FFS machine production is evolving fast with the requirement for automation, efficiency, and sustainability in packaging. FFS machines reduce the process of packaging by forming, filling, and closing products in a single step, conserving labor and optimizing speed. Flexible, high-speed, and configurable FFS machines are being more sought after in food & beverages, pharmaceuticals, and personal care sectors.

Manufacturers are integrating AI-driven monitoring, IoT-driven automation, and energy-efficient designs to maximize productivity and sustainability. The sector is shifting towards sustainable materials, smart sensors, and modularized equipment that facilitate high flexibility and low downtime.

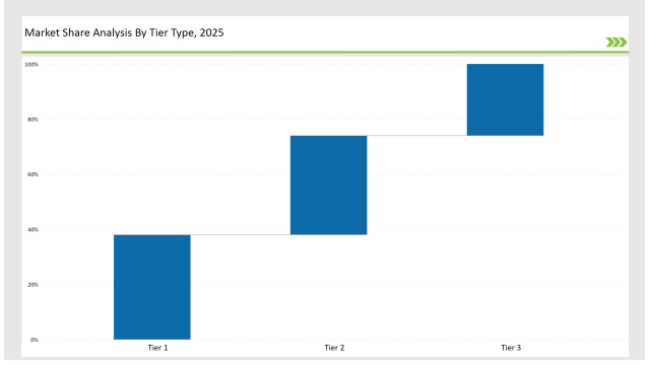

Tier 1 players like Bosch Packaging Technology, IMA Group, and Krones AG command 38% of the market on the strength of their leadership in precision-based, high-speed automation and close ties with global FMCG companies.

Tier 2 companies, such as Syntegon, ProMach, and Omori Machinery, capture 36% of the market by providing cost-effective, high-performance FFS machines for diverse packaging applications.

Tier 3 consists of regional and niche players specializing in sustainable packaging solutions, compact FFS machines, and industry-specific customizations, holding 26% of the market. These companies focus on localized production, smart packaging integration, and precision engineering.

Explore FMI!

Book a free demo

| Category | Market Share (%) |

|---|---|

| Top 3 (Bosch Packaging Technology, IMA Group, Krones AG) | 20% |

| Rest of Top 5 (Syntegon, ProMach) | 12% |

| Next 5 of Top 10 (Omori Machinery, Uhlmann, Viking Masek, Hayssen, Mespack) | 6% |

The form fill seal machine industry serves multiple sectors that require high-speed, automated packaging solutions with minimal human intervention. Companies are developing precision-engineered machines to meet the evolving market needs.

Manufacturers are optimizing FFS machines with smart automation, modular designs, and sustainability-driven solutions.

Efficiency, automation, and sustainability are driving the form fill seal machine industry. Companies are integrating AI-driven production analytics, IoT-based predictive maintenance, and recyclable packaging materials to improve performance and reduce waste. They are also developing high-speed FFS systems that adapt to varying product viscosities and packaging sizes. Manufacturers are incorporating robotic integration to streamline operations and reduce manual intervention. Additionally, firms are improving sealing technology to enhance product safety and shelf life while minimizing material waste. Businesses are implementing cloud-based monitoring to provide real-time diagnostics and improve machine uptime.

Technology suppliers should focus on automation, precision engineering, and sustainability-driven innovations to support the evolving FFS machine market. Partnering with major packaging companies will drive technology adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Bosch Packaging Technology, IMA Group, Krones AG |

| Tier 2 | Syntegon, ProMach, Omori Machinery |

| Tier 3 | Uhlmann, Viking Masek, Hayssen, Mespack |

Leading manufacturers are advancing FFS machine technology with AI-driven analytics, high-speed automation, and sustainability-focused innovations.

| Manufacturer | Latest Developments |

|---|---|

| Bosch Packaging Technology | Launched AI-powered FFS systems for real-time efficiency tracking in March 2024. |

| IMA Group | Introduced high-speed aseptic packaging machines in April 2024. |

| Krones AG | Expanded modular, energy-efficient FFS solutions in January 2024. |

| Syntegon | Released biodegradable-compatible packaging systems in June 2024. |

| ProMach | Strengthened predictive maintenance for FFS machines in october 2024. |

| Omori Machinery | Developed compact multi-functional FFS solutions in August 2024. |

| Uhlmann | Innovated smart, data-driven pharmaceutical packaging FFS systems in September 2024. |

The form fill seal machine market is evolving as companies focus on automation, smart manufacturing, and sustainable packaging solutions.

The industry will continue integrating AI-driven automation, predictive analytics, and smart packaging technologies. Manufacturers will optimize machine performance with self-learning AI algorithms to enhance efficiency. Businesses will invest in eco-friendly packaging materials to meet sustainability regulations. Companies will develop ultra-fast FFS systems to increase productivity without compromising quality. Smart sensors will enhance real-time packaging adjustments for minimal waste. Additionally, firms will streamline maintenance protocols using digital twins for precise system diagnostics.

Leading players include Bosch Packaging Technology, IMA Group, Krones AG, Syntegon, ProMach, Omori Machinery, and Uhlmann.

The top 3 players collectively control 20% of the global market.

The market shows medium concentration, with top players holding 38%.

Key drivers include automation, sustainability, efficiency, and predictive maintenance.

Sustainable Packaging Market Trends – Innovations & Growth 2025 to 2035

Specialty Pulp and Paper Chemicals Market Analysis – Growth & Forecast 2025 to 2035

Sublimation Paper Market Analysis – Growth & Demand 2025 to 2035

Wire Cage Pallet Collar Market Growth & Insights 2025 to 2035

Kraft Paper Machine - Market Outlook 2025 to 2035

Retail Paper Bag Market Analysis by Material, Product Type, Thickness and End Use Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.