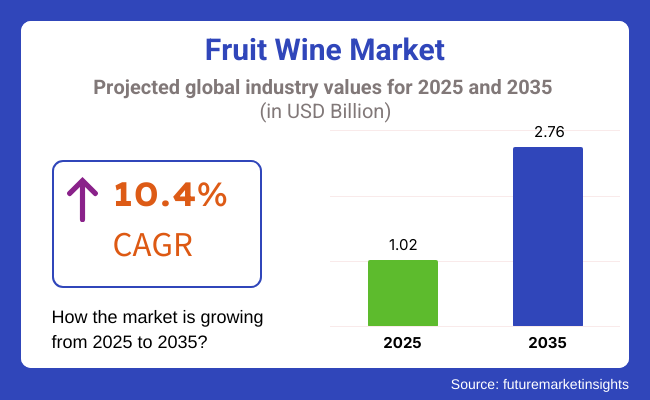

The fruit wine market is registering robust growth due to changing consumer preferences, health-conscious drinking habits, and increasing interest in artisanal and unconventional drinks. The market is projected to witness notable growth at a CAGR of 10.4% during the forecast period. The market is expected to exceed USD 1.02 billion by 2025 and over USD 2.76 billion by 2035, indicating a continuation of global demand for novelty fruit-based wines.

Fruit wines have received positive attention for simple fruit freshness, antioxidant content, etc. Popularity of fruit wines are rising among millennials and Gen Z consumers. These populace who have a preference for diverse and locally sourced wines, helping to drive growth in this segment. The locavore movement has also only added to the appeal around fruit wines, and consumers both want sustainable, small-batch, and regional varieties out there.

Regionally, the market has been led by North America, with the United States witnessing accelerated growth with the growing popularity of natural and orange wines. Germany (9.5% and Australia (8.5%) are also significant markets, highlighting a trend toward fruit-infused and non-traditional wine offerings. Wineries from these areas have been cashing in on this trend as by releasing limited edition fruit wines and by partnering with chefs and influencers to create exclusive premium products.

In order to accommodate shifting consumer palates, leading wine brands, as well as up-and-coming players, are shaking things up with novel flavors and production methods. Another example is Accolade Wines, which in 2023 expanded its Jam Shed brand with a new range of fruit-infused wines, responding to increasing interest in more premium, more approachable options than traditional grape wines. Expect this trend of innovation to continue, with brands harnessing the power of digital marketing and influencer partnerships, as well as sustainable sourcing, to connect with the new generation of wine lovers.

Since the market continues to strengthen and adapt to what consumers are looking for, fruit wine producers seem to have plenty of potential to reach more people and add some new products to their lines. As the segment has begun to gain real mainstream traction, the next 10 years are likely to see even further diversification and premiumization across the fruit wine category.

Explore FMI!

Book a free demo

Wineries and beverage companies identify their targetted consumers with these features-health-conscious consumers with unique fruit-based blends, showing acceptance of natural ingredients, and sustainable initiatives. Retail and e-commerce platforms such as Amazon are significant factors in increasing accessibility, giving consumers access to a wider variety of products while often providing the convenience of online sales.

To stay in sync with changing tastes, restaurants and bars add fruit wines to their lists. They even showcase food pairings and seasonal selections to improve customer experience. Fruit wines catch the attention of event organizers, as they are used when hosting events and celebrations like birthdays or anniversaries while emphasizing the long-held notion attached to grapes; grapes aren't an everyday sight; hence, original grape wineries provide cult or class.

The health and wellness trends also drive demand by promoting organic, low-sugar, and preservative-free fruit wines. In line with their expectations, brands focus on clean-label ingredients and eco-friendly packaging. With more businesses coming up, firms need to position themselves differently and create a unique value proposition, elaborate on it, create an identity, and ensure adherence to it, thus giving birth to branding, storytelling, and experiential marketing.

During 2020 to 2024, the fruit wine market expanded as consumer demand for flavored, low-alcohol, and organic beverages increased. Wineries introduced exotic fruit blends, canned packaging, and sustainable production methods to attract health-conscious buyers. Online sales and subscription models grew, while North America and Asia-Pacific saw rising demand. Regulations are tightening for transparency, labeling for organic certification, and control over alcohol content.

Stricter sustainability rules and carbon footprint labels will mold production and marketing. Beverage majors also acquire smaller brands to diversify their range, and the other part of the consumption growth will happen in new markets such as Latin America and Africa. The second phase of the industry growth and product acceptance will be creating innovation in flavor, eco-friendly packaging, and sales online - an approach that would make fruit wine accessible, attractive, and relevant for the global consumers.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 (Projections) |

|---|---|

| New fermentation techniques and exotic fruit blends emerged. | AI-driven fermentation and biotech-enhanced yeasts will improve production. |

| Low-alcohol and organic fruit wines gained popularity. | Personalized flavors and enhanced preservation methods will expand. |

| Canned and single-serve packaging grew in demand. | Smart packaging with traceability features will become mainstream. |

| Regulations focused on labeling transparency and organic certification. | Stricter health and sustainability mandates will be enforced. |

| Support for eco-friendly production increased. | Carbon footprint labeling and stricter advertising policies will develop. |

| Alcohol content regulations varied by region. | Evolving e-commerce and direct-to-consumer policies will shape sales. |

| Craft wineries and startups gained market presence. | Major beverage companies may acquire niche fruit wine brands. |

| Online sales and subscription models expanded. | Market consolidation and digital marketing strategies will drive growth. |

| North America and Asia-Pacific saw rising demand. | Emerging markets in Latin America and Africa will experience higher adoption. |

| Sustainability and organic trends gained traction. | Eco-friendly sourcing and sustainable packaging will become a standard. |

| Health-conscious consumers preferred low-alcohol fruit wines. | Sugar-free and functional fruit wines will see increased demand. |

| Direct-to-consumer sales and digital marketing strategies grew. | E-commerce platforms and subscription models will dominate sales. |

| Premiumization and customized flavors emerged. | High-quality, limited-edition fruit wines will attract niche consumers. |

The fruit wine market is witnessing growth due to the increasing consumer inclination for flavored, low-alcohol, and organic beverages. On the other hand, production at salaries recently calmed to reach quality fruits and fermentation processes, which are a financial burden. In order to sustain in the competitive landscape, organizations strive for efficient production, responsible sourcing, and continual innovation.

Changing consumer tastes and health trends-the current focus on plant-based protein-pose the risk of product obsolescence. These companies should offer functional ingredients, exotic flavors, and customized solutions. Supply chain disruptions - including erratic fruit harvests, climate change’s impact, and logistics issues - can affect production and pricing.

Business investments that can help reduce risk include diversifying sources of supply, cold-storage solutions, and partnerships with local suppliers. Businesses have to spend money to meet regulatory needs - it could be regulatory requirements to meet stricter labeling requirements, alcohol content regulations, or sustainability mandates.

Strawberry, blueberry, raspberry, and other berry-based fruit wines are forecasted to dominate the market in 2025 because of their exquisite taste, as well as their antioxidant properties. Growing consumer inclination toward nontoxic and healthy-enriching alcohols and the perception of berry wines being less aggressive to health as compared to grape wines are offering new horizons for the growth of the berry wines market.

This is attributed to many craft wineries creating eclectic mixtures of berry blends, producing interesting types of fruit wines that have a younger target audience. Also, interest in berry-based options has been spurred by the rise of organic and low-sugar wines.

The popularity of these types of wines can also be attributed to their versatility with different types of cuisines, leading to a favorable representation in restaurants and retail outlets. As there is a trend for premiumization and flavored wines, berry-based fruit wines are anticipated to capture sustainable demand due to rising product innovation capabilities and marketing efforts.

In 2025, the supermarkets and hypermarkets segment is anticipated to hold the highest fruit wine market share, owing to the convenience of the one-stop shopping experience at these outlets. In addition, consumers are increasingly opting for retail stores to purchase their fruit wines, where they can see the options available and take advantage of promotional offers.

Supermarkets across a larger range of customers, giving way for both established and emerging brands to showcase their products. Retailers are responding to rising demand for fruit wines by expanding their selections to include organic and regionally produced options, according to changing consumer preferences.

Supermarket groups also work closely with winemakers to understand in-house exclusive labels that enhance competitive pricing and consumer interest. The increasing number of specialty craft beverage sections at big box stores has also elevated fruit wine visibility. This will also ensure supermarkets and hypermarkets are an integral part of the path to market and brand penetration.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

| UK | 6.9% |

| France | 6.5% |

| Germany | 7.1% |

| Italy | 6.4% |

| South Korea | 7.3% |

| Japan | 7% |

| China | 7.5% |

| Australia | 6.8% |

| New Zealand | 6.2% |

The fruit wine market in the USA is expected to expand at a CAGR of 7.2% over the next 10 years. This growing trend stems from rising consumer preference for natural & craft drinks, combined with growing health awareness. Many consumers are leaning toward fruit alternatives like berry, apple, and tropical fruit wines because they are lower in alcohol and filled with antioxidants.

Wineries are capitalizing on this trend and broadening portfolios by introducing premium and organic fruit wines while also catering to sustainability-conscious consumers. E. & J. Gallo Winery and Oliver Winery are among the industry leaders pushing the market forward with cutting-edge offerings. In addition to DTC increase the rises of these e-commerce platforms also significance’ growing the access to the market.

The UK fruit wine market is anticipated to register a 6.9% CAGR between 2025 and 2035. This growth is attributed to an increase in consumer preferences for craft alcohol beverages and flavor innovations. At British wineries, elderberry, rhubarb, and gooseberry are among the ingredients being trialed to create drinks for a market that prizes artisanal and locally sourced.

This aligns with the farm-to-table movement and growing interest in sustainable production methods, both contributing to the growth of the market. Fruits wines should be marketed as a lighter and more refreshing product range compared to the heavier grape wines, which can be a reason why they are being adopted by younger generations as well as the health-conscious people.

France, traditionally a grape wine-dominated country, is experiencing an increasing demand for fruit wines, which is anticipated to grow at a CAGR of 6.5% from 2025 to 2035. This is driving some market growth as the cider culture and fruit-based wines gain popularity, especially among younger and health-conscious drinkers.

Producers like Château de Brissac are raising the quality of fruit wines with expensive production methods. Fruit wines are also hitting the gourmet pairings and luxury hospitality options, which are nudging them further up the acceptance ladder of the somewhat snooty French wine culture. This trend has also caught international eyes and increased the possibility of exporting products.

Germany is projected to be growing at a CAGR of 7.1% during the forecast period. GermanyTo determine Consumer Preferences for Wine, N.wine is well represented in the German market, and there is a long-standing tradition of fruit wines (Obstwein) in the country. Still, consumers are increasingly interested in natural and fermented beverages, which is leading to a resurgence.

Wines made from cherry, plum, and apple are quickly making their way into the hearts and mouths of a health-conscious replacement alcohol-consuming population. Sustainability initiatives and a robust export market have strengthened Germany’s place in the international fruit-wine market. Local wineries are also taking advantage of cutting-edge fermentation skills and organic farming to produce excellent quality fruit wines suitable for domestic and even global consumers.

The fruit wine industry in Italy has a projected CAGR of 6.4% from 2025 to 2035. Italy has a long history of making wine. Still, it is diversifying into styles made from fruit, such as peaches and cherries, especially in well-known production areas such as Tuscany and Sicily.

Additionally, consumers are embracing low-intervention beverages, and the rising prevalence of organic and biodynamic farming is supporting market expansion. Producers are focusing on varieties like peach, fig, and berry-based wines to appeal to a segment that wants something other than traditional grape wines. Italy’s robust tourism industry is enabling local fruit winemakers to draw overseas consumers to wine tastings and agritourism offerings.

A major contributor to industry growth is craft alcohol and the low-alcohol beverage trend. Regular rice wine (makgeolli) led the way to fruit-infused variants, and winemakers offered blueberry, yuzu, and plum wine to match changing consumer tastes.

This demand has been further supplemented in the restaurant and retail space owing to the rising trend of pairing fruit wines with Korean cuisines. The spread of online alcohol sales and aggressive marketing campaigns are also driving the fruit wine boom in South Korea.

Wine producers from these established fruit-growing regions, such as Yamanashi, are ramping up their premium and health-oriented offerings. Peaches, plums, and yuzu are the main fruits aimed at consumers who enjoy lighter, refreshing alcoholic drinks.

Exports are also growing: Japanese fruit wines are starting to find favor in the international market. Tourism-induced consumption is also contributing to market growth, particularly in fruit-producing regions where tourists are interested in trying local beverages, which further drives market growth.

China’s fruit wine market is expected to grow at a CAGR of 7.5% over 10 years from 2025 to 2035. India’s increasing disposable income and middle class are fueling demand for premium and high-quality beverages. The local production of lychee, longan, and hawthorn fruit wines is on the rise, with enterprises employing modern fermentation processes to improve product quality.

Market growth is further propelled by the rising influence of health fads and traditional Chinese medicine (TCM), which recommends fruit-based alcoholic beverages. Moreover, as digital marketing and e-commerce channels develop, they improve accessibility to fruit wines, making it easier for consumers, or “fruit wine lovers,” to purchase them from any part of China.

Australia is predicted to grow at a 6.8% CAGR from 2025 to 2035 in fruit wine sales. The market is expanding thanks to the emergence of boutique wineries and the growing willingness of drinkers to try exotic fruit wines such as mango, passionfruit, and berry varieties.

The increasing demand for both agritourism and wine tourism is essential in driving the market as consumers look for unique, locally produced wine offers. Quality demand for organic and preservative-free fruit wines also leads winemakers to create new wines with sustainable production techniques. Coupled with solid domestic consumption and export growth, these factors have overtaken Australia in the world fruit wine industry.

The country’s abundant agriculture and experience making wine are also propelling growth in fruit-based wines, from apple to feijoa to berry varieties. Market growth is also being fueled by rising global demand for craft and sustainable beverages.

By concentrating on premium branding and high-quality production techniques, New Zealand is further enhancing its reputation in both international and domestic markets. Evolution in the taste of discerning consumers is aiding stable market growth. Wine lovers, especially, are becoming aware of fruit wines, which aids in the steady growth.

The fruit wine market is highly fragmented, with few major players and many small and medium-sized players operating in the market. These are driven by variables like entry costs, regulatory barriers, funding access, tastes, and preferences. Although fruit wine production facilities require an initial investment in equipment and licensing, this sector is often more available than traditional grape wine production, as many producers are capable of using locally available fruits.

In Maharashtra, India, grape wine producers benefitted from large government incentives. In contrast, fruit wine producers were being taxed heavily on excise duties and did not receive such incentives, resulting in some businesses shutting down or consolidating the market space.

Access to funding is yet another important factor, as smaller producers often find it difficult to raise financing to scale and grow. In contrast, larger companies with access to better capital can acquire a larger share of the market.

Also, a rising consumer trend towards local and handmade beverages has benefited a larger number of fruit wine producers, further increasing the fragmentation of the industry. Nevertheless, there is stiff competition from other alcoholic drinks, such as craft beer and ciders, affecting the market share among the players.

Collectively, the fruit wine market continues to be quite fragmented with relatively low entry barriers, gold consumer opportunities for niche products, the variable interpretation of legalization, and regulatory challenges are localized to certain regions and, as such, could induce consolidation in some of those regions where fruit wines are capital intensive to produce.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| E. & J. Gallo Winery | 20-25% |

| The Wine Group | 15-20% |

| Constellation Brands | 12-17% |

| Treasury Wine Estates | 8-12% |

| Castel Group | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| E. & J. Gallo Winery | Leading producer of fruit-based wines, including innovative blends and organic options. |

| The Wine Group | Offers a variety of affordable and premium fruit wines with a strong global distribution. |

| Constellation Brands | Focuses on high-end and specialty fruit wines, along with strategic acquisitions of premium brands. |

| Treasury Wine Estates | Specializes in luxury and mid-tier fruit wines with a strong focus on brand heritage. |

| Castel Group | One of Europe's largest wine producers, offering a mix of traditional and modern fruit wine styles. |

Key Company Insights

E. & J. Gallo Winery (20-25%)

A global leader in fruit wine production, known for its extensive portfolio and innovation in flavors. Strong branding and distribution drive its market dominance.

The Wine Group (15-20%)

Known for producing accessible and widely distributed fruit wines, with a strong presence in retail chains.

Constellation Brands (12-17%)

Focused on premium fruit wines and strategic expansion through acquisitions, targeting high-end consumers.

Treasury Wine Estates (8-12%)

A significant player in the fruit wine industry with a focus on heritage brands and international market expansion.

Castel Group (5-9%)

A well-established European producer offering a mix of traditional and modern fruit wine varieties.

Other Key Players (30-40% Combined)

The industry is expected to generate USD 1.02 billion, driven by rising consumer demand for alternative and craft alcoholic beverages.

The market is projected to experience steady growth worth USD 2.76 billion, fueled by increasing interest in organic and locally produced wines, as well as expanding distribution channels.

Key players include E. & J. Gallo Winery, The Wine Group, Constellation Brands, Treasury Wine Estates, Castel Group, Bronco Wine Company, Accolade Wines, Pernod Ricard, Kendall-Jackson Vineyard Estates, and Vina Concha y Toro.

North America and Europe present strong growth opportunities due to increasing consumer preferences for craft and fruit-based alcoholic beverages. The Asia-Pacific region is also emerging as a key market, particularly in countries with a rising demand for premium and flavored wines.

Berry-based and apple-based wines dominate the industry due to their widespread availability and consumer preference for natural and flavorful wine alternatives. The growing trend toward organic and low-sugar fruit wines is further shaping the market.

The industry includes supermarkets & hypermarkets, specialty liquor stores, online retail, and direct-to-consumer sales.

By application, the industry is categorized into household consumption, restaurants & bars, and special events & gifting.

By type, the industry covers apple wine, berry wine, citrus wine, and other fruit-based wines.

By region, the industry spans North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa (MEA).

A Detailed Analysis of Brand Share Analysis for Herbs and Spices Industry

A detailed analysis of the Australia Bakery Ingredient Market and growth outlook covering product type, and application segment

USA Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

UK Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Herbs and Spices Market by Product Type, Form, End Use, and Country through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.