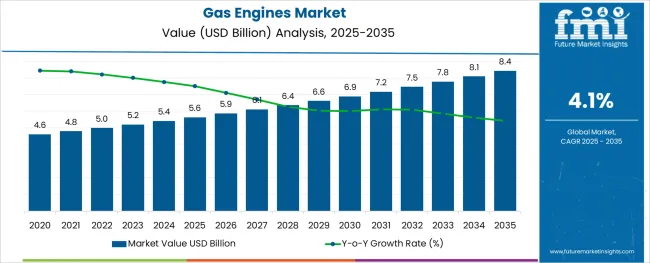

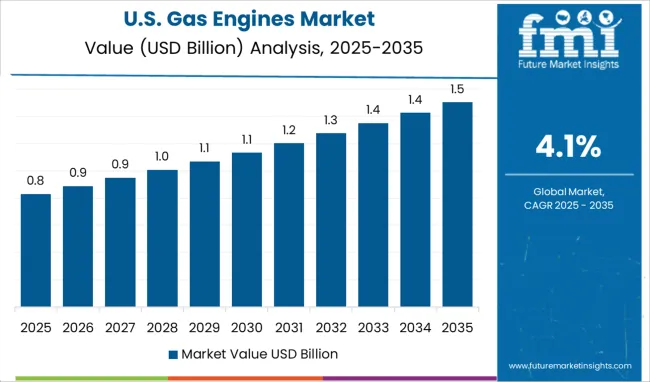

The Gas Engines Market is estimated to be valued at USD 5.6 billion in 2025 and is projected to reach USD 8.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

The gas engines market is expanding steadily as energy transition efforts intensify and demand for efficient, cleaner combustion systems increases. Growth is being supported by stricter emissions regulations, improved fuel-flexible engine designs, and rising investments in distributed power generation.

Industrial operators and utilities are increasingly favoring gas engines over traditional diesel-based systems due to their superior performance in combined heat and power (CHP) applications, reduced operating costs, and lower greenhouse gas emissions. Infrastructure upgrades in urban power networks and the rising adoption of decentralized energy resources are also bolstering market expansion.

Moreover, advancements in digital monitoring, remote diagnostics, and predictive maintenance are enhancing engine efficiency, uptime, and lifecycle economics. As nations aim to decarbonize power generation while maintaining grid reliability, the role of gas engines is expected to become more integral, particularly in load-balancing and backup power roles.

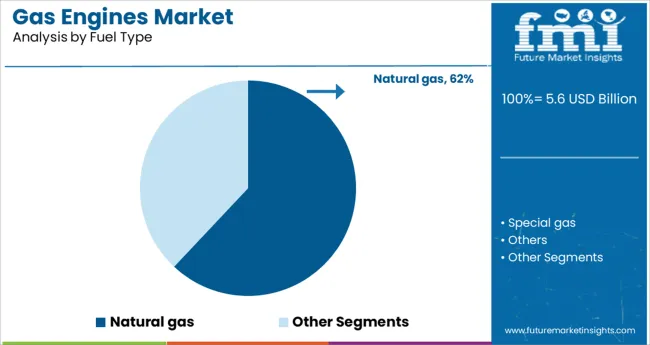

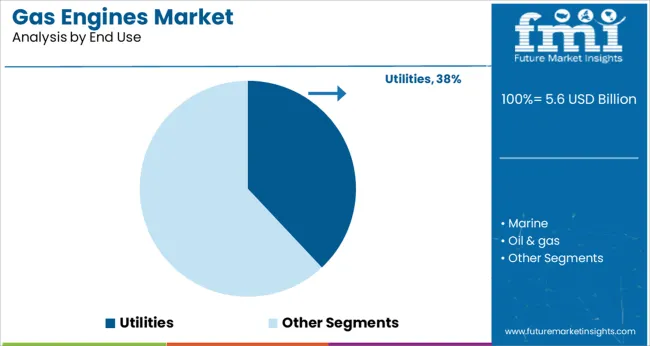

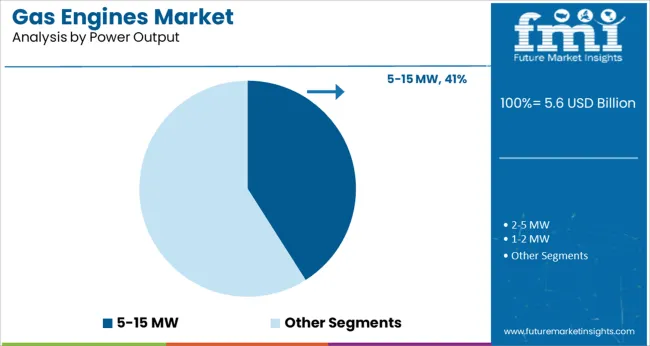

The market is segmented by Fuel Type, End Use, Power Output, and Application and region. By Fuel Type, the market is divided into Natural gas, Special gas, and Others. In terms of End Use, the market is classified into Utilities, Marine, Oil & gas, Manufacturing, and Others. Based on Power Output, the market is segmented into 5-15 MW, 2-5 MW, 1-2 MW, and Above 15 MW.

By Application, the market is divided into Power Generation, Mechanical Drive, Cogenerations, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Natural gas is expected to account for 62.0% of the gas engines market revenue in 2025, positioning it as the leading fuel type segment. This leadership is being driven by natural gas's widespread availability, favorable pricing, and significantly lower carbon footprint compared to coal or oil-based alternatives.

Its high thermal efficiency and lower NOx, SOx, and particulate emissions have made it the preferred fuel for power generation in regions with strong air quality mandates. The compatibility of natural gas engines with CHP systems and renewable methane blending has further accelerated their adoption in industrial and municipal applications.

Infrastructure development, including LNG terminals and gas pipeline expansion, has enhanced fuel accessibility across emerging markets, reinforcing the dominance of natural gas as the primary energy source for engine-based power generation.

The utilities segment is projected to represent 38.0% of the overall market share in 2025, making it the largest end-use sector in the gas engines market. This segment’s prominence is being fueled by growing demand for flexible grid support, peak load balancing, and backup power solutions in modern electricity networks.

Utilities are adopting gas engines to supplement intermittent renewable energy sources, stabilize grid performance, and meet local energy needs efficiently. Their modular scalability, quick start-up times, and operational reliability make them ideal for microgrids and distributed generation infrastructure.

Increasing government support for resilient energy systems and public-private investments in clean, localized power assets are also contributing to the segment's growth. As utilities shift toward hybrid and low-carbon generation portfolios, gas engines are expected to play a critical role in enabling the transition.

The 5-15 MW segment is expected to lead the gas engines market by 2025, accounting for 41.0% of the total revenue. This range is favored for its balance between scalability and operational efficiency, making it ideal for large commercial, industrial, and municipal installations.

Engines within this capacity are well-suited for distributed energy generation, cogeneration applications, and integration with renewable sources. Their ability to maintain high efficiency across varying load conditions makes them a reliable choice in environments with dynamic energy demands.

Additionally, units in this power range are commonly chosen for mission-critical infrastructure such as hospitals, data centers, and airports, where performance reliability and rapid response are essential. Enhanced technological innovation, coupled with modular installation advantages, has positioned the 5-15 MW range as the most commercially attractive output category in the evolving gas engine landscape.

With an increasing focus on reducing carbon emissions, the presence of strict government regulation, and rising usage of natural gas for power generation and mechanical drive applications in North America to drive the gas engine market during the forecast period.

The increasing consumption of natural gas in many applications is creating immense demand for sustainable technologies like gas engines.

The gas engine market in North America accounts for a significant share of the global revenue generation, owing to various technological enhancements and ongoing investments by several companies, and an increase in the number of gas-powered power plants will create huge demand for gas engines in the future.

As natural gas is eco-friendly as it burns cleaner and emits less carbon than other fuels thus major end-use industries such as utilities, manufacturing, automotive, and oil & gas use natural gas fueling engines.

The increasing usage of natural gas in gas engines across electricity generation plants boosts the growth of the segment. Also, the increased consumer awareness about the benefits of using natural gas coupled with favorable government initiatives is expected to positively impact the gas engine market forecast.

The shifting regulatory policies toward energy transition and sustainable energy sources, driven by integrated energy considerations, will enhance natural gas uses.

Over the years, there has been a significant increase in the demand for gas engines due to growing environmental concerns and a gradual shift towards producing energy by using natural gas and special gas fuels.

Today, the majority of power generation plants are replacing their traditional power generation infrastructure with gas engines to reduce emission levels.

Gas engines are internal combustion engines that run on gaseous fuel, such as natural gas, coal gas, biogas, and special gas. They are gradually gaining traction across end-use verticals like utilities, automotive, oil & gas, and manufacturing due to their higher efficiency, low operating costs, and eco-friendly nature.

Rising demand for electricity coupled with increasing usage of natural gas for producing energy due to its clean, economical, and readily available nature is expected to boost the growth of the gas engine market during the forecast period. According to the USA Energy Information Agency (EIA), 23.2% of the total global energy supply was produced by using natural gas in 2020.

Further, advancements in gas engine technologies and growing environmental concerns will fuel the adoption of gas engines across the world during the assessment period.

The global demand for gas engines is projected to grow at a steady CAGR of 4.1% during the forecast period from 2025 to 2035, surpassing a valuation of USD 8.4 Billion by the end of 2035.

Rising adoption of gas engines in power generation and mechanical drive applications, implementation of stringent carbon emission regulations, increasing government initiatives to expand the power generation infrastructure, the growing popularity of gas engine technologies across emerging economies, and technological advancements in gas engines are some of the major factors driving growth in the global gas engines market.

Since natural gas is clean and economical, various end use-industries are utilizing it for performing several functions including powering mechanical equipment, generating electricity, and propelling vehicles. This will continue to boost the sales of gas engines during the forecast period.

Similarly, rising environmental concerns along with growing demand for clean and efficient power production technologies and increased usage of distributed power generation systems will create opportunities for gas engine manufacturers, thereby expanding the global gas engine market size.

The expansion of the industrial gas turbine market along with rising awareness of environmental hazards and surging demand for clean and efficient power production resources is expected to improve the gas fuel engines market share during the forthcoming years.

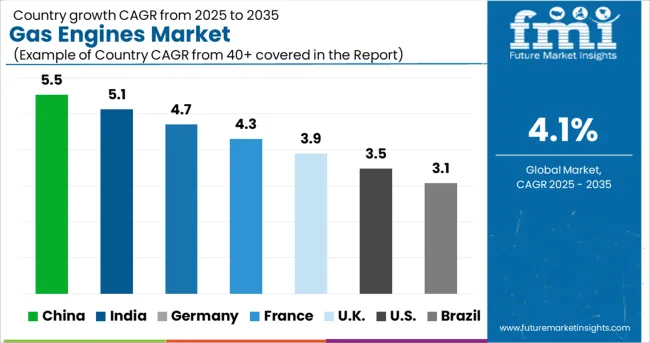

Countries like India, Germany, and the United Kingdom are spending large amounts on the construction of gas-powered power plants to reduce carbon emission levels as well as to cater to rising energy demands. Thus, an increase in the number of gas-powered power plants will create huge demand for gas engines in the future.

It has been observed that natural gas-fired power plants emit negligible amounts of greenhouse gases as compared to oil and coal fired-plants. Driven by this, countries are continuously striving to develop and expand their gas-powered power infrastructure, thereby creating space for gas engine market growth.

Despite its optimistic stance, the global gas engine market is facing various challenges that are restraining its growth to some extent. Some of these factors are the shortage of natural gas due to wars and outbreaks of pandemics, fluctuations in natural gas prices, lack of sufficient infrastructure in some regions, and expansion of the gasoline engine market size.

Rising Usage of Natural Gas for Power Generation Application Creating Demand for Gas Engines in China

As per FMI, sales of gas engines across China are projected to grow at a significant pace during the forecast period, owing to the rising demand for clean and efficient power generation technologies, presence of stringent government regulations, rapid increase in the number of gas-fired power plants, availability of advanced products at lower prices, and increasing usage of natural gas in myriad applications.

Rapid usage of coal for power generation and cogeneration applications across China has caused many serious environmental consequences. As a result, there has been a dramatic shift towards large-scale production and consumption of eco-friendly and sustainable alternatives like natural gas.

According to the USA Energy Information Agency (EIA), China’s natural gas consumption rose by 9% in 2020 to 10.8 Tcf from 9.9 Tcf in 2020, making it the world’s third-largest natural gas consumer behind the United States and Russia. This rising usage of natural gas is expected to generate significant demand for gas engines throughout the forecast period.

Similarly, increasing government initiatives and investments to reduce carbon emission levels while at the same time, increasing electricity generation is positively impacting the gas engine market in the country. As per the Center for Strategic and International Studies (CSIS), China invested USD 5.4 billion in energy transition measures in 2024.

Rising Need for Reducing Carbon Emissions and the Presence of Strict Government Regulation Driving Market Growth in the United Kingdom

With an increasing focus on reducing carbon emissions, the presence of strict government regulation, and the rising usage of natural gas for power generation and mechanical drive applications, the United Kingdom's gas engine market is poised to exhibit steady growth during the forecast period.

Rising consumption of natural gas in a wide range of applications is creating immense demand for sustainable technologies like gas engines and this trend is likely to continue during the forecast period. According to the Worldometer, the United Kingdom consumes 2,795,569 million cubic feet (MMcf) of natural gas per year as of the year 2020.

Similarly, the growing popularity of turbofan engines and the rapid expansion of the marine gas engine market is expected to create opportunities for gas engine manufacturers across the United Kingdom during the forecast period.

Demand for Natural Gas-Based Engines to Continue Rising Throughout the Forecast Period

Based on fuel type, the gas engine market is segmented into natural gas, special gas, and others. Among these, the natural gas segment holds the largest portion of the global gas engine market and is likely to grow at a higher CAGR during the forecast period.

The growth of the segment is attributed to the increasing usage of natural gas in gas engines across electricity generation plants.

Natural gas is more eco-friendly as it burns cleaner and emits less carbon than other fuels. This is prompting major end-use industries such as utilities, manufacturing, automotive, and oil & gas. to use natural gas fueling engines.

Growing consumer awareness about the benefits of using natural gas coupled with favorable government initiatives is expected to positively impact the natural gas engine market forecast.

Above 15 MW Gas Engines Remain Most Preferred for Power Generation and Cogeneration Applications

As per FMI, the above 15 MW gas engines segment accounted for the largest revenue share in 2024, owing to their increasing usage in power generation and cogeneration applications. These engines are mostly used in island-type configurations to supplement major power plants and help avoid blackouts.

The rapid expansion of power generation infrastructure worldwide coupled with growing demand for power generators for the military will further boost the growth of this segment during the forecast period.

Mechanical Drive Segment to Create Maximum Opportunities for Gas Engine Manufacturers

In terms of application, the gas engine market has been segmented into power generation, mechanical drive, cogeneration, and others. Among these, the mechanical driver segment dominates the global gas engine market.

A wide range of mechanical equipment, such as pumps, blowers, compressors, etc. used across manufacturing and oil and gas industries are powered by gas engines. Thus, the rapid expansion of the industrial gas turbine market will boost segment growth during the forecast period.

Leading gas engine manufacturers have adopted various organic and inorganic strategies such as new product launches, the establishment of new facilities across attractive regions, partnerships, acquisitions, collaborations, etc. to gain a competitive edge in the global gas engines market.

For instance:

Future Market Insights' latest report provides a professional and in-depth study of the current state of the global gas engines market. It provides details about the global gas engine market size, key revenue drivers, market restraints, growth opportunities, and recent developments.

The report examines the impact of the booming gas turbine industry on overall gas engine sales and illustrates how the rapid expansion of the power generation sector is creating space for the growth of the gas engine market.

Besides this, FMI also attempts to reveal the prevalent gas engine market trends guiding the gas engine market growth. Does it provide solutions to queries like how will a rise in fuel prices influence the demand for gas engines? Why is Europe becoming the hub for gas engines? And who are the top gas engine manufacturers?

A certain number of chapters have been dedicated to analyzing leading market segments and regional pockets. This makes the study more informative and interesting.

The Gas Engines Market Analysis Includes:

| Attributes | Details |

|---|---|

| Projected Growth Rate (2025 to 2035) | 4.1% |

| Estimated Market Valuation (2035) | USD 8.4 billion |

| Forecast Period | 2025 to 2035 |

| Historic Data Available for | 2020 to 2024 |

| Market Analysis | million for Value |

| Report Coverage | Market forecast, company share analysis, competition intelligence, Drivers, Restraints, Opportunities and Threats analysis, market dynamics and challenges, and strategic growth initiatives |

| Key Segments Covered | Product, Application, Device Type, Grade Type, Distribution Channel, Region |

| Key regions covered | North America(USA, Canada, Rest of North America); Latin America(Brazil, Argentina, Mexico, Rest of Latin America); Western Europe(Germany, United Kingdom, France, Rest of Western Europe); Eastern Europe(Russia, Spain, Rest of Eastern Europe); South Asia Pacific(China, India, Japan, Malaysia, Thailand, Indonesia, South Korea, Rest of South Asia & Pacific); Middle East & Africa(GCC Countries, Turkey, Israel, Rest of Middle East and Africa(MEA)); Rest of the World(Oceania, Africa, South America) |

| Application | Power Generation, Mechanical Device, Cogenerations, Others |

| Key companies profiled | Westport Fuel Systems Inc; Wärtsilä; IHI Power Systems Co., Ltd. (Subsidiary of IHI Corporation); YANMAR HOLDINGS CO.; MAN SE; BERGEN engines AS; LIEBHERR; JFE Engineering Corporation; Siemens; INNIO; MITSUBISHI HEAVY INDUSTRIES, LTD; Kawasaki Heavy Industries, Ltd and Caterpillar; Cummins Inc. |

The global gas engines market is estimated to be valued at USD 5.6 billion in 2025.

It is projected to reach USD 8.4 billion by 2035.

The market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types are natural gas, special gas and others.

utilities segment is expected to dominate with a 38.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Desiccant Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Gas Jet Compressor Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Gastric-soluble Hollow Capsules Market Size and Share Forecast Outlook 2025 to 2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Smart Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Oil Market Size and Share Forecast Outlook 2025 to 2035

Gas Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Condensing Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Gas Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Gastroesophageal Reflux Disease (GERD) Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gas Station Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA