The global Gas Delivery Systems market is anticipated to register substantial growth through 2025 to 2035, on the back of the increasing adoption of gas delivery systems in semiconductor manufacturing, healthcare, industrial and energy applications. The growth of this market can be attributed to the rising investments in smart manufacturing, automation, and energy-efficient gas management solutions.

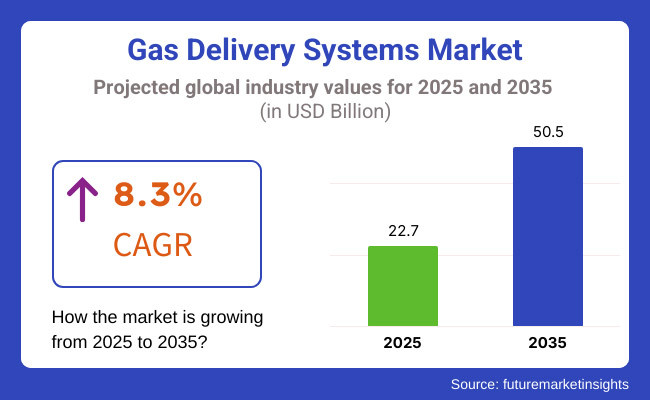

Over the next several years, the market is anticipated to grow from USD 22.7 Billion in 2025 to USD 50.5 Billion by 2035 at a Compound annual growth rate (CAGR) of 8.3% during the forecast period.

These new technologies are extensively used in industries where high-purity specialty gases are also extensively utilized; with the rapid industrialisation and advancements in gas flow control technologies for better purity, it is likely that the fusional use of specialty gases will increase and subsequently stimulate growth of the specialty gas market.

Other factors driving innovations of gas delivery systems are the need for stricter regulations of gas emissions, workplace safety, and environmental compliance. Rising deployment of integrated gas management solutions that enable a higher class of safety, precision and automation also are sowing increased demand across all segments of industry.

Explore FMI!

Book a free demo

North America represents a mature and high-valued market for gas delivery systems, with sustained demand coming from the semiconductor, healthcare, and energy industries. The USA and Canadian markets account for a significant amount, backed by existing industrial infrastructure and higher levels of automation technologies.

Increasing utilization of high-purity specialty gases in semiconductor manufacturing, pharmaceutical sector, and sterilizing medical devices is driving demand for high-precision gas delivery systems. Moreover, stringent government regulations for industrial emissions and worker safety are propelling the demand for automated and leak-proof gas handling systems.

Germany, France, and UK are the leading industrial automation and semiconductor manufacturing countries and driving the growth of gas delivery systems market. Additionally, the increasing use of clean energy solutions, hydrogen-based fuel technologies and strict safety standards are also increasing the demand for advanced gas delivery systems.

As the supply chain for medical gas continues to grow particularly as healthcare needs rise and developments in respiratory treatment occur, there will be higher demand for effective, safe and efficient types of gas management solutions to be adopted.

The Asia-Pacific segment is expected to witness the most significant growth, primarily due to rapid industrialization, increased semiconductor manufacturing, and a rise in significant investments in clean energy innovations. Regions such as China, India, Japan, and South Korea are creating their industrial and healthcare infrastructure which is also increasing the demand for gas delivery systems.

With the rise of electronics and semiconductor manufacture there is a growing need to have a well-controlled flow of gas during the manufacture process creating a major market opportunity and now you have been trained to fill it even better. Government initiatives are also supporting market growth initiatives in hydrogen energy, carbon capture, and advanced healthcare infrastructure.

Challenges

Opportunities

Due to increasing demand across semiconductor manufacturing, healthcare, industrial processing, and energy sectors, the gas delivery systems market progressed steadily from 2020 to 2024.

Automated gas delivery solutions, which have become the subject of significant development, are built to meet the growing demand for accurate and efficient gas flow control in sectors such as electronics, chemicals and pharmaceuticals. The demand for ultra-high-purity gas delivery systems became more prevalent and critical in the semiconductor fabrication and medical utilization processes.

Regulatory authorities such as EPA, OSHA, and ISO have set higher safety and emissions standards, making installation of high-efficiency gas handling and leak detection systems inevitable. The semiconductor industry, propelled by 5G growth, AI creation, and next-generation chip production, became a large user of ultra-high-purity gas distribution systems that needed gas control for etching, deposition, and doping applications.

