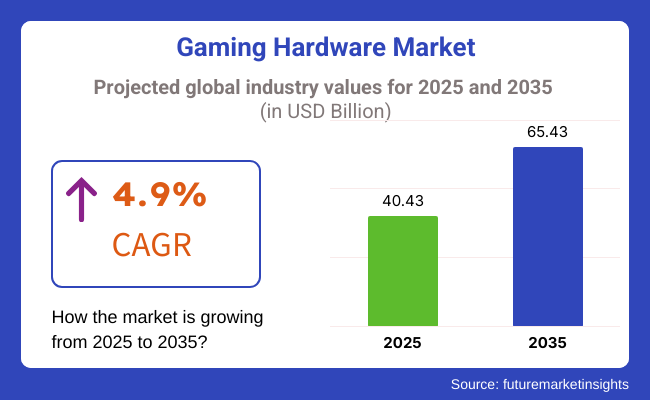

The gaming hardware market is expected to grow steadily between 2025 and 2035 on the strength of growing demand for high-performance gaming consoles, computer gaming peripherals, and interactive gaming technologies. The market is also expected to reach USD 40.43 billion in 2025 and reach USD 65.43 billion by 2035 at a compound annual growth rate (CAGR) of 4.9% over the forecast period.

As the pace of the trend towards esports, cloud gaming, and virtual reality (VR) gaming accelerates, the players are making investments in AI-driven gaming peripherals, next-gen GPUs, and cloud-connected gaming consoles. The addition of haptic feedback, ray-tracing technology, and high-refresh-rate panels is also adding further to a more immersive gaming experience.

Besides, cloud gaming technologies in hardware, wireless gaming peripherals, and adaptive controllers are transforming the game. Ergonomic and high-precision gaming peripherals like programmable gamepads, motion-sensing cameras, and wireless headsets are required because gamers require more comfort and responsiveness.

Explore FMI!

Book a free demo

The Industry remains on the path of continuous evolution primarily on the basis of the novel technical aspects that directly associate to the graphics performance, immersive experiences, and cloud gaming infrastructure. In the case of PC gaming, the preference of users is for powerful GPUs, customize options, and responsive displays, making them the most hardware-intensive segment.

Consoles are still a market with a performance, graphics, and exclusive gaming ecosystem orientation. Innovation in hand-held devices like the Nintendo Switch and Steam Deck that carry the baggage of being portable and long-lasting battery, therefore, they are attractive to mobile gamers.

VR/AR gaming requires advanced motion tracking, high refresh rates, and very low latency which are the main features that one would need for effectively playing a game on these platforms unless one is stuck in reality, causing a demand for specialized hardware. As a parallel current trend, cloud is surfacing as a cheap alternative, with the emphasis on the network and low latency to smooth streaming.

During the life span of these games, the expenses of equipment have been attributed mainly to the performance, affordability, and device interoperability, making the market a competitive and dynamic one.

| Company | Contract Value (USD Million) |

|---|---|

| Sony Interactive Entertainment | Approximately USD 130 - USD 140 |

| Microsoft Xbox | Approximately USD 120 - USD 130 |

| NVIDIA Corporation | Approximately USD 110 - USD 120 |

| Razer Inc. | Approximately USD 90 - USD 100 |

High-performance console, gaming PC and peripherals categories powered the industry growth surge between 2020 and 2024. The new consoles, like the PlayStation 5 and Xbox Series X, arrived to provide powerful high-charge GPUs, ray tracing, and faster load times, making gaming go faster. Advancements in graphics cards, high-refresh-rate displays, and mechanical keyboards spurred PC gaming.

Cloud gaming and portable hardware like the Steam Deck made it more accessible. Things that trail behind the esports and streaming consumption fantasy, like professional-class peripherals for ergonomics and hi-fi headsets, were pushing growth in the component set.

Expansion continued, albeit it was “muted” due to global chip shortages, supply chain losses and increasing component cost, it said. Producers were forced to provide energy-efficient technology and recyclable materials, as sustainability called for.

Armed with AI-optimized upgrades, quantum chips, and haptic tech, it will be unrecognizable by around 2035. GPUs that are optimized for AI will improve real-time rendering, and quantum computing could make forays into physics simulation. Flexible OLED screens and adaptive controllers will facilitate immersive experiences. For instance, brain-computer interfaces (BCIs) will allow direct interaction through thoughts, fundamentally changing the way we communicate with technology.

Cloud-based gaming hardware will reduce local processing needs, and high-end gaming will become more mainstream.’ Sustainability will guide materials and energy-efficient designs. By the year 2035, it will have AR and VR natively, resulting in incredibly immersive digital worlds.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments and environmental organizations (RoHS, WEEE, Energy Star) compelled its vendors to use green materials and power-efficient designs. | AI-based, carbon-aware gaming hardware incorporates biodegradable materials, AI-based energy optimization, and real-time smart cooling for green gaming environments. |

| AI-powered gaming hardware enhanced rendering of graphics, optimization of the frame rate, and real-time adaptive AI gaming. | AI-origins gaming consoles and GPUs enhance in-game physics, NPC behavior based on AI, and real-time adaptive difficulty for highly personalized gaming. |

| Gamers used cloud gaming platforms (Xbox Cloud Gaming, NVIDIA GeForce Now), which are less dependent on high-performance gaming PCs and consoles. | AI-powered, edge-native cloud gaming hardware enables ultra-low latency streaming, AI-enhanced graphics upscaling, and real-time network optimization for next-gen cloud-based gaming. |

| 5G-enabled gaming hardware improved multiplayer gaming, AR/VR responsiveness, and mobile gaming experiences. | AI-enhanced, 6G-powered gaming hardware provides ultra-fast data transmission, real-time AI-driven latency reduction, and immersive cloud-native gaming ecosystems. |

| VR and AR gaming platforms blended advanced haptic feedback, eye-tracking, and spatial audio to create more immersive gaming. | AI-driven, full-body haptic gaming suits, real-time neurofeedback hardware, and ultra-HD holographic displays redefine immersive gaming experiences and interactive AI-powered storytelling. |

| AI-driven cheat detection and hardware security layers protected competitive and multiplayer gaming ecosystems. | Quantum-secure, AI-born gaming platforms naturally block hacking, enforce AI-driven fair play policies, and facilitate blockchain-based anti-cheat authentication for trustless multiplayer universes. |

| Manufacturers played around with modular designs for easy upgrading, reducing e-waste and maximizing hardware lifetimes. | AI-based, self-optimizing gaming components provide predictive hardware lifespan management, intelligent component replacement suggestions, and eco-friendly recycling initiatives. |

| AI-enhanced consoles and GPUs (e.g., NVIDIA DLSS, AMD FSR) improved real-time rendering, AI-driven ray tracing, and intelligent workload balancing. | AI-native, self-learning gaming GPUs provide real-time AI-driven physics simulation, predictive AI-assisted game rendering, and neural network-based asset generation for next-gen gaming realism. |

| AI-powered content (procedural game worlds, dynamic storytelling) was the hallmark of game development. | Generative gaming engines in real-time powered by AI create AI-driven open-worlds, hyper-dynamic stories, and AI-simulated character actions for infinite gaming experiences. |

| Blockchain-gaming platforms enabled decentralized ownership of assets, payment in-game using NFTs, and digital identity safeguarding. | AI-driven blockchain-gaming platforms enable trustless digital asset exchange, AI-verifying smart contracts, and decentralized player economies for future-gaming monetization. |

The industry confronts numerous risks such as supply chain interruptions, technological novelty, regulatory problems, consumer cybersecurity threats, and adaptation to consumer shifts. In order to be equal to the competition, both producers and suppliers should act fast in risk performance and adjust to the quick-transforming trade environment.

Supply chain disruptions, which are related to semiconductor circuits and other components, are the top risk. The disruption in the supply chain was mainly caused by shortfalls, wars, and production delays which raised the cost of manufacturing and the time taken for the products to be ready leading to the item being either unavailable to the customers or priced high.

Companies need to adopt the strategy of suppliers' diversification, by selecting multiple suppliers, and efficient inventory management systems to reduce risks.

Regulatory challenges as well as import/export restrictions can have negative impact on industry progress. Some regions are strict with the environmental, safety, and trade policies that affect the manufacturing and distribution of the industry. Companies need to comply with the regulatory requirements and ensure that they achieve cost efficiency concurrently for them to outperform the competition.

Cybersecurity threats stand out, borne largely upon the fact that the industry is sophisticated and more interconnected. Cloud gaming, online multiplayer, and IoT integrated devices are under constant risk from data breaches, hacking, and piracy. The main plan should be the installation of the strongest security protocols and the most up-to-date firmware to obviate the dangers to companies as well as to the consumers.

The manufacturers could keep their presence in the industry and exploit the industry's growth by using the risks mitigation through long-term strategies such as planning, technological diversification, and making the supply chain resilient.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 10.9% |

| China | 11.5% |

| Germany | 10.2% |

| Japan | 10.6% |

| India | 11.9% |

| Australia | 10.4% |

The USA industry is growing at a rapid pace, with high-performance gaming consoles, sophisticated GPUs, and interactive peripherals picking up pace. The USA gaming industry continues to take advantage of innovative hardware to drive faster real-time rendering, cloud gaming, and AI-powered gaming experiences. Spending on artificial intelligence (AI) graphics processing, augmented reality (AR)/virtual reality (VR) deployment, and new-generation gaming peripherals are driving growth.

In 2024, the USA gaming industry spent more than USD 25 billion on gaming peripherals and hardware. FMI is of the opinion that the industry is slated to grow at 10.9% CAGR during the study period.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Growth in Next-Gen Consoles and High-End GPUs | Greater usage of sophisticated gaming hardware increases competitive and engaging gameplay. |

| Growth in AI-Powered Graphics Processing and Ray Tracing | AI-driven enhances realism, performance, and power efficiency. |

| Expansion in Cloud Gaming, Esports, and VR Gaming Applications | It streamlines latency reduction, streaming, and virtual interaction. |

China's industry is growing with swift esports infrastructure development, high-refresh-rate gaming monitor adoption, and government-driven programs to drive indigenous gaming technology. As a world gaming industry leader, China is seeing rising demand for high-performance gaming PCs, gaming consoles, and peripherals.

The government's interest in AI-powered gaming innovation and local industry is driving industry growth. In 2024, China spent USD 28 billion on developing gaming hardware and esports complexes. FMI is of the opinion that the industry is slated to grow at 11.5% CAGR during the study period.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Government Support for Building Esports and Production of It | Pro-government policies in favor of local gaming technology allow for faster adoption. |

| Introduction of AI-Powered Graphics Cards and Cloud Gaming Infrastructure | Higher adoption of high-end guarantees a smooth gaming experience. |

| Increasing Demand for Competitive Gaming Monitors and Mechanical Keyboards | The gaming community is seeking high-refresh-rate monitors and accurate peripherals to enhance the gaming experience. |

Gaming in Germany is growing because of its robust gaming culture, higher demand for PC gaming peripherals, and increasing interest in VR gaming. One of the biggest gaming industries in Europe, Germany continues to spend on premium gaming laptops, hardware, and AI-based gaming GPUs.

The country's emphasis on esports growth and adoption of it by casual as well as professional gamers further reinforces industry expansion. FMI is of the opinion that the industry is slated to grow at 10.2% CAGR during the study period.

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| High-End Gaming Hardware | German gamers use high-end options to live stream and create content. |

| Increased Use of AI-powered GPUs and Real-Time Ray Tracing | Greater investment in the future generation of gaming graphics provides more realistic visuals. |

| Wireless Gaming Peripherals and Ergonomic Controllers | The use of high-precision gaming mice, mechanical keyboards, and adjustable controllers increases. |

Japan's industry is growing as a result of expansion in console gaming, increasing adoption of cloud-based gaming services, and advancements in immersive gaming accessories. Japan's gaming sector employs the latest hardware for mobile gaming, VR integration, and high-end console gaming.

Japan's position as an industry manufacturer and AI-driven gaming solutions provider fuels adoption across sectors. FMI is of the opinion that the industry is slated to grow at 10.6 % CAGR during the study period.

Growth Drivers in Japan

| Key Drivers | Details |

|---|---|

| Integration of AI in Gaming Graphics and VR-Based Entertainment | Japan leads in AI-based game rendering and virtual reality-based entertainment. |

| Expansion in Next-Gen Console Gaming and Portable Gaming Devices | There is more demand for hybrid gaming consoles and high-performance handheld gaming devices. |

| Improvements in Haptic Feedback Controllers and Motion-Sensing Accessories | More adoption of realistic gaming experience by new hardware. |

India's industry is growing at a high rate as gaming peripherals investment, mobile gaming accessories popularity, and pro-gaming government policies drive gaming innovation. Cloud gaming platforms and esports growth fuel demand for affordable gaming laptops, high-refresh-rate monitors, and AI-powered gaming consoles.

Local gaming startups and AI-powered solutions drive growth further. FMI is of the opinion that the industry is slated to grow at 11.9% CAGR during the study period.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Government Policies for Esports Growth and Manufacturing | Policies that favor the development of the gaming industry spur hardware adoption. |

| Development of AI-Based Gaming Consoles and Smartphone Gaming Peripherals | Smartphone gaming, esports, and streaming utilize more gaming peripherals. |

| More demand for low-cost, high-performance products | The adoption of low-cost gaming PCs and cloud gaming is increasing among casual gamers. |

Australia's gaming industry expands as more investments are being made in gaming PCs of the highest caliber, VR gaming systems, and gaming performance software through AI. The next generation is embraced by professional esports gamers, content creators, and Australian gamers through enhanced graphics, live gameplay analysis, and richer experiences.

Digital entertainment and research across Australia drives premium gaming solution demand. FMI is of the opinion that the industry is slated to grow at 10.4% CAGR during the study period.

Growth Drivers in Australia

| Key Drivers | Details |

|---|---|

| Government incentives toward esports and advancements in the industry | Policies that encourage game innovation are at the forefront of driving industry growth. |

| Growth in Wireless Gaming Peripherals and AI-Based Gaming Devices | Expanded use of ergonomically shaped gaming peripherals and haptic feedback gaming controllers. |

| Continued Growth in Demand for High-Definition Displays and Smarter Gaming Displays | Gamers utilize AI-powered refresh rate adaptation and HDR gaming technology. |

The industry is segmented into PC gaming (PC gaming hardware) and TV gaming (TV gaming hardware); both platforms are driving industry growth through technological advancements and changing consumer preferences.

Gaming Hardware in PC is the major segment owing to high demand for Gaming laptops and desktops & peripherals. While the popularity of eSports, competitive gaming, and AAA game titles continue to inspire gamers, higher spending on graphics processing units (GPUs), gaming monitors, mechanical keyboards, and VR-compatible systems is being fueled.

Graphics giants like NVIDIA, AMD, and ASUS are gearing up for high-refresh-rate displays, ray-tracing GPUs, and AI-powered processors for seamless gaming. Furthermore, services such as NVIDIA GeForce Now and Xbox Cloud Gaming enable more gameplay without having to invest in high-end hardware, making it an attractive feature for hardcore gamers.

TV Gaming Hardware remains the leading platform, leading with a 43.4% share in the 2025 industry. Because more people are using gaming consoles like the PlayStation, Xbox, and Nintendo Switch, which all contribute to growth, smart TVs are providing a better gaming experience.

In addition to all of that, console gaming is reaching new heights thanks to high dynamic range (HDR), HDMI 2.1 support, and increasingly larger 4K and even 8K TVs. In order to improve performance, Sony, Microsoft, and LG are developing new gaming-specific TVs with variable refresh rates (VRR) and low-latency settings.

The industry includes both consoles and accessories, both of which are essential components that greatly enhance both the industry and the whole gaming experience.

High-performance gaming systems continue to dominate the gaming console industry. In 2025, consoles will account for 18.3% of the industry, with the Nintendo Switch, Microsoft's Xbox Series X/S, and Sony's PlayStation 5 leading the way. In addition to expensive, unique games, more consoles have been introduced due to backward compatibility and efficient cloud gaming integration.

New direct on the new generation gaming consoles are adopting ray-tracing graphics, high refresh rates (120Hz), and Solid State Drive (SSD) storage solutions to eliminate waiting times and provide better gameplay.

Also, the trend of purchasing games digitally and through subscription-based gaming services such as Xbox Game Pass and PlayStation Plus is affecting the console industry. With changing industry dynamics and shifting consumer expectations, companies are also working on hybrid and portable console designs like Nintendo Switch OLED and ASUS ROG Ally.

Gaming accessories are also a vital part of typing, audio, sensitivity, touch response, etc., and experience enhancers with products like gaming headsets, mechanical keyboards, VR headsets, gaming controllers, etc. That segment seems set to expand, and we are witnessing an industry-wide boom in demand for pro-quality peripherals targeted at competitive gaming and streaming.

Others, including Razer, Logitech, and Corsair, are issuing heads-up pairs with AI-enabled audio to remount users in the sport and keyboards that can be aligned for customized RGB colors and buttons on the fly, along with new nectar varieties. VR gaming hardware, including Meta Quest, PlayStation VR2, and HTC Vive, is also broadening the accessory horizon.

The industry is rapidly emerging and expanding due to the ever-increasing demand for high-performance gaming consoles, GPUs, and peripherals. The other factors propelling innovation are cloud gaming, esports, and VR. Technological advancements in ray tracing, AI-driven game optimization, and High Refresh Rate Displays are changing the competitive landscape.

The leading players such as Sony, Microsoft, NVIDIA, AMD, and Nintendo have their cutting-edge gaming consoles, high-end GPUs, and premium gaming accessories. Meanwhile, start-ups and niche players concentrate on custom gaming PCs, modular peripherals, and adaptive gaming hardware, creating an atmosphere of intense competition.

Industry evolution is also being spurred by the growing use of AI-based game enhancements, immersive VR and AR gaming experiences, and a slew of cloud-based game streaming options. Companies are investing in energy-efficient hardware frameworks, wireless gaming options, and next-gen chip architectures to meet the rapidly evolving expectations of gamers.

Exclusive gaming ecosystems, hardware-software integration, and supply chain efficiencies represent strategic factors greatly affecting this dynamic industry. In tandem with the above, leading firms ramp up their R&D efforts, driving partnerships with game developers and refining production processes to remain competitive in the quickly evolving landscape.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Sony Interactive Entertainment | 20-25% |

| Microsoft Xbox | 15-20% |

| NVIDIA Corporation | 10-15% |

| AMD (Advanced Micro Devices) | 8-12% |

| Nintendo | 5-10% |

| Razer Inc. | 4-8% |

| Other Companies (combined) | 30-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| Sony Interactive Entertainment | PlayStation consoles and high-performance gaming apparatuses supported by bespoke VR systems. |

| Microsoft Xbox | The Xbox Series consoles with cloud gaming solutions alongside their Game Pass subscription services. |

| NVIDIA Corporation | Premium GPUs, AI gaming optimization, and cloud gaming by GeForce Now. |

| AMD (Advanced Micro Devices) | High-Performance Gaming CPUs with Graphics Technologies and High-Performance Gaming GPUs. |

| Nintendo | Hybrid Consoles (Switch), Family Friendly Gaming, and Portable Gaming Solutions. |

| Razer Inc. | Premium gaming peripherals, high-performance gaming laptops, as well as esports accessories. |

Key Company Insights

Sony Interactive Entertainment (20-25%)

The dominant entity in hardware gaming, Sony offers PlayStations with unparalleled performance for gaming and VR, along with first-party gaming franchises.

Microsoft Xbox (15-20%)

Specializes in hardware gaming and cloud gaming solutions and exploits Xbox consoles and Game Pass services to enhance gaming experiences with artificial intelligence.

NVIDIA Corporation (10-15%)

NVIDIA leads in terms of GPU technology, providing gaming graphics, AI-driven performance optimizations, and cloud gaming via GeForce Now.

AMD (Advanced Micro Devices) (8-12%)

AMD's high-performance CPUs and GPUs drive advanced gaming experiences based on ray tracing and AI-powered rendering technologies.

Nintendo (5-10%)

Nintendo's specialization lies in hybrid gaming experiences, combining portable and family-friendly gaming consoles and developing ecosystems led by user bases.

Razer Inc. (4-8%)

Razer develops high-end gaming peripherals, laptop PCs, as well as esports-centric hardware innovations.

Other Key Players (30-38% Combined)

The industry is slated to reach USD 40.43 billion in 2025.

The industry is predicted to reach a size of USD 65.43 billion by 2035.

Key companies include Sony Corporation, Microsoft Corporation, Apple Inc., Google, HTC Corporation, Nintendo, Linden Research, Inc., Activision Blizzard, Inc., Sega Games Co., Ltd., Oculus VR, LLC, GAMDIAS, and Anker Innovations Technology.

India, with a CAGR of 11.9%, is expected to record the highest growth during the forecast period.

Gaming hardware in TV is among the most widely used in the industry.

By gaming platform, the industry is divided into gaming hardware for PCs, TVs, smartphone gaming.

By product type, the industry includes gaming hardware in consoles (standard consoles, handheld consoles) and gaming hardware accessories (headsets, cameras, gamepads, steering wheels, and joysticks).

By end-user, the industry is segmented into residential and commercial gaming hardware.

By region, the industry spans the North America, Latin America, Europe, Asia Pacific, and Middle East and Africa.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.