In 2024, the gas generating systems Industry saw significant growth driven by heightened demand across industries requiring reliable, cost-effective power generation solutions. A key trend was the growing adoption of natural gas as a cleaner alternative to coal and oil, particularly in regions like North America and Europe.

This shift was driven by increasing environmental concerns and stricter regulatory standards targeting emissions reductions. The industry experienced a surge in new installations, particularly for small to medium-sized gas generators, as businesses and industrial sectors sought more flexible, on-demand power sources.

Technological advancements played a crucial role in 2024, with innovations in hybrid systems that combine gas generators with renewable energy sources like solar and wind. These systems are expected to offer both cost savings and energy security. On the supply side, key players faced supply chain challenges due to lingering global semiconductor shortages, affecting the availability of advanced gas generating technologies.

Looking ahead, the gas generating systems industry is projected to continue expanding. In 2025, the industry will likely see continued technological innovation, particularly in smart grid integration and energy storage solutions. Additionally, demand will be driven by emerging economies in Asia and Africa, where energy infrastructure development is a top priority. The industry is set to grow at a steady 9.4% CAGR from 2025 to 2035, reflecting increasing reliance on gas generating systems as part of the global energy transition.

Key Industry Insights

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 10,200 Million |

| Industry Value (2035F) | USD 25,700 Million |

| CAGR (2025 to 2035) | 9.4% |

Explore FMI!

Book a free demo

Surveyed Q4 2024, n=450 stakeholder participants evenly distributed across manufacturers, distributors, industrial operators, and regulators in the USA, Western Europe, Japan, and South Korea

Regional Variance

High Variance

Convergent and Divergent Perspectives on ROI

70% of USA stakeholders determined IoT integration to be "worth the investment," whereas 40% in Japan still preferred standalone systems.

Consensus

Stainless Steel Components: Selected by 65% globally for their durability, corrosion resistance, and longevity in harsh environments.

Variance

Shared Challenges

84% cited rising material and energy costs as a primary concern.

Regional Differences

Manufacturers

Distributors

End-Users (Industrial Operators)

Alignment

75% of global manufacturers plan to invest in IoT-enabled and energy-efficient gas generating systems.

Divergence

High Consensus

Compliance with environmental regulations, system efficiency, and cost pressures are global concerns.

Key Variances

Strategic Insight

Regional adaptation (e.g., IoT and hybrid systems in the USA, eco-friendly models in Europe, and compact, cost-effective devices in Asia) is necessary to infiltrate diverse industries effectively.

| Country | Regulations and Certifications |

|---|---|

| United States |

|

| Germany |

|

| France |

|

| Japan |

|

| South Korea |

|

| China |

|

| India |

|

| United Kingdom |

|

| Italy |

|

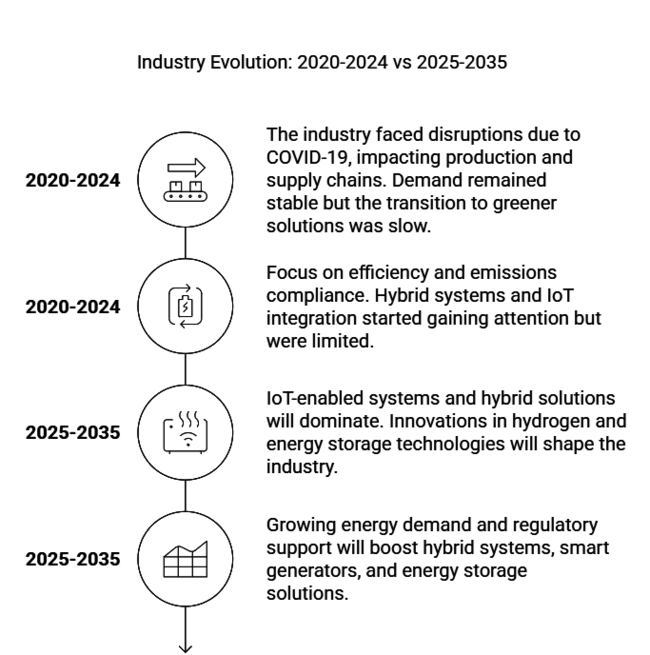

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The industry faced disruptions due to COVID-19, impacting production and supply chains. Demand remained stable but the transition to greener solutions was slow. | Post-pandemic recovery with steady growth driven by energy security, efficiency, and cleaner solutions. Hybrid systems (gas + renewables) will see significant growth. |

| Focus on efficiency and emissions compliance. Hybrid systems and IoT integration started gaining attention but were limited. | IoT-enabled systems and hybrid solutions will dominate. Innovations in hydrogen and energy storage technologies will shape the industry. |

| North America and Europe were dominant, while Asia-Pacific (China, India) began showing growth due to industrial expansion. | Asia-Pacific will lead in growth, with continued demand in North America and Europe, and rising interest from emerging industries. |

| Stricter emissions regulations in the EU and USA pushed the industry toward cleaner technologies. | Increasing regulations on emissions and sustainability will drive demand for low-emission, hybrid systems worldwide. |

| Supply chain issues, fluctuating fuel prices, and reliance on traditional systems hindered growth. | Growing energy demand and regulatory support will boost hybrid systems, smart generators, and energy storage solutions. |

Medium power generation systems (75 kVA to 375 kVA) are the most popular in the industry due to their ability to balance price and performance. They are extensively used in commercial, industrial, and manufacturing settings. These systems offer dependable, reasonably priced power.

Large-scale businesses' and infrastructure projects' increasing energy consumption are fuelling the rapid growth of high-power generation systems (over 2MW). These systems are gaining traction in high-demand industries such as heavy industries and data centres due to their higher capacity. They are becoming more attractive for large-scale applications due to improvements in efficiency and emissions reduction.

Since industry and large-scale production require consistent, dependable power, the industrial sector remains the biggest user of gas generating systems. Gas generators are increasingly used as backup power sources due to the rapid expansion of the commercial and residential sectors.

Hybrid systems that integrate gas with renewable energy are gaining popularity due to their sustainability and reliability. Gas generating systems are becoming a preferred choice for both commercial and residential applications. This shift is driven by government incentives promoting cleaner energy sources, including hybrid and low-emission gas solutions. Furthermore, advancements in gas generator technology, such as improved fuel efficiency and lower emissions, are further driving adoption across various sectors.

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| United States (USA) | 9.3% |

| China | 9.3% |

| United Kingdom (UK) | 8.7% |

| France | 9.0% |

| Germany | 9.2% |

| Italy | 8.9% |

| South Korea | 9.3% |

| Japan | 8.8% |

| India | 9.5% |

The USA gas-generating systems market is projected to grow at 9.3% from 2025 to 2035, driven by significant investments in both infrastructure modernization and cleaner energy policies. The country’s large-scale development of shale gas reserves continues to dominate its energy landscape, offering an affordable and abundant source of natural gas for power generation. Moreover, USA policies like the Inflation Reduction Act incentivize clean technologies, including carbon capture and storage (CCS) for gas plants.

Natural gas plays a pivotal role in transitioning the power sector away from coal, reducing emissions while maintaining grid reliability. Furthermore, advanced gas turbines are improving efficiency, while a growing emphasis on energy independence further drives the adoption of gas-based power systems.

The UK is expected to witness a 9.0% CAGR in its gas-generating systems market between 2025 and 2035, driven by its stringent decarbonization policies and shift toward low-emission energy generation. As part of the nation’s Net Zero Strategy, natural gas plays an essential role in replacing coal and supporting intermittent renewable sources like wind and solar.

Combined Cycle Gas Turbines (CCGTs) are expected to meet growing demand for flexible, low-emission power generation. The UK government continues to support gas as a bridging fuel, providing incentives for more efficient technologies and reducing emissions in the power sector. Additionally, its strong regulatory framework and stable energy market make the UK a favorable environment for investments in gas-based power systems.

France’s gas generating systems market is expected to grow at 9.1% from 2025 to 2035, as the country accelerates its energy transition. France is making significant investments in renewable energy but faces challenges in integrating variable sources into the national grid. Gas-fired power plants, particularly Combined Heat and Power (CHP) systems, are seen as a critical solution for balancing demand and ensuring grid stability.

Gas provides a cleaner, more flexible backup for intermittent solar and wind energy, ensuring grid stability as the country works toward its carbon reduction goals. The French government’s support for low-emission technologies and its commitment to reducing nuclear dependence further solidify gas’s position in the energy mix.

Germany is expected to experience a 9.2% CAGR in its gas generating systems market, driven by its ambitious energy transformation (Energiewende) policy. The shift away from nuclear and coal-fired power plants has positioned natural gas as a key transitional fuel to reduce carbon emissions while meeting growing electricity demand. Gas turbines are increasingly used for their efficiency and ability to quickly adjust to changes in renewable energy production.

Germany’s regulatory environment encourages innovation in gas power generation, and its extensive infrastructure ensures that gas remains a stable and reliable source of energy during the energy transition. Additionally, Germany’s leading role in the European energy market strengthens the demand for gas-based power generation systems.

Italy's gas-generating systems market is projected to grow at 9.0% between 2025 and 2035, driven by the country’s efforts to reduce coal dependency and increase renewable energy adoption. With significant investments in wind and solar energy, Italy is looking to gas-powered systems as a solution for ensuring grid stability and reliability. Combined Cycle Gas Turbines (CCGT) and gas-fired power plants play a crucial role in balancing the grid when renewable output fluctuates.

The Italian government’s policy framework supports the development of cleaner, more efficient gas-based power generation technologies as part of its broader commitment to achieving carbon neutrality. Furthermore, Italy’s energy security concerns, especially in light of geopolitical instability in Europe, make natural gas a critical energy source.

South Korea’s gas-generating systems market is expected to see a 9.2% CAGR, driven by a combination of rapid industrial growth and the country's commitment to cleaner energy systems. South Korea’s focus on reducing its reliance on coal has led to a shift toward natural gas, which is viewed as a lower-emission alternative. Gas-fired power plants are crucial in supporting the country’s growing demand for electricity, particularly as urbanization and industrialization continue.

South Korea’s government is investing heavily in renewable energy while positioning gas as a bridging fuel to ensure grid stability during the transition. Furthermore, the country’s advanced technology infrastructure and regulatory support for clean energy innovations further bolster the growth of the gas generating market.

Japan’s gas-generating systems market is set to grow at a 9.1% CAGR from 2025 to 2035, primarily driven by the country's post-Fukushima energy policy shift. In the aftermath of the nuclear disaster, Japan increasingly turned to natural gas to meet its energy needs, given its affordability and lower carbon emissions compared to coal. Gas turbines, particularly those using Combined Cycle Gas Turbines (CCGT), are becoming a key component of Japan’s power generation infrastructure.

The Japanese government is also focusing on energy efficiency and clean energy technologies, further enhancing the role of gas in the national energy mix. Additionally, Japan’s energy security concerns, due to limited domestic energy resources, make natural gas an essential energy source for the future.

China’s gas-generating systems market is projected to grow at a 9.2% CAGR from 2025 to 2035, largely driven by rapid industrialization and government-backed energy policies. The Chinese government has made substantial investments in natural gas infrastructure as part of its broader energy strategy, which aims to reduce dependence on coal and improve air quality.

China’s adoption of cleaner technologies, including gas turbines, supports its goals of reducing carbon emissions and meeting growing energy demands. Moreover, the shift towards a market-based economy and the increasing demand for electricity in the industrial and residential sectors further boost the need for gas-based power generation. China's commitment to renewable energy integration also strengthens the role of natural gas as a flexible and reliable backup source for the grid.

India's gas generating systems market is set to grow at 9.5% CAGR between 2025 and 2035, fueled by high-speed industrialization, growing infrastructure, and rising power demand. Manufacturing and heavy industries in India, especially steel, chemicals, and pharmaceutical industries, need round-the-clock power, for which gas generators prove to be an essential investment.

India's initiative in becoming self-sufficient in energy production, coupled with government policies, is expected to encourage local manufacturing of gas-based power solutions.

Furthermore, the increasing demand for uninterrupted power in high-rise buildings and data centers has significantly boosted the adoption of gas generators. Another strong driving factor has been the shift to cleaner fuels with industries replacing diesel-based generators with gas-based ones owing to the increased focus on environmental regulations and curbing carbon emissions.

In addition, growing emphasis in India on integrating renewable energy is driving demand for hybrid power solutions in which solar and wind energy systems are supported by gas generators. Incentives from the government to adopt cleaner energy solutions and advances in natural gas infrastructure, like increases in pipeline networks and LNG terminals, are encouraging wider availability and affordability of gas generators, further driving market growth.

In 2024, the global gas generating industry witnessed significant developments, with leading players like Air Liquide S.A., Linde AG, and Air Products and Chemicals, Inc. driving innovation and consolidation. Air Liquide S.A. continued to dominate the industry with a 25% share, focusing on expanding its hydrogen production capabilities to meet the growing demand for clean energy.

In March 2024, Air Liquide announced a €200 million investment in a new hydrogen production facility in Normandy, France, aimed at supporting Europe’s decarbonization goals. Linde AG, holding a 22% industry share, strengthened its position by acquiring Messer Group GmbH in a USD 7 billion deal, as reported by Reuters in February 2024. This acquisition allowed Linde to expand its industrial gas portfolio and enhance its presence in Europe and North America.

Air Products and Chemicals, Inc., with a 20% industry share, made headlines in January 2024 with the launch of its next-generation hydrogen fuelling stations in California, targeting the transportation sector. The company also partnered with Itron, Inc. to integrate smart metering solutions into its gas distribution networks, enhancing operational efficiency and real-time monitoring.

Continued to utilize its parent company’s resources to advance carbon capture and storage (CCS) technologies, securing several contracts with European governments for industrial emissions reduction.

Smaller players like Iwatani Corporation and Matheson Tri-Gas, Inc. also made strategic moves in 2024. Iwatani Corporation focused on expanding its liquefied natural gas (LNG) infrastructure in Japan, capitalizing on the country’s shift away from coal. Matheson Tri-Gas, Inc. invested heavily in helium recovery systems, addressing the global helium shortage and securing long-term supply contracts with semiconductor manufacturers. Colfax Corporation and GCE Holding AB prioritized digital transformation, launching IoT-enabled gas monitoring systems to cater to the growing demand for smart industrial solutions.

Overall, 2024 was a transformative year for the gas generating industry, marked by strategic acquisitions, technological progress, and a strong focus on sustainability. Companies that aligned their strategies with regional regulatory demands and customer needs, such as Air Liquide and Linde, emerged as clear leaders, while smaller players carved out niches in specialized segments. The industry’s trajectory suggests continued growth, driven by the global push for clean energy and industrial efficiency.

Industry Share Analysis

Air Liquide S.A. (25-30%)

A global leader in industrial gases, Air Liquide dominates with a focus on hydrogen production and clean energy. In 2024, it invested €200 million in a hydrogen facility in Normandy, France.

Linde AG (20-25%)

Linde AG is known for advanced gas processing technologies. In 2024, it acquired Messer Group GmbH in a USD 7 billion deal (Reuters, February 2024), expanding its industry presence.

Air Products and Chemicals, Inc. (15-20%)

Specializing in hydrogen and helium, Air Products launched next-gen hydrogen fuelling stations in California and partnered with Itron, Inc. for smart gas solutions in 2024.

Praxair, Inc. (10-15%)

Now part of Linde AG, Praxair focuses on carbon capture and storage (CCS) technologies, securing several European government contracts in 2024.

Iwatani Corporation (5-10%)

A leading Japanese player, Iwatani expanded its LNG infrastructure in 2024 to support Japan’s shift from coal to cleaner energy.

Matheson Tri-Gas, Inc. (5-10%)

Specializing in specialty gases, Matheson invested in helium recovery systems in 2024 to address global shortages, particularly for semiconductors.

Messer Group GmbH (5-10%, prior to acquisition by Linde AG)

Messer Group was known for innovative gas solutions. Its acquisition by Linde AG in 2024 strengthened Linde’s industry position.

Colfax Corporation (2-5%)

Colfax focuses on gas control technologies and IoT-enabled systems, launching advanced monitoring solutions in 2024.

GCE Holding AB (1-3%)

GCE specializes in gas equipment and solutions, with a niche focus on portable and medical gas systems.

Itron, Inc. (1-2%)

Itron provides smart metering and monitoring solutions, partnering with Air Products in 2024 to enhance gas system efficiency.

The industry of gas power generation is a vital part of the broader energy generation and utilities sector, focused on converting natural gas into electricity. This industry plays a central role in meeting the growing global demand for reliable and affordable power across industrial, commercial, and residential sectors. It is particularly critical in regions undergoing significant infrastructure development and industrialization.

Economically, the industry is influenced by rising energy consumption, shifting energy policies, and the increasing need for cleaner, more sustainable energy solutions. As governments implement stricter emissions regulations and sustainability targets, the demand for more efficient and low-emission gas-based generation systems is accelerating. Technological advancements, such as hybrid gas-renewable systems and smart grid integration, are driving innovation and enhancing system efficiency.

The industry is poised for steady growth, particularly in emerging economies where rapid urbanization and industrialization are fuelling demand for robust power generation. As energy security becomes a priority and sustainability goals intensify, this industry is expected to evolve, becoming an increasingly important contributor to global energy supply.

There are numerous significant growth prospects for those involved in the gas generating sector in 2024 and beyond. The use of hybrid systems, which combine conventional gas power systems with renewable energy sources like solar and wind, is one of the most promising prospects. This method is a very appealing choice in areas with strict emissions rules since it not only provides a cleaner alternative but also guarantees energy generation flexibility.

By partnering with renewable energy firms to provide integrated solutions, stakeholders may leverage this trend and establish themselves as leaders in the energy transition. The incorporation of hydrogen into gas-based systems is another important growth area. Hydrogen is becoming a key fuel for cutting emissions as governments and businesses work to decarbonize.

Stakeholders can meet the rising need for sustainable energy solutions by creating systems that are suitable for hydrogen or by adapting existing gas plants. For businesses hoping to stay competitive in the changing energy industry, investments in hydrogen infrastructure will be essential.

Another key growth driver is the integration of smart technologies and IoT solutions. Stakeholders may increase system efficiency, save operating costs, and provide customers more value by integrating linked systems and digital solutions like energy optimization and predictive maintenance. The integration of energy storage technologies with gas generating systems will also increase their adaptability and resilience to variations in the production of renewable energy, which will help to stabilize the grid and increase overall reliability.

Finally, it is important for stakeholders to match their plans with government incentives and emissions standards. In addition to ensuring compliance, staying ahead of legislative changes will allow businesses to benefit from incentives for implementing cleaner technologies. Stakeholders can maintain a competitive edge in this changing industry by interacting with legislators and consistently adjusting to regulatory changes.

The demand is driven by the need for reliable and flexible power generation, especially in regions transitioning to renewable energy. Increasing industrialization and government regulations encouraging cleaner energy solutions also play a significant role.

Hybrid systems combine gas with renewable energy, offering cleaner and more efficient power generation. They help balance the intermittency of renewable sources and improve overall grid reliability.

Yes, technologies like IoT integration, predictive maintenance, and hydrogen blending are shaping the future. These innovations improve efficiency, reduce emissions, and enhance operational reliability.

Governments worldwide enforce emissions standards and offer incentives for adopting cleaner technologies. Regulations push the industry to adopt low-emission, energy-efficient systems to meet sustainability goals.

Energy storage solutions help balance supply and demand by storing excess energy during low-demand periods and releasing it when needed, ensuring grid stability, especially when integrating renewable sources.

The industry is segmented into less than 75 kVA, 75-375 kVA, above 375 kVA.

The landscape is divided into industrial, commercial, residential.

The industry is studied across North America, Latin America, Europe, Asia-Pacific, and the Middle East and Africa.

Electric Winch Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Commercial RAC PD Compressor Market Growth - Trends & Forecast 2025 to 2035

Electric & Hydraulic Wellhead Drives for Onshore Application Market Insights - Demand, Size & Industry Trends 2025 to 2035

Echo Sounders Market Insights - Demand, Size & Industry Trends 2025 to 2035

Industrial Motors Market Insights - Growth & Demand 2025 to 2035

Electric Hedge Trimmer Market Insights Demand, Size & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.