The GCC adventure tourism market is expected to grow from an estimated USD 18.6 billion in 2025 to USD 71.4 billion by 2035, with a CAGR of 14.4% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Industry Size 2025 | USD 18,642.3 Million |

| Projected Value 2035 | USD 71,472.6 Million |

| Value-based CAGR from 2025 to 2035 | 14.4% |

A demand rise for distinctive experiences in traveling, sustainable tourism, and increasing infrastructure for adventure-oriented activities within GCC countries are forecasted to positively influence market growth.

Factors of an increase in disposable income, youth demographics, and the use of social media in travel planning also are going to impact the market. With these advancements, the industry in GCC countries is expected to grow 3.8X in the next decade translating to an absolute dollar opportunity of USD 52.8 Bn between 2025 and 2035.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

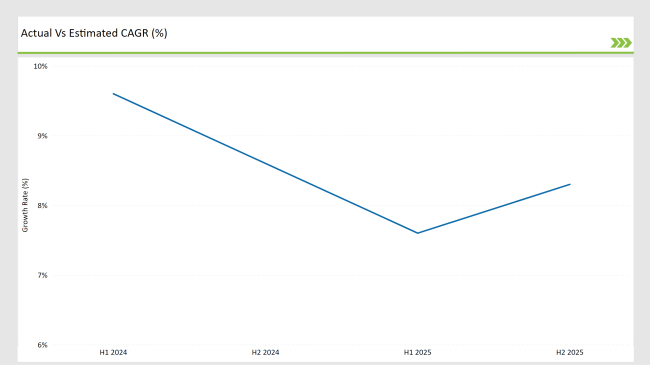

A comparative assessment of the changes in CAGR for the base year (2024) and the current year (2025) has been provided in the following table. This semi-annual analysis highlights the shifts in market dynamics and outlines revenue trends.

It is predicted that the GCC adventure tourism market will grow at a CAGR of 11.6% in the first half of 2024, with a slight increase to 12.5% in the second half of the year. In 2024, the market growth rate is expected to increase slightly to 11.8% in H1 but is likely to rise to 14.3% in H2. This indicates a minor dip in early 2025, followed by an uptick later in the year as new destinations and tourism activities are introduced.

| Date | Development/M&A Activity & Details |

|---|---|

| March 2024 | Expansion of Desert Adventures Tourism Announced: The expansion of Desert Adventures Tourism’s operations into Oman was announced. The focus of the expansion is placed on eco-friendly adventure resorts and sustainable tourism initiatives, which are aimed at meeting the growing demand for outdoor experiences in the region. |

| Oct 2024 | New Adventure Packages Launched by Saudi Adventure Sports: Saudi Adventure Sports launched a new series of adventure tourism packages, which included desert safaris, rock climbing, and mountain biking. These packages were specifically targeted at international tourists, focusing on eco-tourism and adventure activities in the vast deserts of Saudi Arabia. |

| May 2024 | Water-Based Activities Expanded by Arabian Adventures: The leading water-based adventure activities along the coast of the UAE include jet skiing, kite surfing, and paddleboarding, expanded by Arabian Adventures. As it is expected that such experiences are going to increase in demand, they are going to attract regional and international tourists. |

| Mar 2024 | Partnership for Cultural Tours Formed by Adventure Zone: A new partnership was formed by Adventure Zone with global tourism authorities to develop new guided tours in remote desert regions. The tours, which will integrate cultural exploration with adventure activities, will provide tourists with authentic desert experiences. |

| Sept 2024 | VR Desert Safaris Launched: The venturist companies and tech firms working together formed a successful collaboration that was creating virtual reality (VR) desert safaris, which allowed tourists to preview their adventure experiences before booking them in an immersive digital format on the GCC's tourism destinations. |

Rising Popularity of Adventure Tourism in GCC Region

In the GCC region, adventure tourism is gaining popularity, with more people seeking adrenaline-pumping experiences, sustainable travel, and outdoor exploration. Adventure activities such as desert safaris, rock climbing, hiking, and scuba diving are being offered across countries like the UAE, Saudi Arabia, and Oman. The increasing demand for unique and off-the-beaten-path experiences is expected to continue fueling growth in the market, with leading players such as Arabian Adventures and Desert Adventures Tourism spearheading the industry.

Increase in Eco-Friendly and Sustainable Tourism

There will be an increasing demand for environmentally responsible travel. In order to capture the increasing eco-tourism travel opportunities, nature-based experiences, and eco-friendly adventure resorts, Oman will take the lead by pushing forward the adoption of nature reserves and eco-friendly lodging. Tourism is bound to attract more people searching for sustainable adventure, hence catching up with the increasing demand of eco-tourism in the region.

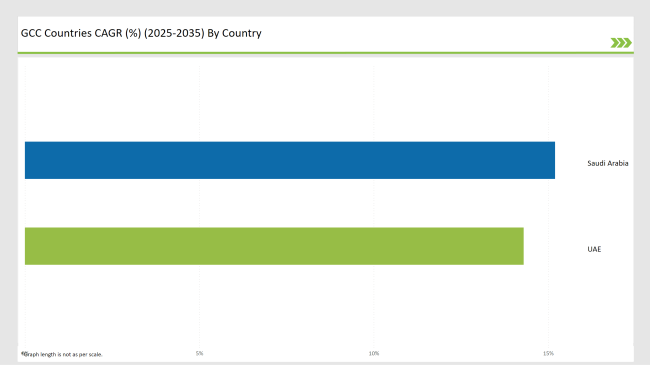

UAE: A Leading Destination for Adventure Tourism

The modern infrastructure, luxurious resorts, and a variety of adventure activities like desert safaris, skydiving, and dune bashing continue to make the UAE a significant destination for adventure tourism.

Diversification efforts in tourism offerings by the government have helped adventure tourism to boom with the addition of artificial ski slopes and international standard adventure sports. The UAE, therefore, becomes an important market for adventure tourism.

Saudi Arabia: A Rapidly Growing Adventure Tourism Destination

Recently, Saudi Arabia has witnessed rapid growth in adventure tourism due to the investments made recently in tourism infrastructure and initiatives undertaken for the promotion of natural landscapes of the country.

Easing of restrictions on tourist visas and introduction of new adventure activities like desert trekking and rock climbing are making the country a major adventure tourism destination. Operators like Saudi Adventure Sports are capitalizing on these opportunities and attracting international adventure enthusiasts to drive the market.

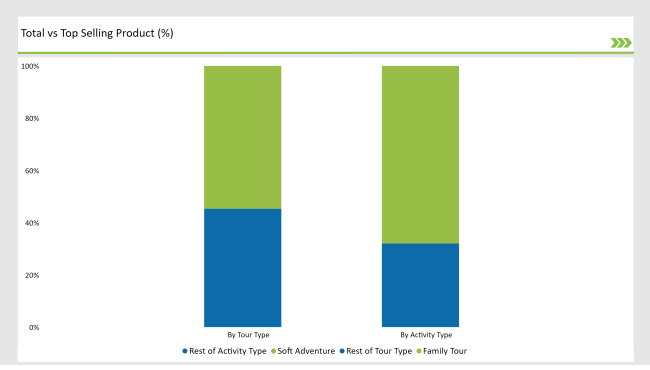

Soft Adventure Activities Becoming More Popular

Soft adventure activities are expected to capture the market in 2025 with 68.2% of the total market share, followed by nature walks, camel rides, and light hiking. These types of activities appeal to tourists seeking outdoor experiences that do not demand extreme physical exertion. Hard adventure activities such as rock climbing and extreme sports, though gaining momentum, are expected to be a small part of the market (31.8%).

The soft adventure tourism industry in the Gulf Cooperation Council (GCC) countries has been experiencing steady growth as travelers increasingly seek outdoor experiences that combine excitement with safety and accessibility. The GCC, traditionally known for its luxurious resorts and urban attractions, is diversifying its tourism offerings to include more nature-based activities, catering to both local and international tourists.

UAE, Oman, and Qatar have made tremendous efforts to develop soft adventure tourism. For instance, the UAE has transformed into a hub for desert safaris, mountain trekking, and kayaking in Hatta and along the Fujairah coastline. Oman, with diverse landscapes of mountains, deserts, and beaches, has gained popularity in trekking, camping, and rock climbing activities in Jebel Akhdar and Wadi Shab.

In Qatar, the Al Thakira mangroves have attracted kayaking and eco-tourism enthusiasts, while Saudi Arabia is investing in eco-tourism and nature experiences as part of its Vision 2030 initiative. The country has opened new hiking trails, like those in the Asir Mountains, and launched adventure parks.

The region is gaining increasing focus on sustainable tourism and wellness, along with its year-round warm climate, which makes soft adventure tourism an increasingly popular concept, thereby offering a balanced mix of nature and culture in accessible, family-friendly ways.

Group Tours Expected to See Increased Popularity

In 2025, group tours are forecast to take 23.1% of the market share, and family tours will be the largest share, at 54.7%. Group adventure tours have provided tourists with both convenience and mutual experiences, which has led to the growth of packaged adventure tourism options in the GCC region.

The interest in adventure tourism within GCC countries is anticipated to be fueled by an increasing appetite for distinctive and genuine travel experiences. Tourists are progressively pursuing activities that integrate cultural immersion, excitement, and nature-oriented exploration. The presence of luxury resorts and customized adventure travel packages is likely to enhance accessibility to adventure tourism activities, thereby broadening its appeal to a larger demographic.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

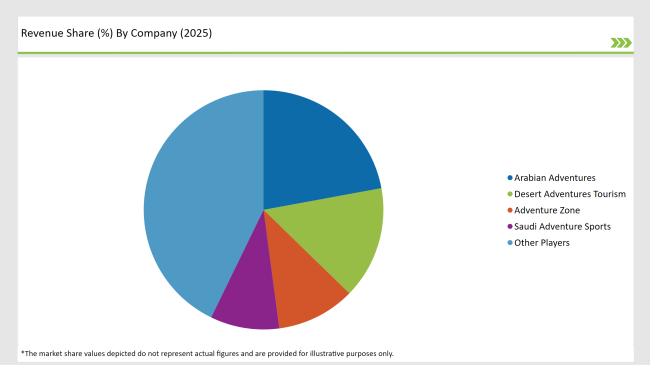

The GCC adventure tourism market is moderately consolidated, with strong brands like Arabian Adventures, Desert Adventures Tourism, and Adventure Zone operating in the marketplace.

These big players will continue to stay on top by virtue of having a very well-established brand portfolio, excellent domestic knowledge, and customized adventure tour experiences. It is expected that smaller local companies will focus more on niche market areas and give customized tours targeting niche areas given the increased requirement for such individualistic adventure holidays.

The GCC adventure tourism market is expected to grow at a CAGR of 14.4% from 2025 to 2035.

The market is expected to reach an estimated value of USD 71.5 billion by 2035.

The market is expected to be driven by the rising demand for unique adventure experiences, the growth of eco-tourism, and the increasing disposable income in GCC countries.

The UAE, Saudi Arabia, and Oman are expected to be key regions with high consumption rates in the GCC adventure tourism market.

Leading players in the industry include Arabian Adventures, Desert Adventures Tourism, Adventure Zone, and Saudi Adventure Sports, known for their diverse and tailored adventure tourism offerings.

Explore Outdoor Tourism Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.