The global fruit snack market is quite moderately fragmented in terms of competition and sales with General Mills, Kellogg Company, Welch's, Kraft Heinz Company, and Bare Snacks sharing 51.4% of the total market. After such company brand recognition, the strong hold in retail, and continuous product innovations, the remaining 48.6% market share is controlled by mid-tier and start-up players, revealing further fragmentation in the niche and organic fruit snack segments.

General Mills makes the largest contribution to fruit snacks sales with 16.8% of total share supported mainly with Sugar Roll-Ups, Fruit by the Foot, and Mott's fruit snacks in the classes dealing with children's snack categories and convenience-based consumption.

Kellogg Company, with 12.4%, markets other fruit snack products under Nutri-Grain and Stretch Island brands, aimed toward health-conscious consumers and functional fruit-based snacks. Welch's 9.7% is particularly strong in fruit-flavored gummy snacks fueled by its heritage with fruit products and association with 100% real fruit ingredients. The remaining 48.6% of the market is held by mid-tier and emerging brands including SunOpta, Sunkist Growers, Seneca Foods Corporation, Mount Franklin Foods, and Crispy Green Inc.

Explore FMI!

Book a free demo

| Market Structure | Top 5 Leading Brands |

|---|---|

| Industry Share (%) | 51.4% |

| Key Companies | General Mills, Kellogg Company, Welch’s, The Kraft Heinz Company, Bare Snacks |

| Market Structure | Mid-Tier & Regional Players |

|---|---|

| Industry Share (%) | 30.6% |

| Key Companies | SunOpta, Sunkist Growers, Seneca Foods Corporation |

| Market Structure | Specialty & Emerging Brands |

|---|---|

| Industry Share (%) | 18.0% |

| Key Companies | Mount Franklin Foods, Crispy Green Inc, other niche brands |

The fruit snacks market is moderately fragmented, with the top five companies controlling 51.4% of the industry, while 48.6% is held by mid-tier, regional, and niche brands.

The sweetened fruit snacks segment leads with 45.6%, with fruit-flavored gummies, fruit strips, and coated fruit snacks being the most consumed. General Mills and Welch's have the majority share in the segment, providing gummy-type and sugar-enhanced fruit snacks aimed at children and convenience snacking.

Unsweetened fruit snacks make up 29.8% and are driven by the demand for natural, no-added-sugar products. Bare Snacks and SunOpta are growing in the clean label baked fruit and natural dried fruit space targeting health-conscious consumers.

Freeze-dried fruit snacks account for 17.2%, with innovators Crispy Green Inc. and Seneca Foods Corporation introducing light, crispy, and convenient options of freeze-dried whole fruits and fruit chips. Other fruit snacks occupying 7.4% of the market include fruit rolls and fruit puree-based snacks, with brands like Kellogg's and Kraft Heinz testing innovative formats and functional fruit-based snacks.

Strips are the market leaders at 31.2% with General Mills (Fruit Roll-Ups, Fruit by the Foot) and Kellogg's (Nutri-Grain Fruit Strips) boosting growth of this convenient and easy-to-carry format. Shaped pieces hold 28.4% mainly because of fruit gummies and bite-sized dried fruit products; Welch's holds this category with its fruit-shaped gummies made from real fruit purees.

Bars share 21.5% with Bare Snacks and Sunkist Growers aimed toward consumers looking for high fiber fruit-based snack bars. Dried whole fruits account for 12.3%, with companies such as Crispy Green Inc. and Seneca Foods Corporation growing in the markets of freeze-dried and dehydrated fruit snacks. Rolls account for 6.6%, sustaining a niche among children and convenience-seeking snackers, and is led by General Mills' Fruit Roll-Ups.

The fruit snacks market in 2024 was marked by innovations around sugar-free formulations, plant-based ingredients, and freeze-dried fruit snacks, as companies began catering to evolving consumer preferences for natural, clean-label, and functional fruit snacks.

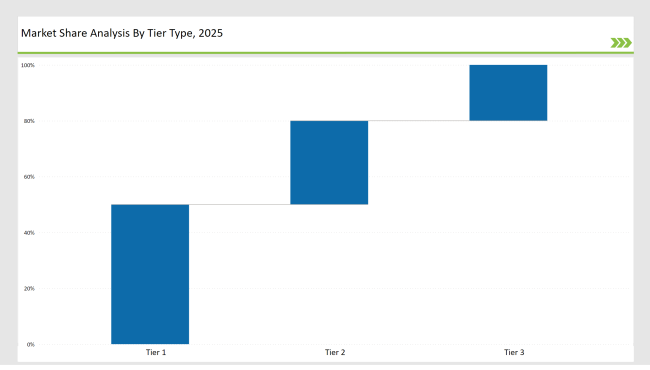

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 50% |

| Example of Key Players | General Mills, Kellogg Company, Welch’s, The Kraft Heinz Company, Bare Snacks |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 30% |

| Example of Key Players | SunOpta, Sunkist Growers, Seneca Foods Corporation |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 20% |

| Example of Key Players | Mount Franklin Foods, Crispy Green Inc, other emerging fruit snack brands |

| Brand | Key Focus |

|---|---|

| General Mills | Launched no-sugar-added Fruit Roll-Ups, targeting health-conscious consumers. |

| Kellogg’s | Expanded Nutri-Grain fruit bars with added fiber and probiotics. |

| Welch’s | Introduced sugar-free fruit gummies with natural sweeteners. |

| The Kraft Heinz Company | Developed plant-based gelatin-free fruit snacks for vegan and vegetarian consumers. |

| Bare Snacks | Launched freeze-dried tropical fruit blends, targeting premium snack consumers. |

| SunOpta | Strengthened organic fruit snack production, expanding into new retail partnerships. |

| Sunkist Growers | Introduced multi-fruit snack packs with functional ingredient blends. |

| Seneca Foods Corporation | Expanded freeze-dried fruit offerings into mainstream retail chains. |

| Mount Franklin Foods | Grew e-commerce presence, enhancing direct-to-consumer fruit snack sales. |

| Crispy Green Inc. | Partnered with functional beverage brands for snack-beverage combo packs. |

Freeze-dried fruit snacks will still be the go-to category in explicitly enticing consumers with beautiful lightweight, nutrient-dense, minimally processed snacks since their needs are strongly leading towards that direction. In terms of skilling up production and diversifying into new fruit varieties, feedback is expected from brands such as Crispy Green Inc. and Seneca Foods Corporation. Other investments will include advancements in air-drying techniques to produce texture-retaining and flavor-retaining fruit without preservatives.

Over the next five years, the market will see significant impetus toward biodegradable, compostable, and recyclable packaging. Bare Snacks and SunOpta are setting sustainability standards within the sustainability push, with ethical sourcing of fruit ingredients through fair-trade partnerships becoming a key differentiator for brands to attract eco-conscious consumers.

The next generation of fruit snacks will be about fruit melding with nuts, seeds, and plant proteins to create hybrid functional snacks. With this innovation, athletes, consumers with active lifestyles, and snackers who focus on protein content will be targeted. Kellogg's and Mount Franklin Foods are already on their way to producing such innovations with their introduction of protein-infused fruit bars and fruit-nut blends. Such creation is expected to be popularized this year.

The fruit snacks market is moderately fragmented, with the top five players controlling 51.4% of the industry, while 48.6% is held by mid-tier and specialty brands focusing on organic, sugar-free, and functional fruit snacks.

Brands like SunOpta, Crispy Green Inc., and Mount Franklin Foods focus on freeze-dried fruit snacks, organic certifications, and functional ingredient innovations, appealing to health-conscious consumers.

Brands are investing in functional ingredients such as probiotics, fiber, protein, and superfoods to enhance nutritional benefits. Kellogg’s and Welch’s have expanded their functional fruit snack offerings, while Bare Snacks is leading in freeze-dried product innovation.

Consumers are prioritizing sustainable packaging and ethically sourced ingredients. Companies are investing in biodegradable materials, carbon-neutral production, and organic certifications, with SunOpta and Bare Snacks leading in sustainable practices.

Organic and plant-based fruit snacks are gaining market traction, with brands like Sunkist Growers and The Kraft Heinz Company developing vegan, gelatin-free fruit snacks. Plant-based gelatin alternatives are becoming a major innovation area.

Challenges include balancing taste and health-conscious formulations, rising raw material costs for organic fruit ingredients, regulatory compliance for health claims, and competition from private-label snack brands. Companies are overcoming these challenges by investing in product innovation, clean-label formulations, and premium pricing strategies.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.