The Global Freeze-Dried Fruits Market is reasonably fragmented with a combination of multinational food giants, regional processors, and specialist firms competing market space. Large multinational firms like Olam Food Ingredients and Dole Packaged Foods hold 40% market share, relying on their colossal supply chains, robust B2B relationships, and sophisticated freeze-drying technology.

Regional operators such as Crisp Green, Stoneridge Orchards, and Döhler Group take up 35%, utilizing regional production, knowledge of fruit sourcing, and specialized processing. Niche small brands and start-ups such as Lyophilized, Fruit d'Or, and Lyofood take up 25%, focusing on premium organic freeze-dried products, retail building, and private label agreements.

The leading five companies combined own approximately 55% of the world market, reflecting a competitive but moderately consolidated market, with differentiation being fueled by technological innovation, premiumization, and penetration into functional food applications.

Explore FMI!

Book a free demo

| Market Structure | Top Multinationals |

|---|---|

| Industry Share (%) | 40% |

| Key Companies | Olam Food Ingredients, Dole Packaged Foods |

| Market Structure | Regional Leaders |

|---|---|

| Industry Share (%) | 35% |

| Key Companies | Crisp Green, Stoneridge Orchards, Döhler Group |

| Market Structure | Smaller Niche Players |

|---|---|

| Industry Share (%) | 25% |

| Key Companies | Freeze-Dry Foods, Lyophilized, Fruit d'Or, Lyofood, Tropical Freeze Dried |

The freeze-dried fruits market is moderately fragmented, with mass-scale suppliers dominating the bulk B2B segment, and regional and niche players dominating organic, specialty, and premium retail markets.

Traditional-style freeze-dried fruits rule (75%) as bulk foodmakers like cheaper mass buying. Olam Food Ingredients and Döhler Group command this segment by selling food manufacturers processed freeze-dried fruit ingredients. Organic freeze-dried fruits (25%) are becoming increasingly popular, especially in upper-end retailing and dietary supplements markets, as Fruit d'Or and Lyofood continue to increase organic-certified products.

Diced freeze-dried fruit (45%) has the largest market share, and it is used in breakfast cereals, snack bars, and bakery products. Whole freeze-dried fruit (30%) is prevalent in premium retail packs and snack packs under brands such as Crisp Green and Stoneridge Orchards. Powdered and granulated freeze-dried fruit (25%) is also gaining space in functional beverages and nutritional supplements, and Döhler Group and Lyophilized are leading the innovation of fruit powder.

Food & Beverage uses (55%) account for most of the consumption, freeze-dried fruit ingredients being incorporated in baked goods, confections, dairy products, and drinks. Retail/household use (45%) is increasing strongly, driven by increased consumer health awareness and demand for clean-label snack foods, supporting brands such as Crisp Green and Tropical Freeze Dried to grow direct-to-consumer sales.

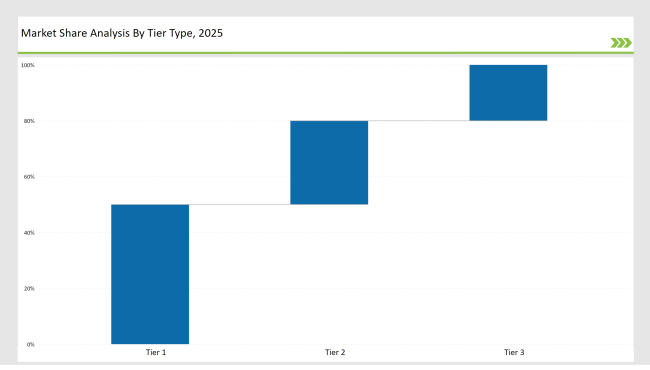

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 50% |

| Example of Key Players | Olam Food Ingredients, Dole Packaged Foods |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 30% |

| Example of Key Players | Crisp Green, Stoneridge Orchards, Döhler Group |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 20% |

| Example of Key Players | Freeze-Dry Foods, Lyophilized, Fruit d'Or, Lyofood, Tropical Freeze Dried |

| Brand | Key Focus |

|---|---|

| Olam Food Ingredients | Expanded freeze-drying facilities to meet growing B2B demand for food processing. |

| Dole Packaged Foods | Launched freeze-dried fruit snack pouches in premium health-conscious retail chains. |

| Crisp Green | Secured private label contracts with major supermarket brands. |

| Stoneridge Orchards | Developed freeze-dried chocolate-coated fruit snacks, appealing to indulgent consumers. |

| Döhler Group | Introduced superfruit freeze-dried powders for functional beverages. |

| Freeze-Dry Foods | Enhanced sustainability in processing through solar-powered freeze-drying. |

| Lyophilized | Pioneered immune-boosting freeze-dried superfruit powder blends. |

| Fruit d'Or | Increased production of organic-certified freeze-dried fruits. |

| Lyofood | Entered the sports nutrition segment with endurance-focused freeze-dried fruit snacks. |

| Tropical Freeze Dried | Strengthened direct-to-consumer e-commerce with subscription-based fruit snack boxes. |

Premiumization is entering the market of retail freeze-dried snacks in the form of new luxury fruit blends, exotic flavor combinations, and chocolate-covered freeze-dried fruits. Brands such as Stoneridge Orchards and Crisp Green are catering to the needs of health-conscious consumers looking to indulge in clean-label indulgence.

Manufacturers will invest in solar-powered freeze-dryers, water-recycling technologies, and low-waste fruit-processing technologies with increasing environmental concerns. Companies such as Olam and Freeze-Dry Foods resulted in maximizing supply chain efficiency and sustainable production toward the achievement of ESG targets.

With the upsurge of plant-based nutrition, freeze-dried fruits will be used extensively in dairy-free yogurts, vegan protein bars, and natural sweeteners. Brands such as Fruit d'Or and Lyofood are focusing on innovative ingredients, plant-based, to meet the growing consumer demand in North America and Europe.

Since freeze-dried fruits do not spoil and take up very little space, demand for them will surely increase in travel, outdoor adventure, military rations, and emergency preparedness food kits. Companies like Tropical Freeze Dried directly target markets via online subscriptions and survival food kits.

Top players include Olam Food Ingredients, Dole Packaged Foods, Döhler Group, Crisp Green, and Stoneridge Orchards, with strong B2B and retail presence.

The market is shifting towards functional ingredient applications, organic-certified products, and sustainable freeze-drying innovations.

Freeze-dried fruits are used in snacks, smoothies, baked goods, baby food, functional beverages, and protein powders.

Brands are launching chocolate-coated freeze-dried fruits, tropical superfruit blends, and functional snack mixes to attract premium consumers.

Freeze-dried fruit powders are increasingly used in meal replacements, protein shakes, collagen drinks, and probiotic-enriched supplements.

Supermarkets and health food chains are expanding private-label offerings, sourcing directly from bulk freeze-dried fruit manufacturers.

Next-gen freeze-drying methods will focus on energy efficiency, moisture retention, and enhanced nutrient preservation, ensuring longer shelf-life and superior taste.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Vegan DHA Market Outlook - Growth, Demand & Forecast 2025 to 2035

Catechins Market Trends - Growth & Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.