities are also propelling market growth. Aluminium and glass industries development are also enabling enhanced usage of quicklime for fluxing and refining processes. FMI is of the opinion that the UAE industry is set to experience 4.6% CAGR during the study period.

Growth Factors in UAE

| Key Factor | Detail |

|---|---|

| Increased Urbanization & Mega Infrastructure Projects | Increasing demand for Quicklime in construction materials. |

| Water Desalination & Wastewater Treatment Capacity Build-up | Increased use of quicklime in filtration and pH neutralization. |

| Industrial Use & Chemical Manufacturing Development | Increased usage in glass, paper, and aluminium smelting. |

| Steel Industry Development & Metallurgical Processing | Increased use of Quicklime in metal and steel smelting. |

| Environmental Regulations Promoting Air & Water Quality Management | Increased use of flue gas desulfurization using lime. |

Demand for quicklime in Qatar is rising because of the escalating construction activity, cement production, and industrial applications. Mega-development projects like smart city projects and FIFA World Cup legacy projects are dominating the demand for quicklime in the construction and cement industry.

Apart from this, the increasing oil and gas activities in Qatar are further increasing the application of quicklime in treating flue gases, desulfurization, and chemical processing. The demand is also expanding with lime products increasingly being used in water treatment plants and wastewater treatment plants. FMI is of the opinion that the Qatar industry is slated to capture 4.7% CAGR during the study period.

Growth Factors in Qatar

| Key Factor | Detail |

|---|---|

| Oil & Gas Industry Development | Greater use for flue gas treatment and desulfurization. |

| Increased Cement & Lime Production | Greater demand for use in ready-mix concrete and mortar manufacturing. |

| Water Treatment Plant Capacity Expansion | Greater use of Quicklime for sludge purification and treatment. |

| Industrialization & Export Market | Greater use in chemical processing and industrial uses on an export scale. |

The Kuwait, Bahrain, and Oman market is still expanding due to increasing investments in industrial manufacturing, environmental protection, and building. Demand for lime products in the course of cement manufacturing, steel refining, and municipal wastewater treatment is increasing in these countries.

Sustained investment in Kuwaiti and Omani oil refineries and petrochemical plants is fueling the demand for lime in the form of processes such as sulphur stripping, catalyst treatment, and gas purification. State development policies are further promoting consumption in chemical industries involved in manufacturing, agriculture, and construction. FMI is of the opinion that the industry in Kuwait, Oman, and Bahrain will experience 4.5% CAGR during the forecast period.

Growth Factors in Kuwait, Oman & Bahrain

| Key Factor | Detail |

|---|---|

| Expansion of Petrochemical & Oil Refining Industries | Large consumer for quicklime application in desulfurization and catalyst reactivation. |

| Expansion of Municipality Water Treatment & Desalination | Increased application for the neutralization of acidic waste as well as water treatment for potable purposes. |

| Expansion of Steel & Glass Industry | Increasing application for processes of fluxing and refining. |

| Agricultural Utilization & Stabilization of Soil | Increased application for controlling pH and fertilizer production. |

GCC calcium oxide market is a competitive, dominated by steel production, construction, water treatment, chemical processing, and environmental requirements. Calcium oxide finds wide application in metallurgical refining, flue gas desulphurisation, soil stabilisation, and pH correction.

It is controlled by Saudi Arabia, UAE, Qatar, Oman, Kuwait, and Bahrain's infrastructure development, industrialization, and environmental policy. Key GCC quicklime industry players aim for high-purity production, value chain optimization, and capacity addition to meet growing demand in the steel, cement, and chemicals industries.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Saudi Lime Industries Co. | 14-17% |

| Emirates Lime Factory | 12-14% |

| Qatar National Cement Company (QNCC) | 9-11% |

| Oman Lime Industry LLC | 5-7% |

| United Lime Industries Co. (ULI) | 3-5% |

| Other Companies (combined) | 48-57% |

| Company Name | Key Offerings/Activities |

|---|---|

| Saudi Lime Industries Co. | Produces high-purity quicklime, hydrated lime, and dolomitic lime to be utilized for steel, water treatment, and chemicals. |

| Emirates Lime Factory | Manufactures the Quicklime for environmental, industrial, and construction applications, with a focus on sustainable production of lime. |

| Qatar National Cement Company (QNCC) | Supplies quicklime for construction activities, cement production, and flue gas desulfurization, and couples lime production with cement grinding. |

| Oman Lime Industry LLC | Hydrated lime and quicklime specialties for steel, mining, and water treatment applications, offering reliable quality for industrial applications. |

| United Lime Industries Co. (ULI) | Provides Quicklime solutions for chemical processing, water treatment, and agriculture with an emphasis on specialty lime formulations. |

Saudi Lime Industries Co.

Saudi Lime Industries Co. is Saudi Arabia's largest manufacturer of quicklime, hydrated lime, and dolomitic lime for metallurgical, chemical, and construction applications. Saudi Lime Industries Co. emphasizes high-purity production, advanced calcination technology, and environmental friendliness, making it the first choice for industrial and infrastructure projects in the GCC.

Emirates Lime Factory

Emirates Lime Factory is the UAE market's leading supplier, shipping steelmaking, water treatment, and environmental markets. It applies sustainable, energy-efficient lime production through the use of advanced kiln technology in the manufacture of quality quicklime.

Qatar National Cement Company (QNCC)

QNCC dominates Qatar's cement and lime industry, producing quicklime for utilization in cement batching, soil stabilization, industrial and power plant flue gas desulfurization. The company leverages the production ability in cement in delivering cost-effective supply of lime to developmental infrastructure projects.

Oman Lime Industry LLC

Oman Lime Industry LLC produces quicklime and hydrated lime that is applied in steel, mining, and wastewater treatment. Uniformity and high reactivity of the company's lime products are assured through its precision calcination and customized product formulation.

United Lime Industries Co. (ULI)

ULI is providing chemical, agri, and environmental solutions with custom-made lime solutions to industry customers who need unique granulometry and purity specifications. It is also strengthening its regional supply chain to provide infrastructure and industrial developments in the GCC.

Other Key Players

The market is slated to reach USD 167.5 million in 2025.

The market size is slated to reach USD 264.2 million by 2035.

Advancements in the iron & steel industry have boosted the sales of calcium oxide in GCC.

Saudi Arabia, slated to grow at 4.8% CAGR during the study period, is anticipated to experience fastest growth.

Kuwait Lime Company, Al Jazeera Lime Factory, Riyadh Cement Company – Lime Division, Bahrain Lime & Chemicals W.L.L., Fujairah Lime Industry FZC, Jabal Al Dhanna Lime Co., Al Safwa Lime & Chemicals, Al Kout Industrial Projects Co. (Kuwait), and Lhoist Middle East (regional presence) & United Mining Industries (UMI) are the key players.

Based on the grade, the market is segmented into food grade and commercial grade.

On the basis of end-use industries, the market is segmented into building and construction, iron and steel, water treatment, food industry, glass making, agriculture, and others.

On the basis of country, the market is segmented into United Arab Emirates, Saudi Arabia, Qatar, Kuwait, Bahrain, and Oman.

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Asia Pacific Industrial Solvents Market Growth - Trends & Forecast 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Growth - Trends & Forecast 2025 to 2035

Diamond Wire Market Size & Outlook 2025 to 2035

Thioesters Market Growth & Trends 2025 to 2035

The Self-Healing Materials Market is segmented by product, technology, and application from 2025 to 2035.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.