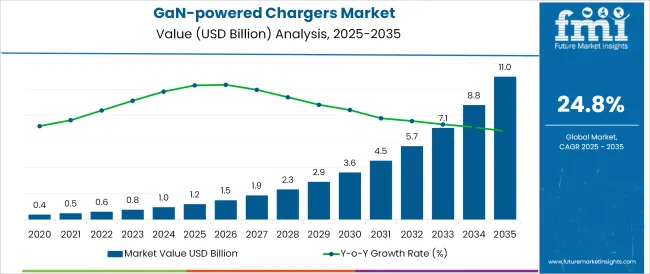

The GaN-powered Chargers Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 11.0 billion by 2035, registering a compound annual growth rate (CAGR) of 24.8% over the forecast period.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 1.2 billion |

| Market Size in 2035 | USD 11.0 billion |

| CAGR (2025 to 2035) | 24.8% |

The GaN-powered chargers market is undergoing accelerated growth as advancements in gallium nitride (GaN) semiconductors reshape the power electronics industry with smaller, faster, and more efficient charging solutions.

Industry journals and semiconductor manufacturers’ investor presentations have highlighted GaN’s superior thermal performance, higher switching frequencies, and reduced energy losses compared to traditional silicon, which have been instrumental in driving adoption across consumer electronics and enterprise applications.

Current demand is being fueled by increasing power needs of portable devices, consumer preference for compact and multi-port chargers, and sustainability goals focused on energy efficiency.

Future expansion is expected to benefit from broader integration of GaN into high-power applications, falling production costs, and deeper penetration into automotive and industrial sectors. Continued innovations in packaging and circuit design, as well as growing awareness among end users about faster and safer charging, are paving the way for long-term market maturity.

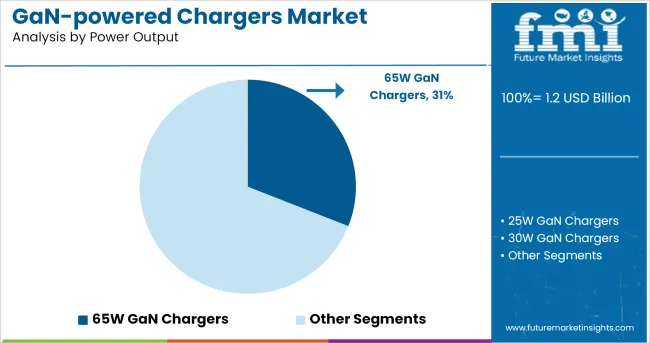

The market is segmented by Power Output and Application and region. By Power Output, the market is divided into 65W GaN Chargers, 25W GaN Chargers, 30W GaN Chargers, 45W GaN Chargers, 60W GaN Chargers, 90W GaN Chargers, 100W GaN Chargers, and Others.

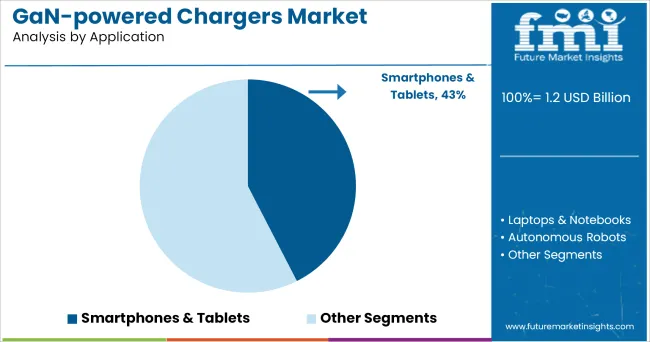

In terms of Application, the market is classified into Smartphones & Tablets, Laptops & Notebooks, Autonomous Robots, Industrial Equipment, Wireless Charging, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by power output, 65W GaN chargers are projected to account for 31.0% of the market revenue in 2025, making it the leading power output category. This leadership has been supported by the segment’s optimal balance between power, size, and affordability, which has positioned it as a versatile solution for a wide range of consumer electronics.

According to company product announcements and engineering publications, 65W chargers have gained popularity due to their ability to simultaneously charge laptops, smartphones, and tablets efficiently while maintaining a compact form factor.

Enhanced thermal management and safety features enabled by GaN technology have further encouraged adoption in this segment. Manufacturers’ focus on multi-device compatibility and universal USB-C standards has also reinforced consumer and retailer preference for 65W chargers, ensuring that they meet both personal and professional usage scenarios without over-specifying or underdelivering power.

Segmented by application, smartphones and tablets are expected to command 42.5% of the GaN powered chargers market revenue in 2025, establishing themselves as the top application category. This dominance has been reinforced by the ubiquity of these devices and their increasing power requirements driven by high-resolution displays, faster processors, and larger batteries.

Corporate earnings reports and industry association publications have noted that consumer demand for faster, safer, and more compact charging solutions has made GaN chargers particularly attractive for mobile devices.

The ability of GaN-based chargers to deliver higher wattages with reduced heat and minimal footprint aligns perfectly with consumer expectations in this segment. Additionally, strong marketing efforts from major consumer electronics brands promoting GaN’s benefits, alongside regulatory emphasis on energy efficiency and universal charger standards, have accelerated adoption. Retailers and OEMs have increasingly bundled or recommended GaN chargers for smartphones and tablets, reinforcing this segment’s market leadership.

FMI has projected the global GaN-powered chargers market to witness a growth in revenue from USD 1 Million in 2024 to USD 11 Bn by 2035. The interest regarding GaN-powered chargers has piqued in the last few years due to improvements in wireless and connected electronic devices and technology.

Several market players are focusing on the development of miniature versions of GaN-powered chargers to be integrated with small size electronics devices. GaN-powered chargers offer various advantages such as small size, more efficient charging, and higher switching frequency, and others. These factors will continue driving their application across diverse segments.

GaN-powered chargers are moving from a once niche landscape into the mainstream standard, while also being positioned to deliver functionalities as per evolving customer needs. With advances in device design, performance, energy efficiency, and power requirements, sales are expected to pick up in the coming years.

Increasing demand for energy-efficient and fast charging devices for electronic items will guarantee growth. GaN-powered chargers are comparatively compact, they offer high switching frequencies, and have wide band gap. Shifting focus from Si to GaN is a result of improvement in electronic devices operating frequency and reduction in the charging time, weight, and cost of the components.

The demand for developments and implementation of new technologies such as Next-Gen GaN-powered chargers is rising fast. GaN technologies are used for various applications within enterprises. It enables higher performance and promises convenience for users, as well as simplicity for designers and manufacturers.

Advantages and benefits such as high speed charging, higher power density, and portable & wireless applications besides the ability to integrate with various consumer electronic devices are the primary factors resulting in an increasing adopting.

The integration of technologies such as the Internet of Things (IoT), machine learning, artificial intelligence (AI), and others is expected to boost the GaN-powered chargers market.

GaN-powered chargers manufacturers are entering into a strategic partnership with other technology vendors, power electronics devices original equipment manufacturers (OEMs) and others stakeholders for the development of new technologies and products. Partnership among key players is a major trend observed in the global GaN-powered chargers market.

For instance, in January 2024, Navitas Semiconductor announced partnership with Dell, on new GaN-based charging technology. Both the companies have partnered on the development of new gallium nitride (GaN) applications.

Apart from this, industry players are focusing on research and development (R&D) activities to improve GaN technology and introduce more efficient products. GaN-powered chargers suppliers are entering into long-term contracts with manufacturers of consumer electronics devices to maintain or increase their market share in the global market.

The increasing demand for economic and high-speed GaN-powered chargers from various applications including smartphone & tablet, and laptops are creating attractive growth opportunities. The advent of artificial intelligence and internet of things have been fuelling the demand for high power charging technologies, creating attractive opportunities for innovation in the market.

GaN is being widely used in smartphone & tablet chargers due to its enhanced properties such as high thermal conductivity, high voltage potential, and large critical fields.

The development of cost-effective and high-speed GaN-powered chargers is expected to boost growth over the forecast period. It also offers various benefits such as high-reliability, improves system efficiency, enables higher operating frequency, and capable of reverse conduction. These factors are driving the GaN-powered chargers market

Currently, lack of standardization regarding the technology and components used for manufacturing for GaN-powered chargers is a major challenge. Undefined standards in the market lead to high product and price differentiation, which is expected to hamper the growth of the GaN-powered chargers market.

Many electronic accessories are of local brands, and do not have any specific standards or rules for manufacturing, which has led to low quality GaN-powered chargers. This factor is expected to hamper the growth of the GaN-powered chargers market globally.

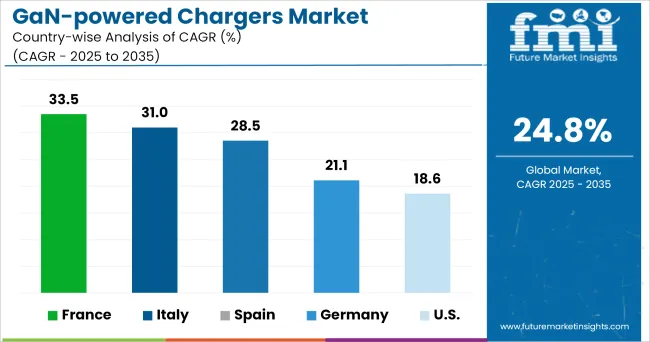

North America will be the largest market for the GaN-powered chargers due to the strong presence of some of the leading manufacturers and provider in the region. This is attributable to the increase in demand for GaN-powered chargers for various applications such as smartphones & tablets, laptops & notebooks, autonomous robots, industrial equipment, wireless charging, and others.

According to the report, the overall GaN-powered chargers spending in the United States alone is likely to increase by 15.7% between 2024 and 2035. The USA will continue accounting for lion’s share of sales registered in the region.

Furthermore, the USA is the dominant country in the global GaN-powered chargers market accounting for around 20%-25% of the market share in 2024. GaN technology is being widely used in high power amplifiers in the USA Due to its high power density and its ability to dissipate heat from a small package, its application in power amplifiers is increasing.

Technological improvements in GaN semiconductor devices are accelerating application in various end-use sectors. Growth within the market will also be aided by increasing focus on various types of radio frequency (RF) and wireless applications. The increasing demand for GaN in wireless devices is one of the major trends in Germany.

Presence of some of the key players such as Koninklijke Philips N.V., Infineon Technologies AG, STMicroelectronics, and others will continue supporting expansion in the country. Besides this, the growth of data center landscape will create a conducive environment for GaN-powered chargers.

The growing demand for advanced GaN-powered charger products such as Dual USB-C PD GaN Wall Charger, controllers & chargers in emerging countries such as China is creating lucrative growth opportunities. Automobile and telecom sectors are growing rapidly in East Asia owing to the high number of Tier II & Tier III manufacturers, which in-turn is expected to increase the demand for GaN-powered chargers.

Growth of the market in China is attributable to the presence of some of the leading manufacturers such as the Xiaomi Corporation, Baseus, and others. The rising demand for consumer electronics such as LED based lighting and displays, and advanced mobile communications and computing devices will spur GaN-powered chargers sales in the country.

The demand for GaN-powered chargers is growing at a rapid pace in developing countries such as India, especially due to exponential growth of the mobile accessories market. The demand for advanced mobile phone accessories such as GaN-powered chargers, controller & charger that can support multiple devices though a universal port is expected to increase consistently.

This can be attributable to the improving internet and smartphone penetration in the country. According to a report, jointly released by Indian Cellular and Electronics Association and consulting firm KPMG, in terms of internet users, rural India reported y-o-y growth of 35% in 2020 against 7% growth in urban India. These numbers are indicative of surging population of internet users, which has been greatly facilitated by smartphone penetration.

Spurred by these factors, India is expected to continue exhibiting high demand for GaN-powered chargers through the course of the forecast period.

In terms of power output, the market is segmented into 25W GaN chargers, 30W GaN chargers, 45W GaN chargers, 60W GaN chargers, 65W GaN chargers, 90W GaN chargers, 100W GaN chargers, and others. The 60W GaN chargers segment to exhibit an impressive CAGR of 29.9% during the forecast period. The 30W GaN chargers however is forecast to account for dominant 25.0% in 2024.

A 30W GaN chargers have been increasingly adopted for charging smartphones & tablets and laptop devices due to their high efficiency and high energy density.

On the basis of application, the smartphones & tablets application segment is expected to register a CAGR of 26.5% during the forecast period. Also, the smartphones & tablets application segment is expected to create an incremental opportunity of USD 2,275.9 Million between 2024 and 2035.

GaN-powered chargers are small and lighter but efficient and tougher as compared to silicon. These chargers also ensure fast charging capabilities, which will boost their sales over the forecast period.

Market players are currently focusing on innovation and strategic collaborations to gain competitive advantage. For instance, in November 2024, GaN Systems expanded power market with GaN power module evaluation kits such as 100V Driver GaN DC/DC Power Stage Module, 650V 150A Half-Bridge IPM, 650V 150A Full-Bridge Module and Driver, and 650V 300A 3-Phase Module and Driver. GaN modules meet industry standard footprints with superior system performance.

Some of the leading companies operating in the market are:

*The list is not exhaustive, and only for representational purposes. Full competitive intelligence with SWOT analysis available in the report.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East & Africa |

| Key Countries Covered | USA, Canada, Germany, UK, France, Italy, Spain, Poland, Russia, China, Japan, South Korea, India, Thailand, Malaysia, Vietnam, Indonesia, Australia, New Zealand, GCC Countries, Turkey, Northern Africa, South Africa |

| Key Segments Covered | Power Output, Application and Region |

| Key Companies Profiled | Xiaomi Corporation.; Koninklijke Philips N.V.; Belkin International, Inc.; GaN Systems Inc.; Baseus; RAVPower; Anker; AUKEY |

| Report Coverage | Market Forecast, Vendor share analysis, competition intelligence, DROT analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global GaN-powered chargers market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the GaN-powered chargers market is projected to reach USD 11.0 billion by 2035.

The GaN-powered chargers market is expected to grow at a 24.8% CAGR between 2025 and 2035.

The key product types in GaN-powered chargers market are 65w GaN chargers, 25w GaN chargers, 30w GaN chargers, 45w GaN chargers, 60w GaN chargers, 90w GaN chargers, 100w GaN chargers and others.

In terms of application, smartphones & tablets segment to command 42.5% share in the GaN-powered chargers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Explosive Chargers Market

Car Battery Chargers Market Growth - Trends & Forecast 2025 to 2035

Bulk Bag Dischargers Market Trends – Growth & Outlook 2024-2034

Gasoline Turbochargers Market Insights – Growth & Forecast 2025 to 2035

Wireless Phone Chargers Market

Industrial Battery Chargers Market Growth – Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA