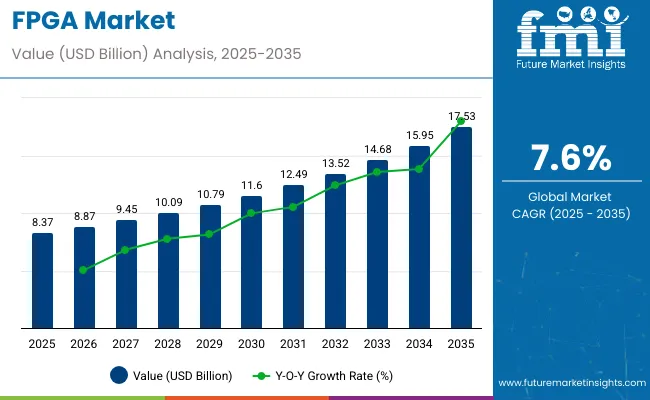

The FPGA (field-programmable gate array) market is projected to expand from USD 8.37 billion in 2025 to USD 17.53 billion by 2035, growing at a CAGR of 7.6% during the forecast period. This growth is being driven by the increasing adoption of programmable and reconfigurable integrated circuits across industries such as data centers, telecommunications, automotive, aerospace, and defense.

Distinct advantages such as hardware-level flexibility, low latency, and rapid prototyping are being leveraged for AI, edge computing, and next-generation networking applications. Rising demand for real-time data processing and the ongoing deployment of 5G networks are fueling this trend. The ability to customize hardware post-manufacture is positioning FPGAs as essential components of emerging computing architectures worldwide.

| Attributes | Details |

|---|---|

| Estimated Market Size (2025) | USD 8.37 billion |

| FPGA Market Forecast Size (2035) | USD 17.53 billion |

| FPGA Market CAGR (2025 to 2035) | 7.6% |

Surging demand for FPGAs is being observed in data centers, where they are being deployed to accelerate AI inference, encryption, and image processing workloads. In the automotive sector, FPGAs are being utilized to enable advanced driver-assistance systems (ADAS), autonomous driving, and infotainment applications. The telecommunications industry is relying on FPGAs to support 5G baseband processing, network optimization, and software-defined networking.

Aerospace and defense sectors are utilizing FPGAs in mission-critical systems where reliability and adaptability are vital. Open-source FPGA tools and high-level synthesis (HLS) solutions are being adopted to broaden accessibility and adoption. These developments are expected to sustain the market’s positive trajectory over the coming decade.

Future expansion of the market is expected to be driven by technological advancements in AI, machine learning, and edge computing. Heterogeneous computing platforms that integrate FPGAs with CPUs and GPUs are being developed to enhance performance and energy efficiency.

As Sandra Rivera, CEO of Altera, stated: “As customers deal with increasingly complex technological challenges and work to differentiate themselves from their competitors and accelerate time to value, we have an opportunity to reinvigorate the FPGA market.” A renewed focus on programmable solutions and accessible AI across key industries is expected to accelerate FPGA adoption globally.

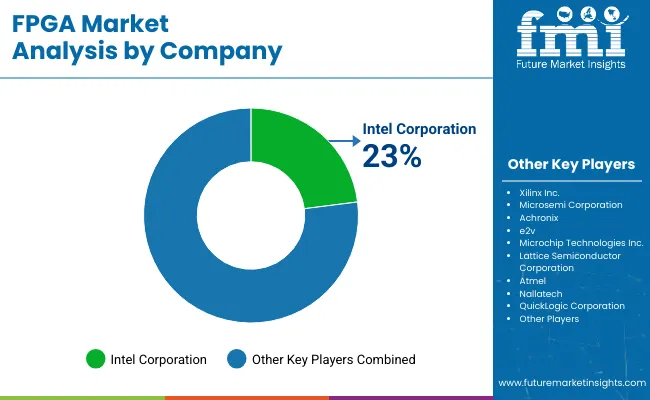

The FPGA market is rapidly evolving with leading companies integrating smart technologies to meet the demands of advanced applications such as edge AI, autonomous systems, and cloud computing. Key players like AMD, Intel, Lattice Semiconductor, Microchip Technology, and Achronix Semiconductor are driving innovation by combining AI engines, adaptive logic, and embedded processors in their FPGA products.

The FPGA market adheres to a comprehensive set of compliance standards aimed at ensuring product safety, quality, and environmental responsibility. Manufacturers follow ISO 9001 standards for quality management systems, ensuring consistent production processes and product reliability. Additionally, ISO 14001 guidelines help companies maintain sustainable environmental practices throughout the product lifecycle.

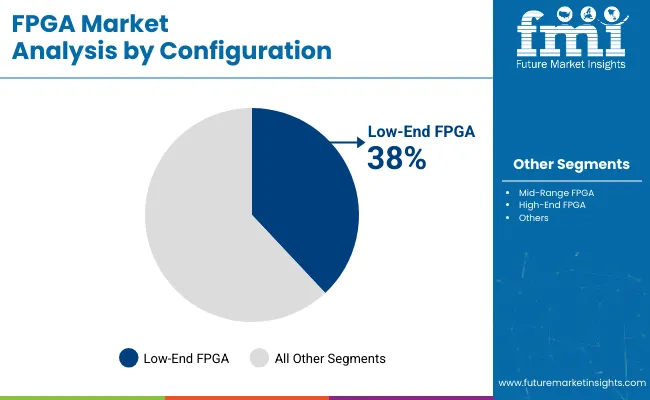

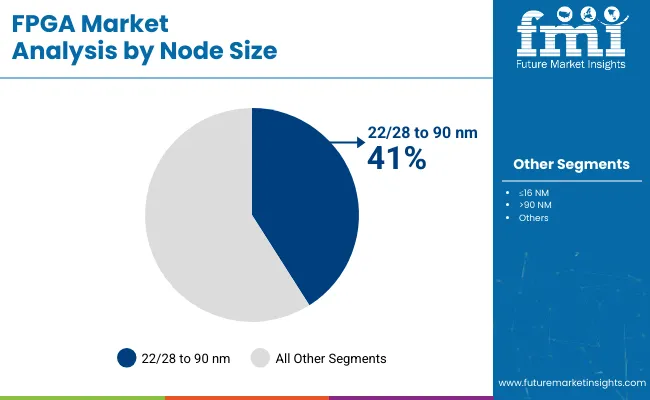

The FPGA market is being reshaped by growing demand for adaptable hardware solutions across diverse industries. Low-end FPGAs are maintaining leadership by supporting cost-conscious applications. Meanwhile, the adoption of 22/28 to 90 nm node sizes is being driven by markets prioritizing a balance between cost, power efficiency, and reliability, ensuring broad applicability across both emerging and mature sectors.

Low-end FPGAs are projected to account for a 38% market share in 2025, driven by cost-sensitive industries requiring programmable flexibility. These devices are being utilized across consumer electronics, industrial IoT, and edge computing applications. Vendors such as Lattice Semiconductor, Intel, and Microchip Technology are expanding offerings with greater logic density and improved energy efficiency.

As programmable hardware is increasingly required at the edge, low-end FPGAs are being selected to provide real-time data processing and AI acceleration. In the automotive sector, applications including driver assistance systems and infotainment are being supported through low-end FPGAs.

Manufacturing scalability and favorable cost structures are encouraging OEMs to adopt these solutions. Furthermore, product lifecycles in industrial and aerospace markets are being extended through the flexibility of FPGA-based platforms. The demand for adaptable, low-power programmable devices is expected to support this segment’s leadership position through the forecast period.

FPGAs built on 22/28 to 90 nm nodes are projected to hold a 41% market share in 2025 as they continue to deliver the ideal balance between power efficiency, performance, and cost. These nodes are being deployed across a broad range of applications, including communications infrastructure, automotive electronics, industrial control systems, and medical devices. Leading players such as Xilinx (AMD), Intel, and Lattice Semiconductor are offering FPGAs on these nodes to address the need for power-optimized and reliable performance.

Applications that do not require the advanced power of sub-16 nm nodes are benefiting from the cost-effectiveness and maturity of 22/28 to 90 nm technologies. In particular, long-lifecycle markets such as aerospace, defense, and industrial control systems are heavily favoring these node sizes. Additionally, as AI capabilities are increasingly required in mid-range devices, FPGAs on these nodes are being leveraged to enhance processing performance while maintaining low thermal output. This balance is expected to keep demand for 22/28 to 90 nm FPGA products robust over the next decade.

| Attributes | Details |

|---|---|

| 2020 | USD 5,209.1 million |

| 2024 | USD 6,735.6 million |

| CAGR (2020 to 2024) | 6.6% |

Due to the introduction of new products with different features at a low cost, the field-programmable gate array market has seen significant growth due to the unforeseen scope of this technology in various industries. Increasing smartphone use and the proliferation of electronic content in cars drive market growth for field-programmable gate arrays. In addition, embedded computing has widely implemented field-programmable gate arrays for building complex, mission-critical systems.

To run highly optimized autonomous operations, data centers are an absolute necessity for the adoption of IoT. Several FPGAs are now found in data centers, employed for offloading and accelerating specific services. In addition, an FPGA is used to offload computing workloads from the CPU to improve performance, reduce response time, and reduce energy consumption in 5G applications, high-performance computing, and ADAS.

Their handling of hardware acceleration and FPGAs have been proven to be useful for HPC applications. As IoT is increasingly used in different verticals, the demand for data centers is forecast to rise substantially, improving the performance of data centers through the use of FPGAs.

FPGA market growth is driven by increasing network traffic and the need to process large amounts of data across data centers. Investing in the establishment of new data centers by various software providers is likely to open more market opportunities for FPGA in the market. FPGAs can enhance the performance of military equipment like radars, sensors, and combat systems by enhancing their range, performance, and defense capability without affecting their overall quality. The development of field-programmable gate arrays for military applications is a constant innovation since more countries are focusing on improving their military establishments.

The rapid growth of the FPGA industry has been attributed to the increased use of FPGAs by cloud customers as a resource under Infrastructure-as-a-Service. FPGAs are expected to grow rapidly in response to a growing demand for customizable integration.

Due to the rising complexity and expensive price of application-specific integrated circuits, FPGAs are likely to gain more popularity in the market shortly. Hence, FPGAs are predicted to gain more popularity in the coming years.

In contrast to this, the power consumption is higher for field-programmable gate arrays, and there is no standard for the verification technique for the industry, which inhibits the growth of the technology. Because of a critical flaw in the hardware of FPGAs, they are vulnerable to security attacks allowing hackers to gain complete control over chips. This is likely to therefore decline the market growth of FPGAs in the market.

FPGAs are also expensive to implement and maintain, which is a factor limiting their growth in the market. With a rise in demand for highly skilled professionals who can write VHDL or Verilog code and possess fundamental knowledge of digital systems, FPGA market sales have declined. The extremely fast I/O rates of FPGA designs and the bidirectional data buses make it challenging to verify the validity of valid data in a reasonable amount of time.

Programmers are required to use the resources available in the FPGA IC once they select and use the FPGA IC in their design. This is likely to limit the size and number of features of the design. Choosing an appropriate FPGA at the beginning of a project can mitigate this problem. As FPGAs are manufactured in greater quantities, the cost per unit also increases. In contrast, ASIC implementation has a lower cost per unit. This is likely to result in a decrease in the demand for FPGA in the market.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 24.8% |

| Japan | 5.3% |

| China | 8.2% |

| India | 13.1% |

| United Kingdom | 9.1% |

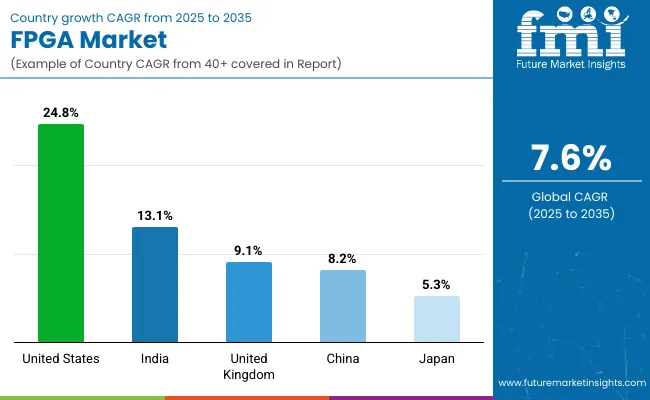

The United States accounted for the highest value share in the global market in 2024 at 24.8%. This is due to government initiatives to support electronic and semiconductor manufacturing firms in the market.

It is evident that the growing number of technologically advanced companies, as well as the telecommunication and military industries in these countries, are propelling the market demand for FPGA in United States markets.

Asia Pacific is projected to dominate the FPGA market during the forecast period. As a result of ongoing investments and measures taken by the Chinese government to boost industry growth, China captured an 8.2% value share in the global market in 2024.

India's value share in the global market in 2024 reached 13.1%. Growing Internet penetration, advancing technology, the proliferation of mobile devices including 4G and 5G, and increasing numbers of consumers using technologically advanced and connected devices have all contributed to the growth of this market in this region. Increasing industrial automation in the region is also driving the demand for FPGAs in China.

Over the forecast period, Japan is projected to achieve a CAGR of 5.7% in 2035. A rise in both industrial production and consumption is expected to boost the market value of the South Korean region by 5% CAGR in the upcoming years.

Technological companies, on the other hand, are shifting their data centers from onsite to cloud-based equipment, which is expected to spur significant growth prospects for the regional demand for FPGAs.

The United Kingdom accounted for a 9.1% value share in the global market in 2024. During the forecast period, the FPGA market in the United Kingdom is expected to grow at a compound annual growth rate of 6.3%. FPGAs are expected to see a high degree of growth in the United Kingdom due to the emergence of IoT and Machine-to-Machine technologies.

This is likely to contribute to the growth of the FPGA market in the United Kingdom. The increasing presence of electronic devices and automotive industry manufacturers in this region has brought a boost to the demand for FPGAs.

Through strategic partnerships, manufacturers can increase production and meet consumer demand, increasing both their revenues and market share.

The introduction of new products and technologies is likely to allow end-users to reap the benefits of new technologies. Increasing the company's production capacity is one of the potential benefits of a strategic partnership.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 8.37 billion |

| Projected Market Size (2035) | USD 17.53 billion |

| CAGR (2025 to 2035) | 7.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Product Types Analyzed (Segment 1) | Low-End FPGA, Mid-Range FPGA, High-End FPGA |

| Applications Analyzed (Segment 2) | Telecommunications (Wired Communication, Optical Transport Network, Backhaul & Access Network, Network Processing, Packet-based Processing & Switching, Wireless Communication, Wireless Baseband Solutions, Wireless Backhaul Solutions, Radio Solutions, 5G); Consumer Electronics; Test, Measurement & Emulation; Data Centers & Computing (Storage Interface Controls, Network Interface Controls, Hardware Acceleration, High-Performance Computing); Military & Aerospace (Avionics, Missiles & Munition, Radars & Sensors, Others); Industrial (Video Surveillance Systems, Machine Vision Solutions, Industrial Networking Solutions, Industrial Motor Control Solutions, Robotics, Industrial Sensors); Automotive (ADAS, Automotive Infotainment & Driver Information, Sensor Fusion); Healthcare (Imaging Diagnostic Systems, Wearable Devices, Others); Multimedia (Audio Devices, Video Processing, Broadcasting, Broadcast Platform Systems, High-End Broadcast Systems) |

| Node Sizes Covered | ≤16 NM, 22/28 to 90 NM, >90 NM |

| Technologies Covered | SRAM, Flash, Antifuse |

| Regions Covered | North America; Europe; Asia Pacific; Middle East & Africa; Latin America |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the FPGA Market | Xilinx Inc., Microsemi Corporation, Achronix, e2v, Intel Corporation, Microchip Technologies Inc., Lattice Semiconductor Corporation, Atmel, Nallatech, QuickLogic Corporation |

| Additional Attributes | FPGA adoption trends across AI/ML applications; Evolution of 5G and IoT driving FPGA demand; FPGA role in data center acceleration and edge computing; Impact of node size innovations on performance and power efficiency; Market share by configuration type; Industry-specific use case developments; Competitive analysis of programmable logic technologies |

The primary consumer for FPGAs is the telecommunications industry.

Some of the key players in the FPGA market include Intel, Xilinx, and Microsemi.

The market is estimated to secure a valuation of USD 8.37 billion in 2025.

The market is estimated to reach USD 17.53 billion by 2035.

The aerospace and defense sector holds high revenue potential in the FPGA Market.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Configuration, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Configuration, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Node Size, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Node Size, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Vertical, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Configuration, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Configuration, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Node Size, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Node Size, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Vertical, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Configuration, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Configuration, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Node Size, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Node Size, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Vertical, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Configuration, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Configuration, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Node Size, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Node Size, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Vertical, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Configuration, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Configuration, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Node Size, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Node Size, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by Vertical, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Configuration, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Configuration, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Node Size, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Node Size, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by Vertical, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Configuration, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Node Size, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Configuration, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Configuration, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Configuration, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Configuration, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Node Size, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Node Size, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Node Size, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Node Size, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 26: Global Market Attractiveness by Configuration, 2023 to 2033

Figure 27: Global Market Attractiveness by Node Size, 2023 to 2033

Figure 28: Global Market Attractiveness by Technology, 2023 to 2033

Figure 29: Global Market Attractiveness by Vertical, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Configuration, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Node Size, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Configuration, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Configuration, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Configuration, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Configuration, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Node Size, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Node Size, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Node Size, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Node Size, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 56: North America Market Attractiveness by Configuration, 2023 to 2033

Figure 57: North America Market Attractiveness by Node Size, 2023 to 2033

Figure 58: North America Market Attractiveness by Technology, 2023 to 2033

Figure 59: North America Market Attractiveness by Vertical, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Configuration, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Node Size, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Configuration, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Configuration, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Configuration, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Configuration, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Node Size, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Node Size, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Node Size, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Node Size, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Configuration, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Node Size, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Vertical, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Configuration, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Node Size, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Configuration, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Configuration, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Configuration, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Configuration, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Node Size, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Node Size, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Node Size, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Node Size, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 116: Europe Market Attractiveness by Configuration, 2023 to 2033

Figure 117: Europe Market Attractiveness by Node Size, 2023 to 2033

Figure 118: Europe Market Attractiveness by Technology, 2023 to 2033

Figure 119: Europe Market Attractiveness by Vertical, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Configuration, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Node Size, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Configuration, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Configuration, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Configuration, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Configuration, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Node Size, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Node Size, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Node Size, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Node Size, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Configuration, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Node Size, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Vertical, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Configuration, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Node Size, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Technology, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Configuration, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Configuration, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Configuration, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Configuration, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Node Size, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Node Size, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Node Size, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Node Size, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by Vertical, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 176: MEA Market Attractiveness by Configuration, 2023 to 2033

Figure 177: MEA Market Attractiveness by Node Size, 2023 to 2033

Figure 178: MEA Market Attractiveness by Technology, 2023 to 2033

Figure 179: MEA Market Attractiveness by Vertical, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Field Programmable Gate Array (FPGA) Size Market Size and Share Forecast Outlook 2025 to 2035

Field-programmable Gate Array (FPGA) Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA