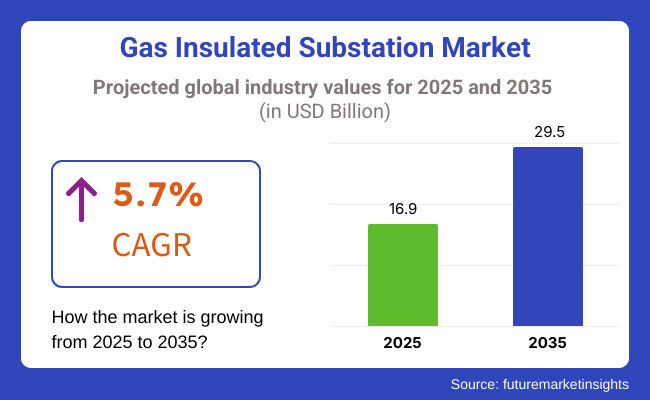

The global gas insulated substation (GIS) market is set for steady expansion between 2025 and 2035, driven by rising electricity demand, rapid urbanization, and the need for efficient and space-saving power infrastructure. The market is projected to reach USD 16.9 billion in 2025 and expand to USD 29.5 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.7% over the forecast period.

The advantages of gas insulated substations, such as their ability to operate under extreme environmental conditions, their reduced size, and their lower maintenance requirements compared to traditional air-insulated substations (AIS), are leading them to gain much popularity. The rapid growth of smart grids, underground substations, and offshore wind farms, as well as the increasing number of heavy industrial parks, is GIS installations' response to both lower carbon footprint and urban areas becoming more crowded and requiring industries that are more power-efficient in their operation.

In addition, government energy infrastructure development policies, more investments in grid upgrades, and the transition to renewable energy are the main factors behind the growth of the GIS market. The increasing worries related to SF₆ gas emissions and the emergence of nature-friendly options are also affecting the efficiency of GIS solutions.

The growth of industrial automation, the more frequent connection of renewable energy generation sources, and the increasing importance of reliable power transmission solutions are the primary driving forces of the market. Furthermore, the digital substations that are developed with remote monitoring and smart automation are expected to be the main reasons for GIS adoption in the mentioned future years.

Explore FMI!

Book a free demo

The North American region ranks among the top 5 markets for gas Insulated substations, fostered by the old and leaky power infrastructure, urban power demand, and government spending on the grid. USA and Canadian workers are swapping the old substations for GIS, as it increases the reliability and efficient operation of urban area.

USA Department of Energy (DOE) and Federal Energy Regulatory Commission (FERC) are the other forces that are in favour of grid modulation that will get rid of most of the transmission losses and also make power distribution easier. Moreover, the increasing penetration of renewable energy sources like wind and solar is the main source of demand for GIS placement in high voltage substations. Moreover, the deployment of wind power projects, electric vehicle (EV) charging networks, and industrial electrification activities is also a driver for GIS in North America.

The European GIS industry has been growing at a fast pace due to the rigorous energy efficiency laws, the rise in renewable energy, and the funding of underground power transmission systems. The front runners in the transition to smart grids and the low-carbon energy networks are countries like Germany, France, the UK, and the Netherlands that need GIS installations to increase the power transmission reliability.

The renewable energy directives of the European Union and the Decarbonization goals are driving the installation of high-voltage GIS substations, especially in offshore wind farms, smart city development projects, and high-density areas. The emphasis on diminishing SF₆ gas by GIS technology is also the cause of utilities and grid operators looking for other insulation choices, thus making the continent the key site for eco-friendly GIS invention.

Asia-Pacific is the fastest-growing market for gas insulated substations, fuelled by rapid industrialization, rising electricity consumption, and increasing investments in power grid infrastructure. Countries such as China, India, Japan, and South Korea are investing in high-voltage GIS solutions to modernize their electricity networks and support economic growth. China’s ultra-high-voltage (UHV) transmission expansion, driven by its renewable energy ambitions, is significantly boosting GIS adoption.

India is also witnessing growing demand for GIS substations, particularly in metro rail projects, urban electrification programs, and renewable energy zones. Meanwhile, Japan and South Korea are leading in technological advancements, incorporating digital automation and AI-based monitoring systems into GIS technology. With the rise of energy-intensive industries and expanding metro electrification projects, the region is expected to continue driving substantial demand for GIS solutions over the forecast period.

The MEA region, which is the Middle East and Africa, is developing well in GIS technology, primarily due to the increase in the energy infrastructure, demand for industrialization, and reliable electricity distribution. With the focus of countries like Saudi Arabia, the UAE, and South Africa on power transmission coupled with grid modernization as a strategy for the growth and development of the industry, they have made it their priority.

The shift to more and more renewable sources of energy, mainly solar and wind, in the Middle East causes the installation of GIS substations for effective energy transmission and integration into the national grid to grow even more. On top of that, the implementation of intelligent city projects, the extension of airports, and the electrification of the oil & gas sector which by the way provides more demand for compact and high GIS technology possible solutions.

Challenges

Environmental Concerns Over SF₆ Gas Usage

The most significant concern in the GIS industry is the detrimental effect of sulfur hexafluoride (SF₆) gas, which is predominantly utilized as an insulating medium in the GIS circuit. SF₆ is primarily a greenhouse gas with a high global warming potential (GWP), making it subject to international environmental regulatory laws. To this end, bodies like the EU’s F-Gas regulations are advocating for less emission of industrial SF6 gases, which is the main driving force behind the invention of SF6-free GIS technologies. While other gases like fluoronitriles, and CO₂ are being focused on as options, their production, and durability challenges remain.

High Installation and Maintenance Costs

Gas insulated substations require more capital investment than air-insulated substations (AIS), thus making cost a big factor for acceptance, especially in developing countries. The difficulty of installation, specialized maintenance procedures, and the need for trained personnel increase the total expenses of GIS further. Moreover, the price of transforming existing substations into GIS technology is also high, needing the utility companies to think very well about profits in a long run and compare them with upfront costs. Nonetheless, a rise in automation and decrease in production price are the main reasons that push GIS technology costs down in forthcoming years.

Opportunities

Advancements in SF₆-Free and Digital GIS Technology

The development of SF₆-free GIS solutions presents a major opportunity for market growth, as utilities and governments focus on reducing carbon footprints and enhancing environmental sustainability. Companies are investing in fluoronitrile-based, vacuum-insulated, and hybrid GIS solutions to comply with emission reduction regulations while maintaining high-performance standards.

Additionally, the integration of AI-driven monitoring systems, predictive maintenance tools, and IoT-enabled GIS components is enhancing grid reliability and operational efficiency. The shift towards fully digital substations is expected to accelerate the adoption of next-generation GIS technology.

Expansion of Smart Grid Infrastructure and Renewable Energy Projects

The worldwide movement towards smart grid renovation and higher integration of renewable energy resources is providing the space for GIS implementation. The growing number of solar and wind power plants makes it necessary to build substations with high-voltage GIS that will be connected to these renewable sources to the national grids.

Meanwhile, both public authorities and enterprises are financing in high-performance and space-efficient GIS technologies with a primary target of strengthening the efficiency of the grid, decreasing electrical losses, and catering to the requirements of the prevailing electricity demand. The establishment of microgrid networks, EV charging points, and mixed power systems will additionally influence the rise of GIS in the next years to come.

The period from 2020 to 2024, the gas insulated substation (GIS) witnessed a steady increase in its market, due to the globalization of electricity, rapid urbanization, and the introduction of renewable energy infrastructures. Gas insulated substations, thanks to their small size, efficiency, and ability to work under extreme conditions, were widely adopted in high-voltage power transmission, offshore wind farms, and smart grid networks.

Progress in high-voltage direct current (HVDC) transmission, monitoring technologies, and the use of insulating gases that are friendly to the environment corroborated the market shapers. However, persistent difficulties such as large installation expenses, doubts regarding SF₆ gas, and intricate maintenance requirements were the limitations that held back the market.

Accordingly, the projected GIS market will undergo a paradigm shift and develop into an AI-based predictive maintenance, a SF₆-free insulating gas technologies, and the integration of blockchain-enabled energy tracking. The transition to smart substations, the alignment of AI grid automation, and decentralized renewable energy networks will be the main drivers of GIS enhancement. Furthermore, compact modular GIS solutions, autonomous fault detection, and digital twin simulation technology will reinvent, substation efficiency, and resilience.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Urbanization & Space-Efficient Substation Demand | According to a recent article, the popularity of GIS solutions in the modern city areas is on the rise as a result of the scarcity of land. |

| Renewable Energy & Grid Integration | Mode GIS substations are being installed in the offshore wind parks and solar power plants more and more frequently. They are becoming the main solution for high-voltage transmission. |

| Transition to SF₆-Free Technologies | Alternative gas-insulated solutions were developed as a result of the regulatory pressure imposed on sulfur hexafluoride (SF₆) emissions. |

| Smart Grid & Digital Substation Innovations | The remote monitoring and automated fault detection of GIS systems are being adopted in some cases. |

| High-Voltage & Ultra-High-Voltage Applications | With the technological advancements GRID stability is being improved with the increasing use of GIS in DC and UHVDC transmission projects. |

| Market Shift | 2025 to 2035 |

|---|---|

| Urbanization & Space-Efficient Substation Demand | Smart cities should have modular and AI-optimized GIS with the autonomous load balancing and the decentralized energy distribution structures. |

| Renewable Energy & Grid Integration | A hybrid GIS systems with Artificial Intelligence (AI) based real-time power flow optimization and Blockchain technology supported energy distribution tracking. |

| Transition to SF₆-Free Technologies | The predominant transition from SF₆ GIS to nitrogen-based and vacuum circuit breaker technologies to realize carbon neutrality is through this technology. |

| Smart Grid & Digital Substation Innovations | The power stations that run on artificial intelligence functions, in addition to including self-repairing parts, also feature power rerouting that is automatic as well as optimum energy management through the cloud. |

| High-Voltage & Ultra-High-Voltage Applications | The incorporation of AI boosted surge protection and quantum secured grid communication for the expansion of 1,000 kV and above ultrahigh voltage GIS has been done. |

The USA gas insulated substation (GIS) sector is steadily increasing as a consequence of the progressive trend of modernization of the power transmission network along with the widespread adoption of renewable energy and the urban need for space-efficient substations.

The power grid in the USA is currently under renovation to a great extent to enhance the system's reliability and to accommodate renewable power sources effectively which causes an increase in the quality of the services such as high-voltage GIS. Digital substations and smart grids are becoming prevalent through the use of advanced GIS technologies endowed with real-time monitoring and automation capabilities that go beyond the solution of simple issues.

Together with that, Compact, low-maintenance substations as a measure proposed by the USA Department of Energy (DOE) and Federal Energy Regulatory Commission (FERC) to mitigate the effects of extreme weather and at the same time improve grid efficiency are also being promoted. The rising awareness of SF₆ gas emissions, a greenhouse gas that is widely used in GIS, is prompting utility companies to consider the use of alternate eco-friendly insulating gases and hybrid GIS solution.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.9% |

The UK gas insulated substation sector has shown a slight growth track which is mainly attributed to the constant influx of investments to the offshore wind power, grid resilience projects, and the essentiality of space-efficient substations. Under the guidance of the UK’s Net Zero 2050 Strategy, the electrification of the country has been put on the top priority list which in turn has resulted in a hike in the GIS installations that are meant for renewable energy projects.

The National Grid ESO (Electricity System Operator) is putting money into the existing high-voltage GIS substations which will improve the stability of the grid network and will also result in lower transmission losses. Furthermore, the swift growth of offshore wind farms in the North Sea is giving rise to the need for compact and high-capacity GIS solutions which are necessary for delivering the power to the city centers in a more efficient manner.

With the age-old electrical infrastructure prevalent in key locations like London, Manchester, and Birmingham, the GIS installations are the first choice for retrofit projects as they take a small amount of land and are easy to handle maintenance wise.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.5% |

The European Union gas insulated substation market is expanding significantly due to stringent emissions regulations, rapid renewable energy integration, and increasing investments in grid reliability. Leading nations such as Germany, France, and the Netherlands are at the forefront of GIS adoption, driven by EU Green Deal policies promoting low-carbon and energy-efficient grid solutions.

With the EU aiming for carbon neutrality by 2050, power utilities are rapidly replacing traditional air-insulated substations (AIS) with GIS, as they offer superior space efficiency, lower maintenance, and better operational reliability.

Additionally, the expansion of high-voltage direct current (HVDC) transmission systems across Europe is increasing demand for GIS to facilitate long-distance power transfers with minimal losses. European manufacturers are also pioneering SF₆-free GIS technologies, developing eco-friendly alternatives such as fluoronitrile-based insulation to meet strict environmental regulations.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.7% |

The steady growth of the Japan gas insulated substation market is due to the efforts on grid modernization, the expansion of renewable energy, and the implementation of the smart grid technologies. The high population density and space constraints in Japan make compact GIS solutions very beneficial for the urban areas.

