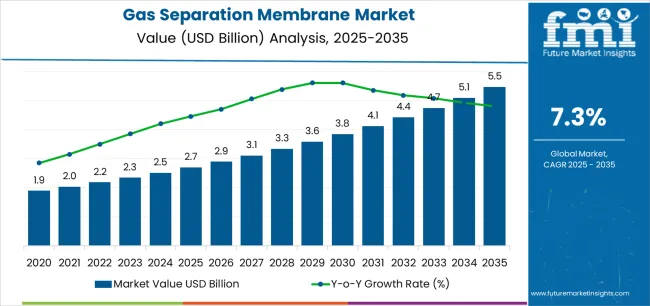

The global gas separation membrane market is projected to grow from USD 2.7 billion in 2025 to approximately USD 5.5 billion by 2035, recording an absolute increase of USD 2.8 billion over the forecast period. This translates into a total growth of 103.7%, with the market forecast to expand at a CAGR of 7.3% between 2025 and 2035. The market size is expected to grow by nearly 2X during the same period, supported by increasing demand for industrial decarbonization, rising adoption in hydrogen purification applications, and growing focus on energy-efficient separation technologies for specialized gas processing applications across global chemical, petrochemical, and energy sectors.

Between 2025 and 2030, the gas separation membrane market is projected to expand from USD 2.7 billion to USD 3.7 billion, resulting in a value increase of USD 1.0 billion, which represents 35.7% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for clean hydrogen production technologies, increasing applications in carbon capture and biogas upgrading, and growing penetration in emerging markets. Membrane manufacturers are expanding their production capabilities to address the growing demand for specialized gas separation solutions in various industrial applications and energy transition processes.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2.7 billion |

| Forecast Value in (2035F) | USD 5.5 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

From 2030 to 2035, the market is forecast to grow from USD 3.7 billion to USD 5.5 billion, adding another USD 1.8 billion, which constitutes 64.3% of the ten-year expansion. This period is expected to be characterized by the expansion of specialized membrane manufacturing facilities, the integration of advanced materials technologies, and the development of customized membrane formulations for specific industrial applications. The growing adoption of decarbonization strategies and climate change mitigation requirements will drive demand for ultra-high performance gas separation membranes with enhanced selectivity specifications and consistent separation performance characteristics.

Between 2020 and 2025, the gas separation membrane market experienced steady expansion, driven by increasing recognition of membrane technologies' importance in industrial gas separation and growing acceptance of energy-efficient separation processes in complex manufacturing operations. The market developed as manufacturers recognized the need for cost-effective alternatives to traditional separation technologies to address complex purification requirements and improve process efficiency. Research and development activities began emphasizing the importance of advanced membrane materials in achieving better separation performance and energy savings in industrial gas processing applications.

Market expansion is being supported by the increasing demand for industrial decarbonization solutions and the corresponding need for energy-efficient gas separation technologies in refining, petrochemical, and clean energy production processes across global manufacturing operations. Modern industrial facilities are increasingly focused on specialized separation technologies that can improve process efficiency, reduce energy consumption, and enhance product purity while meeting stringent environmental regulations and requirements. The proven efficacy of gas separation membranes in various industrial applications makes them an essential component of comprehensive process optimization strategies and environmental compliance programs.

The growing emphasis on hydrogen economy development and clean energy transition is driving demand for high-performance gas separation membranes that meet stringent purity specifications and operational requirements for hydrogen production and purification applications. Industrial operators' preference for reliable, energy-efficient separation technologies that can ensure consistent process outcomes is creating opportunities for innovative membrane materials and customized system solutions. The rising influence of carbon neutrality commitments and emissions reduction targets is also contributing to increased adoption of membrane-based separation systems across different industrial sectors and applications requiring efficient CO₂ capture and removal technologies.

The gas separation membrane market represents a dynamic growth opportunity, expanding from USD 2.7 billion in 2025 to USD 5.5 billion by 2035 at a 7.3% CAGR. As industrial operators prioritize energy efficiency, environmental compliance, and operational cost optimization in gas processing applications, gas separation membranes have evolved from alternative separation technologies to essential process equipment enabling selective gas permeation, multi-component separation, and energy-efficient purification across refinery operations, hydrogen production facilities, and biogas upgrading installations.