Oxygen, nitrogen, and carbon dioxide delivery systems experienced high demand due to the rise in hospitals, life support systems, and biotechnology research in the healthcare sector. COVID-19 pandemic bolstered investments in medical gas infrastructure, leading to modernization of gas storage and distribution systems by hospitals and pharmaceutical companies.

The use of automated gas control systems was also extended to industrial sectors, such as metal processing, food packaging, and oil, gas and petrochemicals, enabling efficiency improvement, workplace safety, and process optimization.

Smart solutions with real-time flow monitoring, remote control and AI-powered leak detection became the new normal due to technological advancements. Operate: To improve the safety of the lighting equipment, IoT-enabled sensors and automated shut-off valves were interfaced providing the advantages of less gas wastage and reduced operational costs.

There was also a growing requirement for modular and scalable gas delivery systems that can dynamically adjust flow rates as production requirements change across industries.

The market has continued to evolve despite some setbacks in adoption due to challenges such as high upfront installation costs, complexity in meeting regulatory compliance, and supply chain disruptions that affect the purity and distribution of gas.

The shortage of specialty gases, critical for semiconductor and aerospace industries, led to adjustments in production timelines, highlighting the importance of alternative gas sourcing and on-site gas generation technology. But with cost-effective gas handling solutions and AI-driven monitoring systems brought in by companies, the adoption of automated gas delivery systems lay continued, guaranteeing safer, more effective, and greener operations.

The market for gas delivery systems will transform between 2025 and 2035: Automation, the integration of AI and hydrogen-based energy solutions will be drivers of this transformation. Industries will transition to self-regulated gas delivery systems, employing machine learning algorithms to optimize gas flow, project demand variability, and pre-empt potential hazards through leakage.

Gas management systems driven by smart sensors will enable real-time monitoring of gas purity, pressure readings, and consumption trends to achieve maximum efficiency and to minimize wastage.

The accelerating growth in semiconductor fabrication facilities, electric vehicle (EV) battery production, and quantum computing will lead to increased demand for ultra-high-purity gas handling solutions. Precision-controlled gas compositions will aid in delivering advanced microchips or microchips processes and other advanced materials, as AI-powered gas flow optimization systems can optimize yield rates in semiconductor manufacturing.

Traceable control of industrial gas transactions will be achieved through block chain-enabled gas supply chain tracking, improving transparency, compliance, and security, and mitigating supply disruptions while confirming authenticity.

With sustainability and decarbonisation entering centre stage, this sector will see an explosive growth of hydrogen delivery systems. The ability to produce green hydrogen and fuel cell technologies will require new gas transport and storage technologies that allow for a transition to hydrogen-based industrial processes, mobility and energy storage.

Gas pipeline assets will migrate to hydrogen-ready delivery infrastructure employing AI-based leak detection and predictive maintenance to further reduce safety risks. They will additionally implement smart gas flow controllers in their renewable energy-powered electrolysis plants, increasing the efficiency of hydrogen production for grid applications.

As industries transition to automated gas distribution networks, issues like cybersecurity and AI-enhanced gas safety monitoring will need to be phased introduced. Advanced-level anomaly detection systems powered by AI will flag abnormalities such as pressure inconsistencies, gas leaks and pipeline corrosion that can result in industrial accidents and compromise compliance.

Cloud-powered gas delivery analytics platforms will offer features like remote triggering of gas delivery, predictive fault diagnostics, and energy-efficient gas usage, increasing operational intelligence across industries.

As the industry moves toward modular gas delivery infrastructures, it will change the standard used to determine the size of companies by dynamically scaling operations in line with real-time gas demand. Exceptionally compact, easily transportable gas generation appliances will produce gas on the site that is required in hospitals, industries or laboratories, alleviating reliance on traditional bulk gas supply channels.

With the next evolution of industries moving into decentralized gas delivery models, automated micro-distribution networks are poised to emerge as the most cost- and energy-efficient way to maintain sustainable gas supply solutions for urban areas, industrial complexes and even off-grid applications.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Industries had to install new automated leak detection and high-purity gas handling systems as governments enforced stricter gas safety and emissions regulations. |

| Technological Advancements | However, industry’s adoption to IoT-integrated gas delivery systems, allowed for remote monitoring, immediate flow adjustments, and automated safety shut-offs. |

| Industry Applications | The growth was driven by demand for semiconductor fabrication, medical gas supply, industrial automation and chemical processing. |

| Adoption of Smart Equipment | Automated pressure regulators, real-time gas purity sensors, and modular gas distribution units were deployed by the manufacturers. |

| Sustainability & Energy Efficiency | These industries are working to minimize gas waste, accelerate the transition to renewable energy-powered gas generators, and improve carbon capture technologies. |

| Data Analytics & Predictive Maintenance | Sensors and cloud-based gas monitoring systems were brought together by businesses in order to identify flow irregularities, reduce gas usage, and increase reliability of devices. |

| Production & Supply Chain Dynamics | Specialty gas supply chain disruptions led to delays in semiconductor production and industrial applications in the market. |

| Market Growth Drivers | Growth was spurred by increased semiconductor demand, medical gas applications and automation in industrial gas processing. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Gas monitoring frameworks enabled by AI, supply chain deliberations driven by block chaining and regulations around hydrogen infrastructure capabilities will shape the future of compliance. |

| Technological Advancements | Fire fighting robots, autonomous gas lines with redundant safety features, quantum gas purity control, hydrogen delivery systems and improved pressure regulation will be the norm. |

| Industry Applications | Research in energy storage devices based on hydrogen will further complement AI-optimized semiconductor production methods and develop decentralized production micro-distribution networks for industrial gases. |

| Adoption of Smart Equipment | This will automate the operational efficiencies through autonomous gas flow controllers, AI-optimized leak detection algorithms, and smart gas analytics platforms. |

| Sustainability & Energy Efficiency | Gas networks powered by hydrogen, AI-driven gas delivery systems designed for energy efficiency will inspire the next wave of sustainability. |

| Data Analytics & Predictive Maintenance | Intelligence will be augmented by AI-enabled predictive maintenance, digital twin-based gas flow simulations and automated compliance tracking. |

| Production & Supply Chain Dynamics | Gas logistics tracking powered by block chain, decentralized gas sourcing, and AI-optimized supply chain management shall guarantee steady availability. |

| Market Growth Drivers | Future expansion will be propelled by the integration of AI-enabled gas delivery networks, hydrogen infrastructure, and modular gas storage solutions. |

USA gas delivery systems market is anticipated to grow at a healthy rate and is projected to grow faster on account of increasing demand from the semiconductor manufacturing, healthcare, and industrial applications in the country. The growth of the market is further propelled by the increasing utilization of specialty gases in the electron and pharmaceutical industries and the increasing automation and smart gas handling technologies.

The booming semiconductor industry is one of the key drivers of that growth, with the USA government showering 52 billion in funding for domestic production under the CHIPS and Science Act. Ultra-high purity (UHP) gases play a pivotal role in the chip fabrication process used for etching, doping, and wafer processing - making gas delivery systems extremely critical.

Healthcare is another critical sector where automated gas delivery systems-such as systems for oxygen, nitrogen, and carbon dioxide distribution-are being extensively used by hospitals, laboratories, and pharmaceutical companies. This market also has potential solutions for drug manufacturing and biotechnology - precision gas mixing and delivery solutions

There is also a growing demand for high-precision gas handling systems in hydrogen fuel production, the growth of renewable energy and hydrogen fuel infrastructure, and carbon capture projects.

However, the gas industry has started finding ways to implement IoT solutions to everything including real-time asset tracking gas commodity, leak detection in plant and gas measurement automation to ensure enhanced safety and efficient handling of gas commodity across the value chain.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.3% |

Gas Delivery Systems increase in United Kingdom has been supported through a few rebounding interest for high-purity gases in commercial applications, health care, and electricity transition tasks. Such demand for advanced gas handling solutions is aided further by the UK government's focus on hydrogen economy development and semiconductor industry growth.

Hydrogen has a major part to play in the UK hydrogen economy - with the government announcing £4 billion in funding to help stimulate hydrogen production and infrastructure. This is continuing to drive demand for gas delivery systems, such as hydrogen fuel cell applications, when industrial gases are stored, and gas transport systems.

High-precision gas management systems are being increasingly used in the semiconductor and electronics industries and are contributing to the UK's strategy to boost local semiconductor manufacturing to meet global supply chain resilience efforts.

Moreover the life sciences sectors of biopharma and biotechnology, especially in Oxford and Cambridge life sciences hubs, are providing increasingly high demand for gas delivery systems for drug synthesis, research labs and medical applications.

In addition, the growing digitalization and automation of industrial gas supply is driving the uptake of smart gas control systems with real-time pressure monitoring and safety controls.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.2% |

The Gas Delivery Systems Market in the European Union is being driven by stringent environmental regulation, swift adoption of green hydrogen, and growth of the semiconductor and healthcare industries. The EU's Net Zero 2050 target is encouraging investment into clean energy technologies, including hydrogen fuel production and carbon capture.

Germany, France and the Netherlands are ahead of the pack in the race to establish hydrogen-based gas delivery systems, aided by the EU’s 10 billion Hydrogen Strategy to establish industrial-scale production and distribution of hydrogen. This is increasing the need for high-accuracy gas delivery systems for fuel cell development and industrial use.

Strong growth is also evident in the semiconductor industry, especially in Germany, where Infineon and Bosch are building production facilities that require ultra-high purity (UHP) gas delivery solutions.

Moreover, EU pharmaceutical and biotechnology industries fuel demand for the gas handling systems used in medical oxygen, nitrogen, and research laboratories.

Industry technologies like AI-driven gas monitoring, automated pressure regulation, and real-time analytics are also improving the safety and efficiency of gas delivery systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 8.3% |

Semiconductor Manufacturing Progresses, Clean Energy Projects Take off, and Healthcare Applications Also Increase = The Japan Gas Delivery Systems Market is Expanding. Japan ranks amongst leading global manufacturers in semiconductors, and local companies such as Tokyo Electron, Renessa, and Sony have also been investing large amount of capital into the next generation chip production, which demands high-purity gas handling systems.

And Japan is at the forefront of hydrogen fuel, introducing the Hydrogen Society Initiative focused on the large-scale dissemination of fuel cells, hydrogen-powered vehicles, and clean energy storage. The government is investing ¥2 trillion (USD 15 billion) in hydrogen infrastructure, conspicuously spurring demand for precision gas delivery solutions used in fuel cell production and industrial applications.

Similarly, the pharmaceutical and healthcare industries are growing and need automated gas supply systems in scientific research laboratories, oxygen delivery in hospitals, and biopharmaceutical production.

Furthermore, by significant focus of Japan on robotics and factory automation, market on smart gas control system is also getting a treadmill adoption, as these control systems are integrated with IoT devices and AI in order to monitor and regulate the gas remotely.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.5% |

(High-pressure gas pumped) South Korean Gas Delivery Systems High-tech Semiconductor Manufacturing, Hydrogen Energy Projects, smart factory automation, the market is growing rapidly. As a major producer of semiconductor wafers, South Korea's global players in the industry, Samsung and SK Hynix, pump more than 150 billion into next-generation wafers, which demand ultra-high purity (UHP) gas handling systems.

Another big growth driver is the South Korean government’s 40 billion investment in hydrogen energy. Hydrogen-powered economy driven demand for gas delivery solutions for hydrogen Fuel cells, storage and distribution.

The biopharmaceutical and healthcare sectors are also growing, with high precision gas delivery systems applied in oxygen therapy, medical research, and drug synthesis.

The growth of smart factory initiatives within South Korea's Industry 4.0 strategy also contributes to the increasing acceptance of AI-based automated gas handling systems, as they provide the much-needed efficiency, accuracy, and safety required for industrial applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.6% |

In gas delivery systems market, there is a substantial share of fully automatic programmable switchover systems and semi-automatic switchover systems owing to the need for efficiency, reliability, and automation among industries in gas supply management. Today, these systems are crucial in manufacturing, chemical processing, semiconductor production, healthcare, and in research laboratories to ensure uninterrupted gas flow, minimal downtime, and accurate gas pressure control.

This innovative solution has quickly become a favorite in industries where gas supply cannot be interrupted and continuous monitoring is required, yet manual intervention needs to be reduced to a minimum. These systems also provide a fully automatic switch from one gas source to another, eliminating the need for operators to manually transfer gases, which is a crucial step that can compromise the safety and reliability of semi-automatic systems.

In the semiconductor and electronics industries, fully automatic programmable switchover systems are widely used for ultra-high-purity gas management such as in chip manufacturing, wafer processing and leading-edge printed circuit board (PCB) manufacturing. Kommix TSD Technologiesogistic are widely used in clean rooms for semiconductor manufacturing, electronics, pharmaceuticals, and biotechnology, among many others.

Fully automated gas delivery systems are also of considerable value to the healthcare and pharmaceutical industries as hospitals, research labs and biotech companies require precisely metered medical gases for applications like patient care, drug formulation, and laboratory experiments. Advanced technology that conforms to IEEE802 standards, integrated with fully automatic gas switching, guarantees high reliability gas supply (O2, N2, specialty gases) 24 hours a day, 7 days a week anywhere in the world, supporting life-saving procedures, sterilization, and cryogenic storage.

Foly gas delivery systems are important for the chemical and petrochemical industries, where such units are used in catalytic applications, refining, and chemical synthesis, applications that require continuous gas supply and precise control of pressure. Innovative switchover systems include real-time pressure sensors, automated leak detection, and remote monitoring to ensure hazardous gases are safely managed, while minimizing manual involvement and improving regulatory compliance.

This has been compensated by the market acceptance of semi-automatic switchover systems, which find a strong hold in industrial gas distribution, welding operations, and laboratory gas supply, where the need for automation and cost is a consideration. Unlike fully automatic systems, semi-automatic switchover solutions only require near-zero operator intervention, where the user has to reset or adjust gas supply manually while switching between sources.

Semi-automatic switchover systems are designed for welding, cutting, and heat treatment applications in the manufacturing and metal fabrication industries. These systems aid in minimizing downtime, optimizing gas usage, and ensuring stable pressure for industrial processes, all of which are crucial in high-precision manufacturing settings.

Semi-automatic gas mannequins are also useful in the food and beverage industry, since gas mixtures are critical in food preservation, packaging, and carbonation. Semi-automated gas management solutions for food storage and production in applications such as Breweries, dairy processing plants and food storage rooms enable programmable control of nitrogen and CO₂ and oxygen supply for better flavor, freshness and shelf-life.

In educational & research institutions, semi-automatic gas switchover systems are used to provide a safe, controlled gas supply for laboratory experiments, analytical testing, & academic research projects. Chemical labs, physics R&D facilities, and biomedical labs at universities and R&D centers deploy semi-automatic gas systems to deliver economical, yet trusted, gas delivery where valuable process assets and expensive research can be jeopardized.

Although they are widely used, semi-automatic switchover systems may be subject to operator dependence, pressure instability risks, and a need for manual reset. Nevertheless, the market for semi-automatic gas delivery systems is not going anywhere with the advent of new and improved modular gas panel configurations, simple to read digital pressure meters, and hybrid gas switching systems that enhance ease of use, safety, and efficiency.

Industrial and chemical sectors account for the largest end-user segments in the gas delivery systems market as companies focus on effective gas management, compliance with safety regulations, and process optimization across various manufacturing and processing industries.

Gases are also essential to welding, metal fabrication, semiconductor manufacturing, glass production, and industrial gas refining, making the industrial sector the top consumers of gas delivery systems.

Gas delivery systems are extensively employed in metal fabrication and automotive industries for processes such as arc welding, laser cutting, and precision coating operations, as they guarantee reliable gas supply, minimized downtime, and cost-efficient operations. Industrial gas suppliers use automated gas handling solutions to provide argon, helium, and CO₂ mixtures to production sites, minimizing manual labor and streamlining operations.

Semiconductors and electronics industries use high-purity gas delivery systems for chip fabrication, PCB manufacturing, and display panel production. Fully automated gas switching systems prevent contamination, control gas contamination levels, and keep the manufacturing environment clean, supporting high-tech production requirements

Gas handling systems are also used in the energy regulatory industry, including in aircraft, oil refineries, natural gas processing plants and utility companies for combustion regulation as well as in cooling and within gas turbines. Gas monitoring devices must be safe and reliable since these facilities need to regulate the gas flow to avoid system failures, emissions, and saving energy.

Industrial gas delivery systems require relatively to be active at all times because of their key role, but they face issues regarding gas leakage risks and high installation and regulatory compliance requirements. Despite this, AI-driven gas monitoring, remote pressure management, and predictive maintenance software are enhancing system safety, cutting operating expenses, and facilitating further market growth.

Advanced gas delivery systems manufactured for hazardous, reactive, and specialty gases in chemical synthesis, refining, and laboratory research have seen significant adoption in the chemical industry.

For example, petrochemical plants and refineries have fully automated gas switching systems for managing hydrogen, nitrogen, and processing gas for use in crude oil refining, catalytic reactions, and polymer production. The operational atmosphere in these facilities is characterized with challenges that require precision gas management solutions for continuous, regulatory-compliant processes and safe operations

Gas delivery systems are applied in the biological fermentation, drug formulation and cryogenic preservation applications for the pharmaceutical and biotechnology industries as well. The comprehensive automation of gas control systems offers risk-free, contamination-free gas delivery, fulfilling high-purity requisites for pharmaceutical processing and laboratory tests.

Gas delivery systems are critical in the chemical industry, however, these systems have issues concerning the maintenance of gas purity, potential for chemical reactivity, and stringent regulatory standards. But technology improvements in gas purification methods, actual time pressure observation, and automated leakage recognition systems help enhance effectiveness, security, and trustworthiness of gas for gas shipping techniques inside the chemical compound industry.

The gas delivery systems market is expanding due to increasing demand for precise gas handling in semiconductor manufacturing, healthcare, chemical processing, and industrial applications. Companies focus on automated gas flow control, high-purity delivery systems, and IoT-enabled monitoring to enhance safety, efficiency, and operational precision.

The market includes global leaders and specialized manufacturers, each contributing to technological advancements in high-pressure gas regulation, leak detection, and smart gas distribution.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Air Liquide S.A. | 12-17% |

| Linde plc | 10-14% |

| Parker Hannifin Corporation | 8-12% |

| Air Products and Chemicals, Inc. | 7-11% |

| MATHESON Tri-Gas, Inc. | 5-9% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Air Liquide S.A. | Develops automated gas delivery systems with high-purity distribution for semiconductor, medical, and industrial applications. |

| Linde plc | Specializes in gas pressure regulation, bulk gas storage, and smart gas control solutions for energy, healthcare, and manufacturing industries. |

| Parker Hannifin Corporation | Manufactures precision gas flow control and monitoring devices, focusing on semiconductors, pharmaceuticals, and laboratory applications. |

| Air Products and Chemicals, Inc. | Offers turnkey gas delivery systems, integrating remote monitoring and AI-driven safety controls for industrial and energy applications. |

| MATHESON Tri-Gas, Inc. | Provides custom-engineered gas handling solutions, ensuring safe and efficient gas distribution in research and manufacturing. |

Key Company Insights

Air Liquide S.A. (12-17%)

Air Liquide leads the gas delivery systems market, offering automated and high-precision gas flow solutions for semiconductors, medical applications, and industrial processes. The company integrates IoT-enabled monitoring and leak detection to enhance safety and efficiency.

Linde plc (10-14%)

Linde specializes in bulk and specialty gas delivery systems, focusing on smart flow regulation, high-pressure gas storage, and remote monitoring. The company plays a key role in hydrogen infrastructure and energy-efficient gas distribution.

Parker Hannifin Corporation (8-12%)

Parker Hannifin provides gas handling and flow control equipment, catering to scientific research, semiconductor fabrication, and precision manufacturing. Its focus on real-time monitoring and digital control enhances accuracy and reliability.

Air Products and Chemicals, Inc. (7-11%)

Air Products develops scalable and AI-driven gas delivery solutions, integrating automated distribution and smart leak detection to ensure safe and efficient gas handling in energy and industrial applications.

MATHESON Tri-Gas, Inc. (5-9%)

MATHESON offers custom gas delivery solutions, emphasizing high-purity gas handling, pressure control, and integrated safety systems for laboratory and manufacturing applications.

Other Key Players (45-55% Combined)

Several manufacturers contribute to cost-efficient gas delivery, smart flow management, and customized industry-specific solutions. These include:

The overall market size for Gas Delivery Systems Market was USD 22.7 Billion in 2025.

The Gas Delivery Systems Market is expected to reach USD 50.5 Billion in 2035.

The demand for gas delivery systems is expected to rise due to the growing applications in semiconductor manufacturing, healthcare, and industrial gas processing, along with increasing safety and precision requirements in gas distribution for laboratories, medical facilities, and manufacturing plants.

The top 5 countries which drives the development of Gas Delivery Systems Market are USA, UK, Europe Union, Japan and South Korea.

Fully Automatic Programmable Switchover Systems to command significant share over the assessment period.

On-Site Solar Power Market Growth – Trends & Forecast 2025 to 2035

United States Flare Gas Recovery System Market Analysis – Demand, Trends & Forecast 2025-2035

Carbon Capture and Storage (CCS) Market Growth - Trends & Forecast 2025 to 2035

CNG Tanks Cylinders Market Growth - Trends & Forecast 2025 to 2035

Swellable Packers Market Growth – Trends & Forecast 2025 to 2035

Sustainable Aviation Fuel Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.