The gas meters market will grow on the back of increasing energy demand, rapid urbanization and advancement in smart metering technology. Gas meters are used to monitor gas consumption in residential, commercial and industrial sectors for billing and energy management. In addition, the increasing use of natural gas as an alternative to conventional fuels continues to drive the market.

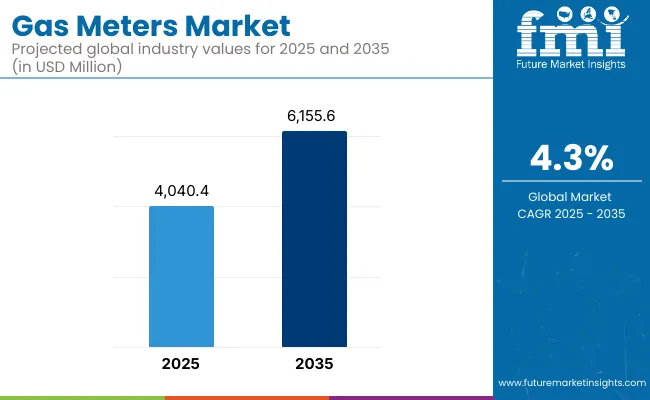

The smart gas meter market is growing due to rising energy conservation and increasing regulatory mandates to accurately monitor the gas. IoT enabled meters and AMR systems are also advancing gas utilities operational efficiency. It is projected to grow at a Compound Annual Growth Rate of 4.3%, from USD 4,040.4 million in 2025 to USD 6,155.6 million by 2035. Factors such as the expansion of gas distribution networks, government smart infrastructure initiatives, and rising investments toward grid modernization would support the market over the longer run.

Key Market Metrics

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 4,040.4 Million |

| Projected Market Size in 2035 | USD 6,155.6 Million |

| CAGR (2025 to 2035) | 4.3% |

North America dominates the gas meters market on account of continuous infrastructure upgrades, increasing natural gas consumption, and growing adoption of smart metering solutions. The strongest market continues to be the United States, helped by major government programs that encourage the deployment of smart grid technologies and advanced metering infrastructure (AMI).

The growth of the gas meters market in Europe is attributed to the stringent energy efficiency regulations, smart city initiatives, and increasing usage of renewable energy sources. Germany, the UK, and France lead the way in introduction of smart gas metering systems that help to optimize gas distribution and ultimately its usage.

Asia-Pacific is predicted to grow the fastest owing to rapid urbanization, expansion of gas distribution networks, and rising energy demand. Use of advanced metering technologies through government-led initiatives in countries such as China, India, and Japan is steadily contributing to the investment in smart gas infrastructure. The region’s transition to sustainable energy solutions also augments the market growth.

Challenges

Aging Infrastructure, High Initial Investment, and Regulatory Compliance

Gas Meters Market challenged by aging pipeline infrastructure shifting towards a boxed test type solution increased reliance on smart metering systems fuels the growth of gas meter players. Utility and consumer also face high capital costs to upgrade traditional gas meters to smart gas metering systems are seen as significant barriers. Moreover, stringent energy regulations and safety protocols established by organizations such as the US Environmental Protection Agency (EPA), the International Energy Agency (IEA), and regional energy authorities exacerbate the operational intricacies for manufacturers and energy suppliers.

Opportunities

The Rise of Smart Meter Adoption, Integration of Renewable Gas and IoT-Enabled Gas Monitoring

Amidst all these challenges, the market is witnessing growth owing to increased demand for real-time monitoring and automated billing smart gas meters. Government initiatives have been driving the adoption of advanced metering infrastructure (AMI), focusing on energy efficiency, carbon reduction, and grid modernization. The rise of renewables (renewable natural gas (RNG) and hydrogen blending on the gas grids) is opening new opportunities for next generation gas meters that can process changing gas compositions. Gas meters that include remote diagnostics, AI-based leak detection, and predictive maintenance that leverage the Internet of Things (IoT) are also gaining market share.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with gas safety, emissions control, and efficiency standards. |

| Consumer Trends | Growing demand for accurate gas billing and remote monitoring solutions. |

| Industry Adoption | Use of mechanical and diaphragm gas meters in residential applications. |

| Supply Chain and Sourcing | Dependence on traditional gas meter components and local utility contracts. |

| Market Competition | Dominated by established gas meter manufacturers and utility providers. |

| Market Growth Drivers | Expansion of urban gas distribution networks and infrastructure investments. |

| Sustainability and Environmental Impact | Efforts to reduce gas leaks, improve energy efficiency, and comply with emissions regulations. |

| Integration of Smart Technologies | Adoption of smart prepayment gas meters and mobile billing apps. |

| Advancements in Meter Technology | Development of digital diaphragm and ultrasonic gas meters. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter mandates for smart gas metering, hydrogen-ready gas grids, and AI-powered gas leak detection. |

| Consumer Trends | Expansion in IoT-enabled smart meters, AI-driven gas consumption analytics, and automated energy management. |

| Industry Adoption | Shift toward smart ultrasonic gas meters and hybrid digital-analog metering systems. |

| Supply Chain and Sourcing | Increased adoption of modular and cloud-connected gas metering solutions. |

| Market Competition | Entry of tech-driven start-ups, AI-powered metering firms, and cloud-based energy analytics companies. |

| Market Growth Drivers | Accelerated by AI-integrated metering, hydrogen gas metering solutions, and next-gen grid modernization projects. |

| Sustainability and Environmental Impact | Large-scale transition to carbon-neutral gas grids, AI-powered gas flow optimization, and block chain-based energy transparency. |

| Integration of Smart Technologies | Expansion into real-time AI-based gas leakage prevention, predictive analytics for maintenance, and block chain-based energy trading. |

| Advancements in Meter Technology | Evolution toward self-powered smart meters, hydrogen-compatible metering, and wireless sensor-enabled gas distribution networks. |

Demand for hydrogen-ready gas meters is surging as the drive for hydrogen integration in natural gas pipelines continues. Moreover, IoT-enables metering systems and AI-based gas monitoring solutions are increasing the accuracy of billing and leaks detection. As the major utilities are moving toward advanced metering infrastructure (AMI) to reduce operational costs and optimize energy usage.

| Country | CAGR (2025 to 2035) |

|---|---|

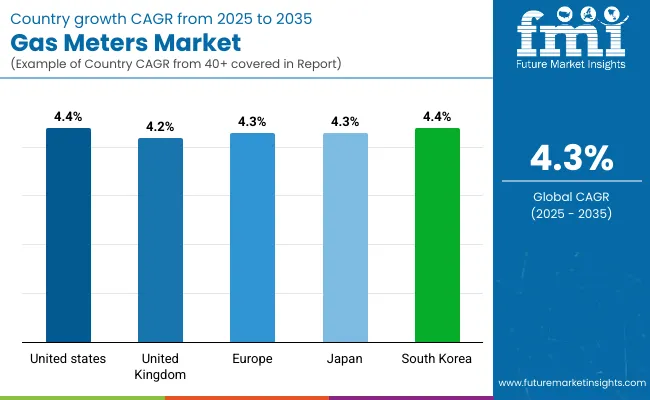

| USA | 4.4% |

The market in the UK is expanding because of Government regulations encompassing smart gas meters, rising uptake of energy-efficient gas appliances, and carbon-neutral energy transition objectives. The national smart meter roll-out continues to fill in the spaces between classic meters with smart prepayment and automatic gas metering systems.

So are initiatives encouraging green hydrogen blending in the gas grid, which is increasing demand for hydrogen-compatible metering solutions. Block chain-based gas billing with the addition of AI-powered energy management platforms integrated into existing ones will also revolutionize the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.2% |

Europe gas meters market growth is driven by EU mandated smart gas meter installations and increasing usage of renewable gas sources, and an increase in demand for gas leakage detection. Countries like Germany, France, and Italy are revamping their gas distribution networks using AI-based methods for gas monitoring, remote diagnostic analytics, and predictive analytics.

Rising adoption of green hydrogen and bio methane in gas pipelines is creating demand for next-generation gas metering systems. Furthermore, growing transition towards smart gas metering infrastructure providing on-time billing along with cloud-based energy tracking is positively influencing the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 4.3% |

Japan gas meters market is projected to grow owing to gradual adoption of smart metering technologies, rising natural gas demand, and government-led initiatives related to hydrogen energy integration. The Philippine focus on seismic gas infrastructure drives demand for automated shutoff and AI-based gas monitoring systems.

Japan’s pioneering efforts in hydrogen fuel technology to develop hydrogen-compatible gas meters for both domestic and industrial use are also making great strides. Here, decarbonisation in the energy sector continues to drive investment in next-generation gas distribution and metering technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.3% |

Government policies promoting the modernization of smart gas grids, coupled with rising LNG (liquefied natural gas) imports and rapid urbanization, are expected to position South Korea as a major gas meter market. The country has invested in hydrogen-based energy solutions as part of its net zero carbon emissions strategy, driving up demand for hydrogen-ready gas meters. Furthermore, the block chain-based gas billing platforms are changing the way energy consumption is tracked, and turning it into money.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

Through superior gas consumption monitoring, strengthened safety measures, and improved energy management, the gas meter market is divided into two divisions based on type, namely, basic gas meters and smart gas meters. These segments are essential to ensure optimum utilization of fuel while complying with regulations and monitoring in real-time across several end-use industries.

Basic gas meters have become one of the most adopted segments in the gas meters market by providing an economical gas measurement solution to residential, commercial, and industrial applications. In contrast to smart gas meters, simple models are based on traditional diaphragm, rotary, or turbine measuring methods, making them dependable and simple to operate.

This has accelerated the adoption in the market for standardized gas metering solutions with robust mechanical structure, high pressure resistance and less dependence on electronics. Research shows that more than 60% of gas distribution networks are using mechanical meters as they are comparatively cheap and simple to maintain.

The strengthening of the gases market which is driven by the expansion of municipal gas distribution projects, widespread distribution grids, as well as the low-tech deployments of gas meters for residential and small commercial purposes.

Enhanced accuracy in measurement via integrated recalibration technologies, high-sensitivity pressure compensation, and corrosion-resistant durable materials has in turn driven adoption, ensuring long service life and reliability.Such hybrid mechanical-digital basic gas meters, which are compatible with manual and digital readouts, have optimized the growth of the progress of this market, allowing the gradual transition of technology in gas metering infrastructure.

Advantage of basic gas meters in terms of costing, toughness, and operation brings it limitations related to real-time data transferring, wear of machine gets measured inaccuracy, modern grid monitoring systems compatibility, etc., which segments is expected to uplift the basic gas meter segment. But, improvements in mechanical metering accuracy, sensor-based calibration and AI driven predictive adjustments are enhancing reliability to ensure continued proliferation of foundational gas meters across a wide range of industrial and municipal applications.

Real-time monitoring and automated data analytics has altered the energy management landscape, leading to widespread market adoption of smart gas meters, especially among utility companies, industrial consumers, and smart city infrastructure projects. Besides, basic gas meters do not offer the capability of having remote connectivity, automated leak detection, and advanced monitoring analytics to improve energy efficiency, and operational safety for clients, provision of all these services is possible by smart meters.

The internet and computerization of devices such as smart meters have had a significantly favourable impact on the market, increasing demand for digital gas monitoring, which includes these smart meters, cloud-based gas consumption tracking, and automated billing integration. Research suggests that around 55% of utility providers are investing in smart metering infrastructure to improve their gas distribution efficiency and regulatory compliance.

Market growth has also been bolstered by the evolution of smart grid technology with interconnected gas, water, and electricity metering that is used to centrally manage energy consumption and deliver uninterrupted utility management automation driven energy.Adoption has been further accelerated by gas usage optimization powered by AI, thanks to features like machine-learning best- anomaly detection, real-time alerts for leak prevention as well as gas demand prediction for cost savings, which have helped industrial consumers maximise safety and savings.

The market has been characterized by the emergence of next-generation smart gas meters with features such as self-calibrating sensors, low-power wireless connectivity, and block chain-secured metering data to ensure transparency and security within energy billing systems, which has contributed to its growth.

The smart gas meter segment shows great potential in providing automation, efficiency, and increased safety but faces challenges in the form of initial deployment costs, cybersecurity threats, and integration with aging gas infrastructures. Nevertheless, advancements in encrypted data transmission technologies, AI-assisted gas consumption optimization, and scalable metering network solutions are increasing the feasibility of smart gas meters, and the global market is likely to witness continued expansion.

Automotive and semiconductor & electronics segments are October 2023 growing market components due to reliance on gas metering to achieve fuel economy, manage emissions, and for precision manufacturing processes.

One of the fastest growing segments of the gas meter market is the automotive industry, including manufacturers and fuel suppliers who require precise gas volume measurement for vehicle testing, alternative fuel dispensing, and emissions monitoring. In contrast to conventional applications, automotive gas meters deal with high-accuracy measurement for combustion efficiency analysis and gas-powered vehicle performance assessment.

The need for compressed natural gas (CNG) and hydrogen fuel applications with gas metering for fuelling stations, on board gas measurement, and optimizing fuel injection in engines has accelerated market adoption. Because more than half of CNG vehicle architecture uses dedicated gas meters to accurately measure the flow of fuel, studies show.

Thus, the growth of alternative fuel vehicle production (smart metering for hydrogen FCVs and LNG refuelling stations) boosts market growth, providing a better distribution efficiency of gas and fuel economy.Together with AI-integrated gas flow regulation with new capabilities for real-time fuel injection monitoring, adaptive combustion analysis, and gas consumption predictive analytics, adoption has improved even further and ensured a well-balanced power performance in gas-powered vehicles.

Although it offers several advantages such as optimizing fuel power consumption, reducing emissions, and tracking gas consumption on board, the automotive segment still faces challenges such as gas meter calibration, compatibility with emerging fuel technologies, and high costs associated with advanced metering solutions. Sensor-assisted fuel metering,AI-powered emissions tracking, and smart vehicle-integrated gas flow measurement innovations pave the way for enhanced precision, guaranteeing growth for automotive gas meters.

Gas meters have seen robust growth across the semiconductor & electronics industry, with market adoption increasingly driven by cleanroom environments, semiconductor fabrication and printed circuit board (PCB) manufacturing, where precise gas regulation is a prerequisite for process consistency and optimization of yield. Semiconductor manufacturing requires ultra-precise gas metering for inert gas handling, chemical vapour deposition (CVD), and plasma etching, in contrast to traditional industrial applications.

The rise of the global microelectronics and nanotechnology manufacturing sectors, which would include gas metering in thin-film deposition, precision coating applications, and photolithography processes, has further contributed to growth in the market, allowing improved product quality and defect reduction.

Also, Adoption is driven by the introduction of AI-based process gas management systems that provide real-time analysis of the gas mixture and can match the required flow, to the predictive guarantees about gas purity before data input, providing additional efficiency and wastage in the semiconductor production process.

Although it has several advantages, including ultra-precise measurement, contamination control, and semiconductor yield enhancement, high gas meter calibration demands, extreme sensitivity to process fluctuations, and stringent industry compliance requirements pose challenges in the semiconductor & electronics segment. Still, advancements like AI-supported gas metering, next-gen flow control sensors, and nanotech-based process monitoring tools are boosting their reliability, helping keep gas meters growing in semiconductor and electronics manufacturing applications.

Increasing government regulations on energy efficiency and integration of smart meter with IoT and cloud based platform will further accelerate the industry growth. The industry participants mainly emphasize the adoption of AI-powered data analytics, smart gas metering solutions, and advanced communication technologies to facilitate accurate and automated billing. Key players such as metering equipment manufacturers, energy utility companies, and IoT technology providing technologies are innovating in intelligent metering systems and next-generation gas distribution solutions.

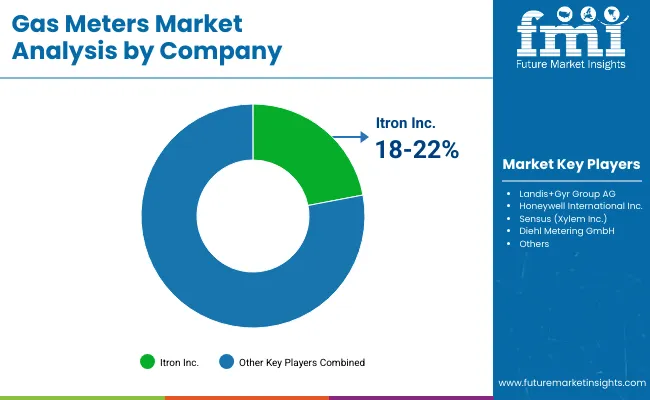

Market Share Analysis by Key Players & Gas Meter Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Itron Inc. | 18-22% |

| Landis+Gyr Group AG | 14-18% |

| Honeywell International Inc. | 12-16% |

| Sensus (Xylem Inc.) | 8-12% |

| Diehl Metering GmbH | 6-10% |

| Other Gas Meter Manufacturers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Itron Inc. | Develops AI-powered smart gas meters, real-time consumption monitoring systems, and advanced data analytics for energy efficiency. |

| Landis+Gyr Group AG | Specializes in IoT-integrated smart gas metering solutions, AI-driven predictive maintenance, and cloud-based meter management platforms. |

| Honeywell International Inc. | Provides high-precision gas metering systems, AI-enhanced leak detection technology, and automated billing solutions. |

| Sensus (Xylem Inc.) | Focuses on intelligent gas metering solutions with AI-powered analytics, remote meter reading, and smart grid connectivity. |

| Diehl Metering GmbH | Offers smart gas meters with AI-assisted anomaly detection, enhanced data security, and real-time monitoring for utility providers. |

Key Market Insights

Itron Inc. (18-22%)

Itron leads the gas metering market with AI-driven smart gas meters, predictive analytics, and cloud-based energy management solutions for efficient resource allocation.

Landis+Gyr Group AG (14-18%)

Landis+Gyr specializes in IoT-enabled smart gas meters, offering AI-enhanced remote monitoring, leak detection, and automated utility billing integration.

Honeywell International Inc. (12-16%)

Honeywell provides AI-powered metering technologies, advanced flow measurement solutions, and real-time gas usage tracking for commercial and residential applications.

Sensus (Xylem Inc.) (8-12%)

Sensus focuses on next-generation gas metering solutions, leveraging AI-driven analytics, remote meter reading capabilities, and smart grid integration.

Diehl Metering GmbH (6-10%)

Diehl Metering specializes in smart gas metering with AI-powered consumption tracking, real-time anomaly detection, and high-precision measurement technologies.

Other Key Players (30-40% Combined)

Several metering technology firms, IoT solution providers, and utility service companies contribute to next-generation gas meter innovations, AI-enhanced remote monitoring, and smart grid advancements. Key contributors include:

The overall market size for the gas meters market was USD 4,040.4 Million in 2025.

The gas meters market is expected to reach USD 6,155.6 Million in 2035.

The demand for gas meters is expected to rise due to increasing adoption of smart metering solutions, rising energy efficiency regulations, and growing investments in gas infrastructure development. The expansion of the automotive industry, particularly in natural gas-powered vehicles, is further fuelling market growth. Additionally, advancements in IoT-enabled gas metering technology and government policies promoting sustainable energy usage are key drivers.

The top 5 countries driving the development of the gas meters market are the USA, China, Germany, India, and Japan.

The automotive industry is expected to command a significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Insulated Switchgear (GIS) Bushing Market Size and Share Forecast Outlook 2025 to 2035

Gas Discharge Tube (GDT) Arresters Market Size and Share Forecast Outlook 2025 to 2035

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Desiccant Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Gas Jet Compressor Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Gastric-soluble Hollow Capsules Market Size and Share Forecast Outlook 2025 to 2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Smart Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Oil Market Size and Share Forecast Outlook 2025 to 2035

Gas Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Condensing Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Gas Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA