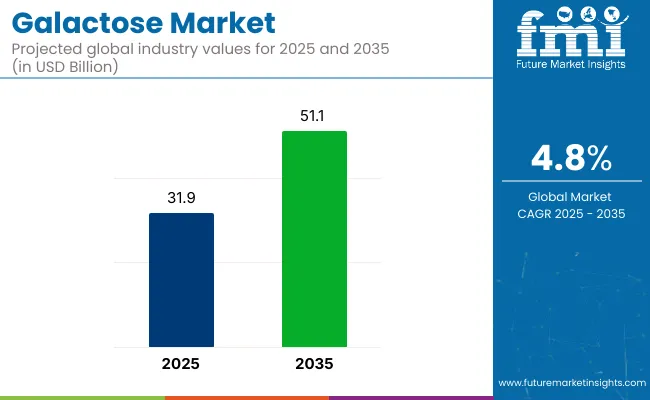

The global galactose market is valued at USD 31.9 billion in 2025 and is slated to reach USD 51.1 billion by 2035 with a robust CAGR of 4.8%. This growth is being driven by increasing adoption of functional food ingredients, rising demand for lactose-free formulations, and expanding use in biotechnology and pharmaceutical applications.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 31.9 billion |

| Market Size in 2035 | USD 51.1 Billion |

| CAGR (2025 to 2035) | 4.8% |

Additionally, heightened interest in clean-label and plant-based dietary preferences is expected to support the ongoing penetration of galactose across both developed and emerging markets.

The market is being shaped by innovations in enzyme processing, integration of AI for cost control, and demand for vegan-friendly, non-dairy alternatives. Companies are focusing on hybrid solutions combining galactose with prebiotics, skincare formulations, and medical nutrition. Rising health consciousness and expanding clinical use cases are forecasted to provide long-term stability and opportunity in this evolving market.

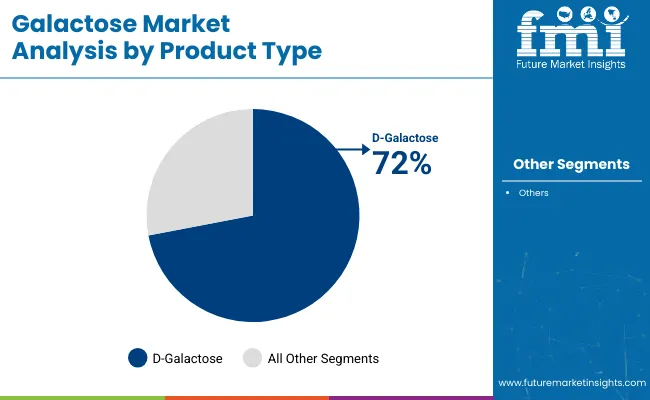

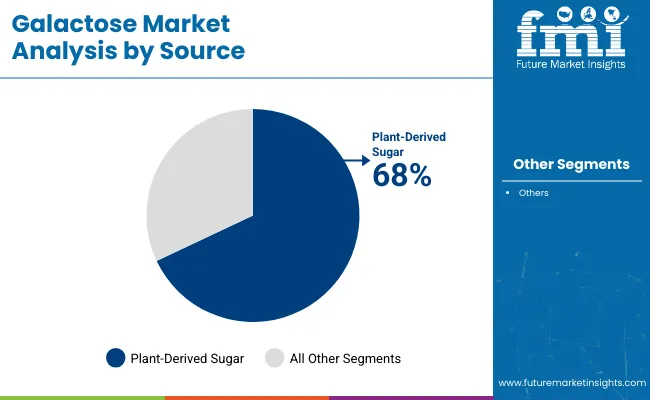

Within the galactose market, the plant-derived sugar segment is expected to register the highest growth in the source category, while accounting for 68.0% of the market share in 2025. In the product type segment, D-galactose is projected to grow at the fastest rate, capturing a dominant 72.0% share of the segment.

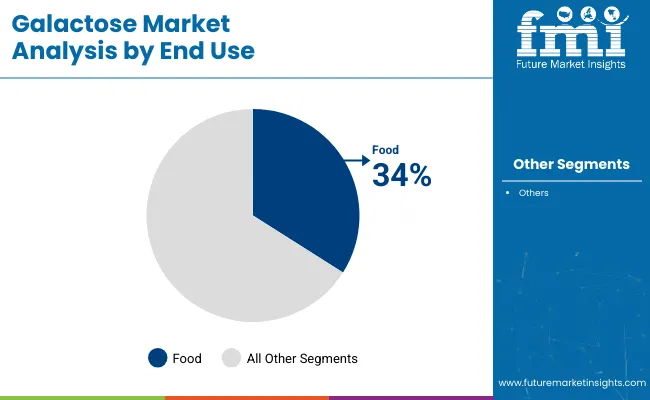

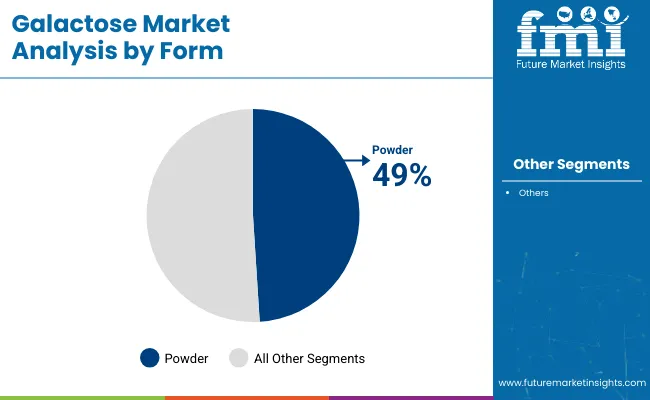

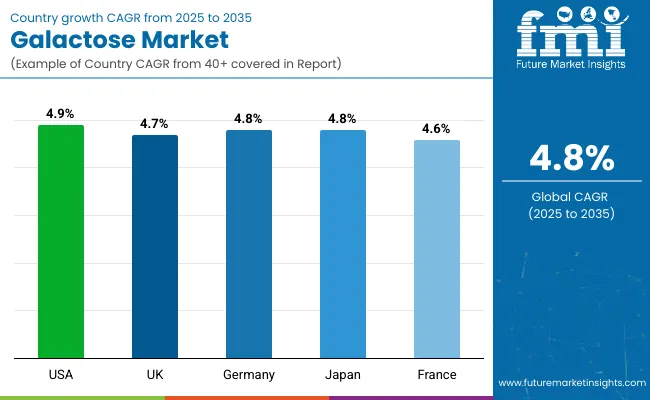

Among the various forms, powdered galactose is forecasted to hold a 49.0% market share in 2025, due to its superior shelf life and formulation compatibility. In terms of end use, the pharmaceutical segment is anticipated to expand most rapidly, while the food segment is expected to lead the category with a 34.0% market share. On a country level, the USA is projected to be the fastest-growing market, with a CAGR of 4.9% from 2025 to 2035, supported by enzyme-based innovations and rising demand for functional sugar alternatives.

Ongoing research and development efforts are being intensified to enhance the therapeutic potential of galactose, particularly in treating metabolic disorders such as galactosemia and neurodevelopmental applications. Collaborations between biotechnology firms and academic institutions are being strengthened to create advanced formulations with higher bioavailability and stability.

Per capita consumption of galactose-based products is primarily influenced by dairy consumption patterns, as galactose is naturally present in foods containing lactose. Factors such as dietary habits, cultural preferences, lactose intolerance prevalence, and access to dairy alternatives shape consumption trends globally. The market includes milk, cheese, yogurt, and other lactose-containing foods, with varying intake across different regions.

Developed Countries:

In countries such as the United States, Canada, Germany, the United Kingdom, and Australia, per capita consumption of galactose-based products is relatively high. Dairy products are regularly included in daily diets, with milk, yogurt, and cheese being common sources. The widespread availability of dairy through supermarkets, foodservice outlets, and online channels contributes to consistent intake. Although plant-based alternatives are growing, traditional dairy consumption remains strong.

Emerging Markets:

In nations like India, Brazil, Indonesia, South Africa, and Mexico, galactose consumption is gradually increasing due to rising urbanization, improved access to packaged foods, and greater awareness of nutritional benefits. As dairy products become more accessible and affordable, consumption of milk-based beverages and processed dairy foods is rising. However, regional differences and affordability still influence the level of galactose intake.

The global trade of galactose-based products is closely tied to the dairy industry and the broader market for functional and specialty carbohydrates. Galactose is primarily traded in the form of lactose-containing dairy products or as a refined ingredient for pharmaceuticals, nutraceuticals, infant formulas, and food processing. Demand is driven by the health, nutrition, and food technology sectors, with trade patterns reflecting dairy production capacities and processing infrastructure.

Major Exporting Countries:

Leading exporters include the United States, New Zealand, Germany, the Netherlands, and France. These countries have strong dairy industries and advanced food processing capabilities, enabling the export of both raw dairy products and refined galactose derivatives. They supply galactose-based ingredients for use in infant nutrition, medical foods, and functional beverages. Trade also includes high-purity galactose for pharmaceutical and laboratory applications.

Major Importing Countries:

Top importers include China, India, Japan, South Korea, and Middle Eastern nations.

These markets import galactose-rich dairy ingredients and specialty carbohydrates for use in food manufacturing and health products. In regions with limited dairy production or high demand for functional foods, imports are essential to meet industrial and consumer needs. Pharmaceutical companies and infant formula manufacturers are key buyers in these markets.

The market is segmented into source, product type, form, end use, and region. By source, the market is divided into plant-derived sugar and synthetic sugar. Based on product type, the market is categorized into D-galactose and L-galactose.

In terms of form, the market is segmented into powder, liquid, and crystal. In terms of end use, the market is segmented into food (bakery goods, sweet spreads, confectionery, dairy products, and canned food), beverages (carbonated drinks, fruit drinks and juices, powdered drinks and mixers, and alcoholic beverages), pharmaceuticals, personal care, biofuel industry, and animal feed industry. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East and Africa.

D-galactose is projected to lead the product type segment, accounting for 72% of the global market share by 2025. This monosaccharide has been recognized as a critical ingredient in pharmaceutical, biotechnological, and functional food applications due to its structural compatibility and biological functions.

The plant-derived sugar segment is expected to lead the source category, securing 68% of the global market share by 2025. Known for its clean-label positioning and natural origin, this segment has been favored for food, nutraceutical, and infant formula applications.

The food segment is anticipated to lead the end-use category, capturing 34% of the global market share in 2025. Consistent demand for low-lactose and functional sugar alternatives in processed and health-focused foods has been driving this trend.

The powder segment is expected to dominate the form category, capturing 49% of the global market share by 2025. Its widespread use in pharmaceuticals, dietary supplements, and functional food products has been driven by its superior stability, ease of handling, and long shelf life.

The galactose market is witnessing consistent expansion, fueled by rising demand for lactose-free nutritional ingredients, advancements in fermentation-based synthesis, and growing adoption across pharmaceutical, functional food, and biotechnology sectors.

Recent Trends in the Galactose Market

Challenges in the Galactose Market

The USA galactose market is expected to grow at a CAGR of 4.9% from 2025 to 2035. Growth is being supported by high demand for lactose-free and functional sugar products in pharmaceuticals and dietary supplements. Advanced enzyme synthesis technologies and expanded clinical research on galactose's role in cognitive health have contributed to robust market traction.

The UK galactose market is projected to expand at a CAGR of 4.7% during the forecast period. Market growth is being fueled by consumer preference for lactose-free foods, regulatory incentives for plant-based sugar alternatives, and research investments in galactose-rich medicinal compounds.

Germany’s galactose market is forecasted to grow at a CAGR of 4.8% from 2025 to 2035. As a biotechnology leader within the EU, Germany has prioritized galactose for use in pharmaceuticals, synbiotics, and dietary innovations. Industrial-grade D-galactose is produced for advanced medical applications.

Japan’s galactose market is expected to expand at a CAGR of 4.8% through 2035. High prevalence of lactose intolerance and the country's leadership in functional food innovation are driving galactose consumption. Plant-derived and enzymatically synthesized galactose solutions are favored in both health and cosmetic sectors.

France’s galactose market is projected to grow at a CAGR of 4.6% from 2025 to 2035, supported by increasing demand for functional sugars in medical nutrition and personal care. The country’s leadership in pharmaceutical-grade carbohydrate innovation and regulatory emphasis on clean-label products are driving the expansion of galactose applications.

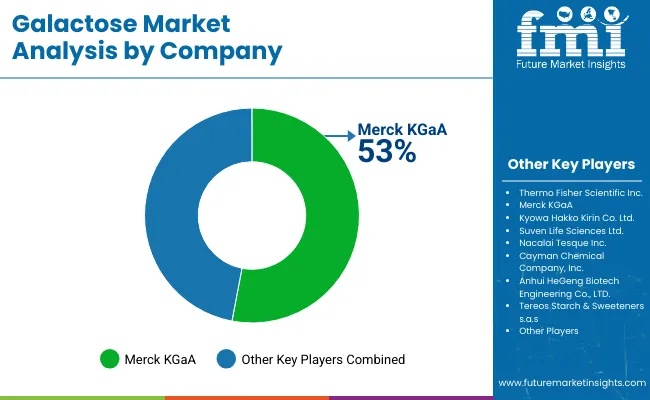

The galactose market is moderately consolidated, with several global leaders such as Merck KGaA, Thermo Fisher Scientific Inc., DuPont de Nemours, Inc. (IFF), and Kyowa Hakko Bio Co., Ltd.accounting for significant revenue shares. These companies are competing through innovations in enzymatic synthesis, AI-driven purification, and sustainable production methods. Strategic partnerships and acquisitions are being pursued to expand product portfolios and reach global audiences.

Company strategies have been centered on enhancing production efficiency, ensuring high-purity outputs, and meeting the growing demand for plant-based and lactose-free products. Investments in research and development have been made to explore novel applications of galactose in pharmaceuticals, nutraceuticals, and functional foods. Additionally, collaborations with biotech firms and dietary supplement brands have been established to broaden application scope.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 31.9 billion |

| Projected Market Size (2035) | USD 51.1 billion |

| CAGR (2025 to 2035) | 4.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for dollar sales |

| Sources Analyzed (Segment 1) | Plant Derived Sugar, Synthetic Sugar |

| Product Types Analyzed (Segment 2) | D-Galactose, L-Galactose |

| Forms Analyzed (Segment 3) | Powder, Liquid, Crystal |

| End-uses Analyzed (Segment 4) | Food (Bakery Goods, Sweet Spreads, Confectionery, Dairy Products, Canned Food), Beverage (Carbonated Drinks, Fruit Drink and Juice, Powdered Drinks and Mixers, Alcoholic Beverages), Pharmaceuticals, Personal Care, Biofuel Industry, Animal Feed Industry |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Galactose Market | Thermo Fisher Scientific Inc., Merck KGaA, Kyowa Hakko Kirin Co., Ltd., Suven Life Sciences Ltd., Nacalai Tesque Inc., Cayman Chemical Company, Inc., Anhui HeGeng Biotech Engineering Co., LTD., Tereos Starch & Sweeteners s.a.s, Cambridge Isotope Laboratories, Inc., Zhejiang Yixin Pharmaceutical Co., Ltd. |

| Additional Attributes | dollar sales, CAGR trends, source-based demand, product type distribution, form-based preferences, end-use industry share, competitor dollar sales & market share, regional growth patterns |

The market is expected to reach USD 51.1 billion by 2035.

The global market is projected to grow at a CAGR of 4.8% during this period.

D-Galactose is expected to lead with a 72% market share in 2025.

Plant-derived sugar is expected to hold a 68% share of the market in 2025.

The USA is anticipated to be the fastest-growing market with a CAGR of 4.9% through 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA