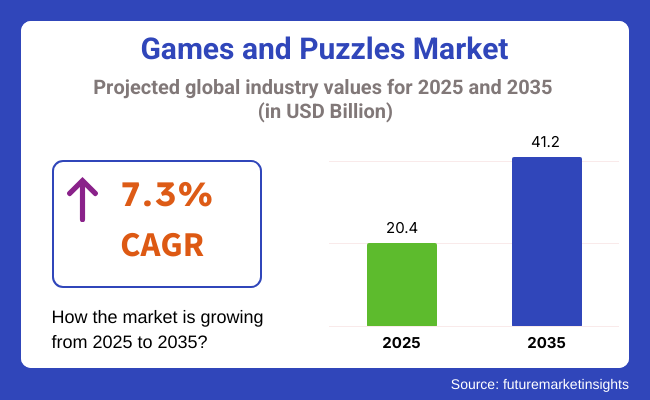

The global games and puzzles market size was valued at USD 20.4 billion in 2025 and is expected to grow at a 7.3% CAGR from 2025 to 2035. The global industry for games and puzzles is expected to reach USD 41.2 billion by 2035. A major key driver of this growth is the rising consumer demand for screen-free recreational activities and mental stimulation across all age groups, particularly driven by educational awareness and family bonding preferences.

The industry has witnessed a resurgence as consumers seek tactile and interactive experiences in an increasingly digital world. Traditional board games, strategy-based puzzles, and card games continue to gain popularity for their cognitive benefits, social interaction, and nostalgia-driven appeal. At the same time, contemporary trends such as escape room kits, 3D puzzles, and hybrid board-game apps are modernizing the category and attracting younger demographics.

Educational games and puzzles are finding strong uptake among parents and institutions, particularly for early learning and developmental skills. From alphabet puzzles to logic-based board games, this sub-segment is supported by rising awareness of screen-time management and the benefits of hands-on learning. Moreover, manufacturers are incorporating STEAM (Science, Technology, Engineering, Arts, and Mathematics) principles into product design to align with global educational frameworks.

Retail dynamics are evolving, with online channels playing a significant role in expanding reach and personalization. Platforms now offer AI-based recommendations, subscription boxes, and customizable puzzles, enabling deeper consumer engagement. Social media virality and influencer endorsements also contribute to periodic spikes in demand, particularly for limited edition and collaborative releases.

North America and Europe remain dominant in premium and educational puzzle categories, while Asia-Pacific is emerging as a high-growth region, particularly in puzzle manufacturing and exports. The industry is evolving into a hybrid format where physical products are enhanced by mobile interactivity and digital extensions, expanding the lifecycle and relevance of games and puzzles.

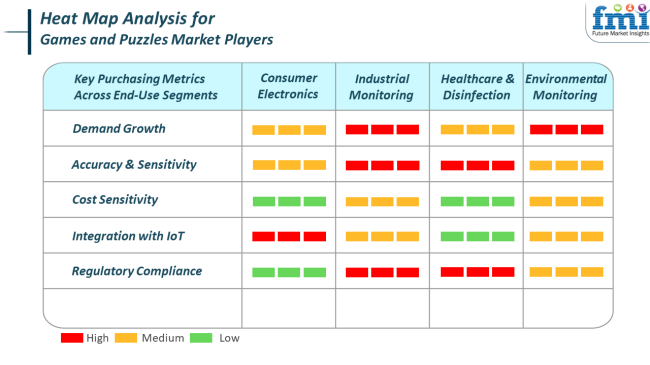

Puzzles and games aimed at the consumer electronics market are increasingly networked with digital platforms, with app-connected puzzles or augmented reality board games. The connectivity creates high demand and encourages repeat purchasing through downloadable content, gamification layers, and real-time tracking.

In industrial monitoring, gamification is used in training simulations and problem-solving modules. In such uses, the correctness of scenario representation and users' feedback mechanisms is critical. Such puzzle-based systems provide for employee engagement, compliance monitoring, and risk simulations in high-risk environments.

Healthcare and therapeutic environments use puzzles for cognitive therapy and stress relief. Products are required to achieve safety and usability, especially in pediatric and geriatric uses. Environmental monitoring industries use puzzle-type models for educational awareness and interactive learning, focusing on awareness and behavior modification through eco-friendly games and online experiences.

The games and puzzles industry, while robust, has weaknesses. The largest threat is likely the saturation in the industry and short product life due to seasonable spikes and trend dependency. Successful products have intense but brief sales bursts, which are difficult to replicate without continuous innovation or licensing tie-ins.

Fake products and low-quality imitations cause reputational and safety issues, especially in kids' games. These imitations undermine the brand value and may be non-compliant with global safety standards, mostly on matters regarding material toxicity, choking and durability. There must be tight quality controls and trademark enforcement for long-term expansion to persist. Digital disruption, as it offers opportunity, also brings complexity.

Companies that cannot transition to hybrid models-physical and digital gameplay in tandem-will become relics of the past. On top of this, striking a balance between traditional appeal and technological advancement remains a problem, as too much digitization stands to drive away core audiences who prefer non-virtual interaction. Long-term expansion will depend on adaptability, cross-generational relevance, and a keen awareness of evolving consumer behavior.

From 2020 to 2024, the industry grew rapidly due to high demand for home entertainment during the COVID-19 pandemic. People shifted to board games, jigsaw puzzles, and card games as vehicles for social interaction and mental stimulation. The time witnessed a revival of traditional games and an increase in new, fresh designs. The industry was also aided by the growth of e-commerce websites, allowing consumers to access a broad range of games and puzzles more readily.

Through 2025 to 2035, the industry is forecasted to maintain its growth, driven by a number of key trends. The use of technology in traditional games, like virtual friends and augmented reality (AR), will improve user interaction. Therapy and learning games will find more interest, both among kids and adults in need of mental stimulation and stress relief.

Issues related to the environment will find prominence, with green elements and environmentally friendly packaging being adopted by manufacturers. The growing "kidult" audience that enjoys games created for children will further expand the sales, with increasingly more complex and difficult games being offered.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Demand for home-based entertainment due to the pandemic | Technological fusion and emphasis on educational and therapeutic value |

| Nostalgia for classic games and new introductions of designs | Inclusion of AR, digital content, and eco-friendly materials |

| Increased fa mily and social gaming | Growth of the adult gaming market ("kidults") and focus on cognitive development |

| Emergence of e-commerce platforms | Omnichannel strategies integrating online and offline shopping |

| Initial steps toward green products | Mass adoption of eco-friendly packaging and materials |

| Regulation in terms of safety standards and proper age content | Increased focus on Internet safety and data protection law |

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.4% |

| UK | 6.8% |

| France | 6.5% |

| Germany | 6.2% |

| Italy | 5.9% |

| South Korea | 6.1% |

| Japan | 5.7% |

| China | 7.8% |

| Australia-NZ | 6.3% |

The USA is also expected to grow at 7.4% CAGR over the forecast period. High consumer expenditures, high awareness of technology, and wide distribution networks support the industry. The industry is expanding with increasing demand for board games, jigsaw puzzles, and learning games among children and adults.

The strong presence of top industry players and ongoing innovation in game design also contribute significantly to long-term growth. Digitalization has also aided in changing the traditional puzzle and board game formats, with online multiplayer games and mobile apps boosting the consumer base.

Also, the industry is moving towards nostalgia products, which are gaining traction among mature consumers in search of non-digital entertainment. E-commerce platforms are further improving access, while specialized interest puzzles are being developed to satisfy specialized interests.

The UK is expected to grow at 6.8% CAGR during the study period. Demand for puzzles and board games remains strong in the UK, especially in family and educational settings. The country's heightened favor towards unplugged forms of entertainment, especially among urban populations, is fostering demand for traditional puzzles and strategy-based board games. Domestic companies and international players are launching theme-based games and expanding product lines to attract younger age groups as well as adult consumers.

Retail distribution channels, particularly internet-based marketplaces, are becoming vital to reach increasing segments of people. In addition, the UK is augmented by the widespread cultural adoption of game-based learning, making adoption easier in educational environments. Puzzle books, logic games, and cooperative board games are growing, particularly around holidays. Growth in the gift segment, along with increased interest in mental health, will sustain industrial development through 2035.

France is expected to grow at 6.5% CAGR during the research period. France's historical cultural predisposition towards literature, logic, and socialization creates a favorable environment for games and puzzles. The country demonstrates consistent interest in strategic games, crosswords, and jigsaw puzzles, particularly those of artistic or cultural orientation. Family entertainment and the use of puzzles in cognitive skill building are strengthening demand across age groups.

Growing awareness about the benefits of offline activity is also contributing to a shift in consumer behavior, with more and more homes buying board games and puzzles. The rise in the number of specialty stores and online platforms selling imported and locally made puzzles contributes to industry growth. Moreover, France still appreciates education-oriented products, making puzzles a relevant tool for study as well as entertainment. The revenue is slated to grow in strength with support from differentiated portfolios of products and a sophisticated customer base.

The German economy is projected to record a 6.2% CAGR growth during the forecast period. Germany has always been one of the leading puzzle and board game producers and users in Europe. The culture of innovative game design and craftsmanship has developed a strongly competitive and quality-oriented domestic industry.

German players enjoy strategy-rich games, rational puzzles, and entertainment for the family, thus building stable demand. In recent years, a resurgence of social gaming and analog entertainment has marched in tandem with offline and interactive experience demands from consumers.

School and nursing home expansion has fueled the wider utilization of puzzles as cognitive health and activity tools. Export demand by neighboring countries also contributes to the strength of the domestic manufacturing base. Germany's well-tuned blend of tradition and innovative thinking makes it a stable region for growth in the years to come.

Italy is expected to grow at 5.9% CAGR during the study period. Whereas traditionally more attuned to arts and culture, Italy has gradually shown more interest in the social and educational appeal of puzzles and games. Increased family involvement in interactive home entertainment and logic puzzles is stimulating new consumption patterns. Children's games remain a top priority, but adult segments are expanding, especially for memory-enhancing and brain-training puzzles.

The industry is gradually transforming, with online platforms at the forefront of expanding product reach. Gift-oriented puzzles and premium board games are emerging as niche divisions. Further, the growing acceptance of learning games by the educational segment supports stable demand.

However, the industry has limitations, such as limited domestic production and competition from behemoths of European companies. A sustained focus on customization and thematic products should enhance growth prospects.

South Korea will register a 6.1% CAGR during the period under study. South Korea has experienced greater demand for mental activity and leisure pursuits resulting from urbanization and a hectic life that supports quality leisure time. Educational puzzles, brain games, and reasoning puzzles are favorite items among students and adults in pursuit of skill gain and mental challenge.

The nation's digital infrastructure also facilitates the hybridization of classic puzzles with augmented reality and internet connectivity, increasing appeal among younger consumers. Furthermore, value-added packaging, character licensing, and brand alliance have become popular, especially among themed puzzle categories.

Academic priority in South Korea also encourages the incorporation of puzzles into educational environments. As technological advancements and demand remain synchronized, the nation stands poised for stable and diversified growth through the next decade.

Japan is expected to post 5.7% CAGR growth during the study period. Japan focuses on precision, originality, and handcraft. The puzzles, especially intricate jigsaw puzzles and origami puzzles, are culturally steeped in bias. Traditional toys dominate, but interest in educational games and therapy games is observed to grow among children and elderly citizens.

An aging population is supporting the demand for cognition-oriented puzzles, particularly in urban centers. Puzzle cafes and public events are also driving a revival in social gaming. Japan's mature retail networks and innovative culture underpin diversified product offerings. Sluggish digital penetration in the puzzle category softly slows growth.

China will grow by 7.8% CAGR during the study period. China is a highly valuable and dynamic region fueled by a wide population base, rising disposable incomes, and an increasing emphasis on educational development. Urbanization and expansion of the middle class are further driving consumer spending on quality family entertainment and thinking games.

Increased investment in early childhood education and emphasis on STEM learning tools have propelled the demand for educational puzzles. Online retailing and social commerce platforms are at the core of accelerating product distribution, especially in tier-2 and tier-3 cities.

Moreover, local manufacturing capacity supports cost-effective production and innovation in puzzle design. China's technology integration, including app-based games and interactive physical-digital puzzles, is revolutionizing consumer interaction and driving future growth.

The Australia-New Zealand region is expected to grow at 6.3% CAGR during the study period. The area is a mature place for puzzles and games, with a growing consumer preference for unplugged, family-oriented recreational activities. A focus on education and child development results in a consistent demand for puzzles with educational value, particularly in schools and households.

In both nations, the traders are increasingly diversifying products to stock eco-friendly, local content and theme puzzles that appeal to local interests and values. Online distribution has expanded access for international brands specifically. There is also an increase in adult puzzling activity fueled by mental health trends and retro popularity. Incorporation of learning value and sustainability within product development will keep shaping regional trends from 2035.

The industry will be driven mainly by games, which account for 63.2% of the global share. Puzzles, on the other hand, will account for 36.8%.

Games lead the market due to their cross-generational appeal and versatility. In general, the demand for entertainment or competitive experiences in board games and video games keeps growing worldwide. Hasbro and Mattel are leading companies in this area, and board gaming includes traditional games such as Monopoly, Pictionary, Scrabble, and Risk. Their continued product innovations with different editions and themes attract not only traditional players but also younger ones, aiding the retention of a good share by games.

On the other hand, video game developers like Sony and Microsoft boost market activity with the latest gaming consoles and interactive games that engage millions of users worldwide. This segment is also expanding due to the growing trend of social and mobile gaming, with mobile gaming giants like King (Candy Crush creator) and Supercell having a greater global presence.

Although a small segment, puzzles withstand the pheromone effects of cognitive health stimulation, stress relief, and satisfaction for dedicated as well as casual puzzle aficionados. Jigsaw puzzles seem to witness a comeback, owing to a growing need for offline entertainment. In contrast, the likes of Ravensburger and The New York Puzzle Company are famed for top-quality puzzle products, which encompass everything from standard jigsaw puzzles to 3D models.

In educational and therapeutic fields, puzzles are also highly valued, with schools and healthcare centers employing them to help children and patients advance key thinking and fine motor skills.

The entertainment industry will continue to be impacted by both games and puzzles, with games capturing a larger share due to their diverse formats and ever-changing attributes. In contrast, puzzles obtain loyal demand owing to their mental engagement and tactile experience.

In 2025, for the global market of games and puzzles, about 68.4% of the revenues will be derived from non-licensed products, whereas the remaining share will be from the licensed market, which will be 31.6%.

Non-licensed games and puzzles are more favorable for customers since they are more affordable and involve broader concepts. The traditional concepts or sometimes even private creations cater to the people who use such games and puzzles with no connection to an outside brand or intellectual property rights.

Companies such as Hasbro and Mattel used to develop their legacy on non-licensed items and have well-popular games and puzzles that won't require costly licensing. Games like Monopoly, Scrabble, and Puzzles-Rensburger, which market 1000-piece collections, are reaching global customers because they possess timeless entertainment for players of all ages. Their non-licensed games and puzzles are equally versatile and simple, making it easy for any company to reach a wider audience.

Licensed products are linked to well-known characters or franchises or intellectual property rights that lure much more fans than collectors. Licensed games and puzzles will always consist of favorite brands such as Disney, Marvel, or Star Wars, which have an established fan base and followers.

Such highly prized characters and franchises can be exploited by companies such as The Walt Disney Company, Lego, and, of course, Ravensburger (having their Disney brands' puzzles) to make exciting experiences exclusive for fans. Nowadays, nostalgia and fandom attached to popular culture often provide for a very personal purchase experience in dealing with licensed items in specific segments of the market.

The industry is highly competitive and has players such as Buffalo Games, Hasbro, Inc., and Mattel, Inc., which are some of the top players that command huge shares of revenue and continue to expand their portfolios. Their products cater to varying audiences, from traditional jigsaw puzzles to board games with familiar titles to formats that have evolved into innovative concepts.

Buffalo Games and Ravensburger AG share the pie in the puzzles segment. Their premium offerings feature unique designs and a broad range of difficulty levels to get casual spenders and those interested in the collection.

Hasbro, Inc. And Mattel, Inc., powerful players in the board games marketplace, utilize the brand recognition strength of classic titles such as Monopoly, Scrabble, and Uno, along with their latest modernized puzzle formats. Their extensive suite of products aims to reach every demographic, from families to collectors. Further, Schmidt Spiele and Ceaco, Inc. Have forged a strong position in their respective regions, with a special emphasis on Europe and North America.

Some niche players like Educa Borras and Cubicfun 3D Puzzle add value to the industry and focus on 3D puzzles and themed designs. Castorland and Cobble Hill have gained many collectors because both companies have been among those that produce high-quality artistic puzzles that often consist of photography and art themes.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Buffalo Games | 18-22% |

| Hasbro, Inc. | 15-19% |

| Mattel, Inc. | 12-16% |

| Ceaco, Inc. | 10-14% |

| Ravensburger AG | 8-12% |

| Other Players | 24-28% |

| Company Name | Offerings & Activities |

|---|---|

| Buffalo Games | Premium jigsaw puzzles with diverse designs and high-quality materials. |

| Hasbro, Inc. | Iconic board games and puzzles like Monopoly, Scrabble, and themed puzzles. |

| Mattel, Inc. | Family-friendly games and puzzles with an emphasis on creative play and entertainment. |

| Ceaco, Inc. | Offers a wide variety of puzzles, including licensed themes and custom designs. |

| Ravensburger AG | Known for high-quality puzzles, including 3D p uzzles and large-format jigsaws with diverse themes. |

Key Company Insights

Buffalo Games (18-22%)

One of the dominant players in the puzzle segment, Buffalo Games stands out for its premium-quality, themed puzzles and creative design styles, resonating with new and seasoned puzzlers alike.

Hasbro, Inc. (15-19%)

Leads the games segment with a huge library of beloved board games and puzzles, appealing to a wide demographic from families to serious collectors.

Mattel, Inc. (12-16%)

Famous for its puzzle and game offerings for families, Mattel continues to grow its creative play business with high brand loyalty.

Ceaco, Inc. (10-14%)

Experts in puzzles with artistic and distinctive designs, providing a wide variety of licensed themes and exclusive custom puzzle choices for collectors.

Ravensburger AG (8-12%)

Famous for its high-quality puzzles, such as intricate 3D puzzles and large-format jigsaws, that attract serious puzzle enthusiasts as well as collectors.

Other Key Players

The segmentation is into Games and Puzzles. The Games segment is further classified into Board Games and Card Games.

The segmentation is into Non-Licensed and Licensed categories based on intellectual property usage.

The segmentation is into Online and Offline channels.

The report covers North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The global games and puzzles market is estimated to be worth USD 20.4 billion in 2025, fueled by rising demand for recreational and cognitive development products across age groups.

The valuation is projected to grow to USD 41.2 billion by 2035, driven by the continued popularity of tabletop games, digital puzzle integration, and educational uses.

China is expected to experience a 7.8% CAGR, supported by the growing middle-class population, increasing e-commerce penetration, and a surge in educational game demand.

Games hold the dominant share due to consistent innovation, themed editions, and the growth of family and social gaming trends.

Prominent companies in the industry include Buffalo Games, Hasbro, Inc., Mattel, Inc., Ceaco, Inc., Ravensburger AG, Schmidt Spiele, Cubicfun 3D Puzzle, Educa Borras, Castorland, and Cobble Hill.

Table 1: Global Market Value (US$ Billion) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Billion) Forecast by Type, 2018 to 2033

Table 3: Global Market Value (US$ Billion) Forecast by Licensing, 2018 to 2033

Table 4: Global Market Value (US$ Billion) Forecast by Distribution Channel, 2018 to 2033

Table 5: North America Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Billion) Forecast by Type, 2018 to 2033

Table 7: North America Market Value (US$ Billion) Forecast by Licensing, 2018 to 2033

Table 8: North America Market Value (US$ Billion) Forecast by Distribution Channel, 2018 to 2033

Table 9: Latin America Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Billion) Forecast by Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Billion) Forecast by Licensing, 2018 to 2033

Table 12: Latin America Market Value (US$ Billion) Forecast by Distribution Channel, 2018 to 2033

Table 13: Western Europe Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Value (US$ Billion) Forecast by Type, 2018 to 2033

Table 15: Western Europe Market Value (US$ Billion) Forecast by Licensing, 2018 to 2033

Table 16: Western Europe Market Value (US$ Billion) Forecast by Distribution Channel, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ Billion) Forecast by Type, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Billion) Forecast by Licensing, 2018 to 2033

Table 20: Eastern Europe Market Value (US$ Billion) Forecast by Distribution Channel, 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Value (US$ Billion) Forecast by Type, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ Billion) Forecast by Licensing, 2018 to 2033

Table 24: South Asia and Pacific Market Value (US$ Billion) Forecast by Distribution Channel, 2018 to 2033

Table 25: East Asia Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Value (US$ Billion) Forecast by Type, 2018 to 2033

Table 27: East Asia Market Value (US$ Billion) Forecast by Licensing, 2018 to 2033

Table 28: East Asia Market Value (US$ Billion) Forecast by Distribution Channel, 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Value (US$ Billion) Forecast by Type, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Billion) Forecast by Licensing, 2018 to 2033

Table 32: Middle East and Africa Market Value (US$ Billion) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Billion) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Billion) by Licensing, 2023 to 2033

Figure 3: Global Market Value (US$ Billion) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Billion) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Billion) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Billion) Analysis by Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 11: Global Market Value (US$ Billion) Analysis by Licensing, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Licensing, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Licensing, 2023 to 2033

Figure 14: Global Market Value (US$ Billion) Analysis by Distribution Channel, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 17: Global Market Attractiveness by Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Licensing, 2023 to 2033

Figure 19: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Billion) by Type, 2023 to 2033

Figure 22: North America Market Value (US$ Billion) by Licensing, 2023 to 2033

Figure 23: North America Market Value (US$ Billion) by Distribution Channel, 2023 to 2033

Figure 24: North America Market Value (US$ Billion) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Billion) Analysis by Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 31: North America Market Value (US$ Billion) Analysis by Licensing, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Licensing, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Licensing, 2023 to 2033

Figure 34: North America Market Value (US$ Billion) Analysis by Distribution Channel, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 37: North America Market Attractiveness by Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Licensing, 2023 to 2033

Figure 39: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Billion) by Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Billion) by Licensing, 2023 to 2033

Figure 43: Latin America Market Value (US$ Billion) by Distribution Channel, 2023 to 2033

Figure 44: Latin America Market Value (US$ Billion) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Billion) Analysis by Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Billion) Analysis by Licensing, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Licensing, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Licensing, 2023 to 2033

Figure 54: Latin America Market Value (US$ Billion) Analysis by Distribution Channel, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Licensing, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ Billion) by Type, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Billion) by Licensing, 2023 to 2033

Figure 63: Western Europe Market Value (US$ Billion) by Distribution Channel, 2023 to 2033

Figure 64: Western Europe Market Value (US$ Billion) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ Billion) Analysis by Type, 2018 to 2033

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 71: Western Europe Market Value (US$ Billion) Analysis by Licensing, 2018 to 2033

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Licensing, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Licensing, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Billion) Analysis by Distribution Channel, 2018 to 2033

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by Licensing, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ Billion) by Type, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ Billion) by Licensing, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ Billion) by Distribution Channel, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Billion) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ Billion) Analysis by Type, 2018 to 2033

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ Billion) Analysis by Licensing, 2018 to 2033

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Licensing, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Licensing, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ Billion) Analysis by Distribution Channel, 2018 to 2033

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by Licensing, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Value (US$ Billion) by Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Billion) by Licensing, 2023 to 2033

Figure 103: South Asia and Pacific Market Value (US$ Billion) by Distribution Channel, 2023 to 2033

Figure 104: South Asia and Pacific Market Value (US$ Billion) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Market Value (US$ Billion) Analysis by Type, 2018 to 2033

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 111: South Asia and Pacific Market Value (US$ Billion) Analysis by Licensing, 2018 to 2033

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Licensing, 2023 to 2033

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Licensing, 2023 to 2033

Figure 114: South Asia and Pacific Market Value (US$ Billion) Analysis by Distribution Channel, 2018 to 2033

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 118: South Asia and Pacific Market Attractiveness by Licensing, 2023 to 2033

Figure 119: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Billion) by Type, 2023 to 2033

Figure 122: East Asia Market Value (US$ Billion) by Licensing, 2023 to 2033

Figure 123: East Asia Market Value (US$ Billion) by Distribution Channel, 2023 to 2033

Figure 124: East Asia Market Value (US$ Billion) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Market Value (US$ Billion) Analysis by Type, 2018 to 2033

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 131: East Asia Market Value (US$ Billion) Analysis by Licensing, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Licensing, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Licensing, 2023 to 2033

Figure 134: East Asia Market Value (US$ Billion) Analysis by Distribution Channel, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 137: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 138: East Asia Market Attractiveness by Licensing, 2023 to 2033

Figure 139: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 140: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Billion) by Type, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Billion) by Licensing, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Billion) by Distribution Channel, 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Billion) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Billion) Analysis by Type, 2018 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Billion) Analysis by Licensing, 2018 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Licensing, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Licensing, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Billion) Analysis by Distribution Channel, 2018 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Licensing, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Board Games Market Size and Share Forecast Outlook 2025 to 2035

eSports & Games Streaming Market – Trends & Forecast 2023-2033

Traditional Toys and Games Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Mesh Nebulizer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA