The France cell culture media bags market is expected to reach USD 68.3 million in 2025. Forecasts suggest the market will achieve a 2.9% compound annual growth rate (CAGR) and exceed USD 90.9 million in value by 2035.

| Attributes | Values |

|---|---|

| Estimated France Industry Size in 2025 | USD 68.3 million |

| Projected France Value in 2035 | USD 90.9 million |

| Value-based CAGR from 2025 to 2035 | 2.9% |

This particular market of cell culture media bags for the near term will grow significantly in France, facilitated by solid public health initiatives. France is one of the largest contributor in the expansion of the sector by 2025 in the European market. The market is expected to gain a steady CAGR of 2.9% till 2035, and the opportunity reflects a sustainable growth and investment future.

France has very high regulatory standards in the production of biopharmaceuticals, leading to strict usage of only quality and reliable products during production. Advanced solutions like cell culture media bags are thus called for due to the strict compliance requirements. Media bags would have to provide optimal conditions for cell cultivation, maintaining sterility and stability, yet meeting the regulatory benchmarks. This adherence to high standards enhances the adoption of advanced bioprocessing technologies and supports the increasing demand for scalable and compliant production systems in France's biopharmaceutical sector.

Explore FMI!

Book a free demo

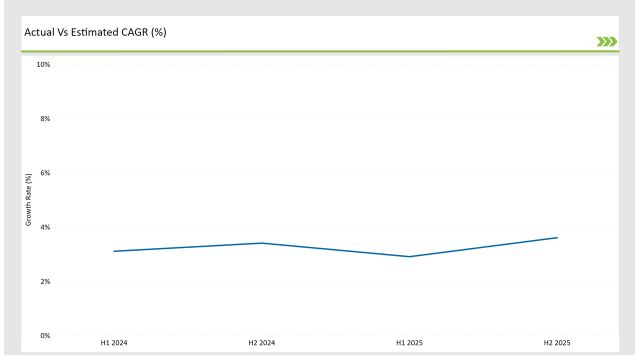

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the France cell culture media bags market. This semi-annual analysis is important to understand some important changes in market dynamics patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

The cell culture media bags market for the France market will grow at a CAGR of 3.1% in the first half of 2023. This will pick up to 3.4% in the second half of the same year. In the year 2024, the growth rate is expected to slightly declines at 2.9% in H1 but is likely to increase at 3.6% in H2. This pattern shows a decrease of 18 basis points from the first half of 2023 to the first half of 2024, while in the second half of 2024, it is raised by 15 basis points compared to the second half of 2023.

These figures represent a dynamic and fast-changing France cell culture media bags market, largely influenced by well-established biopharmaceutical industry, funding and incentives for life-science & biotech industry research and development, and others. This semestral breakup is crucial to businesses that chart their strategies, taking into consideration the growth trends and navigating market complexities.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Regulatory Expertise & Market Adaptation: Merck KGaA focuses on leveraging its deep understanding of European regulatory requirements to cater to the French market. The company customizes its cell culture media bags to comply with France's specific standards and works closely with local regulatory bodies to facilitate smooth product introductions, enhancing customer trust. |

| 2024 | Sustainability & Digital Transformation: GE Healthcare's growth strategy in France includes offering sustainable and environmentally friendly cell culture media bags, in line with France's growing emphasis on eco-conscious practices. They also focus on digital transformation, integrating advanced data analytics and automation into their product offerings to streamline French biomanufacturers’ operations and improve efficiency. |

| 2024 | Strategic Collaborations & Regional Expansion: Sartorius focuses on expanding its regional presence by forming partnerships with French biotech companies and research institutions. Their strategy includes providing tailored cell culture media bags and technologies to meet the unique needs of France's rapidly growing cell therapy sector, while strengthening the company’s foothold in Western Europe. |

Strong Biopharmaceutical Industry

France is yet another matured biopharmaceutical sector and has a rising demand for biologics, vaccines, and cell-based therapies. It leads to an urgent requirement for effective and scalable bioprocessing solutions, including cell culture media bags, hence increasing the market's growth.

Government Support for Biotechnology

France's government provides significant funding and incentives for biotech research and development, encouraging innovation in bio-manufacturing technologies. This support accelerates the adoption of advanced solutions like single-use systems, including media bags.

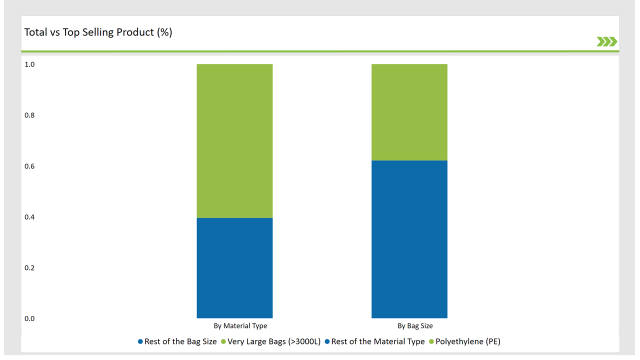

% share of Individual categories by Bag Size and Material Type in 2025

Very large bags (>3000L) records significant surge in France cell culture media bags market

Very Large Bags (>3000L) account for major sales due to the increasing demands of large-scale biopharmaceutical manufacturing, especially in the area of cell-based therapies, vaccines, and biologics. Very large bags enjoy fast growth a bigger volume have become necessary in the production of biologics and other treatments, companies need large capacity media bags with the capability to hold huge quantitates of cell culture media with the sterility level and prevention of contamination.

The Polyethylene (PE) segment is likely to witness considerable growth in the market, on account of material's cost-effectiveness, durability, and excellent barrier properties. PE is widely applied in the manufacturing of media bags as it can resist moisture and oxygen better and more other kinds of contaminants while keeping the sterility of the cell culture media intact.

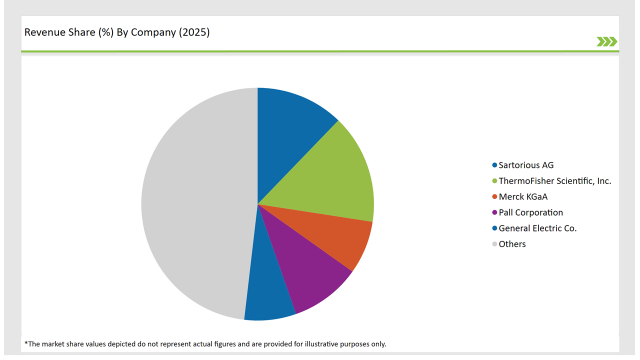

The cell culture media bags market in France is moderately concentrated, with strong brands that hold significant market shares, including Sartorius AG, Merck KGaA, and others. These companies' strong positions result from advanced product offerings, extensive distribution networks, and continuous innovation in bioprocessing technologies.

2025 Market share of France Cell Culture Media Bags suppliers

Note: above chart is indicative in nature

Heavy investments in R&D have helped these companies develop scalable and eco-friendly solutions, thereby increasing their market strength. Apart from the global players, regional and smaller companies are serving niche applications in the cell culture media bag market. Strategic alliances, mergers, and acquisitions have further diversified the product portfolios and supported market expansion and increased demand for cell culture media bags in France, which will sustain the growth in the market.

By 2025, the France cell culture media bags market is expected to grow at a CAGR of 2.9%.

By 2035, the sales value of the France cell culture media bags industry is expected to reach France is 90.9 million.

Key factors propelling the France cell culture media bags market include well-established biopharmaceutical industry, funding and incentives for biotech research and development, and others, ensuring widespread adoption of high-quality cell culture media bags.

Prominent players in the France cell culture media bags manufacturing include Sartorious AG, Thermo Fisher Scientific, Inc., Merck KGaA, Pall Corporation, General Electric Co., Saint-Gobain Performance Plastics, Charter Medical, Avantor Fluid Handling LLC, Lonza and Entegris Inc. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry classifies bag sizes into very small bags (< 150 ml), small bags (151 - 500 ml), medium bags (501 ml - 1000L), large bags (1001L - 3000L), and very large bags (>3000L).

Regarding material types, the sector is categorized into polyethylene (PE), ethylene vinyl alcohol (EVOH), fluorinated ethylene propylene (FEP), polyolefin, and additional options.

Hyperammonemia Treatment Market Trends – Growth & Therapeutic Advances 2025 to 2035

Home Respiratory Therapy Market – Growth & Forecast 2025 to 2035

Veterinary Auto-Immune Therapeutics Market Growth - Trends & Forecast 2025 to 2035

Radial Compression Devices Market Growth - Trends & Forecast 2025 to 2035

Digital Telepathology Market is segmented by Application and End User from 2025 to 2035

Suture Anchor Devices Market Is Segmented by Product Type, Material Type, Tying and End User from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.