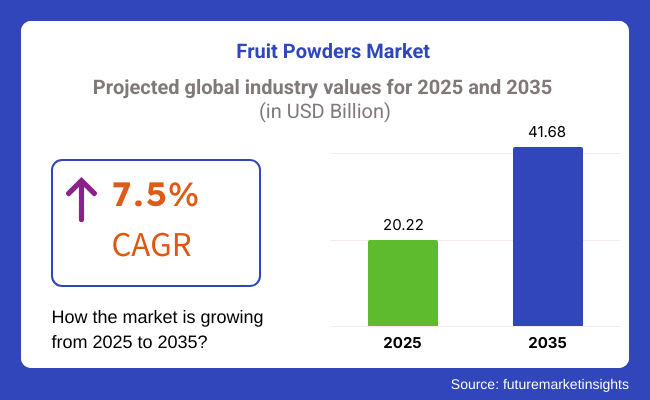

The global fruit powders market is predicted to increase from USD 20.22 billion in 2025 to USD 41.68 billion by 2035, at a compound annual growth rate of 7.5% during the forecast period.

Increasing consumer demand for natural, minimally processed ingredients is having a major impact on these market dynamics, and fruit powders are preferred as a natural substitute for synthetic flavoring agents and preservatives in the food and beverage industry.

Across industries as diverse as confectionery, snacks, dairy products, and nutraceuticals, manufacturers are ramping up production capabilities to meet surging demand for fruit powders. In the process of transforming fruits into fruit powder, firms are adopting advanced drying technologies like spray-drying and freeze-drying, which help the company achieve better nutrient retention and shelf life.

This position of fruit powders has been bolstered by their ability to deliver natural taste, color, and nutritional benefits without requiring artificial additives. The competitive dynamics are reshaping due to consumer demand for clean-label products.

Fruits have been quickly integrated into food and beverages and have become popular in the healthy food category, as health-conscious consumers are looking for fruit-based products without synthetic preservatives, which is expected to boost the demand for both organic and non-GMO fruit powders. Manufacturers are meeting demand with organic-certified fruit powders and partnerships with sustainable farming initiatives for ethical sourcing.

Some regional players are gaining momentum by selling local fruit powders that cater to Indigenous taste profiles and eating habits. Global manufacturers, however, are developing exotic fruit powder blends as well as functional formulations, as well as fortified variants that contain the addition of probiotics or collagen. Rising acceptance of fruit powders, especially in plant-based and vegan formulations, is further promoting market growth.

It is a crucial part of the competition with brands that highlight green packaging, waste in fruit processing, and cases of surplus or ugly fruit being used to make quality powders. Companies that invest in innovation, sustainability, and clean-label formulations will most likely continue to dominate the industry as consumer preferences change.

Explore FMI!

Book a free demo

According to the fruit powders industry, which is going through an immense growth curve, the rise in demand for natural, plant-based ingredients by companies of all ilk has led to its expansion.

The food and beverage sector appears to be at the forefront of this trend, with fruit powders being used for flavor enhancement, natural coloring, and nutritional enrichment, and the demand for organic and clean-label products is high. These powders, typically consumed in functional foods and supplements, are popular in the nutraceutical sector, and vitamins and antioxidants are abundant in these foods.

Fruit powders are considered natural skin-care products and provide hydration and antioxidants, making them a valuable addition to cosmetics and personal care items. Home appliance settings, on the other hand, are experiencing a shift in consumer preferences as convenient and long-lasting fruit-based products for easy popularity in smoothies, baking, and meal prep among molders are now being rolled out in the form of powder products.

The innovations in the spray-drying and freeze-drying processes caused these fruit powders to become better products, with their quality, shelf life, and usability being mentioned, thus propelling sales further.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and the current year (2025) for the global fruit powders industry. This analysis highlights key shifts in performance and revenue realization patterns, offering stakeholders a clearer understanding of the growth trajectory.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 7.1% |

| H2 (2024 to 2034) | 7.5% |

| H1 (2025 to 2035) | 7.2% |

| H2 (2025 to 2035) | 7.7% |

The first half of the year, H1, spans from January to June, while the second half, H2, includes the months from July to December. During the first half of the decade (2025 to 2035), the industry is expected to grow at a CAGR of 7.1%, followed by an increase to 7.5% in the second half.

As the period progresses, the industry is projected to exhibit a CAGR of 7.2% in H1 and maintain a steady growth rate of 4.4% in H2. This growth pattern reflects an overall increase of 10 BPS in H1, while H2 records an additional 20 BPS, indicating a stable expansion of the industry.

Growth in the fruit powders industry was particularly robust between 2020 and 2024 as consumers placed greater emphasis on natural, clean-label, and functional food ingredients. The increased trend towards health-conscious diets and food consumption contributed to the hastened application of fruit powders in beverages, snacks, and nutritional supplements.

Artificial intelligence and large data aided the manufacturers in pinpointing popular fruit flavors and refining production methods to optimize taste, texture, and preservation of nutrients. Freeze-drying and spray-drying technology was extensively embraced to extend shelf life and ensure nutrition retention. However, expensive production, inconsistency of raw materials, and clear supply chain situations were the most challenging.

Preservation and bioavailability of nutrients will be enhanced through quantum-powered molecular analysis. Blockchain-enabled supply chains will increase traceability and remove supply fraud. Solar drying and green packaging will minimize the environmental footprint.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing demand for natural, plant-based, and clean-label foods | Hyper-personalized blends of fruit powder with functional health benefits |

| AI-powered insights for creating trending flavors and maximizing nutrient retention | Quantum-enabled molecular analysis for enhanced bioavailability and flavor accuracy |

| Raw material sourcing issues and price volatility | Blockchain-enabled transparent sourcing and fraud protection |

| Embracing sustainable packaging and energy-efficient drying technologies | AI-enabled carbon-neutral production with renewable energy sources |

| Compliance with food safety and natural ingredient labeling laws | Automated, AI-enabled compliance and real-time safety tracking |

| AI and big data for flavor trend forecasting and manufacturing optimization | Edge AI and real-time processing for greater production efficiency |

| Increased demand for nutrient-rich, functional fruit powders | Greater health benefits with the inclusion of probiotics, adaptogens, and vitamins |

The fruit powders industry is facing different types of risks, such as price volatility of raw materials, disruptions in the supply chain, and regulatory challenges. Extreme climate change and irregular weather lead to variances in fruit harvests, resulting in scarcity and price hikes.

Another big problem is quality control. Contamination from pesticides and improper drying or storage conditions inevitably come with health problems and product recalls. This adds a level of compliance due to strict food safety regulations and certifications that must be met. Noncompliance may result in damage to a company's brand image and lawsuits.

And the volatility of consumer preferences and competition adds an extra level of risk. The demand for clean-label products and organic products is rising; hence, it will be necessary for the companies to accept change and offer only additive-free and organic natural powders. Otherwise, sooner or later, the share is going to be lost to competitors who innovate new products, such as functional and fortified fruit powders.

There are also logistics and distribution risks that affect steadiness. Industry instability is also due to product quality, which includes temperature-sensitive temperature and transportation, as well as product quality if the product sacrifices quality in order to supply big raw materials, and also depending on the global supply chain, such as trade restrictions or a rise in fuel costs, which can increase operating costs and reduce profit margins.

| Countries | CAGR (2020 to 2035) |

|---|---|

| The USA | 3.7% |

| Japan | 3.3% |

| China | 1.5% |

| Germany | 7.0% |

| Australia | 9.8% |

FMI is of the opinion that the USA industry is slated to grow at 3.7% CAGR during the study period. Growth is propelled by the demand for natural and convenient food, which is induced by consumers' increasing health awareness and a well-established food processing industry in the country.

Mass food producers add powders to soft beverages, baked goods, and dietary supplements to address the growing trend toward clean-label products. The trend toward plant-based eating and organic foods adds to the demand.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Health-conscious consumers | Customers opt for natural ingredients and shy away from artificial additives, thereby fueling demand. |

| Powerful food processing industry | The USA boasts a developed food sector and extensive use and innovation in fruit powder use. |

| Clean-label movement | Consumers favor less processed and labeled products, increasing the use of fruit powder. |

| Greater intake of functional foods | Companies utilize these powders in functional food items like energy drinks and health supplements. |

FMI is of the opinion that the Japanese industry is slated to grow at 3.3% CAGR during the study period. Consumers look for functional and health-oriented foods extensively, and thus, the market has incorporated these powders in health beverages, confectionery, and nutraceuticals.

Older people need easy and nutrient-dense foods, thereby driving the demand for these powders as the ideal ingredient. Japanese firms concentrate on product innovation, using rare powders in conventional sweets and drinks.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Functional food demand | Japanese consumers are looking for food with improved health benefits, thus increasing demand. |

| Demographic trend: aging population | Seniors are looking for convenient, healthy options and are increasing their consumption of these powders in supplements. |

| Product development innovation | Companies launch new uses of these powders in conventional and innovative foods. |

| High-quality food standards | Japan's rigorous food safety laws promote the use of high-quality powders. |

FMI is of the opinion that the Chinese industry is slated to grow at 1.5% CAGR during the study period. Urbanization and increasing disposable income have transformed food trends, with increased consumption of healthy and convenient foods.

There is a cultural practice of preferring the use of fruits for their health benefits and favoring the addition of fruit powder to functional foods and nutraceuticals. The growing consumer industry of the middle class and increasing demand for food safety also encourage more use of fruit powders in foods and beverages.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Urbanization and lifestyles | Urban residents need healthy and quick food, which increases the sales. |

| Impact of traditional medicine | Consumption of fruit for health is promoted by traditional Chinese medicine, thereby facilitating the consumption. |

| Emerging middle class | More people can afford to buy good-quality food products, which results in more demand for fruit powder. |

| Food safety awareness | More concern about the quality of food raises demand for good-quality, natural powders. |

FMI is of the opinion that the industry is slated to grow at 7.0% CAGR during the study period. German consumers are looking for organic and green products, and hence, the demand for natural powders is high.

Germany's industry for organic foods is highly developed and is enthusiastically involved in adding powders to snacks, drinks, and dietary supplements. Increasing veganism and plant-based lifestyles also favors growth.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| High demand for organic foods | German consumers favor naturally and sustainably processed powders. |

| Growing vegan and plant-based food | These powders are crucial in plant-based food innovation. |

| Food technology industry | Companies utilize new processing methods to improve the quality of these powders. |

| High expenditure by consumers on healthy foods | German consumers spend money on high-quality dietary supplements and natural foodstuffs. |

FMI is of the opinion that the Australian industry is slated to grow at 9.8% CAGR during the study period. Australia possesses a successful health and well-being sector, fueling robust demand for organic food products, smoothies, and supplements.

Demand is also spurred by consumers' active uptake of clean-label and plant-based options. Additionally, Australia's successful agribusiness sector guarantees a secure supply of quality, locally sourced powders.

Growth Factors in Australia

| Key Drivers | Details |

|---|---|

| Growth in the health and wellness market | Healthy food solutions are popular with consumers, supporting the sale of fruit powder. |

| Plant-based diet trend | Australians prefer plant-based and clean-label offerings, supporting industry growth. |

| Robust agricultural industry | Local production of quality fruits meets the domestic fruit powder market. |

| Growing premium food market | Consumers are looking for premium, organic, and functional food, which propels innovation in fruit powders. |

| Segment | Value Share (2025) |

|---|---|

| Blueberry Powder (By Product Type) | 20% |

In terms of the powder produced from tropical fruits like mango in the paprika powder market, the global fruit powder market is divided into strawberry, blackberry, black currant, raspberry, blueberry, peach, apple, pear, apricot, plum, and others, where nutritional benefits and flavour preferences drive the flavour across food and beverages applications.

Blueberry powder now represents over 20% of the global market, driven by its superfood status. It is used in nutraceuticals, functional foods, and beverages, as it is rich in antioxidants, polyphenols, and vitamins C & K. Common applications include dietary supplements, smoothies, protein bars, health drinks, and baked goods.

These processes, freeze-drying, and spray-drying, help to preserve its nutrient profile and boost shelf stability. Demand is driven by North American and European markets, led by the clean-label and organic food movement. Top suppliers such as Kanegrade, FutureCeuticals, and NutraDry supply blueberry powder and offer organic and conventional versions.

The peach powder has started to gain a foothold as it is naturally sweet and nutrient-rich, and it provides vitamins A & C, fiber, and antioxidants to consumers' bodies for immunity and digestive health. This has fuelled its adoption in instant drink mixes, dairy alternatives, confectionery, and baby food.

Functional drinks and bakery products are becoming more popular in the southern market, including Asia-Pacific and Europe. The segment is primarily driven by players such as Paradise Fruits, BATA Food, Van Drunen Farms, etc., who are catering to "premium" peach powder. Freezing and spray-drying blueberry powder, like several others, helps to retain as much flavour and nutrients as possible, which makes it a popular product among health-savvy buyers.

| Segment | Value Share (2025) |

|---|---|

| Freeze-Dried Fruit Powder (By Processing Technology) | 35% |

Based on the processing technology, the global fruit powder market can be classified into (i) freeze-dried, (ii) spray-dried, (iii) vacuum-dried, and (iv) drum-dried. Freeze-drying dominates the market, contributing more than 35% to total sales, owing to its better nutrient retention and its application in premium products.

Freeze-drying is the method of choice for high-value applications (e.g., dietary supplements, baby food, functional beverages), as it retains up to 97% of nutrients, like vitamin C, polyphenols, and antioxidants. This process is often prevalent in health-oriented and clean-label markets, particularly popular in North America and Europe, where demand for organic and minimally modified components is soaring.

"To meet the rising demand," says the firm, "leading manufacturers including Paradise Fruits, Chaucer Foods, and European Freeze Dry are ramping up production, especially for superfruit powders like acai, goji, and elderberry."

An economical alternative is spray-drying, already widely used, for example, in mass-market products like instant beverages, confectionery, and dairy applications. However, the process subjects fruit to heat, so some heat-sensitive nutrients are lost. The bulk production of essential low-price segments is tilted heavily by businesses like Van Drunen Farms, Dohler, and Aarkay Food Products.

Freeze-dried offers a premium positioning appeal for organic products; however, spray-dried powder is used primarily in the food and beverage large-scale manufacturing process when it comes to large volumes, particularly in emerging markets such as Asia-Pacific, where the key focus is on cost optimization.

The fruit powder market is likely to undergo rapid expansion owing to the trend among consumers toward natural, clean-label, and shelf-stable food ingredients. Demand for freeze-dried, spray-dried, and dehydrated powders is expected to increase in different segments, including food and beverage, nutraceuticals, and cosmetics, thus encouraging competitive intensity among major market players.

Major players like Kanegrade Ltd, Döhler Group, Paradise Fruits, Chaucer Foods, and Saipro Biotech together form the poster boys with varied product portfolios, advanced drying technologies, and global distribution networks. New entrants attach special importance to organic, non-GMO, and exotic fruit powder product offerings to serve the consumer expectations of premium and functional food ingredients.

The evolution of the market is spearheaded by technology for drying processes, nutritional retention, and the adoption of these powders in plant-based formulations. The companies will build in sustainable sourcing, sustainable and green packaging, and customized blends as a means of product differentiation.

Factors strategic to competition include compliance with food safety standards, resilience of the supply chain, and capacity for developing innovative formulations for functional beverages, bakery products, and dietary supplements. Companies that embrace the concepts of transparency in labeling, sustainability in production practices, and customization in ingredient solutions shall enjoy a competitive advantage in this expanding market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Kanegrade Ltd | 15-18% |

| Döhler Group | 12-16% |

| Paradise Fruits | 10-14% |

| Chaucer Foods Ltd | 8-12% |

| Saipro Biotech Pvt Ltd | 7-10% |

| Other Players | 35-45% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Kanegrade Ltd | Specializes in spray-dried, freeze-dried, and drum-dried powders with clean-label and organic options. |

| Döhler Group | Provides natural fruit powder solutions for the food, beverage, and nutraceutical sectors, emphasizing sustainability. |

| Paradise Fruits | Focuses on premium freeze-dried fruit powders, catering to functional foods and dietary supplements. |

| Chaucer Foods Ltd | Strong in dehydrated fruit powders, offering custom formulations for the food processing industry. |

| Saipro Biotech Pvt Ltd | Specializes in organic and herbal fruit powders, leveraging biotechnology for enhanced nutritional value. |

Key Company Insights

Kanegrade Ltd (15-18%)

The leading company produces very good fruit powders to make bespoke blends and organic products.

Döhler Group (12-16%)

Strong focus on naturalness and sustainability with varied applications in food and beverage.

Paradise Fruits (10-14%)

The innovator in freeze-dried fruit powders for over 20 years to cater to premium and functional food markets.

Chaucer Foods Ltd (8-12%)

Specialize in dehydrated fruit powders for bakery, snacks, and confectionery applications.

Saipro Biotech Pvt Ltd (7-10%)

Organic fruit powders, as a niche claiming their merit in the nutraceutical domain, are the prime focus, having optimized applications spreading with biotech interventions.

Other Key Players (35-45% Combined)

The global fruit powders market is projected to grow at a CAGR of 7.5% from 2025 to 2035, driven by increasing demand for natural ingredients and functional food applications.

By 2035, the global fruit powders market is expected to reach a significant valuation, fueled by rising consumer preference for clean-label products and advanced processing technologies.

The freeze-dried fruit powder segment is anticipated to grow the fastest due to its superior nutrient retention, extended shelf life, and increasing use in dietary supplements, functional beverages, and premium food applications.

Key growth drivers include rising health awareness, increasing demand for natural and organic ingredients, expanding applications in nutraceuticals and cosmetics, and advancements in drying technologies that enhance product stability and nutrient content.

Some of the dominant players in the global fruit powders market include Kanegrade Ltd, Döhler Group, Paradise Fruits, Chaucer Foods Ltd, FutureCeuticals, and Milne MicroDried, focusing on innovation, sustainability, and expanding their product portfolios.

The market is segmented into strawberry, blackberry, black currant, raspberry, blueberry, peach, apple, pear, apricot, and plum, with demand driven by nutritional benefits and flavor preferences.

The market is divided into organic and conventional fruit powders, with organic variants gaining traction due to rising consumer preference for chemical-free and sustainable products.

The fruit powders market is categorized into fruit processing, beverage processing, dietary supplements, pharmaceuticals, and cosmetics and personal care, with increasing applications in functional foods and wellness products.

The market includes freeze-dried, spray-dried, vacuum-dried, and drum-dried fruit powders, with freeze-drying leading due to its superior nutrient retention and premium product applications.

The market is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and The Middle East & Africa.

Take Out Coffee Market Growth - Consumer Trends & Market Expansion 2025 to 2035

Vegan Protein Market Analysis - Size, Share & Forecast 2025 to 2035

Taste Modulators Market Trends - Growth & Industry Forecast 2025 to 2035

Western Europe Whole-wheat Flour Market Analysis by Product Type, Nature, Application, Packaging, Sales Channel, and Country through 2035

Western Europe Fusion Beverage Market Analysis by Product Type, Distribution Channel, and Country through 2035

Western Europe Pectin Market Analysis by Product Type, Application, and Country Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.