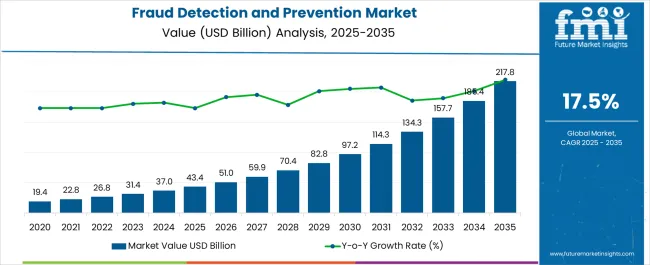

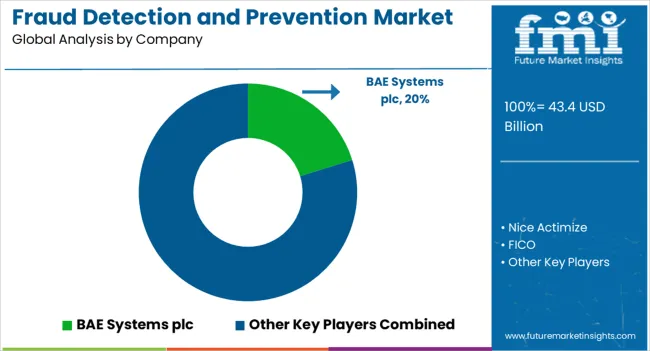

The Fraud Detection and Prevention Market is estimated to be valued at USD 43.4 billion in 2025 and is projected to reach USD 217.8 billion by 2035, registering a compound annual growth rate (CAGR) of 17.5% over the forecast period.

| Metric | Value |

|---|---|

| Fraud Detection and Prevention Market Estimated Value in (2025 E) | USD 43.4 billion |

| Fraud Detection and Prevention Market Forecast Value in (2035 F) | USD 217.8 billion |

| Forecast CAGR (2025 to 2035) | 17.5% |

The fraud detection and prevention market is expanding rapidly, fueled by rising digital transactions, stricter regulatory frameworks, and the increasing complexity of fraudulent activities. Financial institutions, e-commerce platforms, and government bodies are investing heavily in advanced analytics, artificial intelligence, and behavioral biometrics to detect anomalies in real time. Press releases and corporate filings from technology providers have emphasized the role of predictive analytics and machine learning models in reducing false positives and enhancing fraud detection accuracy.

Additionally, increasing cybercrime activity has prompted governments and regulatory agencies to mandate robust compliance and reporting standards, accelerating adoption. Cloud-based deployment models have gained significant traction, offering scalability, faster integration, and reduced infrastructure costs for enterprises of all sizes.

The market outlook remains positive, with future growth expected from cross-industry applications, integration of blockchain technologies, and the development of holistic fraud management ecosystems that span authentication, monitoring, and compliance management.

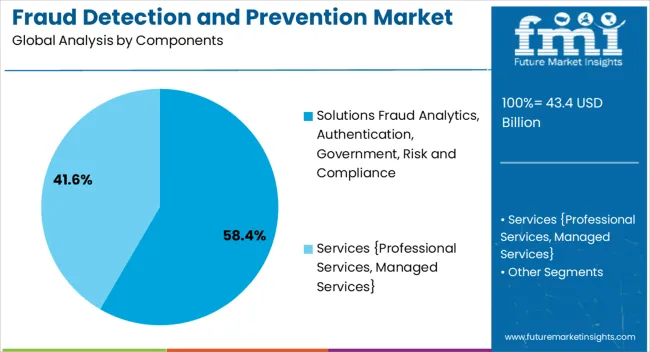

The Solutions segment is projected to account for 58.4% of the fraud detection and prevention market revenue in 2025, sustaining its leadership position due to its comprehensive role in addressing diverse fraud risks. Adoption of fraud analytics and authentication platforms has been driven by the demand for advanced systems capable of monitoring high volumes of real-time data and detecting suspicious patterns across multiple channels.

Governments and enterprises have increasingly relied on governance, risk, and compliance solutions to ensure regulatory adherence while minimizing operational vulnerabilities. Corporate announcements have highlighted growing investments in AI-powered fraud detection, identity verification systems, and integrated compliance frameworks, all of which fall within the solutions category.

As fraudulent activities continue to evolve in sophistication, organizations have prioritized end-to-end solutions over fragmented tools, ensuring stronger detection, faster response times, and greater adaptability to emerging threats.

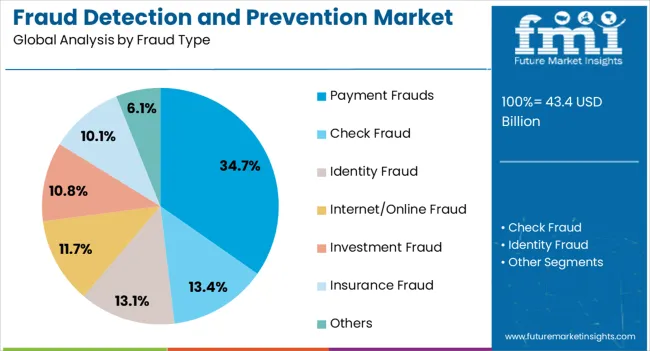

The Payment Frauds segment is projected to capture 34.7% of the fraud detection and prevention market revenue in 2025, maintaining its dominance due to the high incidence of fraud in digital payments and online banking channels. Increasing adoption of mobile wallets, contactless payments, and cross-border e-commerce has heightened exposure to fraudulent schemes such as identity theft, account takeovers, and card-not-present transactions.

Reports from payment security organizations and banking regulators have underscored the urgency of implementing multilayered defenses to safeguard consumers and financial institutions. Investment in authentication tools such as biometric verification, tokenization, and two-factor authentication has been prioritized to mitigate risks associated with payment frauds.

As digital payment volumes continue to accelerate globally, financial ecosystems are investing heavily in proactive monitoring and fraud intelligence platforms. This sustained focus on securing payment channels ensures the Payment Frauds segment remains the largest contributor within fraud type categories.

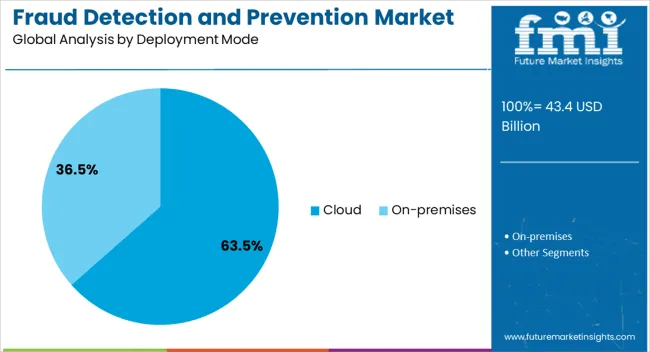

The Cloud segment is projected to contribute 63.5% of the fraud detection and prevention market revenue in 2025, solidifying its position as the preferred deployment mode. Cloud-based platforms have been widely adopted due to their flexibility, scalability, and lower upfront infrastructure requirements compared to on-premise solutions. Enterprises have increasingly migrated fraud detection systems to the cloud to benefit from rapid implementation, continuous updates, and the ability to handle surging transaction volumes in real time.

Technology firms have emphasized the cloud’s role in enabling advanced AI and machine learning integrations, facilitating faster anomaly detection and adaptive risk scoring models. Furthermore, cloud-based solutions have allowed organizations to centralize data from multiple geographies and business units, ensuring more comprehensive fraud monitoring.

With cybersecurity frameworks evolving to meet regulatory compliance in cloud environments, confidence in cloud deployment has grown significantly. As enterprises prioritize agility and cost efficiency, the Cloud segment is expected to remain the leading deployment mode in fraud detection and prevention solutions.

While working & doing activities on the digital platform, it saves time, reduces paperwork, and can help end users do any work online anywhere within network areas. Therefore, the market trends & opportunities are likely to rise with the great innovative technology.

Many key industries, such as financial, banking, healthcare, e-commerce, and manufacturing, are looking for a solution to get out of such frauds.

The fraud detection and prevention software is likely to overcome these situations and help to secure your private transactions, money, and other valuable data on your devices. This factor increases the sales of fraud detection and prevention in the forecast period from 2025 to 2035.

The adoption of fraud detection and prevention is anticipated to raise awareness and trust among consumers and prevent any fraud.

Based on the fraud type segment, apart from check fraud, online fraud, investment fraud, insurance fraud, and identity fraud, payment fraud is likely to dominate the fraud detection and prevention market share during the forecast period.

Hackers steal money from your bank account with online intercept transactions; they use various tricks and hacks by fake WAP, cookie theft, key logger, viruses, phishing, and others.

Increasing cashless payments are boosting hackers to engage in online transactions on which they can complete their tasks. This factor leads to the adoption of fraud detection and prevention.

As per the market report on fraud detection and prevention, this factor is rising in the fraud detection and prevention statistics in the forthcoming year.

The segment is further categorized into BFSI, retail and commerce, government, healthcare, manufacturing, travel, and transportation based on the vertical segment. Retail and commerce are likely to lead the global market share of fraud detection and prevention in the forecast period.

Retail and commerce are expected to grow massively all around the globe due to buying products & services online and transacting payments through online payment modes, which raises the fraud detection and prevention market trends.

Many consumers spend time on retail and e-commerce websites to fulfill their desire for personal and home-use products.

Therefore, the hackers have targeted innocent customers & led scams. It is a powerful segment that contributes to fraud detection and prevention, as per the market survey report for sales of fraud detection and prevention services.

Historic CAGR:

| Regions | Historic CAGR (2020 to 2025) |

|---|---|

| United States Market CAGR | 18.4% |

| United Kingdom Market CAGR | 17.7% |

| China Market CAGR | 18.1% |

| Japan Market CAGR | 17.1% |

| South Korea CAGR | 16.8% |

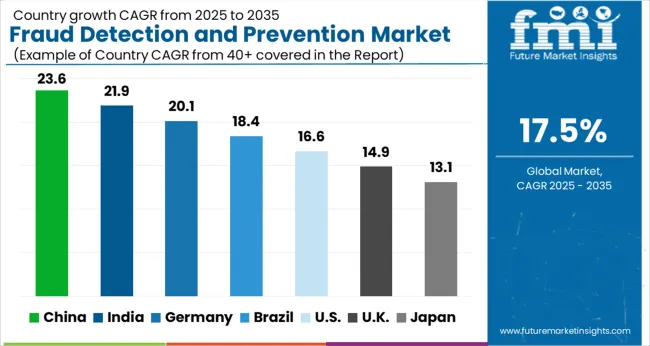

CAGR (2025 to 2035):

| Regions | CAGR (2025 to 2035) |

|---|---|

| United States Market CAGR | 17.5% |

| United Kingdom Market CAGR | 16.8% |

| China Market CAGR | 18.9% |

| Japan Market CAGR | 4.6% |

| South Korea CAGR | 15.5% |

The United States market of the North American region is anticipated to dominate the fraud detection and prevention market size in the forecast period, with a CAGR of 16.7%.

Per the fraud detection and prevention market survey, the North American region is living with high-tech and cybernetic adoption compared to the other regions. This encourages hackers to attack the prominent region, which leads the way to increase fraud detection and prevention in North America.

The United Kingdom market is likely to stand second after the United States in the fraud detection and prevention market, which increases fraud detection and prevention adoption trends.

The United Kingdom market is anticipated with a CAGR of 16.4% during the forecast period. The United Kingdom is a wealthy country, and the country's quality of life is high with tourism, industries, and manufacturing; therefore, they need to secure their wealth around the industries with the adoption of fraud detection and prevention market.

Other countries such as China, Japan, and South Korea are also likely to rise in demand for fraud detection and prevention services in the coming year, given the rising amount of service-based industries in these countries.

The manufacturing and leading companies are the key competitors in the fraud detection and prevention market analysis. Some leading companies are BAE System plc, Nice Actimize, ACI Worldwide Inc., FICO, LexisNexis, TransUnion, Kount, Inc, and others.

Through mergers, acquisitions, partnerships, and collaborations, these companies are likely to increase revenue from adopting fraud detection and prevention services in the coming year. These prominent companies are going to raise the market demand for fraud detection and prevention solutions with advanced features in the forecast period.

Recent Developments in the Fraud Detection and Prevention Market

The global fraud detection and prEVention market is estimated to be valued at USD 43.4 billion in 2025.

The market size for the fraud detection and prEVention market is projected to reach USD 217.8 billion by 2035.

The fraud detection and prEVention market is expected to grow at a 17.5% CAGR between 2025 and 2035.

The key product types in fraud detection and prEVention market are solutions fraud analytics, authentication, government, risk and compliance and services {professional services, managed services}.

In terms of fraud type, payment frauds segment to command 34.7% share in the fraud detection and prEVention market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anti-Fraud Management System Market Size and Share Forecast Outlook 2025 to 2035

AI in Fraud Management Market Size and Share Forecast Outlook 2025 to 2035

Financial Fraud Detection Software Market

Ice Detection System Market Trends, Growth & Forecast 2025 to 2035

Gas Detection Equipment Market Growth – Trends & Forecast 2024-2034

Leak Detection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Odor Detection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bird Detection System Market Size and Share Forecast Outlook 2025 to 2035

Leak Detection Market Size and Share Forecast Outlook 2025 to 2035

Leak Detection Dye Market Trends & Demand 2025 to 2035

Fall Detection System Market Insights – Size & Forecast 2025 to 2035

Spark Detection System Market Forecast and Outlook 2025 to 2035

Spoil Detection Based Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Color Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Fault Detection and Classification Market Size and Share Forecast Outlook 2025 to 2035

Botnet Detection Market Size and Share Forecast Outlook 2025 to 2035

Threat Detection Systems Market

Anomaly Detection Tools Market

Seizure Detection Devices Market

Emotion Detection and Recognition Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA