Frozen smoked salmon is processed and preserved salmon that has undergone smoking and freezing techniques for extended shelf life to fulfil the demands of foodservice, retail, and gourmet food segments. The features of frozen smoked salmon such as aggressive taste, abundant protein, and convenience have contributed to its large use in ready meals, sushi, sandwiches, and high-end seafood products.

The industry is driven by growing consumer demand for protein-based food, the growing demand for premium seafood, and demand for international cuisine. Technological advances in freezing and packing also enhance product quality and shelf life.

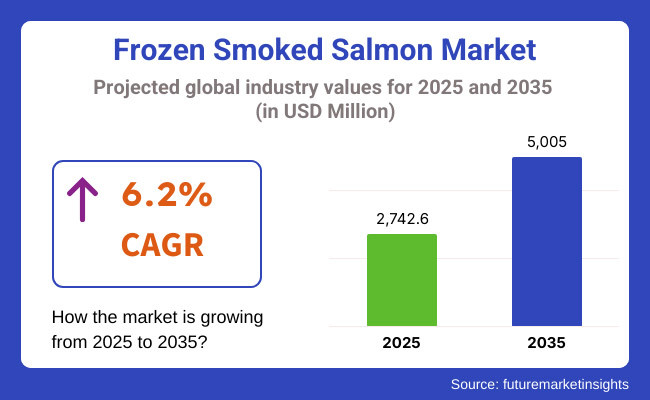

In 2025, the global frozen smoked salmon market is projected to reach approximately USD 2,742.6 million, with expectations to grow to around USD 5005.0 million by 2035, reflecting a Compound Annual Growth Rate (CAGR) of 6.2% during the forecast period.

The predicted CAGR reflects increasing consumption of convenience food seafood products, demand for sustainably caught salmon, and deeper infiltration into emerging markets of frozen smoked salmon. In addition, new developments in vacuum-sealed and MAP (modified atmosphere packaging) are driving product shelf life and market expansion.

High per capita seafood consumption, growing demand for gourmet and ready-to-eat meals, and increasing retail and online seafood distribution drives North America to hold a significant share of the frozen smoked salmon market. North America is the market leader in frozen organic and sustainable sourced smoked salmon, where large retailers and foodservice chains are adding premium seafood meals to their offerings.

Norway, Scotland, and France dominate smoked salmon export and production in the region, which is a large market share for Europe. Europe’s stringent seafood quality standards and sustainability policies are driving demand for traceable certified frozen smoked salmon. Growing interest in Mediterranean and Nordic diets is sparking demand, too.

The frozen smoked salmon market in Asia-pacific is expected to witness the highest growth because of increase in disposable income and served boutique, western-style restaurants, and booming imports of seafood in Australia, Japan, South Korea, and China.

Sales of frozen smoked salmon are being propelled by the booming foodservice business and the burgeoning landscape of e-commerce food platforms in the region. Government seafood safety and traceability policies also affect regional markets.

Challenges

Supply Chain Disruptions and Sustainability Concerns

The frozen smoked salmon industry related to supply chain issues and finding quality salmon in fisheries and aquaculture facilities. The wild-caught salmon has more and more regulations around it, with issues of climate change and overfishing, while increased feed costs impact the costs of production of farmed salmon.

In addition, health concerns about preservatives, process handling of Tanzania-made products and retention of quality of frozen products are obstacles in the way of Tanzania to position itself in high end market.

Opportunities

Growth in Ready-to-Eat Seafood and Sustainable Aquaculture

The growth of frozen smoked salmon is propelled by increasing demand for ready-to-eat (RTE) seafood, high-protein diets, and scrumptious frozen foods. Consumer is opting for convenience, healthy, and long-shelf-life seafood alternatives.

Improvements in technology for flash-freezing, eco-friendly salmon aquaculture and green packaging are expanding the market potential. Additionally, value additions of smoked salmon products (such as pre-seasoned, organic, and premium cold/hot-smoked grades) are driving demand in gourmet and health-related segments.

As consumer demand shifted to home cooking during the pandemic between 2020 and 2024, the frozen seafood market benefitted, as did those seeking omega-3-rich diets. But supply chain disruption, objections to antibiotics in farmed fish and competition from fresh and canned salmon made for limited wider growth.

In 2025 to 2035, the market would change towards Sustainable, Premium & Convenience Frozen Smoked Salmon Product Lines. AI-driven supply chain monitoring combined with sustainable aquaculture accreditations (ASC, MSC) and intelligent packaging for prolonged freshness will inspire consumer trust and brand differentiation. New market segments will emerge for plant-based and lab-grown smoked salmon, too.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, EU, and sustainability standards (ASC, MSC) |

| Technology Innovations | Growth in flash-freezing and vacuum-sealing techniques for frozen salmon |

| Market Adoption | Demand for convenient, frozen smoked salmon in retail and foodservice |

| Sustainability Trends | Focus on certified sustainable farmed salmon (ASC, BAP) |

| Market Competition | Dominated by seafood giants (Mowi, High Liner Foods, Leroy Seafood, Marine Harvest, Bumble Bee Seafoods) |

| Consumer Trends | Demand for high-protein, omega-3-rich frozen seafood |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter mandates on sustainable fisheries, antibiotic-free aquaculture, and eco-friendly packaging |

| Technology Innovations | Advancements in AI-powered seafood traceability, biodegradable packaging, and plant-based smoked salmon substitutes |

| Market Adoption | Expansion into functional seafood products (probiotic-enhanced, omega-3-fortified smoked salmon) |

| Sustainability Trends | Large-scale adoption of carbon-neutral aquaculture, circular seafood supply chains, and alternative protein-based salmon |

| Market Competition | Rise of sustainable seafood startups, lab-grown seafood companies, and premium smoked salmon brands |

| Consumer Trends | Growth in ready-to-eat gourmet seafood, personalized nutrition-focused seafood products, and AI-driven meal planning apps |

The United States frozen smoked salmon market has been rising continuously due to a growing focus among consumers on value seafood products, along with diets rich in proteins. The market is forecast to grow due to increasing gourmet home cooking and the demand for convenient, ready-to-eat seafood products.

Moreover, the rising demand for sustainable and organic seafood, in addition to the presence of large seafood processing giants, is propelling the market growth. In addition to the recent uptick in e-commerce, direct-to-consumer seafood delivery services are also enriching access for frozen smoked salmon products.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

The market is rising owing to the growing number of high-end consumers with an increasing inclination towards premium and environmentally friendly food products. Demand is also being buoyed by the growing acceptability of smoked salmon as part of morning and appetizer meals.

The growing adoption of web-based grocery channels and home-delivery services is also facilitating the frozen smoked salmon reach to a broad consumer base. In addition, the trend towards organic and eco-certified seafood has had an impact on the UK-market trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.0% |

The European Union (EU) frozen smoked salmon market is seen with an increase in seafood consumption coupled with stringent regulations on sustainable fishing. Providing flexibility in meal preparation, frozen smoked salmon, in both retail and foodservice verticals, is witnessing an upward demand.

Germany, France, and Italy major market High-quality smoked seafood are preferred by consumers. In addition, increasing awareness about omega-3-enriched diets and premiumization in the seafood market are other factors fueling the demand in market.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 5.9% |

The increasing consumption of seafood in the nation and the rising demand for quality processed fish products are also contributing to the growth of the market for frozen smoked salmon in Japan. The demand is on the rise for the Western style of dining, and the popularity of smoked salmon in sushi and fusion dishes is driving demand.

The use of modern freezing and preservation techniques ensures a high-quality product and a reliable supply. The market is also affected by Japan's focus on seafood sustainability and strict food safety regulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.2% |

The South Korea frozen smoked salmon market is continuously growing, owing to increasing consumption of imported seafood and high-end gourmet foods. Increasing preference for Western food and café & restaurant culture are the factors promoting demand for smoked salmon foods.

The growing availability of frozen smoked salmon to consumers is due to the expansion of online seafood delivery services and e-commerce. The country’s strong focus on high-quality, fresh seafood is also fueling premium product developments in the frozen smoked salmon segment.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.1% |

Frozen smoked salmon is predominantly made from farmed salmon, offering a reliable, scalable, and managed seafood commodity still available to consumers worldwide. Contemporary aquaculture practices have greatly enhanced sustainability, fish health, and quality, so farmed salmon conforms to stringent industry standards for both taste and texture.

Price and availability across all regions are two of the biggest push factors for adopting farmed salmon. Unlike seasonal wild-captured salmon, which depends on nature with its high environmental volatility, farmed salmon ensures an uninterrupted supply chain for food manufacturers, restaurants, and retail chains.

Farmed salmon, while having its advantages, faces challenges in the areas of consumer perception, sustainability, and competition from wild-caught. The sector is reacting to the challenges it faces, as it invests in organic aquaculture, alternative protein feed options and increased visibility over farming practices, to ensure that farmed smoked salmon retains consumer confidence and fits into a larger market share.

Wild-caught salmon has already established presence in the market for frozen smoked salmon, as the general public associate’s wild fish with improved taste, texture, and nutritional quality. Wild salmon originates from river, lake, and ocean environments, yielding a leaner composition and more complex taste than farmed salmon.

Wild-captured salmon demand is largely driven by its omega-3 richness and natural diet, which provides for deeper color, firmer texture, and richer flavor. Small premium seafood companies, along with upscale restaurants, favour wild-caught salmon for offerings of fine smoked salmon products to ensure authenticity and an exclusive culinary experience.

In addition, responsible sourcing of food, along with eco-labelling certifications such as MSC (Marine Stewardship Council) labelling, has further strengthened consumer trust and willingness to buy wild- captured smoked salmon. Frozen smoked salmon varieties are most popular in wild salmon species from Alaska, Norway, and Canada, highly sought by consumers around the globe.

Wild-captured salmon, however, is subject to supply chain issues, price fluctuations and seasonality that make it less accessible than farmed salmon. In response to such limitations, the majority of seafood companies are expanding frozen ingredient storage capacity, improving upon flash-freezing methods and diversifying regions of wild salmon sourcing to provide a more stable supply of high-quality products of wild-smoked salmon.

Atlantic salmon has relatively mild flavor, buttery texture and high fat content, making it an excellent candidate for smoking and freezing without quality degradation, therefore the most consumed species in frozen smoked salmon market.

Atlantic salmon - a big advantage of this species is its year-round availability through aquaculture, ensuring steady supply for production of frozen smoked salmon. Atlantic salmon is the bulk production standard for smoked salmon by most major seafood companies and processing firms, ensuring consistency not only in taste and texture but allow for easy adaptability to the myriad of smoking processes.

Atlantic salmon is also a good source of omega-3 fatty acids, which are beneficial to cardiovascular health and have good consumer acceptance in a health-oriented food market. Rich in protein, frozen smoked Atlantic salmon is marketed by many functional food and wellness brands as a superfood and demand is increasing across health-conscious consumer segments.

Despite its dominance, Atlantic salmon's reign is under threat with other salmon species recently being challenged by rising concerns around overfishing and aquaculture sustainability. For most seafood companies, this includes investments in genetics, alternative feed sources and low-impact farming techniques that can keep Atlantic salmon production in line with environmentally sustainable industrial practices.

Demand for coho salmon has been growing in the frozen smoked salmon market segment because the coho salmon appeals to consumers seeking different salmon variety species with unique flavor profiles and sustainably sourced items.

Delicately textured and boasting bright red flesh, Coho salmon is a mid-range flavored option between mild Atlantic salmon and the fattier wild salmon species and is the most popular variety in artisanal smoked salmon products.

One of the reasons Coho salmon has become so widely adopted is its sustainability and smaller environmental footprint compared to other salmon strains. Most wild Coho salmon fisheries management programs focus on sustainability, careful harvesting, or minimised ecosystem disturbance during harvest. Coho salmon are also being farmed increasingly in land-based aquaculture systems, reducing the risk of pollution in the ocean and the spread of fish diseases, resulting in more sustainable smoked salmon.

Secondly the versatility of Coho salmon that allows hot smoking or cold smoking contributes to its popularity with gourmet and specialty smoked salmon businesses. C also include some high-value frozen smoked salmon segments sold through specialty channels due to its use in several boutique salmon lines and gourmet seafood companies.

Coho salmon farming has its benefits, but it faces challenges from supply volatility and premium pricing compared with mass-farmed Atlantic salmon. To combat this, seafood producers are investing in improved storage solutions, cooperative fishing endeavors, and targeted marketing of Coho to ensure that more consumers are aware of it, and that there will always be a steady market demand for it.

Demand for premium seafood, convenience foods and high-protein diets continue to drive growth of the frozen smoked salmon market. Wide applications of smoked salmon frozen are in prepared food, gourmet food, sushi, sandwiches and salads. The market is driven by growing health-conscious consumption, rise in online seafood retail, and surge in demand for long-shelf-life seafood products.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Mowi ASA | 18-22% |

| Lerøy Seafood Group | 14-18% |

| Thai Union Group (John West, King Oscar) | 12-16% |

| SalMar ASA | 10-14% |

| High Liner Foods Inc. | 8-12% |

| Others | 26-32% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Mowi ASA | Produces premium frozen smoked salmon with sustainable aquaculture and global distribution. |

| Lerøy Seafood Group | Specializes in high-quality, frozen, cold-smoked and hot-smoked salmon for retail and foodservice. |

| Thai Union Group | Offers frozen smoked salmon under John West and King Oscar brands, focusing on processed seafood innovation. |

| SalMar ASA | Manufactures value-added frozen smoked salmon products, catering to premium retail and export markets. |

| High Liner Foods Inc. | Supplies frozen smoked salmon fillets and portions for North American and European markets. |

Key Market Insights

Mowi ASA (18-22%)

Mowi dominates the frozen smoked salmon market with sustainably farmed, high-quality Atlantic salmon, catering to global retail and foodservice chains.

Lerøy Seafood Group (14-18%)

Lerøy specializes in premium frozen smoked salmon, offering both traditional and flavored varieties with longer shelf life solutions.

Thai Union Group (12-16%)

Thai Union’s John West and King Oscar brands focus on frozen smoked seafood innovation, catering to canned, packaged, and ready-to-eat product markets.

SalMar ASA (10-14%)

SalMar provides value-added frozen smoked salmon, expanding its export operations in Asia, North America, and Europe.

High Liner Foods Inc. (8-12%)

High Liner Foods offers private-label and branded frozen smoked salmon, targeting retail, catering, and foodservice segments.

Other Key Players (26-32% Combined)

Several emerging and niche seafood companies are expanding the frozen smoked salmon market with specialty and organic products, including:

The overall market size for frozen smoked salmon market was USD 2,742.6 million in 2025.

The frozen smoked salmon market is expected to reach USD 5005.0 million in 2035.

Rising consumer preference for ready-to-eat seafood, increasing demand for protein-rich diets, and expanding distribution through retail and e-commerce channels will drive market growth.

The top 5 countries which drives the development of frozen smoked salmon market are USA, European Union, Japan, South Korea and UK.

Coho salmon expected to grow to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Frozen Egg Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Frozen Tissues Samples Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Pastries Market Size and Share Forecast Outlook 2025 to 2035

Frozen Baked Goods Market Size and Share Forecast Outlook 2025 to 2035

Frozen Potatoes Market Size and Share Forecast Outlook 2025 to 2035

Frozen Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Frozen Meat Grinder Market Size and Share Forecast Outlook 2025 to 2035

Frozen Fruits and Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Frozen Vegetable Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Cheese Market Size and Share Forecast Outlook 2025 to 2035

Frozen Snacks Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Frozen Fruit Bars Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Frozen Desserts Market Growth Share Trends 2025 to 2035

Frozen Ready Meals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Tortilla Market Size, Growth, and Forecast for 2025 to 2035

Market Share Insights in the Frozen Food Industry

Frozen Dough Market Analysis by type, distribution channel and region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA