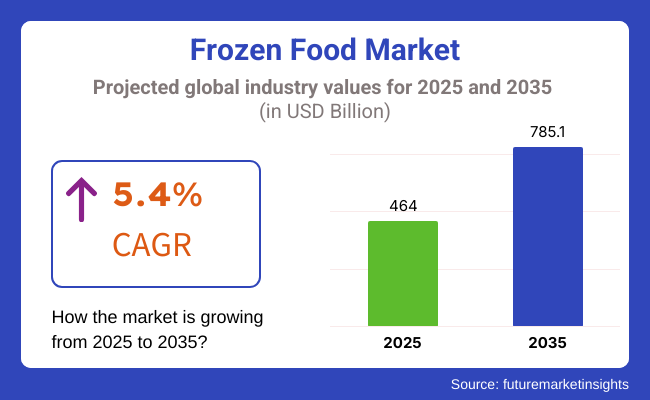

The Global Frozen Food market is currently valued at around USD 464 billion, and is anticipated to progress at a CAGR of 5.4% to reach USD 785.1 billion by 2035.

The global frozen food industry is a manifestation of the transition from a simple convenience-based industry to an innovation-driven market that focuses on premiumization, texture improvement, and high-quality meal solutions. The Frozen Ready Meals segment is a star performer since the preference for multi-cuisine, gourmet frozen meals, and chef-inspired frozen dishes is on the rise.

Manufacturers are pushed to broaden their product range and improve authenticity because of the increasing fusion flavors, for instance, Korean Bibimbap, Mediterranean Falafel Bowls, and Indian Tikka Masala Meal Kits. Quick preparation time, longer shelf life, and high nutritional value have made frozen ready meals a preferred choice among busy professionals, single-person households, and health-conscious consumers.

The market's main driver is consumer confidence in frozen food quality. The previous arguments concerning the loss of nutrients in frozen foods returned unsupported, mainly because of cutting-edge freezing techniques like Individual Quick Freezing (IQF).

The share of this technology in the freezing segment is 42% and it is the most efficient one, thus practitioners are capable of ensuring frozen meals to sustain original texture, color, and nutritional content. Manufacturers are coming up with small-batch premium frozen meals as part of the market which is a great move since it targets both urban millennial and high-income consumers who care about convenience and quality.

Nonetheless, despite the rise in the market, the frozen food industry has to address the challenges of distribution problems, increasing energy prices, and supply chain inefficiencies. The aforementioned problems are being dealt with by the companies through investing in local manufacturing facilities, innovating packaging with self-cooling technologies, and utilizing AI in supply chain management.

Also, the launch of direct-to-consumer (DTC) frozen meal delivery services is transforming the distribution environment by making it feasible for consumers to get freshly frozen and customizable meal plans directly.

The future of the frozen ready meals sector is going to be defined by hyper-personalization, AI-curated meal suggestions, and exclusive restaurants-branded frozen meals. The adoption of new freezing technologies like cryogenic freezing and high-pressure freezing will be predominant and it will enable manufacturers to control moisture, avoid freezer burn and, in turn, improve the post-thaw freshness of products.

Explore FMI!

Book a free demo

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global industry.

This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 5.1% (2024 to 2034) |

| H2 2024 | 5.5% (2024 to 2034) |

| H1 2025 | 5.3% (2025 to 2035) |

| H2 2025 | 5.7% (2025 to 2035) |

The global industry's predicted compound annual growth rate (CAGR) over a semi-annual period from 2025 to 2035 is shown in the above table. The business is anticipated to grow at a CAGR of 5.1% in the first half (H1) of 2024 and then slightly faster at 5.5% in the second half (H2) of the same year.

The CAGR is anticipated to decrease somewhat to 5.3% in the first half of 2025 and continues to grow at 5.7% in the second half. The industry saw a decline of 35 basis points in the first half (H1 2025) and an increase of 46 basis points in the second half (H2 2025).

Gourmet Flash-Freezing for Chef-Crafted Frozen Ready Meals

Frozen meals are gradually shifting from mass-produced to premium, restaurant-style meals made by well-known chefs. The prosperity of flash-freezing technology is the major factor that it is now possible to keep food with all flavor and texture intact, making frozen ready meals being on par with gourmet freshly cooked ones.

Companies are entering into partnerships with Michelin-star chefs to deliver the signature frozen meal line featuring dishes like truffle-infused risottos, aged Wagyu steaks, and seafood paellas. This new phenomenon has dazzled the attentive consumers who are ready to buy real and authentic high-quality frozen food by spending a little more.

Moreover, manufacturers are adopting specific cryogenic freezing techniques to enclose the sensory properties of those meals as if they were just freshly cooked. Retailers' strategies also include higher price tags on the meals that are presented as both luxury and easy, comparable to dining in.

Smart Portion-Controlled Frozen Meals for Personalized Diets

Customized and health-oriented frozen meals are the most sought-after choice among people observing intermittent fasting, keto, and athlete-specific diets. Companies are bringing AI-driven portioning technology to bear, which lets clients alter macronutrient ratios before freezing. What's more, QR-coded packaging has come into play as customers can now track calorie intake and tailor meal plans according to their fitness goals. This trend is making new frozen diet plans more interactive and tailored to individual needs.

Enterprises are creating pre-measured single-serving frozen meals to avoid overconsumption and at the same time stick to a set diet. Clients have positively reacted to the subscription-based frozen meal programs that deliver personalized meal plans on a recurring basis.

Multi-Texture Innovation in Frozen Foods for Authenticity

Texture inconsistency is one of the trickiest problems in frozen food post-thawing. Corporations are utilizing multi-layered freezing methods to guarantee the persistence of crunchy, creamy, and tender components as they used to be.

This development is of particular significance in fried foods, dumplings, and baked goods, where texture is a key characteristic. The Asian frozen dumplings, tempura shrimp, and flaky croissants have made advances in these freezing methods and thus helped the producers to improve genuineness and sensory aspect.

Some brands keep dividing the textures through freezing but in a different way, like special coating that is crispy but the filling is moist; or protecting a moisture barrier that keeps the freeze from evaporating. In addition, firms try out with coating stabilizers that stop moisture migration ensuring texture holds over a long time.

Extreme Weather Resilience in Frozen Supply Chains

The effect of climate change in global cold chain logistics has made manufacturers develop ultra-insulated, adaptive packaging that can resist temperature fluctuations during transit. Self-cooling gel packs, AI-driven temperature sensors, and solar-powered cold storage units are among the standard tools. This innovation guarantees that frozen meals are of high quality not only in unpredictable weather conditions but also in less waste generated and delivery improved.

Also, companies are producing temperature-resistant biodegradable packages that help the environment while keeping their products fresh. Tracking solutions, based on block chain technology, are also being utilized more frequently allowing stakeholders to monitor temperature deviations as they happen.

The frozen food sector saw enduring expansion for the time span from 2020 to 2024 coming out of increasing urbanization, the transformation of dietary patterns, as well as a broadened retail distribution network. The surge in demand for frozen ready meals and extra premium meal kits was further enhanced by the trend among people to eat their meals as in restaurants and also to focus on convenience at home.

The perceived worth of goods has improved its performance and of those the frozen food market sector has gained more respect thanks to advances in freezing technologies and high-quality ingredients. The projected growth of the frozen food market will take place from 2025 to 2035, thanks to custom-built AI-driven meals, high tech freezing equipment, and the increase of the rate of frozen vegetarian foods.

The direct consumer model of frozen meal subscription, expansion of the suply chain, creation of super frozen product lines will all boost demand. As people seek healthier and more personalized frozen options, manufacturers will focus on regionalized flavor profiles, sustainability initiatives, and next-generation freezing solutions to sustain long-term market growth.

The frozen food market on a global scale predominantly comprises of a combination of huge multinational corporations (MNCs) and older firms. The market structure appears to be concentrated with the top players retaining most of the market shares.

The most important frozen food companies in the world are few of the leading MNCs, namely Nestlé, Conagra Brands, General Mills, Tyson Foods, and Unilever. These firms have a well-maintained global structure, a commanding brand name, and they are well connected with a well-developed distribution network that gives them a chance to prevail on the market.

In the secondary tier, the names come Nomad Foods, Sysco Corporation, McCain Foods, and Ajinomoto Co., Inc. These companies are located in the frozen food market and more and more of them are concentrating on specific product types or the regional market which is their trademark and high-tech innovation in the sector.

The market's third layer is more chaotic, dominated by small regional and local players along with private label brands. A good example of this kind of operation is the Kraft Heinz Company that takes part in this segment utilizing its name and product portfolio to motivate the big multinationals.

The overall picture of the global frozen food market shows quite a high degree of concentration, where the first tier MNCs dominate the scene. The second and third tiers are reflected as a more varied and competitive field, as the companies are oriented to the specified products, the regional advantage, or cost-efficient private labelling.

The following table shows the estimated growth rates of the top three countries. USA, China and Germany are set to exhibit high consumption, and CAGRs of 3.8%, 6.3% and 4.5% respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 3.8% |

| China | 6.3% |

| Germany | 4.5% |

The USA frozen food market is stepping forward with AI-based choices that allow consumers to create their own frozen meal plans through mobile applications. The top enterprises example being Nestlé, and its rival Conagra are applying data analysis to the most efficient use of portion control, flavor preferences, and dietary needs.

Consumers can opt for different ingredients for their meals, lower the sodium levels, or replace them with that they want before freezing, and in such a deal, the meals become frozen specially for individual nutrition.

Aside from home consumption, restaurants and food delivery services are taking advantage of AI-powered meal preparation to be more efficient and offer a wider variety. Some enterprises are also linking this with an ordering system based on patients' voice commands which will be handy for consumers to choose their favored frozen meals.

This hyper-customization trend is changing the frozen meal business from the traditional models, and it resonates with the new demand for the health-conscious, diet-specific, and ready-to-eat solutions.

The Chinese frozen food sector is getting a high-end edge for handmade dumplings and crying hot pot with frozen meal kits. Consumers are after adopting locals flavors, and so; manufacturers are availing dumplings that come with a unique digital psychotherapy module in their warehouses. The frozen ready-made hot pot meals, with the option of specialty broths, protein, and vegetable packets are revolutionizing the home dining experience.

Furthermore, self-heating hot pot packaging innovations make it more convenient for consumers to enjoy their favourite meals without stovetop cooking. Brands are also making strides with fermentation-based flavor innovations, turning packaged dumplings and broths into delicatessen. The trend of authentic, premium-quality frozen meals that simulate homemade dishes is a stronghold in the Chinese market despite the fast-paced urban lifestyle.

Germany is leading the way with ingenious frozen meal vending machines that will include all the hot-and-ready 24/7 gourmet frozen meals stocked in high-traffic urban areas. The machines will feature RFID-based cooking sensors that connect to the f2637-like instructions for opening a chef-driven frozen meal each time a customer uses it.

This trend is adding to the convenience and accessibility, especially for singletons and late-night shoppers. Some vending machines have already included organic and plant-based frozen meal options driven by high demand for healthier choices, hence appealing to ecologically conscious urban professionals.

Additionally, smart vending machines are being smoothly equipped with real-time inventory tracking and machine learning algorithm-driven meal recommendations that will let users find the most suitable meals. More cashless payment solutions and touch-free ordering lining up the adoption even more this is why frozen meal vending machines are the new thing in German cities.

| Segment | Value Share (2025) |

|---|---|

| Frozen Ready Meals (Product Type) | 35% |

Frozen ready meals are the champions in the market due to the best convenience possible, changes in consumer tastes, and improvements in freezing technology. The segment has been considerably growing as the lack of time faces people with the need for quick, easy, and nutritious meals. Just as cooking someone else’s food has become widespread, more and more people take the benefits of frozen multi-cuisine options, meal kits, and organic meal products while the trend of frozen food continues.

Companies are putting efforts into strengthening their brands through product variation, giving access to international cuisines, and producing meals that suit specific diets, besides using organic components or a combination of these all to reach their diverse target audience.

| Segment | Value Share (2025) |

|---|---|

| Individual Quick Freezing (IQF) (Freezing Technique) | 42% |

The Individual Quick Freezing (IQF) technique is at the forefront, commanding a 42% share of the freezing techniques market because it is exceptionally good at keeping ingredients fresh, intact, and of the appropriate texture.

Unlike traditional freezing, IQF separates ingredients from each other to avoid clumping, ensuring perfect item states for each component-whether it is vegetables, proteins, or grains-evenly frozen. This method is a great asset not only for the multi-component frozen dishes but also for actual consumers who will be able to enjoy the textures they would get in an upscale restaurant after reheating.

Besides, IQF improves nutrient retention, color control, and moisture management, making it more appropriate for high-quality gourmet frozen foods. Prominent brands are adopting IQF in new product lines like top-notched ready meals, flash-frozen seafood, and noodles of seasonal vegetables that cater to the cryo-demand of customers who want natural, minimally processed frozen foods that are not only healthy but also full of taste and texture.

The frozen food market is very dynamic with the central players seeking product innovation, strategic partnerships, and market expansion to keep their strong position which they currently enjoy. Top brands such as Nestlé, Conagra Brands, Nomad Foods, and General Mills are betting money on AI-driven meal customization, top-notch meal offerings, and cutting-edge freezing technologies to remain in the upper echelon.

Moreover, manufacturers are making advances on D2C plans which add pre-made, customizable, and nutritional frozen meals as perks for consumers. In line with the demand for variation, companies have been introducing multi-layered frozen meals, celebrity chef’s recipes, and eco-friendly packaging.

Nomad Foods for instance brought on a new line of high-protein frozen meal kits that are targeted at fitness enthusiasts. As customers increasingly ask for more and better personalized, frozen food options will be the industry beset with strong challenges which will force the breakthrough of more and more advanced technological systems and the internal upgrade.

The frozen ready meals segment dominates due to increasing consumer demand for convenience, evolving preferences for multi-cuisine and gourmet options, and advancements in freezing technologies that enhance texture and freshness.

IQF technology leads the market with a 42% share due to its ability to maintain ingredient integrity, texture, and nutrient retention, making it ideal for high-quality gourmet frozen foods.

Key trends include gourmet flash-freezing, smart portion-controlled meals, multi-texture innovation, localized seasonal freezing, and in-transit thaw technology to cater to evolving consumer preferences for convenience, personalization, and authentic frozen meal solutions.

Frozen Ready Meals, Frozen Seafood & Meat Products, Frozen Snacks & Bakery Products, Frozen Fruits & Vegetables, Others

Supermarkets/Hypermarkets, Convenience Stores & Independent Retailers, Online Retail, Food Service/HoReCa, Others

Individual Quick Freezing (IQF), Belt Freezing, Blast Freezing, Plate Freezing, Cryogenic Freezing

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

Food Grade Lubricant Market Analysis by Base Oil Type, Product Type and Application Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.