The convergence of industrial decarbonization mandates, increasing clean hydrogen production, carbon capture deployment acceleration, and biogas upgrading expansion creates momentum in demand. High-performance polymeric membranes offering superior separation efficiency, cost-effective hollow fiber configurations balancing performance with economics, and specialized ceramic membranes for high-temperature applications will capture market premiums, while geographic expansion into high-growth Asian industrial hubs and emerging market penetration will drive volume leadership. Regulatory emphasis on emissions reduction and energy efficiency provides structural support.

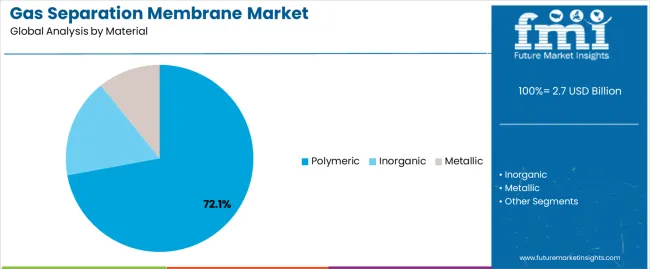

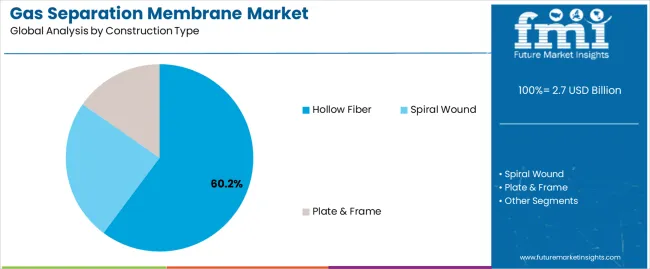

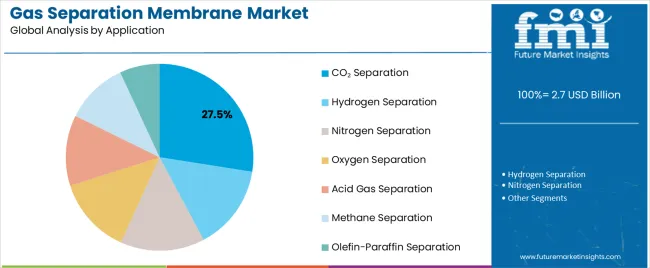

The market is segmented by material, construction type, application, and region. By material, the market is divided into Polymeric, Inorganic, and Metallic. The Polymeric segment is further categorized into Polyimide, Polysulfone, and Others. Based on construction type, the market is categorized into Hollow Fiber, Spiral Wound, and Plate & Frame. By application, the market includes CO₂ Separation, Hydrogen Separation, Nitrogen Separation, Oxygen Separation, Acid Gas Separation, Methane Separation, and Olefin-Paraffin Separation. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

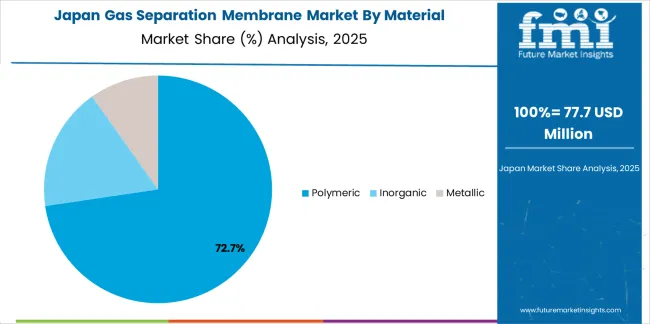

The Polymeric segment is projected to account for 72.1% of the gas separation membrane market in 2025, reaffirming its position as the category's dominant material type. Industrial operators increasingly recognize the optimal balance of performance, cost-effectiveness, and versatility offered by polymeric membranes for most gas separation applications, particularly in hydrogen purification, CO₂ removal, and nitrogen generation processes. This material category addresses both separation efficiency requirements and economic considerations while providing reliable performance across diverse industrial applications.

Within the polymeric segment, Polyimide leads with 36.0% share, driven by superior chemical resistance, excellent thermal stability, and high selectivity for challenging gas separation applications. Polysulfone follows with 22.0% share, offering cost-effective solutions for hydrogen separation and nitrogen generation with good mechanical properties and chemical resistance. Other polymeric materials, including cellulose acetate, polysulfone derivatives, and specialty polymers, account for 14.1% share, serving niche applications requiring specific separation characteristics.

This material category forms the foundation of most industrial gas separation installations, as it represents the most widely accepted and commercially viable membrane technology in the industry. Extensive application testing and continuous material innovation continue to strengthen confidence in polymeric membrane formulations among industrial operators and engineering contractors. With increasing recognition of the performance-cost optimization requirements in industrial gas processing, polymeric membranes align with both operational efficiency and capital investment goals, making them the central growth driver of membrane separation strategies.

Hollow Fiber construction is projected to represent 60.2% of gas separation membrane demand in 2025, underscoring its role as the primary configuration driving market adoption and growth. Industrial operators recognize that large-scale gas separation requirements, including high flow rate processing, compact footprint installations, and modular system designs, often require membrane configurations that standard flat sheet or tubular designs cannot adequately provide. Hollow fiber membranes offer enhanced packing density and superior surface area per unit volume in gas separation applications.

The segment is supported by the growing nature of industrial gas processing requiring high-capacity separation systems and the increasing recognition that hollow fiber configurations can improve operational efficiency and reduce capital costs. Industrial facilities are increasingly adopting evidence-based technology selection guidelines that recommend hollow fiber membranes for optimal separation performance and economic outcomes. As understanding of gas separation technology advances and operational efficiency requirements become more stringent, hollow fiber construction will continue to play a crucial role in comprehensive industrial gas processing strategies within the membrane separation market.

Spiral Wound configuration accounts for 26.4% market share, serving applications requiring robust mechanical construction and easy maintenance access, particularly in liquid-gas separation and high-pressure applications. Plate & Frame construction holds 13.4% share, addressing specialized applications requiring flexible membrane replacement and laboratory-scale installations.

CO₂ Separation is projected to represent 27.5% of gas separation membrane demand in 2025, establishing its position as the leading application driving market growth. The segment addresses critical industrial needs including natural gas sweetening, biogas upgrading, carbon capture from industrial emissions, and enhanced oil recovery applications. Growing carbon neutrality commitments and emissions reduction regulations are driving demand for efficient CO₂ removal technologies across energy, chemical, and industrial sectors.

Hydrogen Separation follows with 23.0% market share, serving clean hydrogen production, refinery hydrogen recovery, ammonia synthesis purification, and fuel cell applications. The rapid expansion of hydrogen economy initiatives and clean energy transition programs creates substantial growth opportunities for hydrogen-selective membranes.

Nitrogen Separation accounts for 20.8% share, addressing applications including enhanced oil recovery, food packaging atmosphere control, chemical process inerting, and electronics manufacturing. Oxygen Separation holds 10.4% share, serving medical oxygen generation, wastewater treatment aeration, and combustion enrichment applications. Acid Gas Separation (7.8%), Methane Separation (6.3%), and Olefin-Paraffin Separation (4.1%) complete the application landscape, addressing specialized industrial requirements in petrochemical processing, natural gas upgrading, and chemical production.

The gas separation membrane market is advancing steadily due to increasing recognition of energy-efficient separation technologies' importance and growing demand for decarbonization solutions across the refining, petrochemical, and energy sectors. The market faces challenges, including membrane fouling and degradation issues, limitations in high-temperature applications, and competition from established separation technologies such as pressure swing adsorption and cryogenic distillation. Innovation in membrane materials and system integration technologies continues to influence product development and market expansion patterns.

The growing adoption of carbon neutrality commitments is enabling the development of more sophisticated gas separation membrane applications that can meet stringent emissions reduction requirements. Industrial decarbonization programs offer comprehensive CO₂ capture and removal services, including carbon capture from flue gas streams and biogas upgrading processes that are particularly important for achieving net-zero emissions targets in energy-intensive industries. Advanced membrane systems provide access to modular, scalable separation technologies that can optimize process efficiency and reduce energy consumption while maintaining cost-effectiveness for large-scale deployment.

Modern membrane manufacturers are incorporating advanced material technologies such as mixed-matrix membranes, nano-composite materials, and ceramic-polymer hybrids to enhance gas separation membrane performance and durability. These technologies improve selectivity, enable high-temperature operation, and provide better resistance to chemical degradation throughout the membrane lifecycle. Advanced material platforms also enable customized separation characteristics and early identification of potential performance limitations or operational challenges, supporting reliable industrial gas processing.

The rapid expansion of hydrogen economy initiatives is driving demand for high-purity hydrogen separation technologies across steam methane reforming, water electrolysis, and industrial hydrogen recovery applications. National hydrogen strategies, including India's National Green Hydrogen Mission and Germany's National Hydrogen Strategy, are creating substantial opportunities for membrane-based hydrogen purification systems. Industrial gas producers and energy companies are investing in membrane separation technologies to support cost-effective hydrogen production and distribution infrastructure development.

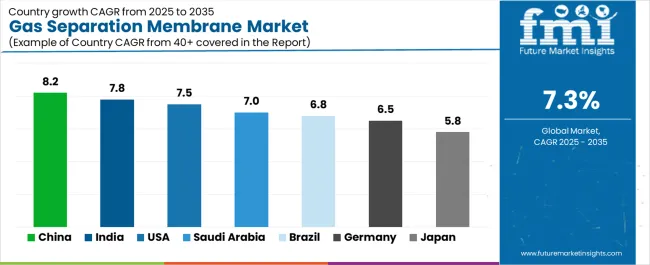

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.2% |

| USA | 7.5% |

| India | 7.8% |

| Germany | 6.5% |

| Brazil | 6.8% |

| Saudi Arabia | 7.0% |

| Japan | 5.8% |

The gas separation membrane market is experiencing varied growth globally, with China leading at an 8.2% CAGR through 2035, driven by dual-carbon goals, industrial decarbonization programs, and refinery-ammonia hydrogen purification pilots. The USA follows at 7.5%, supported by EPA compliance pressure, shale gas CO₂-N₂ removal requirements, and DOE-backed hydrogen projects. India shows growth at 7.8%, driven by National Green Hydrogen Mission pilots, biogas upgrading rollouts, and PSU-EPC adoption of modular systems. Germany records 6.5% growth, focusing on EU Fit-for-55 compliance, biogas upgrading leadership, and hydrogen strategy driving purification demand. Brazil exhibits 6.8% growth, supported by biomethane projects in ethanol-landfill sectors, renewable gas integration rules, and local assembly momentum. Saudi Arabia demonstrates 7.0% growth, driven by Vision 2030-IKTVA localization, blue-clean hydrogen projects, and petrochemical cluster pilots. Japan shows 5.8% growth, emphasizing METI green growth programs, compact high-reliability installations, and ceramic-inorganic hybrid R&D.

The report covers an in-depth analysis of 40+ countries, with top-performing countries are highlighted below.

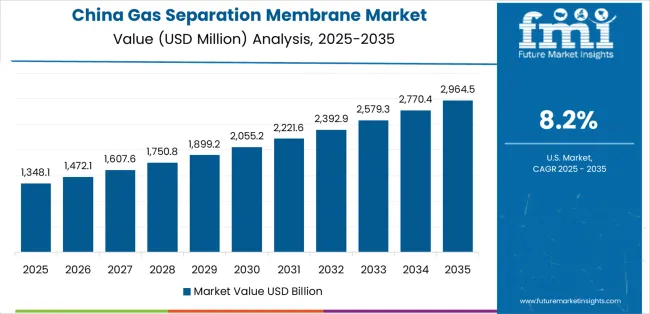

Revenue from gas separation membranes in China is projected to exhibit robust growth with a CAGR of 8.2% through 2035, driven by ambitious dual-carbon goals and increasing deployment of industrial decarbonization technologies as essential components for emissions reduction in energy-intensive sectors. The country's expanding refinery infrastructure and growing availability of hydrogen purification capabilities are creating significant opportunities for membrane adoption across both domestic consumption and export-oriented production facilities. Major international and domestic membrane manufacturers are establishing comprehensive production and distribution networks to serve the growing population of industrial operators requiring efficient gas separation technologies across petrochemical, chemical, and energy applications throughout China's major industrial clusters.

The Chinese government's strategic emphasis on carbon neutrality by 2060 and peak carbon emissions by 2030 is driving substantial investments in clean energy technologies and carbon capture systems. This policy support, combined with the country's large industrial base and expanding hydrogen economy initiatives, creates a favorable environment for gas separation membrane market development. Chinese manufacturers are increasingly focusing on advanced membrane materials to move up the value chain, with gas separation membranes representing a key component in this strategic transformation.

Demand for gas separation membranes in the USA is projected to grow at a CAGR of 7.5%, supported by EPA compliance pressure, shale gas processing requirements, and expanding clean hydrogen infrastructure across the country's diverse industrial landscape. The country's large refining and petrochemical sector and increasing recognition of energy-efficient separation technologies are driving demand for effective membrane solutions in both natural gas upgrading and industrial emissions reduction applications. International membrane manufacturers and domestic technology companies are establishing comprehensive distribution channels to serve the growing demand for advanced separation systems while supporting the country's energy transition objectives.

The USA energy sector continues to benefit from favorable policy support for clean hydrogen development, including DOE funding programs and infrastructure investment incentives. The country's focus on reducing industrial emissions while maintaining manufacturing competitiveness is driving investments in energy-efficient separation technologies. This development is particularly important for gas separation membrane applications, as industrial operators seek reliable domestic sources for critical process equipment to reduce supply chain vulnerabilities and improve operational flexibility.

Revenue from gas separation membranes in India is expanding at a CAGR of 7.8%, supported by National Green Hydrogen Mission implementation, biogas upgrading program expansion, and developing industrial market presence across the country's major manufacturing clusters. The country's large agricultural sector and increasing recognition of renewable gas technologies are driving demand for effective membrane-based biogas upgrading solutions in both waste-to-energy and agricultural residue processing applications. International membrane companies and domestic manufacturers are establishing comprehensive distribution channels to serve the growing demand for modular separation systems while supporting the country's clean energy independence objectives.

India's renewable energy sector continues to benefit from favorable government policies, skilled workforce availability, and cost-competitive manufacturing capabilities. The country's focus on becoming a global green hydrogen production hub is driving investments in hydrogen purification infrastructure and membrane manufacturing capacity. This development is particularly important for gas separation membrane applications, as industrial operators and public sector undertakings seek reliable domestic sources for critical separation technologies to reduce import dependency and improve energy security.

Demand for gas separation membranes in Germany is anticipated to expand at a CAGR of 6.5%, supported by EU Fit-for-55 compliance requirements and advanced biogas upgrading infrastructure that emphasizes energy efficiency, and regulatory compliance. German industrial operators consistently utilize membrane separation technologies for emissions reduction applications and renewable gas production, with particular strength in biogas-to-biomethane upgrading and hydrogen purification systems. The market is characterized by mature technology adoption protocols, comprehensive quality standards, and established relationships between membrane suppliers and industrial operators that support long-term supply agreements and technical collaboration.

Germany's chemical and energy industries benefit from advanced research and development capabilities, sophisticated manufacturing infrastructure, and strong regulatory frameworks that support green industrial practices. The country's emphasis on hydrogen economy development and circular economy principles is driving the deployment of more efficient separation processes and cleaner production methods for industrial gas processing applications. This focus on technological advancement and environmental responsibility aligns with European Union trends toward climate-neutral industrial operations.

Revenue from gas separation membranes in Brazil is projected to grow at a CAGR of 6.8% through 2035, driven by biomethane project development, increasing access to biogas upgrading technologies, and growing recognition of renewable gas importance in energy transition strategies. Brazilian industrial operators are increasingly adopting membrane-based biogas upgrading approaches for renewable natural gas production, supported by expanding ethanol industry cogeneration facilities and municipal waste-to-energy projects across the country's major agricultural and urban regions. The market benefits from Brazil's large sugarcane ethanol sector and growing participation in global renewable energy markets.

Brazil's renewable energy industry is experiencing modernization and expansion, particularly in biogas production from agricultural residues and landfill gas recovery. The country's strategic biofuel production capabilities and favorable renewable gas regulations provide opportunities for membrane separation system deployment. Government support for renewable energy development, combined with increasing private sector investment, is driving infrastructure improvements and capacity expansion in biogas upgrading and biomethane injection systems.

Demand for gas separation membranes in Saudi Arabia is expanding at a CAGR of 7.0% through 2035, driven by Vision 2030 economic diversification objectives, IKTVA (In-Kingdom Total Value Add) localization requirements, and comprehensive petrochemical expansion programs that emphasize industrial capability development and technology deployment. Saudi industrial operators are increasingly adopting membrane-based separation technologies as part of integrated gas processing approaches, emphasizing operational efficiency and environmental compliance in both blue hydrogen production and petrochemical manufacturing. The market benefits from substantial government investments in industrial infrastructure and strategic focus on clean energy technology deployment.

The Kingdom's petrochemical industry is experiencing significant expansion and technological upgrading, with particular emphasis on hydrogen production for refining and ammonia synthesis applications. The country's strategic gas reserves and ambitious clean hydrogen export plans provide substantial opportunities for advanced membrane separation system deployment. Government support for industrial localization, combined with international technology partnerships, is driving infrastructure development and domestic manufacturing capability enhancement in specialized process equipment.

Revenue from gas separation membranes in Japan growingat a CAGR of 5.8% through 2035, supported by the country's METI (Ministry of Economy, Trade and Industry) green growth strategy, comprehensive industrial decarbonization framework, and systematic approach to clean energy technology deployment that emphasizes reliability, quality, and technical excellence. Japanese industrial operators emphasize evidence-based technology selection within structured implementation frameworks that prioritize separation efficiency and operational reliability in both hydrogen production and carbon capture applications. The market is characterized by high technical standards, established quality systems, and long-term technology partnerships.

Japan's industrial sector benefits from advanced materials research capabilities, sophisticated engineering expertise, and a strong emphasis on continuous improvement and innovation. The country's commitment to carbon neutrality by 2050 and focus on hydrogen society development create demand for advanced gas separation technologies, while the emphasis on compact, high-reliability systems supports premium pricing for specialized membrane products.

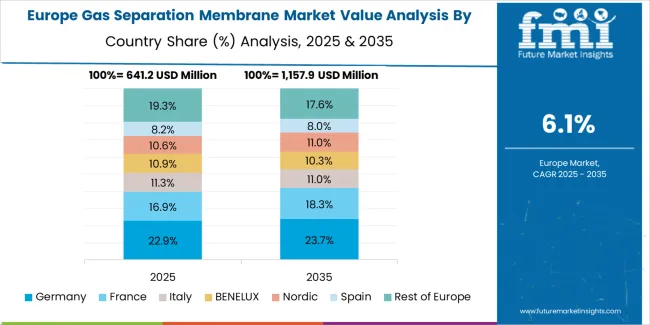

The gas separation membrane market in Europe is projected to grow from USD 0.8 billion in 2025 to USD 1.5 billion by 2035, registering a CAGR of 6.5% over the forecast period. Germany is expected to maintain leadership with a 29.0% market share in 2025, edging to 28.5% by 2035, supported by strong biogas upgrading and refinery hydrogen recovery deployments throughout major industrial regions.

France follows with a 22.0% share in 2025, rising to 22.5% by 2035 on the back of industrial decarbonization programs in chemicals and cement sectors. The United Kingdom holds an 18.0% share in 2025, moderating to 17.5% by 2035 as carbon-capture clusters scale through staged pilots and industrial deployment programs. Italy accounts for 12.5% in 2025 (12.6% by 2035) driven by waste-to-energy and gas-to-power membrane applications in municipal and industrial settings. Spain represents 9.5% in 2025 (9.8% by 2035) with biomethane injection growth and renewable gas infrastructure expansion. The Rest of Europe collectively moves from 9.0% to 9.1% by 2035 as Nordic and Eastern European projects accelerate, attributed to increasing membrane adoption in biogas upgrading facilities and emerging industrial decarbonization programs implementing clean energy technologies.

The gas separation membrane market is characterized by competition among established industrial gas companies, specialized membrane manufacturers, and materials technology providers focused on delivering high-performance, reliable, and cost-effective gas separation solutions. Companies are investing in advanced materials development, manufacturing process optimization, strategic partnerships, and customer technical support to deliver effective, efficient, and reliable membrane systems that meet stringent industrial process requirements and environmental compliance standards. Separation performance optimization, membrane durability enhancement, and system integration strategies are central to strengthening product portfolios and market presence.

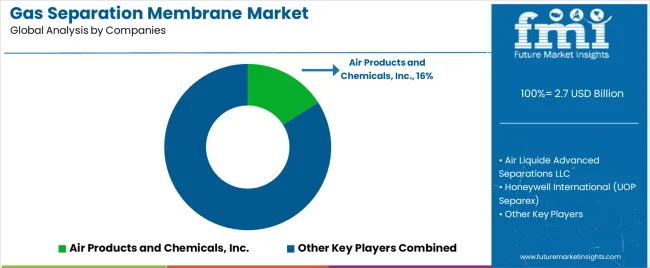

Air Products and Chemicals Inc. leads the market with 16.0% share, offering comprehensive gas separation membrane solutions with a focus on industrial gas applications and process integration expertise. Air Liquide Advanced Separations LLC provides specialized membrane products with emphasis on hydrogen purification and carbon capture applications, supported by comprehensive technical support services. Honeywell International (UOP Separex) focuses on advanced membrane technologies and customized separation solutions for petrochemical and refining applications serving global markets. Membrane Technology and Research Inc. (MTR) delivers established membrane products with strong innovation capabilities and customer service focus, recently expanding Texas production capacity to serve growing biogas upgrading and CO₂ removal demand.

UBE Industries Ltd. operates with a focus on bringing polyimide membrane technologies to specialized gas separation applications and Asian markets. Evonik Industries AG provides comprehensive membrane portfolios, including diacetone glucose derivatives and advanced hollow-fiber systems, across multiple industrial applications and chemical synthesis processes, having launched high-performance hollow-fiber membranes in 2025 aimed at boosting hydrogen purity in petrochemical plants. Parker-Hannifin Corporation specializes in spiral wound membrane modules and integrated separation systems with emphasis on reliability and ease of maintenance. Fujifilm Manufacturing Europe B.V. provides advanced membrane technologies leveraging polymer chemistry expertise for specialized industrial applications. DIC Corporation focuses on polymer membrane materials and manufacturing technologies for Asian industrial markets. Schlumberger Ltd. delivers membrane-based gas processing solutions for oil and gas industry applications with emphasis on field deployment capabilities.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2.7 billion |

| Material | Polymeric (Polyimide, Polysulfone, Others), Inorganic, Metallic |

| Construction Type | Hollow Fiber, Spiral Wound, Plate & Frame |

| Application | CO₂ Separation, Hydrogen Separation, Nitrogen Separation, Oxygen Separation, Acid Gas Separation, Methane Separation, Olefin-Paraffin Separation |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, the United States, Saudi Arabia, Japan and 40+ countries |

| Key Companies Profiled | Air Products and Chemicals Inc., Air Liquide Advanced Separations LLC, Honeywell International (UOP Separex), Membrane Technology and Research Inc. (MTR), UBE Industries Ltd., Evonik Industries AG, Parker-Hannifin Corporation, Fujifilm Manufacturing Europe B.V., DIC Corporation, Schlumberger Ltd. |

| Additional Attributes | Dollar sales by material type, construction configuration, and application, regional demand trends, competitive landscape, operator preferences for specific membrane technologies, integration with industrial gas processing systems, innovations in membrane materials, system performance monitoring, and separation efficiency optimization |

The global gas separation membrane market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the gas separation membrane market is projected to reach USD 5.5 billion by 2035.

The gas separation membrane market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in gas separation membrane market are polymeric, inorganic and metallic.

In terms of construction type, hollow fiber segment to command 60.2% share in the gas separation membrane market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Gas Separation Membranes in EU Size and Share Forecast Outlook 2025 to 2035

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Desiccant Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Gas Jet Compressor Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Gastric-soluble Hollow Capsules Market Size and Share Forecast Outlook 2025 to 2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Smart Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Oil Market Size and Share Forecast Outlook 2025 to 2035

Gas Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Condensing Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Gas Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Gastroesophageal Reflux Disease (GERD) Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gas Station Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA