Gamma Knife market is anticipated to expand in the range of 2025 to 2035 owing to the growing incidence of neurological disorders and rising usage of non-invasive treatment options.

Gamma Knife radiosurgery is a sophisticated type of stereotactic radiosurgery (SRS) that enables the non-invasive treatment of an array of brain pathologies, such as tumors, arteriovenous malformations (AVMs), and certain functional disorders such as trigeminal neuralgia.

This approach targets gamma radiation at specific areas, unlike conventional surgery that leads to collateral damage to surrounding healthy tissue and longer recovery time.

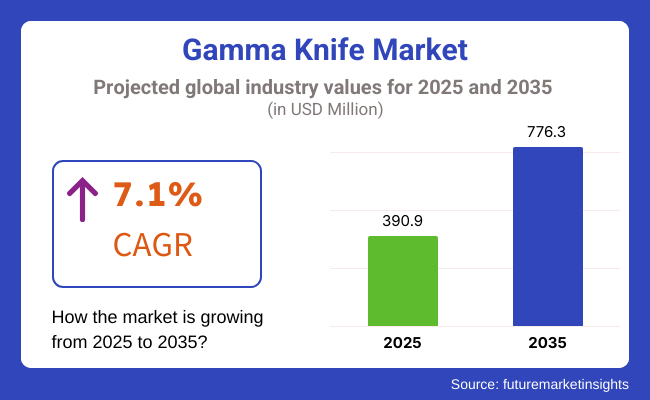

Gamma Knife technology is witnessing high demand due to the increasing prevalence of brain tumours and vascular malformations. The market was worth USD 390.9 million in 2025 and estimated to reach USD 776.3 million by 2035, with a CAGR of 7.6%.

The growing healthcare infrastructure along with healthcare expenditure and technological advancements in radiation therapy has helped the market to grow. Furthermore, increasing knowledge about the advantages associated with the procedure along with patient outcomes drive the growth of this market. Global Gamma Knife Market, perceived to grow at a CAGR of around 4% over the forecast period.

Explore FMI!

Book a free demo

Gamma Knife Market - North America dominates the global Gamma Knife market mainly due to its advanced healthcare infrastructure and the high prevalence of neurological conditions. The United States hosts many Gamma Knife centers due to reimbursement policies favouring its use and advances in technology in radiation oncology.

The local market is also strengthened by the presence of top medical device manufacturers, ample research and development activities, and growing investments in healthcare technology.

North America is expected to see lucrative growth in the gamma knife procedure market due to increasing incidence of brain tumours and the increasing trend of non-invasive treatment option. Moreover, improvement of imaging and radiotherapy techniques increases treatment accuracy and patient trust in this modality.

North America is expected to continue to lead the market during the forecast period, owing to the high emphasis on innovation and accessible healthcare.

The Gamma Knife radiosurgery market in Europe is a mature market with the highest use observed in Germany, France, and the United Kingdom. The healthcare system, supportive government initiatives, and the awareness to the availabilities of advanced treatment options play a factor in the growth of the respective market in the region.

Patient demand for minimally invasive and highly accurate precision procedures with little damage to adjacent brain tissue has led to the greater uptake of Gamma Knife in European hospitals and cancer treatment centers.

The increasing prevalence of neurological disorders such as brain metastases and functional disorders has resulted in increased demand for Gamma Knife treatments. Furthermore, rising healthcare spending and the collaboration of medical institutions with research organizations, are further contributing to the growth of the stereotactic radiosurgery market.

As a result, Europe accounts for a lesser portion of the global Gamma Knife market, however, efforts focused on reimbursement policies for non-invasive procedures shall further support market growth.

Market Dynamics the Gamma Knife market includes additional growth inhibitors as seen in the market overview aspect of the global industry. Region-wise, the Asia-Pacific area is anticipated to witness the fastest growth between 2025 and 2035. Gamma Knife centers are appearing now in countries such as China, India, Japan, and South Korea, where healthcare infrastructure expansion is progressing rapidly.

The regional market is mainly driven by the growing medical tourism, increasing awareness for advanced neurosurgical procedures, and governments and private organizations investing in healthcare.

The increasing prevalence of brain tumours and vascular malformations in Asia-Pacific, patients are more focused on early diagnosis and treatment. A rising population of middle-class people in the region and growing disposable income is expected to increase the demand for advanced medical technologies.

In addition, the collaboration of international healthcare providers with domestic institutions promotes the implementation of state-of-the-art radiation therapy solutions. With increasing access to advanced medical care in the region, the Gamma Knife market is poised for significant expansion.

Challenges

Elevated Installation and Maintenance Expenditure: Gamma Knife systems necessitate substantial initial capital, rendering them costly for smaller healthcare facilities and restricting penetration in price-sensitive markets. Moreover, maintaining and operating these systems incurs expenses that can become a burden for health care systems.

Limited Accessible in Emerging Areas: Developed markets, such as the USA, already have gamma knife centers, while limited access in some emerging markets due to financial and infrastructural restrictions. Traditional treatment methods continue to be used in most developing and under developed nations, thus limiting the market growth.

Regulatory and Compliance Hurdles: Stringent regulatory standards governing medical device clearance and radiation therapy protocols may impede the timely introduction of novel Gamma Knife systems in certain geographical areas, limiting overall market penetration.

Opportunities

Technological Innovations: Continuous developments in imaging, therapy planning, and automation are being investigated to improve the accuracy and efficiency of Gamma Knife radiosurgery. Topological quantum computers help achieve better treatment results and a wider range of treatable conditions with the technology.

Broadened Clinical Indications: Gamma Knife radiosurgery is expanding in indications beyond brain tumours and AVMs to include functional disorders like epilepsy and obsessive-compulsive disorder (OCD). Increasing its clinical indications increases market opportunity and attracts new patient demographics.

The Rise among Emerging Economies: There is persistent development in healthcare infrastructure in developing economies which provides enormous opportunities for Gamma Knife technology suppliers. Market recovery is anticipated amidst rising investment in the medical technology coupled with an increase in government healthcare initiatives across the region enabling well-suited environment for the market growth in this region.

The growth of the market can be attributed to increased uptake of neovascular radiosurgery for swirling headaches and movement disorders including, trigeminal neuralgia, demographic disorders from 2020 to 2024.gamma knife market, data for 24 march, 2023 The increasing desire of patients for GKR compared with open brain surgery and WBRT was due to the high accuracy, low invasiveness, and quick recovery of GKR.

Rising patient familiarization and the realization of non-surgical methods of treatment during their lifetime performance resulted in technology adoption by hospitals and specialty neurosurgical facilities leading to the introduction of Gamma Knife, a primary website to introduce targeted brain tumour treatment with lesser side effects and enhanced functional results.

The USA and European regulatory agencies including USA Food and Drug Administration (FDA), European Medicines Agency (EMA), and the International Stereotactic Radiosurgery Society (ISRS) approved next-generation Gamma Knife systems with higher radiation precision, improved patient comfort and more sophisticated treatment planning software.

The evolution for patient specific structuring of adaptive radiotherapy protocols, and AI powered radiosurgery planning platforms aided us in improving the targeting accuracy, sparing the collaterals of healthy brain tissues, and planning for dose fractionation strategies. Consequently, Gamma Knife procedures emerged as an attractive option for patients with inoperable brain tumours or those preferring a less actively confrontational approach.

Advances in robotic-assisted radiation delivery, AI-driven radio surgical mapping, and real-time brain imaging integration have improved treatment precision, efficiency, and safety. With the Gamma Knife ICON's frameless treatment options and real-time tracking of patient positioning, greater flexibility and patient comfort was possible.

AI-enabled tumour segmentation algorithms and dose prediction models allowed radiation oncologists to reliably establish sub-millimeter accurate tumour boundary maps to maximize tumour control rates whilst minimizing exposure to surrounding tissues.

MRSI and FMRI, 2 modalities that assess multiple metabolic pathways, along with PET imaging were becoming integrated into Gamma Knife planning systems and provided more specific pre-treatment assessments of selected patients to guide their treatment.

Nonetheless, despite advancements, the market encountered hurdles like expensive equipment, scarce, available Gamma Knife centers, and competition from alternate stereotype radiosurgery (SRS) platforms (e.g., cyber knife, LINAC-based systems). Many developing countries did not have the infrastructure or the funding to create dedicated Gamma Knife installations, which limited access to cutting-edge radiosurgery.

Also, insurance reimbursement complexities and specialized training needs for both neurosurgeons and radiation oncologists limited the spread of advanced Gamma Knife technology. Conversely, as healthcare delivery systems made investments in AI-integrated radio surgical automation, cost-effective financing models, and telemedicine-enabled Gamma Knife treatment designs, accessibility, affordability, and clinical adoption of Gamma Knife interventions thrived.

The Gamma Knife market will witness transformative advancements from AI-assisted radiosurgery and quantum-enhanced radiation precision to gene therapy-integrated radiotherapy between 2025 and 2035, paving new pathways in brain tumour treatment, functional neurosurgery, and non-invasive radio surgical interventions.

As hospitals and cancer treatment centres evolve, AI-based Gamma Knife planning platforms with real-time tumour tracking, adaptive energy dosing, and predictive analytics technologies will become the standard to deliver tailored radiosurgery treatment to patients.

Using algorithms for AI-powered automated lesion mapping, multi-modal imaging data will be analysed to identify risks of tumour progression while dose fractionation strategies will be optimized to yield improved long-term outcomes. Radiation treatment times will be shortened, whilst tumour control rates will be increased, by use of quantum computing-assisted radio surgical simulations to finely calculate hyper-precise radiation dose measurements.

Nanotechnology-based radio sensitizers and radio protectors will be widely used in clinical practice, increasing the curative effect of Gamma Knife treatment and reducing the corresponding radiotherapy-induced side effects. Nano medicine receiving radiation therapy will become specialized by Nuclear vehicles that can saturate intensity of collagen fibers to facilitate selective radiation damage from therapeutic approaches to target cancer cells.

The support from the University of Melbourne and hence Monash FGT, will ultimately lead to tailored gene therapy-enhanced radio surgical protocols that will allow for the induction of tumour-specific genetic modification thereby favouring apoptotic death of the tumour cell whilst leaving unperturbed healthy neuronal structure.

Passive biodegradability and bioengineering of these radio sensitizers will further improve selective radiation absorption, bringing both more accurate tumour ablation and reduced damage to adjacent brain tissue.

Instead of relying on rigid stereotactic frames, next-generation frameless Gamma Knife systems will achieve real-time motion-adaptive radiosurgery, resulting in improved flexibility, excellent patient comfort, accurate dosimetry, and performance.

The combined use of AI integrated neuromodulator-guided Gamma Knife therapy will pave the way for innovative applications beyond oncology, with non-invasive treatment of neurological diseases like epilepsy, major depressive disorder (MDD), and obsessive-compulsive disorder (OCD).

Allowing for a personalized radio surgical targeting of busy functional neural circuits through the optimized AI powered functional brain mapping and Gamma Knife treatment planning combined solution to better enhance neuromodulator based therapeutic outcomes.

The next generation Gamma Knife radiosurgery will also focus on cost efficiency, sustainability, and global accessibility. The operational costs will drive down around due to AI-driven automated Gamma Knife machine calibration, decentralized radiosurgery treatment hubs, and block chain powered patient data tracking enabling greater accuracy of treatment and access.

Portable, AI-assisted Gamma Knife units with the potential to educate the patient before the treatment can meet the demand for radiation therapy in rural and minority population areas and make radiotherapy delivery sustainable and cost-effective so that it could be made accessible to a larger global patient pool.

Furthermore, robotic assisted Gamma Knife delivery systems will improve precision, safety, and procedural efficiency, thus, increasing the scalability and cost-effectiveness of the non-invasive brain tumour treatment.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Category | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Gamma Knife ICON, frameless radiosurgery techniques, and AI-driven treatment planning software received approvals from various governments and regulatory agencies. |

| Technological Advancements | Gamma Knife technology evolves with the introduction of Real-time imaging guidance, frameless treatment options, and Artificial intelligence-based tumour segmentation algorithms. |

| Industry Applications | Gamma Knife radiosurgery was used extensively for brain tumours, AVMs, trigeminal neuralgia, and movement disorders. |

| Adoption of Smart Equipment | Gamma Knife ICON, adaptive radiation dosing platforms, and robotic-assisted radio-surgical delivery systems were trusted by hospitals and cancer centres. |

| Renewable Energy Sourced & Cost Effective | These high costs and limited accessibility needed to be overcome in order to make radiosurgery more widely available; although digital radiosurgery planning has helped to make the delivery of treatment more efficient, the future potential and actual clinical application of AI-based cost optimization processes will allow into the long term. |

| Data Analytics & Predictive Modelling | Modelling of tumour-persistent volume change, radio surgical treatment response prediction through AI, and real-time tracking of lesions optimized patient outcomes in Gamma Knife through AI. |

| Production & Supply Chain Dynamics | Due to the high cost for Gamma Knife units, curing for radiosurgery was limited in the world, and there were regulations which hindered the expansion of radiosurgery. |

| Market Growth Drivers | Growth was fuelled by increasing brain tumour prevalence, a growing demand for non-invasive treatments and policies regarding advancement in AI-based radiosurgery. |

| Category | 2025 to 2035 |

|---|---|

| Regulatory Landscape | The future will be defined by AI-driven automated dose adjustment regulations, quantum-assisted radiosurgery compliance, block chain-based radio surgical patient tracking policies etc. |

| Technological Advancements | Quantum-optimized treatment plans, radio sensitizers made effective through nanotechnology, AI-trained neuromodulator for functional radiosurgery will further define treatment success. |

| Industry Applications | Extrapolation per AI-led personalized neuromodulator, gene therapy-directed radiosurgery, and non-invasive psychiatric syndromes treatment will increase indications. |

| Adoption of Smart Equipment | These advances as well as portable AI-powered Gamma Knife units, autonomous robotic radiosurgery platforms, and blockchain-enhanced radio surgical outcome trackers will improve accessibility globally. |

| Renewable Energy Sourced & Cost Effective | We are bound to have AI-optimized treatment pricing models for Gamma Knife, decentralized radio surgical centres and real-time automated machine calibration to contribute to affordability. |

| Data Analytics & Predictive Modelling | Quantum-enhanced radio surgical outcome simulations, AI-based predictive neuro-oncology analytics and intelligent patient-specific dose calibration models will enhance treatment precision. |

| Production & Supply Chain Dynamics | AI radio surgical unit manufacturing, decentralized robotic radiosurgery delivery models, and block chain Gamma Knife logistics will democratize access. |

| Market Growth Drivers | The future development of radiation drugs will be driven by the emergence of gene therapy-based radiosurgery, AI-powered neuromodulator and self-adjusting radio surgical dose delivery systems. |

United States Gamma Knife Market Growth However, as of 2025 the growing number of companies offering their services and products in the market are some of the factors aiding in the USA Gamma Knife market growth.

With more than 700,000 Americans are living with brain tumours, per the National Brain Tumour Society, leading to an increase in demand for Gamma Knife radiosurgery, as an accurate and minimally invasive treatment alternative for patients.

One of the prime market drivers is the rising incidence of brain metastases and arteriovenous malformations (AVMs), the condition for which highly focused radiation therapy saves the patients from undergoing any surgical treatments. Gamma knife procedures enable lesions to be targeted to sub-millimetre accuracy with minimal devastating damage to surrounding brain tissue.

The use of AI in treatment planning software for Gamma Knife radiosurgery centers is on the rise and is in the process of improving targeting accuracy and patient outcomes. Gamma Knife technology usage is expanding in major cancer treatment centers like Mayo Clinic, Cleveland Clinic, and MD Anderson Cancer Centre.

Moreover, the growing coverage of stereotactic radiosurgery (SRS) by both Medicare and private insurances is also improving patients’ access to the Gamma Knife treatment, propelling the market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.4% |

Gamma Knife Market in UK is driven by rising prevalence of neurological diseases, increase in investment by NHS in radiosurgery technology, and increasing demand for minimally invasive brain tumour treatments.

At least 12,000 brain tumour cases are diagnosed in the UK every year, according to the National Health Service (NHS), alongside an increasing number of patients needing treatment for trigeminal neuralgia and vascular malformations. The NHS is boosting funding for Gamma Knife radiosurgery units in large hospitals, improving access to non-invasive neurosurgical therapy and cutting waiting compiled to intricate brain operations.

Advanced imaging and AI-powered calculation tools for radio surgical planning are increasing the accuracy of treatment and reducing complications, whilst enhancing patient survival.

Moreover, the rise in preference for outpatient radiosurgery replacing traditional neurosurgery and the increasing number of elderly and high-risk patients opting for Gamma Knife treatment is creating a boom in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.0% |

Government Spending on Cancer and Neurosurgery Treatment Rise, Increased Adoption of AI-Integrated Radiosurgery, and Expansion of Gamma Knife Treatment Centers are Some Factors Driving Growth of the Gamma Knife Market in the European Union. Gamma knife radiosurgery competitive landscape Imperative for technological innovation in Gamma Knife radiosurgery has been addressed in the EU’s Horizon Europe Program that has allocated 5 billion for cancer research and also precision radio therapy.

Germany, France, and Italy are the forerunners among countries in Gamma Knife adoption since specialized hospitals and oncology centers are compelling their way to invest in advanced stereotactic radiosurgery equipment.

Artificial Intelligence and digital twin technology are playing an increasingly important role in radiosurgery planning, obtaining more accurate results for clinical radiotherapy targeting of tumours and neurological lesions, leading to improved survival and quality of life after treatment.

In addition, the EU expanding cross-border healthcare initiatives are aiding the patients from smaller nations to access Gamma Knife treatment in large neurosurgical centers which is driving the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.1% |

Rising geriatric population, rising prevalence of neurological conditions, and increasing government location investments in radiotherapy and neurosurgical advancements are driving the Gamma Knife Market in Japan.

Japan has one of the highest aging populations globally, and more than 28% of its citizens are aged 65 and older, resulting in a greater occurrence of neurological diseases, including Parkinson’s disease and brain metastases.

Japanese government funding of around 250 billion for advanced radiotherapy and neurological disease studies has facilitated the quicker adoption of Gamma Knife technology at major hospitals.

With the deployment of synchronized robotic-assisted and AI-powered Gamma Knife systems, treatment planning is becoming more accurate, enabling fewer side effects for patients and better clinical outcomes.

Moreover, the expertise of the Japanese in high-precision imaging technologies is also facilitating the introduction of these MRI-guided Gamma Knife treatments, allowing integration of real-time tracking of the tumours to ensure improved radio surgical outcome.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.3% |

The South Korea Gamma Knife Market is mainly driven by the increasing prevalence of cancer, rising adoption of AI-driven radiosurgery and government focus on precision radiation therapy.

To support the development of high-precision Gamma Knife radiosurgery solutions, South Korea’s Ministry of Health and Welfare has invested 1.8 trillion in neural surgery and cancer treatment research.

Advances in the field of radiosurgery with AI-assisted treatment planning combined with robotic integration is producing enhanced tumor targeting and lesser collateral damage, producing superior patient outcomes.

Gamma knife centers tend to be located in predominant regional hospitals, which enables increased access for patients who otherwise might have to undergo craniotomy for other neurosurgical procedures.

Also, South Korea’s adoption of digital health technologies allows for real-time patient monitoring and post-radiosurgery follow-ups to personalize treatment through effective long-term adjustments.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.4% |

Segment taxonomy indicates dominance of the brain metastasis and arteriovenous malformation (AVM) segments in the overall Gamma Knife market as the Gamma Knife radiosurgery (GKR) method is gaining traction majorly among oncologists, radiation specialists and neurosurgeons to treat complex neurological ailments with high accuracy and less invasiveness.

These therapies are essential to the management of brain tumors, vascular malformations, and functional neurological disorders, although targeted therapy, decreased collateral damage, and improved outcomes.

Among the many different disease types that can be treated non-invasively for multiple brain metastasis, lung, breast, melanoma, and renal carcinoma are some of the primary cancers that spread to the brain that are potentially improved by Gamma Knife radiosurgery.

Unlike whole-brain radiation therapy (WBRT), Gamma Knife radiosurgery focuses high-dose radiation beams on metastasis lesions while sparing healthy brain tissue and minimizing neurocognitive adverse effects.

Growing incidence of metastatic brain tumors has increased the demand for Gamma Knife treatment as late-stage cancer patients now demand for feasible, minimally invasive, efficacious options that improve local tumor control and prolonged survival. With local tumor control rates exceeding 85% in metastatic brain lesions, Gamma Knife radiosurgery leads to improved quality of life and decreased disease progression.

The incorporation of Gamma Knife therapy with systemic cancer therapies such as immunotherapy and targeted chemotherapy has additionally solidified demand for Gamma Knife therapy, as combination treatment approaches lead to increased patient response rates, reduced tumor growth, and extended time to more aggressive measures.

Gamma Knife radiosurgery is fully compatible with immuno-oncology. Graduate students and practicing medical doctors will find this book an excellent tool to learn about the tumor micro-environment, techniques to modulate this environment better and improve treatment outcomes.

It has facilitated systemic optimization of Gamma Knife radiosurgery through AI-optimized treatment planning systems, intraoperative imaging guided radiosurgery, with real-time imaging of reaction to treatment and automated control of the radiation beams in response to tumor response. Such innovations guarantee improved procedural precision, shorter treatment duration, and better safety profiles.

The increasing demand for outpatient-based Gamma Knife procedures has also enhanced the accessibility of the market, due to the fact that patients can receive treatment on the same day, thereby allowing for shorter recovery periods and lower hospitalization costs, which is exactly why Gamma Knife radiosurgery has become a more cost-effective and patient-oriented option to implant invasive surgical procedures for brain tumours.

Despite its clinical benefits, Gamma Knife radiosurgery for brain metastases continues to grapple with challenges posed by expensive equipment, limited dissemination in low-resource settings, and a requirement for highly-specialized medical personnel.

Innovations that favour the sector include: fractionated radiosurgery, artificial intelligence dose modulation and automated patient treatment response monitoring system, making radiosurgery more accessible, economical, offering durable outcomes so that the wider availability of Gamma Knife radiosurgery for brain metastasis tumors sector continues to expand.

The AVM space is well-established, and market share here is strong, primarily in patients with complex, inoperable cerebral vascular malformations, who are increasingly treated with Gamma Knife radiosurgery to occlude abnormal blood vessels, rather than invasive surgical approaches.

Gamma Knife treatment provides highly concentrated delivery of radiation beams to AVMs, which promotes progressive vascular sclerosis and ultimately decreases the likelihood of haemorrhaging over time, unlike open neurosurgical resection.

The increasing prevalence of patients diagnosed with symptomatic and asymptomatic AVMs has further increased the use of Gamma Knife radiosurgery because those who have deep-seated vascular lesions or lesions, which cannot be accessed through surgery, are likely to benefit from an accurate, non-invasive treatment method that damages the surrounding brain tissue minimally.

Radiosurgery with the Gamma Knife has been shown to have AVM obliteration rates of 70-90% at 3 years with a reduced risk of rupture, and long-term cerebrovascular stability.

The use of AI-driven dose calculation algorithms and real-time 3D imaging has improved treatment accuracy, decreased radiation exposure to nearby normal brain structures, and increased targeting of the lesion as a whole, thereby increasing procedural safety and obliteration rates.

Minimally invasive treatment options are favoured over high-risk neurosurgical procedures in young patients with fragile cerebrovascular anatomy, leading to greater clinical adoption of Gamma Knife radiosurgery for the treatment of paediatric AVM cases. Reduced anaesthesia requirements, decreased recovery times, and decreased post-procedural complications ensures better long term neurological outcomes for paediatric patients.

Moreover, the rapid adoption of Gamma Knife radiosurgery in treatment of recurrent and residual AVM has enhanced the demand within the market due to benefits rendered to patients that received embolization or partial surgical resection in the past, as they capitalized the non-invasive, targeted-ablative therapy for achieving eradication of any residual component from the AVM and at the same time, prevent revascularization.

Despite its clinical utility, however, Gamma Knife radiosurgery of AVMs has several drawbacks, including delayed vascular occlusion, treatment efficacy limitations for large AVMs, and the requirement for prolonged follow-up neuroimaging.

Nonetheless, the integration of hybrid therapeutic modalities, intelligent lesion monitoring, and personalized dose modifications advances treatment success rates and minimizes complications while expanding patient eligibility, ensuring sustained market growth in Gamma Knife radiosurgery applications in AVM management.

Gamma Knife radiosurgery is progressively gaining traction at hospitals, radiation oncology centers, and neurosurgical institutes for both cranial and extracranial indications — the head and neck segments are two distinguished market drivers to the growth of this sector, ensuring precise lesion targeting, minimum invasiveness for tumor control, and improved patient access.

The primary anatomical application for Gamma Knife radiosurgery has remained head treatment, where intracranial tumors, functional neurological disorders, and cerebrovascular lesions can be controlled with highly focused radiation therapy. Gamma Knife radiosurgery applies highly concentrated, stereotactic beams of radiation to intracranial lesions and thus limits radiation exposure to adjacent healthy brain structures to lower the risk of long-term neurotoxic effects compared to conventional radiotherapy.

Increasing occurrence of brain metastases, meningioma and vestibular schwannomas have grown demand for Gamma Knife radiosurgery since more patients with complicated intracranial pathologies choose non-invasive treatment modalities over traditional open brain surgery. Studies show that Gamma Knife therapy provides excellent tumor control rate, maintains neurological function, and increases overall survival in patients with aggressive brain lesions.

AI-assisted treatment planning, 4D motion tracking, and automated lesion segmentation have enabled us to perform intracranial radiosurgery with great precision, leading to better outcomes in complex neurological conditions.

However, despite its stellar performance in intracranial interventions, Gamma Knife radiosurgery for head is not without hurdles, including high procedural costs, limited availability in rural settings, and requirement for multidisciplinary teamwork in challenging cases. Nonetheless, the market will continue to grow for Gamma Knife radiosurgery in cranial applications as more non-coplanar beam arrangements and hybrid radiosurgery-immunotherapy protocols emerge and robotic patient positioning systems are introduced as systems for delivering radiosurgery improve treatment precision, minimize treatment duration, and increase patient eligibility.

These results demonstrate that neck treatment has achieved robust market penetration, specifically among patients with head and neck cancers, cervical spinal metastases and trigeminal neuralgia where neurosurgeons and radiation oncologists adopted Gamma Knife radiosurgery to target extracranial lesions accurately to a fraction of millimeter precision. Gamma Knife therapy is different compared to conventional fractionated radiotherapy as it can deliver single-session and high-dose radiation which eases the treatment burden and increases patient comfort.

Gamma Knife proliferation has also been spurred by increasing clinical demand for non-invasive treatment options in patients with recurrent head and neck cancers, specifically those with radioresistant tumors or inoperable lesions, highlighting the advantages of accurate and conclusive radiosurgery with low side effects.

The development of adaptive radiosurgery technologies, artificial intelligence-based dose tailoring, and customized radiation treatment plans have rendered treatment safer and more applicable across a wider range of anatomical sites, with superior rate of response to tumor, long-term survival, and functional outcomes.

Gamma Knife radiosurgery for the neck is perfectly positioned for continued growth, but faces challenges relating to limited study in extracranial radio-surgery, uphill initial investment pricing, and the integration of percutaneous imaging. While the high cost of the equipment and lack of clinical data continue to limit clinical use, cutting-edge developments in extracranial radiosurgical systems, AI-based tumor tracking, and personalized radiation dose optimization are supporting the clinical integration of such devices and boosting procedural success rates along with patient accessibility, fuelling future growth for Gamma Knife radiosurgery in this area.

Gamma Nife Market Growth Gamma Nife such as Gafrin and Nuvatan are penetrating the Gamma Nife market by andise topical tissue and bloodbeat system Aplete Epoch Nivas and TavtanBataDan husband ship. The web-enabled AI-assisted radiation planning, an improvement in dose precision, and robotics are lit the path in this direction, improving treatment accuracy, reducing side effects, and ensuring better treatment outcomes. It encompasses global field leaders and specialized medical device companies, all of which are pushing for innovation in Gamma Knife radiosurgery, radiation oncology, and neuro-oncological treatment solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Elekta AB | 40-45% |

| Varian Medical Systems (Siemens Healthineers) | 18-22% |

| Accuray Incorporated | 12-16% |

| Brainlab AG | 5-9% |

| Other Companies (combined) | 15-20% |

| Company Name | Key Offerings/Activities |

|---|---|

| Elekta AB | Designing Gamma Knife® radiosurgery systems (Leksell Gamma Knife® Icon, Perfexion) deploying them for high-precision brain tumor and neurological disorder treatments. |

| Accuray Incorporated | We are: a company that develops CyberKnife® robotic radiosurgery systems, maximizing the use of real-time image guidance in brain and spine tumor treatment. |

| Brainlab AG | Provides neurosurgical planning and AI-powered radiation therapy software that improves accuracy and workflow for Gamma Knife treatment. |

Key Company Insights

Elekta AB (40-45%)

Elekta is the leading provider of Gamma Knife systems, including Leksell Gamma Knife® systems, for precision SRS to treat brain tumors, AVMs, and functional disorders. AI-powered dose planning, automated patient positioning, and frameless radiosurgery solutions are integrated by the company.

Varian Medical Systems (Siemens Healthineers) (18-22%

It designs AI-driven radiation therapy systems like TrueBeam™ and Edge™ radiosurgery that use high-performance hardware and lightning-fast image analysis algorithms to precisely target neurosurgical targets with sub-millimeter precision.

Accuray Incorporated (12-16%)

CyberKnife® robotic radiosurgery systems from Accuray provide frameless, real-time image-guided SRS for brain and spine cancers. It specializes in adaptive radiation therapy and computer-assisted patient alignment.

Brainlab AG (5-9%)

Brainlab offers radiotherapy software and neurosurgical planning software, including artificial intelligence-assisted radiation dose optimization to enhance precision in Gamma Knife radiosurgery.

Additional Contributors (15-20% Combined)

Advanced applications of stereotactic radiosurgery, real-time image guided radiation therapy, and artificial-intelligence-based neurosurgical planning are provided by several radiotherapy and neuro-oncology device manufacturers. These include:

The Gamma Knife Market has a total market size of USD 390.9 Million in 2025.

Gamma Knife Market filling USD 776.3 Million in 2035.

The rising incidence of neurological disorders, increasing preference for non-invasive radiosurgery, increasing use of precision radiation therapy, and growing geriatric population that requires effective and targeted treatment for brain conditions will increase the demand for gamma knife market.

The foremost five nations that encourages the research of Gamma Knife Market are USA, UK, Europe Union, Japan and South Korea.

Brain Metastasis and Arteriovenous Malformation dominates revenue share across the forecast period.

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.