The country is pushing harder on renewable energy technologies thus, GIS is instrumental in the transmission of offshore wind, solar, and geothermal power efficiently through the grid. Furthermore, the government is funding the earthquake-resistant power infrastructure which is causing the demand for GIS that has better reliability and stability in the seismic areas.

The development of technologies such as remote-controlled GIS and AI-integrated GIS are now also achieving a great deal of success, making utilities more efficient with predictive maintenance and automated monitoring systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.4% |

The South Korea gas insulated substation market is expanding due to rapid industrialization, growing electricity demand, and increasing adoption of smart energy solutions. With South Korea’s ambitious renewable energy goals, GIS is being increasingly deployed in solar and wind energy transmission networks.

The South Korean government’s investment in digital substations and smart grids has also led to the integration of IoT-enabled GIS with real-time diagnostics and automated fault detection. Additionally, the expansion of high-speed rail and metro infrastructure has created demand for compact GIS installations in transportation hubs.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.6% |

Gas Insulated Substations (GIS) from 72.5 to 245 kV voltage range lead the market primarily because they are predominantly used in power transmission and distribution (T&D) infrastructure. These substations are designed compact, increased reliability, and have excellent insulation, thus are favored in the urban power networks, industrial facilities, and renewable energy integration.

T&D utilities see the 72.5 to 245 kV GIS model as a smart choice for medium- to high-voltage transmission systems, therefore, they give space-saving solutions in crowded cities and places with limited land. In contrast to traditional air-insulated substations (AIS), GIS technology considerably minimizes maintenance duties and increases operational safety by the lessening of both the flashover risk and external environmental effects. On top of that, escalated demand for medium- to high-voltage GIS installations is noticed due to the growth of transportation and industrial sectors.

Insulated Sub stations over 245kV rating are getting much more demand amid other ultra-high voltage (UHV) transmission, offshore wind power and large-scale industrial power distribution. These substations ensure the transmission of huge amounts of power over long distances, which increases the grid's efficiency, or line losses, and stabilizes it in remote and high-load areas.

Countries like China, India, and the United States are making significant investments in the above 245 kV GIS to back the UHVDC (ultra-high voltage direct current) transmission systems and ensure the efficient distribution of power from renewable sources to cities.

In addition, with the rise of offshore wind farms and the establishment of intercontinental power grid connections, above 245 kV GIS technology is becoming indispensable in providing the reliable power transmission that is desired even under very tough atmospheric conditions.

The transmission and distribution (T&D) sector have the most applications of gas insulated substations as it expands due to the increase in electricity demand, the replacement of old grid infrastructures, and smart grid development initiatives. T&D utilities across the globe are turning to compact GIS solutions to modernize the existing power networks, bolster grid resilience, and optimize the use of land in substation areas.

GIS technology brings extra advantages in urban areas with scarce space, such as high-voltage interconnectors or underground substations where conventional open Air Insulation (AIS) cannot be installed due to space constraints and environmental issues. Positive energy quotes also lead to T&D showing an eco-friendlier approach of using GIS solutions with alternative insulating gases as opposed to those having SF₆ which has a high GWP.

Gas insulated substations are being installed at a much faster pace in the renewable energy industry, particularly in floating solar projects, offshore wind farms, and hybrid renewable power plants. GIS technology has a natural fit for renewable energy injection because it has high voltage insulation, a modular design, and excellent weather resistance. This ultimately ensures the efficient evacuation of power from faraway generation sites.

Offshore wind farms in Europe, North America, and Asia-Pacific now more than ever turn to GIS switchgear to make the connection between the great wind farms and the national grids with the least possible power losses and the best system reliability. Along the same lines, GIS substations in utility-scale solar farms and hybrid renewable plants minimize the area occupied, enhance grid interconnection, and also assist HVDC transmission.

The worldwide GIS for gas insulated substation market is extensively expanding as a result of the continuous increase in electricity demand, the rise in the adoption of smart grid technologies, and the improvement of high-voltage electrical infrastructure. GIS technology has been the first choice for beyond traditional air-insulated substations because of its compact design, higher reliability, and super insulation characteristics that are particularly suitable for urban, industrial, and offshore applications.

The market is driven by factors such as the rise in investments in renewable energy projects, the increasing need for grid modernization, and the issue of environmental concerns with SF₆ gas emissions that led to the creation of SF₆-free GIS solutions. Major suppliers are inclined to energy-efficient GIS designs, intelligent automation, and alternative development for environmental sustainability to meet global energy transition goals.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ABB Ltd. | 10-12% |

| Siemens AG | 9-11% |

| General Electric (GE Grid Solutions) | 8-10% |

| Hitachi Energy Ltd. | 6-8% |

| Toshiba Corporation | 5-7% |

| Other Companies (combined) | 51-61% |

| Company Name | Key Offerings/Activities |

|---|---|

| ABB Ltd. | A global leader in high-voltage GIS solutions, offering compact, eco-friendly substations with digital automation capabilities. |

| Siemens AG | Develops intelligent GIS switchgear systems, integrating AI-driven diagnostics and low-emission SF₆ alternatives. |

| General Electric (GE Grid Solutions) | Specializes in high-performance GIS substations, ensuring enhanced reliability and real-time monitoring for smart grid applications. |

| Hitachi Energy Ltd. | Provides next-generation hybrid GIS solutions, focusing on space-saving designs and extended operational lifespan. |

| Toshiba Corporation | Offers high-capacity GIS equipment, integrating AI-powered condition monitoring and self-diagnostic technologies. |

ABB Ltd.

ABB leads the GIS market with its comprehensive range of high-voltage and extra-high-voltage (EHV) GIS substations for urban power distribution, renewable energy integration, and industrial applications. The company is progressively focusing on the development of SF₆-free GIS technology, the first of its kind, which is also developing alternative AirPlus gas insulation eco-friendly mainly aimed at reducing the greenhouse gas emissions. Awarding digital automation, real-time fault monitoring, and predictive maintenance to ABB guarantees the upgraded efficient substation and its reliability.

Siemens AG

Intelligent GIS switchgear systems are Siemens's field of competence that combines environmental-friendly low-emission insulation materials, automated AI diagnostics, and compact modular designs. The company's 8VN1 Blue GIS technology uses no SF₆ gas at all and thus is a sustainable and eco-friendly choice for high-voltage applications. As part of the ongoing integration of IoT-based cloud connectivity for remote diagnostics and control, Siemens is also expanding its digital substation portfolio.

General Electric (GE Grid Solutions)

GE Grid Solutions is a supplier of superior GIS substations that guarantee better power transmission efficiency, lower maintenance, and longer system life. The company is dedicated to the management of the grid in real-time, automated substations with cyber security, and hybrid GIS solutions of the next generation. GE is on the road to the invention of novel insulation materials and sustainable GIS designs for the purpose of grid resilience and stability.

Hitachi Energy Ltd.

Hitachi Energy is a pioneering developer of hybrid GIS systems, providing small-sized, high-voltage substations that use both air and gas insulation to minimize environmental impact. The firm is equipped with condition monitoring, predictive maintenance algorithms, and AI-driven grid analytics, which in turn facilitates the substation reliability and performance. Hitachi Company dedicates funds to smart grid GIS solutions that are compatible with the company, therefore, it helps world energy shift from fossil fuels to renewables.

Toshiba Corporation

Highly-capacity GIS devices offered by Toshiba are equipped with smart condition monitoring, self-diagnostic technologies, and automated fault detection. The company's GIS systems are predominant in the energy sector in power utilities and industrial plants, as well as in offshore wind farms, securing high-efficiency energy distribution. Toshiba is aiming to the digital substation through the development of IoT-integrated GIS systems for predictive analytics and better asset management.

The global gas insulated substation market is projected to reach USD 16.9 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 5.7% over the forecast period.

By 2035, the gas insulated substation market is expected to reach USD 29.5 billion.

The 72.5 to 245 kV segment is expected to dominate due to increasing demand for efficient and space-saving substations in urban areas and industrial zones, along with the growing need for reliable power transmission.

Key players in the gas insulated substation market include ABB Ltd., Siemens AG, General Electric, Hitachi Energy, and Toshiba Corporation.

Less than 52 kV, 72.5 to 245 kV, Above 245 kV

Indoor, Outdoor, Hybrid

Transmission & Distribution, Industrial, Renewable Energy, Offshore

North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Middle East & Africa

Diaphragm Coupling Market Growth - Trends & Forecast 2025 to 2035

HID Ballast Market Growth - Trends & Forecast 2025 to 2035

Fluid Conveyance Systems Market Growth - Trends & Forecast 2025 to 2035

GCC Magnetic Separator Market Outlook – Growth, Trends & Forecast 2025-2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

Glass Door Merchandisers Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.