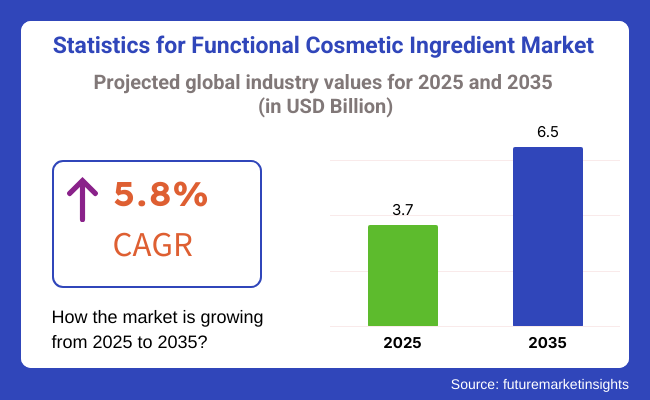

The functional cosmetic ingredient market is slated to exhibit USD 3.7 billion in 2025. The industry is poised to capture 5.8% CAGR from 2025 to 2035 and register USD 6.5 billion by 2035.

Functional cosmetic ingredients provide anti-aging effects, UV protection, skin brightening, hydration, and soothing properties. High-performance makeup and skincare products' continued demand corresponds to the prime driving factor for this industry. The industry is a dynamic area of rapid growth, as major consumer trends continue to evolve. Customers have become much more proactive in their search for specific ingredients that provide benefits like hydration, anti-aging, and sun protection.

Moreover, brands such as The Ordinary and Drunk Elephant advertise science-driven skincare with a dense load of such functional ingredients. In addition, multi-functional ingredients are gaining popularity since consumers prefer fewer products with more benefits. This has initiated the launch of hybrid models such as tinted moisturizers with SPF and anti-aging capabilities.

Also, biotechnological progress is reshaping the industry by making it possible to produce advanced functional ingredients. Some practices like the microencapsulation of active ingredients lead to better absorption and longer actions, like in serums with micro-encapsulated retinol for a controlled release. In addition, probiotics-based cosmetics are also a contemporary trend, like Gallinée which is a brand that has started probiotic-infused skincare to enhance skin health. Growth in the clean beauty movement is another predominant driver, with the consumer increasingly desiring natural, environmentally attuned, and sustainable ingredients. Companies are increasingly choosing sources that are plant-derived, e.g., Bakuchiol (a natural alternative to retinol), and algae extracts to gratify that desire.

Explore FMI!

Book a free demo

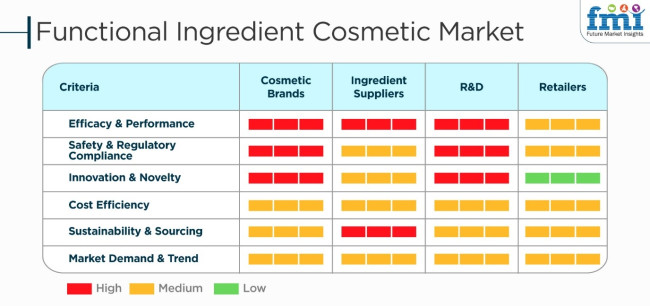

Functional ingredients cosmetic market chart functionalities cosmetic brands, ingredient suppliers, R&D, and retailers. Cosmetic brands and R&D prioritize (red) efficacy and performance, safety and regulatory compliance, and innovation and novelty, which is a clear indicator of the industry's focus on high-quality and innovative products that adhere to the highest standards in the market. It implies boththese categories are highly focused on research, keeping up with compliance and new trends through formulations and technologies.

Ingredient suppliers, who also value efficacy, safety, and innovation but put a medium weight (yellow) on operating in a cost-efficient, sustainable, and sourced manner. This means they deliver solid performance without breaking the bank or polluting the world, especially under pressure from both manufacturers and regulators. Sustainability and sourcing, which are also highlighted as high priority for R&D - very interesting in a direction toward more eco-friendly ingredients and more sustainable production methods.

In contrast, retailers place greater emphasis on market demand and trends, cost efficiency and sustainability, flagging these criteria as medium importance (yellow). They regard innovation and novelty as of low importance (green) compared to all other stakeholders, suggesting that retailers are less focused on product formulation innovation and are instead driven by consumer demand and profitability. While they value quality and compliance, their priorities favor characteristics like sell-ability and affordability, as well as consumer preferences, rather than leading to deep scientific advancements.

Between 2020 and 2024, the functional cosmetic ingredients industry saw rapid growth due to rising consumer demand for multifunctional skincare, clean beauty, and sustainability. Advances in biotechnology led to the development of bioactive peptides, plant-derived antioxidants, and microbiome-friendly ingredients that enhanced skin health while providing anti-aging and protective benefits. The formulation trend clean label drove the shift from synthetic additives toward natural and biodegradable alternatives. At the same time, regulations became stricter, pushing brands to safe and eco-friendly ingredients without compromise on performance.

From 2025 to 2035, the industry will be defined by AI for ingredient development, personalized skincare solutions, and biotech innovations, such as lab-grown actives and DNA-based formulations. Smart delivery systems will boost ingredient efficacy, while circular beauty initiatives would favor upcycled and carbon-neutral ingredients. Consumers will favor skin health over cosmetics, which will lead to functional skincare.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The industry performed moderately well overall, as the pandemic period was a recovery driven by the demand for versatile and basic hygiene products like soapy and lyophilized products. | Speedy growth for sure, due to the continuous demand for the advanced, high-functioning products, like antifungal, hydration, and a lot more. |

| A pandemic with a focus on the basic that with the surge in tourist arrivals hybrid was functional for skin repair, hydration, and soothing.. | Move toward premium, personalized formulations, the growth of demand for natural, clean, and multifunctional active ingredients tailored to specific skin and hair conditions. |

| First on the list of such measures are sustainability practices like eco-friendly packaging and the use of minimal amounts of synthetic ingredients. | A strong emphasis on green chemistry, biodegradable ingredients, and ingredients sourced from sustainable sources is the basis of consumers' demand for transparent and ethical manufacturing. |

| Due to the primary aim of maintaining the supply chains and fulfilling the immediate needs of consumers, there was a short period of no innovation from the brands. | Proliferation in biotechnologies, nanotechnologies, and customizations enabled by AI is brisk. |

| Functional ingredients such as peptides, ceramides, and probiotics are in demand for special applications. | Skincare applications led the way with the largest share from gadgets like moisturizers and anti-inflammatory products that addressed mask-wearing side effects during the pandemic |

| The major regions having strong growth (North America, Europe) owe this to the higher standard of living and the larger number of people that are 'in the know' about beneficial ingredients.. | Many more nations are going through urbanization, and the political and economic empowerment of the rising middle class is changing the global culture of economic performance-oriented beauty products.. |

A major risk in the functional ingredient cosmetic market is the availability of raw materials. A considerable portion of the active ingredients, such as botanical extracts, peptides, and probiotics, are subject to agricultural production or biotechnological processes. Shortages can occur due to climate shifts, supply chain disruptions, or geopolitical issues, leading to production challenges and price variability.

Ingredient quality control and stability are the primary aspects. The variability in sourcing can cause batch discrepancies, which in turn, will affect the product effectiveness and consumer trust. Supplier vetting, third-party testing, and observance of Good Manufacturing Practices (GMP) are some of the tools champed in making sure the ingredients are pure, stable, and meet the required industry standards.

Functional ingredients are, at times, subjected to rigorous regulations based on their claims and applications. What’s more, the company can face product recalls, fines, or bans as a result of violating the FDA, EU Cosmetic Regulation, or other regulatory bodies. It is necessary to keep abreast of the evolving regulations and undertake extensive documentation.

Supplier financial stability is a critical risk factor. If a supplier goes through tough financial times or has production interruptions, it can cause either a sharp increase in prices or an unavailability of the product. Crafting relations with a number of trusted suppliers and availing financial thoroughness can help in mitigating dependency on a single source while also reducing supply chain risks.

Establishing a value-based pricing strategy in the functional ingredient cosmetic market involves the art of finding the right proportion between product efficacy, perceived value, and cost structures. As consumers are inclined to spend more on proven benefits, pricing must demonstrate both scientific support and brand positioning while still being competitive inside the industry.

One commonly used strategy is value-based pricing when ingredient prices are set against their effectiveness, uniqueness, and consumer demand. Ingredients that possess the clinical evidence for their claims, like collagen peptides or skin microbiome probiotics, can charge more because of their perceived advanced advantages and hence attain competitive differentiation.

Dynamic pricing is an approach which allows brands to vary the ingredient costs in relation to industry available resources. The seasonal supply of natural extracts or the disruption of the supply chain will have direct implications for the pricing. The brands taking advantage of the real-time industry insights can maximize the profit margins while keeping competitiveness of costs amidst the ingredient perturbation.

Cost plus pricing, which involves adding a fixed margin to the costs of production, guarantees the income but not always reflects what the consumers want. The introduction of the first-mover functional ingredient by the competitors may render the stiff cost-based pricing inflexible, hence the need to connect costs strategies with trend analysis for the industry.

Competitive pricing is the brand’s best weapon for defensive posturing against the established players. The superior brands can give clinical data and exclusive formulations as the reasons for the high cost while the budget brands may go for the effective but simple products with reduced costs. However, the price cap should ensure both profitability and industry appeal.

The global trend toward sustainable and vegan skincare has driven the demand for natural emollients like shea butter, squalane, and plant oils. In contrast to other specialized actives like anti-aging actives or sunscreen actives, which are used to address specific issues, emollients and moisturizers are broadly used across different demographics and geographies. Their versatility and use in both mass-market drugstore products and high-end luxury skincare products make them the most widely used functional cosmetic ingredient. Also, with the beauty industry trending toward clean-label formulations, the use of natural and bio-based emollients is expanding even further, further cementing their place as a must-have component in the cosmetics industry.

Skin care products command the highest percentage of functional cosmetic ingredient consumption. This is because there is an increased global need for moisturizers, anti-aging creams, sunscreens, serums, and whitening products. People are increasingly focusing on skincare regimens that treat hydration, UV protection, anti-aging, and skin brightening, which in turn drives the consumption of emollients, antioxidants, and peptides. The trend of clean beauty, organic products, and dermatologically approved skincare further adds to the dependency on functional ingredients. Moreover, pollution, global warming, and lifestyle-related skin issues have given rise to active skincare ingredients like anti-inflammatory and plant extracts.

Moisturization is the most basic benefit of functional cosmetic ingredients because sustaining skin hydration and barrier defense is vital to maintaining healthy skin. Emollients, humectants (hyaluronic acid and glycerin, for example), and occlusives retain the moisture by protecting it from being lost and, thereby, hindering dryness, irritation, and untimely aging. This activity pertains to every type of skin and consumer category and thus a primary benefit to be incorporated into lotions, creams, serums, as well as makeups. With increasing worries regarding environmental stressors like pollution and extreme weather, the need for hydrating cosmetics continues to increase.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.1% |

| Australia | 6.7% |

| China | 5.9% |

| India | 7.7% |

The USA functional cosmetic ingredients market is growing because of an increase in awareness among consumers towards skincare wellness, anti-aging treatments, and natural beauty products. As a result of increasing demand for clean-label, organic, and dermatologist-recommended products, cosmetics are being made by brands using moisturizers, peptides, antioxidants, and botanical extracts to respond to changing demands. The push toward sustainability and cruelty-free formulas has also made the adoption of ethically produced ingredients more accelerated. FMI is of the opinion that the USA industry is set to observe 4.1% CAGR during the study period.

The growth of premium and indie beauty companies, combined with increased interest in personalized skincare treatments, also fuels industry expansion. Additionally, the power of social media and beauty influencers has increased consumer demand for high-performance cosmetic ingredients.

| Key Drivers | Details |

|---|---|

| Rising Demand for Clean Beauty | Increasing preference for natural, organic, and non-toxic ingredients in cosmetics. |

| Anti-Aging & Skin Health Focus | Growing consumer interest in anti-aging, hydration, and skin-repairing formulations. |

| Sustainable & Ethical Sourcing | Emphasis on environmentally friendly and cruelty-free ingredient sourcing. |

Functional cosmetic ingredients industry in the UK is fueled by the surge in personalized and dermatology-supported skin care. Consumers are increasingly turning to custom beauty solutions that target particular skin issues like sensitivity, hyperpigmentation, and aging. This has contributed to the increasing demand for customized products with peptides, plant extracts, and vitamins. Also, the growth of premium and indie beauty brands has promoted innovation in high-performance and multi-tasking skincare products. With increasing consumers focusing on efficacy and safety, brands are investing in science-driven ingredients, further driving industry growth in the UK

| Key Drivers | Details |

|---|---|

| Personalized & Dermatology-Backed Skincare | Personalized & Dermatology-Backed Skincare |

| Expansion of Premium & Indie Brands | Development of premium and indie beauty brands fueling innovation in functional ingredients. |

FMI states that the Australian industry is set to witness 6.7% CAGR during the forecast period. The Australian functional cosmetic ingredients market is expanding as a result of growing consumer interest in natural, sustainable, and high-performance skincare products. With the harsh climate and high UV levels in the country, there is a high focus on sun protection, hydration, and anti-aging products, which are driving the application of sunscreen agents, antioxidants, and peptides. Australia's clean beauty trend has also resulted in an increase in organic and green ingredients, with consumers preferring botanical extracts and plant-based products.

| Key Drivers | Details |

|---|---|

| High Demand for Sun Protection | Strongemphasison UV protectionbecauseofAustralia'sclimate and high sun exposure. |

| Rise of Clean & Sustainable Beauty | Growingconsumerinterestineco-friendly, plant-based, and cruelty-free cosmetics. |

FMI cites that the Chinese industry is projected to witness 5.9% CAGR during the study period. The Chinese industry is growing with increased disposable incomes that allow consumers to spend more on advanced, high-quality skincare and beauty products. An expanding middle class and growing purchasing power increase the demand for premium, anti-aging, and multifunctional cosmetics. Consumers are demanding scientifically formulated skincare solutions, thus there is growing usage of peptides, vitamins, antioxidants, and botanical extracts in beauty products.

| Key Drivers | Details |

|---|---|

| Rising Disposable Incomes | Higherspending on premium and scientificallyformulatedskincare products. |

| Demand for Anti-Aging & Whitening | Highconsumerdemandforskin-brightening and youth-revivingformulas. |

India's functional cosmetic ingredients market is growing with growing awareness among consumers for skincare, haircare, and personal hygiene. With more and more of the population growing into the middle class and growing urbanization, the demand is higher for premium, multi-tasking beauty products for various types of skin as well as varying climatic conditions. The impact of Ayurveda and herbal skincare has also fueled the adoption of natural and botanical extracts, in addition to contemporary functional ingredients such as peptides, antioxidants, and vitamins. Moreover, the thriving e-commerce and beauty influencer trends have made high-end and dermatologist-endorsed cosmetics more accessible, leading to innovation and industry expansion within India's beauty industry. FMI states that the Indian industry is projected to observe 7.7% CAGR during the forecast period.

| Key Drivers | Details |

|---|---|

| RisingAwareness of Skincare & Haircare | Increasingconsumerinterestinpersonal grooming and beauty care. |

| Ayurveda & Herbal Skincare Influence | Highdemand forplantextracts andconventionalherbalpreparations. |

The shifting trends in the functional cosmetic ingredient industry are triggered by consumers looking for multi-functional preparations that give them anti-aging, hydrating as well as UV protection benefits in a single product. Such growing consumer demand toward natural, organic, and eco-friendly ingredients has changed the competitive dynamics by forcing companies to adopt green chemistry, ethical sourcing, and biodegradable formulations.

Asia Pacific is showing a lot of promise for its growing middle class, increasing per capita consumption of personal care products, and demand for high-performance skincare solutions. Any company that invests in the development of sustainable production processes, renewable feedstocks, and cruelty-free formulations has a better competitive advantage. In addition, peptides, probiotics, as well as botanical extracts are vital for further distinction among players in the industry. The brands that can leverage the optimal balance between scientific innovation, compliance with regulatory regimes, and eco-conscious consumer demands will be best placed to succeed in this rapidly changing environment.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| BASF SE | 18-22% |

| Dow | 14-18% |

| Croda International | 12-16% |

| Evonik Industries AG | 10-14% |

| Ashland Inc. | 8-12% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | Develops advanced active ingredients, UV filters, and emulsifiers, focusing on sustainable and high-performance formulations. |

| Dow | Specializes in silicones, polymers, and conditioning agents that enhance texture, stability, and efficacy in cosmetic formulations. |

| Croda International | Pioneers plant-based bioactives and skin microbiome-friendly ingredients, supporting the clean beauty movement. |

| Evonik Industries AG | Innovates in biotechnology-driven and biodegradable cosmetic ingredients, catering to eco-conscious consumers. |

| Ashland Inc. | Focuses on botanical extracts, biofunctional actives, and anti-aging compounds, ensuring clinically proven skincare solutions. |

BASF SE (18-22%)

BASF is a global leader in cosmetic ingredients, delivering advanced skincare as well as haircare applications with an emphasis on sustainability and innovation.

Dow (14-18%)

Dow provides silicone and polymeric cosmetic solutions that enhance skin feel, stability, and long wear performance.

Croda International (12-16%)

Croda leads in green chemistry with biodegradable, plant-derived functional ingredients for cosmetics.

Evonik Industries AG (10-14%)

Evonik is the leader in fermentation-based and biotech-enhanced cosmetic actives as enablers of natural and eco-friendly skincare trends.

Ashland Inc. (8-12%)

Ashland is an important supplier of bioactive skincare ingredients and delivery systems focused on dermatology-supported formulations.

Other Key Players (25-35% Combined)

The industry is slated to reach USD 3.7 billion in 2025.

The industry is predicted to reach a size of USD 6.5 billion by 2035.

Key companies include BASF SE, Dow, Croda International, Evonik Industries AG, Ashland Inc., Connect Chemicals, The Good Scents Company, Stepan Company, Gattefossé, Lucas Meyer Cosmetics, Nouryon, Symrise, and Givaudan Active Beauty.

India, slated to grow at 7.7% CAGR during the forecast period, is poised for fastest growth.

Emollients and moisturizers are being widely used.

In terms of ingredient, the industry is divided into emollients and moisturizers, antioxidants, sunscreen agents, anti-aging agents, whitening agents, anti-inflammatory agents, peptides and proteins, botanical extracts, vitamins and minerals, and other ingredients.

With respect to application, the industry is classified into skin care products, hair care products, oral care products, makeup products, and other applications.

By function, the industry is segmented into moisturizing and hydrating, anti-aging and wrinkle reduction, sun protection, skin brightening and whitening, acne treatment and oil control, hair repair and nourishment, color enhancement and pigmentation, dental health and whitening, and other functionalities.

Regionally, the industry is divided into North America, Europe, Latin America, Asia Pacific, and the Middle East & Africa.

Foot Care Product Market Analysis by Product Type, Distribution Channel and Region Through 2035

POU Water Purifier Industry Analysis In MENA: Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.